Overview

Gold is a well-respected store of value that builds a strong foundation for any investment portfolio. While commodities are worth considering, investing in a mining company focused on gold allows you to benefit from the company’s growth and rising gold value. West Africa is known for its significant gold mining operations, comprising over 80 percent of Mali’s total exports, making it the fourth largest gold producer in Africa.

The discovery of a new gold belt in an underexplored area of Southern Mali has captured the attention of major mining companies, such as Eldorado Gold Corporation (NYSE:EGO) and Agnico Eagle Mines Limited (NYSE:AEM).

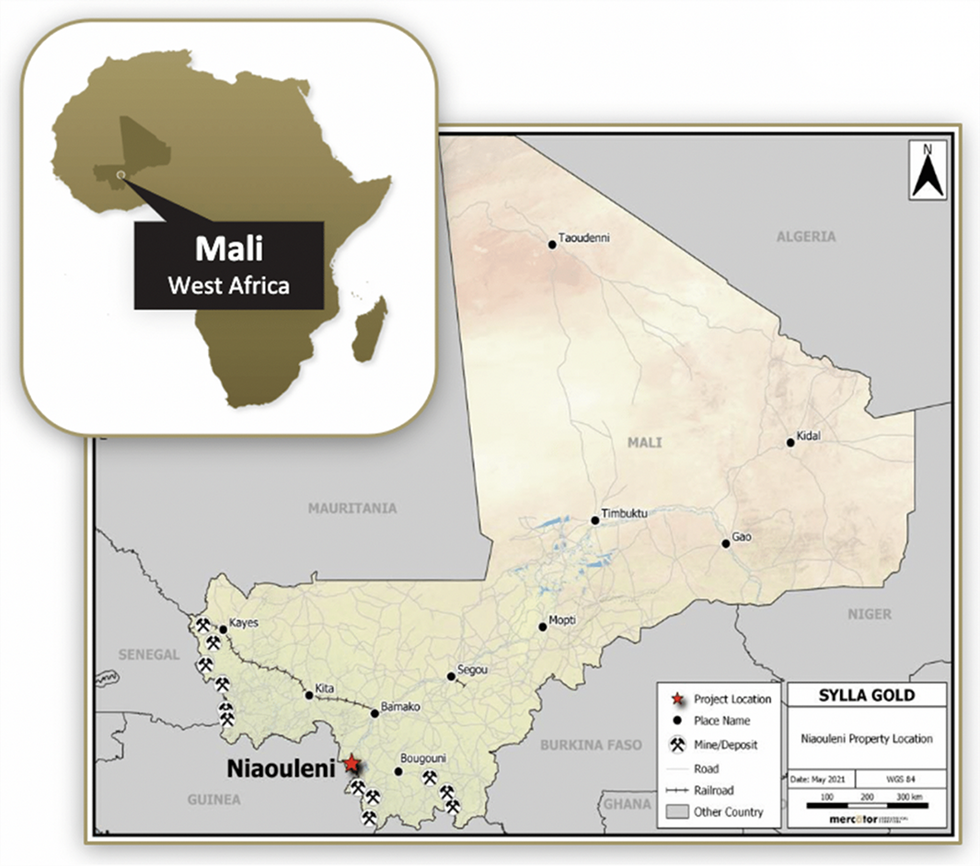

Sylla Gold (TSXV:SYG) is a Canadian junior gold exploration and development mining company focusing on exploring and acquiring gold properties throughout West Africa. The company’s flagship asset, the Niaouleni gold project, covers over 17,200 hectares within an emerging gold camp in the prolific Birimian greenstones of southwest Mali. An experienced management team with a track record of success within West Africa leads Sylla Gold toward its goals of exploring and developing its promising asset.

The company’s Niaouleni project runs contiguously south along Niaouleni-Kobada-Sanankora Corridor, on strike with Toubani Resource’s Kobada Gold Deposit. The Kobada deposit contains a measured and indicated mineral resource of 61.5 million tonnes (Mt) at 0.86 grams per ton (g/t) gold for a total of 1.71 million ounces (Moz) of contained gold, and includes mineral reserves. Additionally, to the north of Toubani within the same corridor is Cora Gold’s Sanankoro Project, which has an indicated resource of 16.1 Mt at 1.27 g/t gold for 657,000 oz of contained gold and an inferred resource of 8.7 Mt at 0.94 g/t gold for 263,000 oz of contained gold. These significant resource estimates on adjacent properties indicate the blue sky potential of the Niaouleni project as exploration continues on all three.

Sylla Gold completed its maiden drilling campaign, which included 6,754 meters of reverse circulation (RC) drilling and an additional 10,600 meters of air core drilling. Assays from the RC drilling indicated 48 out of 57 holes hit high-grade gold mineralization up to 5.17 g/t over 25 meters. The air core drilling was used as a first-pass reconnaissance style drilling and identified multiple additional gold targets for follow-up RC drilling commenced in January 2023 with drilling highlights that include 4.92 g/t gold over 15 meters from drill hole NSRC23-068 including 14.9 g/t gold over 4 meters and 2.56 g/t gold over 7 meters.

Sylla’s management and discovery team has already had success in their previous three West African gold projects, such as the Jilbey Gold discovery of the Bissa Hill deposit, the Merrex Gold discovery of the Siribaya and Diakha deposits, and the Roscan Gold discovery of the Kandiole deposit. Major mining companies acquired Jilbey Gold and Merrex Gold after successful exploration. In addition, the management team and technical advisors bring additional exploration in corporate administration, international finance, and geology.

Company Highlights

- Sylla Gold is a Canadian exploration and development mining company focusing on highly prospective assets within Mali, a West African country known for its gold deposits.

- Despite a long gold mining history, Mali still contains underexplored assets that have received little to no exploration using modern technologies and techniques.

- The flagship Niaouleni asset covers 17,200 hectares within the newly discovered Birimian greenstone gold belt, which runs along southwest Mali.

- The company’s Niaouleni asset is adjacent to Toubani Resource’s Kobada Gold Project which contains a measured and indicated mineral resource of 61.5 million tonnes (Mt) at 0.86 grams per ton (g/t) gold for a total of 1.71 million ounces (Moz) of contained gold, and includes mineral reserves.

- The Niaouleni's close proximity to prolific gold discoveries indicates the potential for future discoveries and development.

- Sylla Gold has completed its maiden drilling campaign at Niaouleni, results of which indicate that 48 out of 57 holes intersected high-grade gold mineralization up to 5.17 g/t gold over 25 meters. Phase 2 of the drilling program commenced in January 2023..

- An experienced management team with a track record of success in West Africa leads the company toward fully exploring its blue-sky gold asset.

Get access to more exclusive Gold Investing Stock profiles here