Overview

An insatiable global demand for critical minerals to supply the rapidly expanding electric vehicle (EV) market has put a massive spotlight on where manufacturing companies are going to be able to source additional material from.

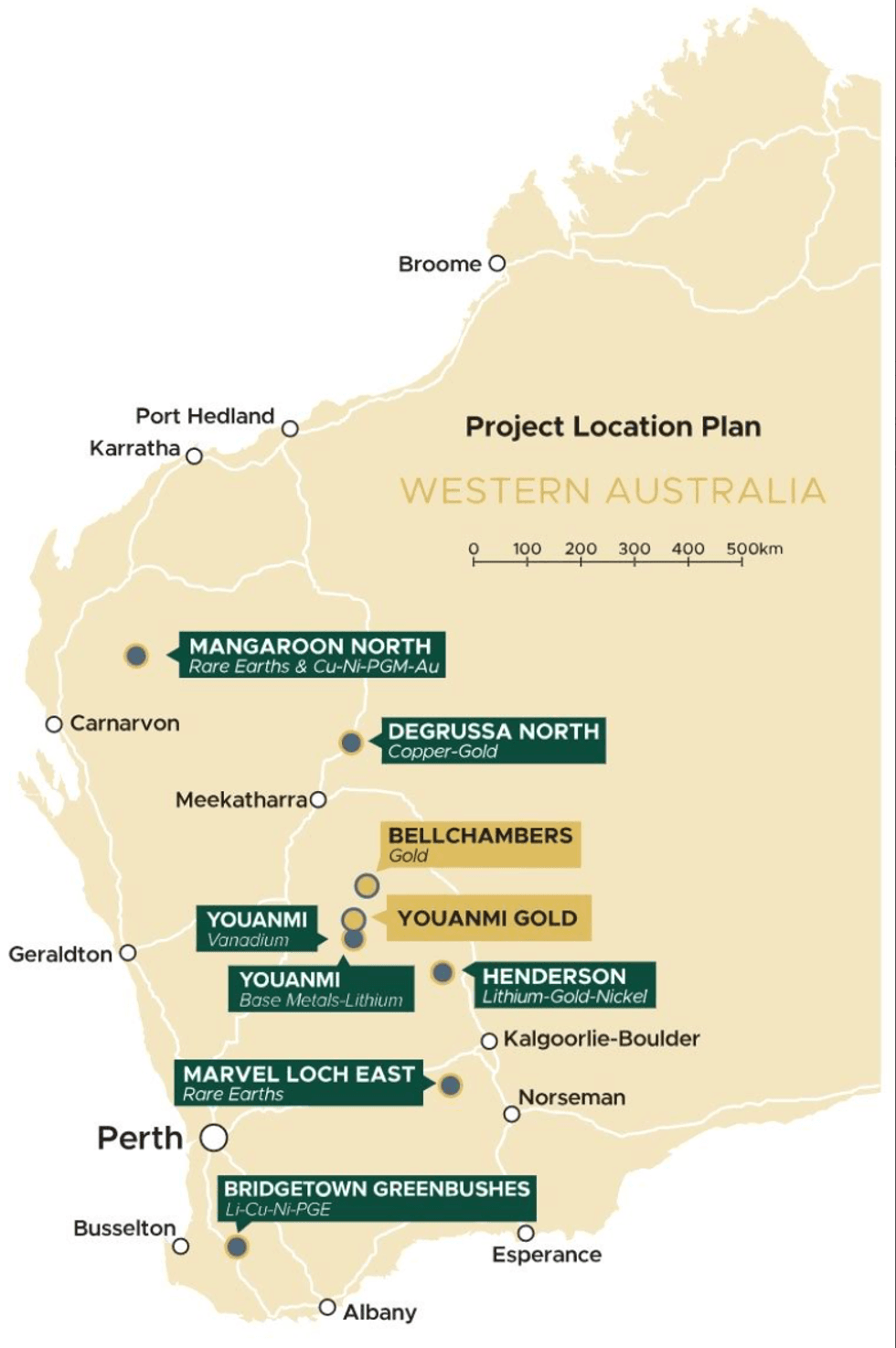

Venus Metals Corporation (ASX:VMC) has been diligently assembling a significant portfolio of gold, lithium, rare earth, vanadium and base metals exploration projects in Western Australia – with a view to being a source for some of those critical minerals.

Unlike many of its peers, Venus Metals is a diversified explorer with highly prospective assets in gold (Youanmi), rare earths (Marvel Loch East & Mangaroon North), lithium and nickel (Henderson & Bridgetown/Greenbushes), and vanadium and base metals (Youanmi).

