- WORLD EDITIONAustraliaNorth AmericaWorld

Top 10 Copper Producers by Country

Top 10 Copper-producing Companies

What Was the Highest Price for Gold?

What Was the Highest Price for Silver?

Top 10 Central Bank Gold Reserves

Investor Insights

Ramp Metals’ strategic focus on precious and base metals is essential for various growing industries in the global market. The company is in a compelling position to potentially make a significant gold discovery in a top-tier Canadian mining jurisdiction which is currently underexplored.

Overview

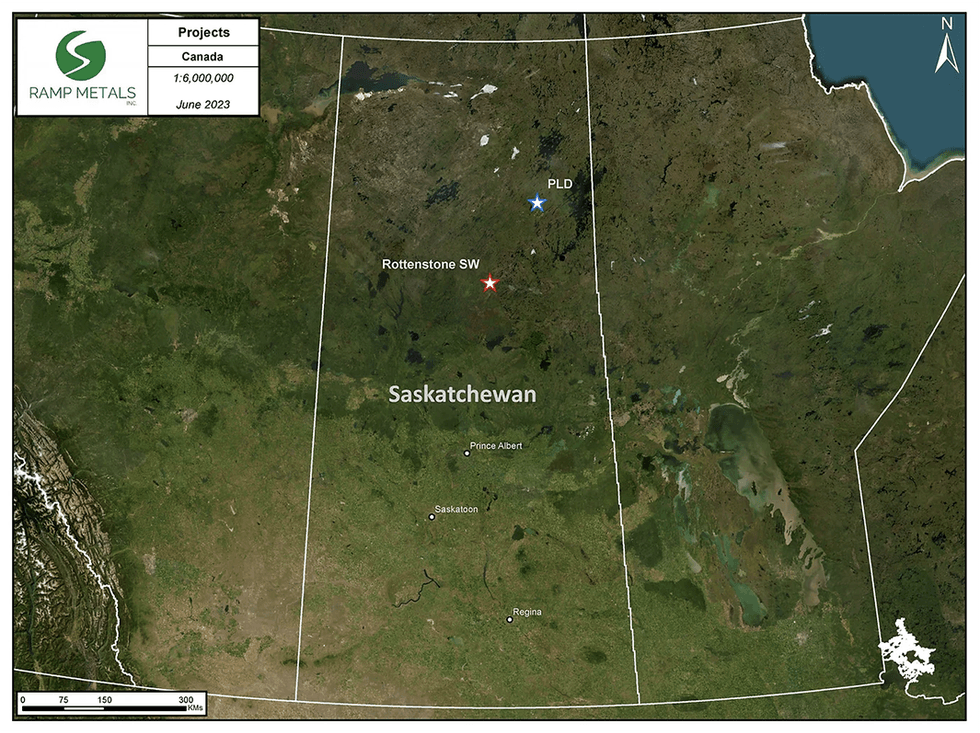

Ramp Metals (TSXV:RAMP) is a grassroots exploration company specializing in precious and base metals, particularly gold and nickel-copper-PGE. The company has two properties, two situated in Northern Saskatchewan, Canada.

The flagship property, Rottenstone SW Claims is situated along a geological structure that historically yielded the highest-grade nickel and platinum group elements (PGE) in Canada. It exhibits remarkable parallels to the Nova-Bollinger nickel-copper mine in Western Australia, which was discovered by Sirius Resources and ultimately sold to IGO Limited for AU$1.8 billion. The Nova-Bollinger mine had an estimated resource of 13.1 million tons (Mt) grading 2 percent nickel, 0.8 percent copper, and 0.07 percent cobalt.

The striking similarity between Rottenstone and Nova-Bollinger mine is encouraging and the appointment of Dr. Mark Bennett, the discoverer of the Nova-Bollinger deposit, as a strategic advisor, reinforces Ramp’s belief in the potential of the Rottenstone property. Bennett has over three decades of experience in establishing mines, and played a key role in multiple discoveries, such as the Wahgnion gold mine, the Thunderbox gold mine, and the Waterloo nickel mine, in addition to the Nova-Bollinger nickel-copper mine. Along with Bennett, Ramp Metals has also appointed leading geologists Scott McLean and Richard Murphy, as its strategic advisors to bolster its geology team.