The company, led by managing director Matt Hogan, has an exceptional deal in the Youanmi Gold Project with its OYG Joint Venture partner, Rox Resources (ASX:RXL) (VMC 30 percent, RXL 70 percent and operator). Rox and Venus further intends to consolidate the Youanmi Gold Project under a simplified, single-ownership structure, providing a strong platform to advance the project. Both parties have agreed to allow Rox to acquire Venus’ gold interests in the OYG JV, giving Rox a 100 percent interest in the Youanmi Gold Project.

The Youanmi Gold Mine contains a JORC inferred and indicated resource of 27.9 Mt at 3.57 g/t gold for 3.2 Moz gold contained gold. A recently published scoping study contemplated a 71 koz per annum at 5 g/t gold over an eight-year mine life producing 569 koz of gold at an all-in sustaining cost of A$1,546/ounce. The pre-tax net present value (NPV) came in at just over $300 million with an internal rate of return of 45 percent assuming a gold price of $2,450/oz.

Venus Metals also released its updated results from the recent reverse circulation (RC) drilling conducted at the Bellchambers Gold Deposit, located in the Western Australian Goldfields. The new JORC 2012 gold resource estimate is 722,000 tonnes @ 1.31 g/t gold for 30,500 ounces, with 22,100 ounces classified in the indicated mineral resource category indicating an increase of 35 percent in tonnes and 40 percent in ounces at 0.5 g/t gold.

VMC also boasts highly prospective rare earth assets at its 100-percent-owned Mangaroon North and Marvel Loch East projects.

A recent soil and laterite sampling program on its tenement E15/1796 at Marvel Loch East indicated “exceptional and highly significant” REE opportunities in an area that has a 25-km aeromagnetic high with associated REE-enriched monzogranite bedrock.

Venus is planning an immediate field mapping program to investigate the regolith settings followed by a shallow AC drilling program to test areas of deep weathering and preserved regolith for clay-hosted REE mineralisation.

Venus’ Mangaroon North rare earth project is located adjacent to the Mangaroon-Yangibana rare earth mineralised zone. Venus’s E09/2541 abuts Hastings Technology Metals’ (ASX:HAS) Yangibana rare earth (REE) project (16.7 Mt ore reserve; 15-year mine life producing 15,000 tpa of high-grade mixed rare earth carbonate and a post-tax NPV of $1billion), as well as Dreadnought Resources Ltd’s (ASX:DRE) Yin tenement and Lanthanein Resources Ltd’s (ASX:LNR) tenement.

The other three exploration licences (E08/3229, E09/2422 and ELA08/3755) all abut Dreadnought’s tenure, which boasts a market capitalisation of more than $300 million on the back of recent drilling success.

Venus believes that the host lithologies found at Yin and Yangibana are also present on the Mangaroon tenements along a regional northwest strike.

Aside from multiple favourable structural traps identified through mapping and geophysics on the tenement, Venus has also identified several potassium, thorium and uranium anomalies. The company is awaiting results from surface sampling and will hopefully be drilling in early 2023.

Venus also boasts two exciting lithium projects – the Henderson Project located 50 kms northwest of Menzies in the Eastern Goldfields of Western Australia and the Greenbushes East and Bridgetown East Project.

The Mt Ida/Ularring Greenstone Belt is recognised as an emerging lithium province following the discovery by Red Dirt Metals Ltd (ASX:RDT) of spodumene-rich lithium pegmatites near the Mt Ida Gold Mine, located some 15 kms northwest of the Henderson Project while IGO has farmed into VMC’s ground near its Greenbushes joint venture lithium operation in Western Australia.

IGO paid 23 cents per share for nine million VMC shares. IGO can progressively earn up to 70 percent by spending $6 million on VMC’s Bridgetown-Greenbushes tenure. In addition, if it completes a prefeasibility study, the miner has the right to acquire the balance at “fair-market value.”

Not a typical exploration company, Venus Metals is a diversified explorer with significant, valuable assets across gold, rare earths, lithium, vanadium and base metals.

It is well-funded (with aggregated cash and investments over $7 million) and has financing arrangements in place with Rox (Youanmi Gold Mine) in regard to funding its share of expenditure in the OYG JV through to a decision to mine, and the IGO (Bridgetown-Greenbushes) farm-in arrangement, as well as NSR royalties over all gold potentially produced from the Youanmi Gold Mine.

Company Highlights

- Diversified explorer with highly prospective assets in Western Australia for gold, rare earths, lithium, nickel, vanadium and base metals.

- The Youanmi Gold Project has a joint venture deal with Rox Resources, which will be consolidated to allow Rox to acquire 100 percent of Venus' gold interest in the Youanmi Gold Project

- VMC’s Mangaroon North and Marvel Loch East projects are highly prospective for rare earth minerals.

- Two promising lithium projects: Henderson Project and Bridgetown Greenbushes Project

- The company is well-funded, with aggregated cash and investments over $7 million, and has financing arrangements in place with Rox Resources (Youanmi Gold Mine) and IGO (Bridgetown-Greenbushes).

Get access to more exclusive Resource Investing Stock profiles here