The project’s presence in Saskatchewan is also encouraging for investors given the region’s mining-friendly policies. Saskatchewan was ranked second globally and the top in Canada by the Fraser Institute as the most attractive jurisdiction for mining investment in 2021.

Saskatchewan has gained prominence for its abundant uranium resources, yet its geological diversity presents significant potential beyond this. Exploration for other battery metals in the region has been limited or largely unexplored.

Current Gold Landscape

According to data from the World Gold Council, total gold demand gained a record 5 percent year-over-year to 1,313 tons during the third quarter of 2024, resulting in a series of record-high gold prices during the same quarter. The value of demand rose 35 percent to more than US$100 billion for the first time ever.

A major driver for gold’s growth are global gold ETF inflows, while bar and coin investments dipped 9 percent year-over-year. Gold jewelry consumption declined 12 percent, despite an increase in spending, with the value of demand jumping to 13 percent to more than US$36 billion.

Year-to-date central bank buying remains in line with 2022, despite a notable slowing down in Q3 2024.

Gold application in technology continues to be driven by artificial intelligence, growing 7 percent year-over-year and the “outlook remains cautious,” the World Gold Council report said.

Outlook on Battery Metals

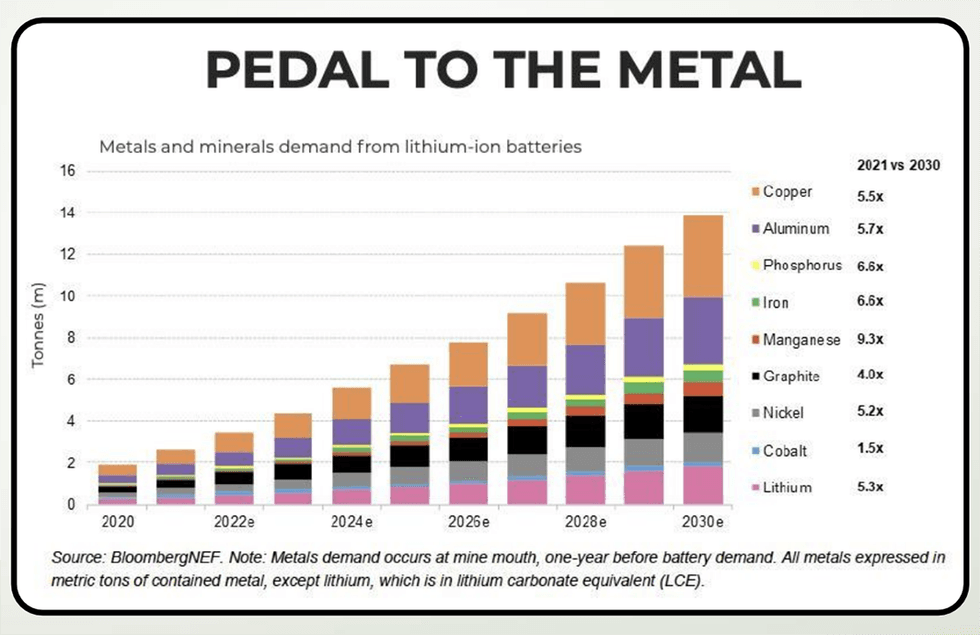

The demand for battery metals will continue to grow, due to a strengthening EV market. S&P Global Mobility's 2024 global sales forecast anticipates battery-electric passenger vehicles will reach approximately 13.3 million units worldwide by the end of 2024, an increase of 40 percent year-over-year. In terms of market share, EVs will constitute around 16.2 percent of the total global passenger vehicle sales in 2024, compared to 12 percent in 2023.

Further, the emerging trend toward high-density batteries using nickel and cobalt, and less lithium, is also expected to boost demand for these metals. As one of the top critical minerals in the US and Canada, nickel projects are likely to see increased funding over the coming years.

There is a strong demand in the market for new, high-quality nickel-copper and lithium opportunities. Rottenstone SW borders Fathom Nickel, which recently secured C$4.6 million in funding and seems to be focusing on a similar geological system. The Rottenstone SW eye structure presents an ideal target for nickel-copper-PGE exploration.

Get access to more exclusive Nickel Investing Stock profiles here