ASX Silver Stocks: 5 Biggest Companies

Top 5 ASX Copper Stocks

Top 5 Junior Gold Mining Stocks on the TSXV

Top 10 Gold-mining Companies

Overview

Will silver offer you the same protection as gold? Some analysts say silver can protect you in times of global turmoil. It's widely considered a safe way to store value, similar to gold. In addition, silver typically has volatile prices, which can benefit investors.

Yet, silver is more than a precious metal used to hedge against inflation and uncertainty. It also has industrial uses that create a steady demand. For example, in 2021, approximately 508.2 million ounces of silver were used in industrial fabrication, such as for producing solar panels and automotive electrical systems. In addition, investors have options; they can invest in silver bullion, commodities markets, or silver mining companies to capitalize on the precious metal. So how will you profit from silver?

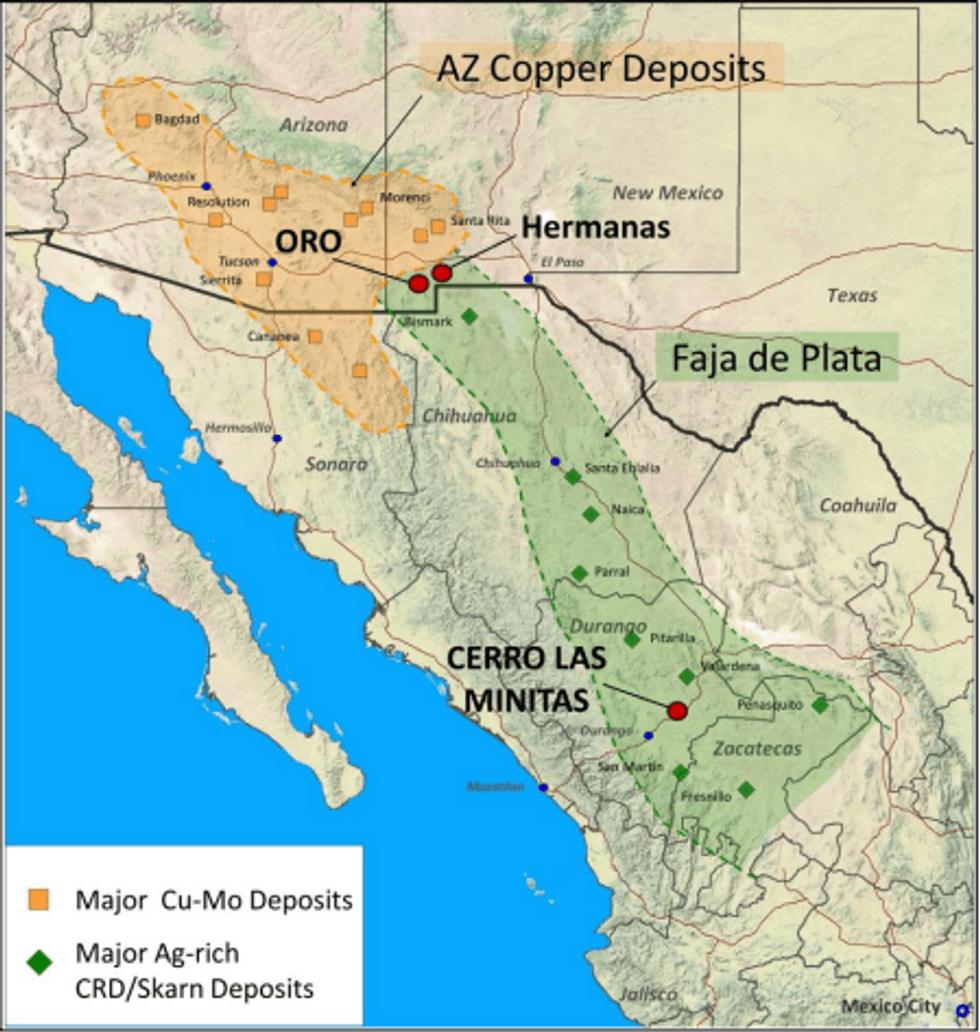

Southern Silver Exploration (TSXV:SSV,OTCQX:SSVFF) is an exploration mining company focused on creating value for shareholders from its unique silver assets. The company’s projects are located throughout North America, strategically positioned in politically safe mining jurisdictions. Its flagship project, Cerro Las Minitas, is located in Durango, Mexico, and is one of the top high-grade, undeveloped, silver projects in the world. Mexico is known for containing high-grade silver deposits, and Southern Silver Exploration’s flagship project is an undeveloped asset with excellent upside potential.

Durango has attracted several mining companies due to its largely untapped potential. Fresnillo (OTCMKTS:FNLPF), SSR Mining (NASDAQ:SSRM), Coeur (NYSE:CDE) and Avino (TSX:ASM) are some of the mining companies with good assets in the area. These projects, along with the region's political stability and rich geological formations provide confidence in the area’s viability for further development.

The 100-percent-owned Cerro Las Minitas Project is a silver-lead-zinc property covering 340 square kilometers, with the potential to become one of the top high-grade silver mines in the world. The 2021 resource update, at a US$60 per ton NSR cut-off, features an indicated mineral resource equating to 137 million ounces of silver equivalent,or 2.3 billion pounds of zinc equivalent, consisting of 42.1 million ounces of silver, 28 thousand ounces of gold, 44 million pounds of copper, 358 million pounds of lead, and 895 million pounds of zinc.

An inferred mineral resource equates to 198 million ounces of silver equivalent or 3.3 billion pounds of zinc equivalent, consisting of 73.6 million ounces of silver, 78 thousand ounces of gold, 98 million pounds of copper, 500 million pounds of lead, and 1,009 million pounds of zinc.

These estimates place the asset in the world’s top five silver mines.

Southern Silver Exploration has created a mine life of over 15 years, which will create enduring value for a third-party that may acquire the mine in the future. In addition, to date, the company’s cost of exploration per ounce of silver is C$0.09, which is much lower than its competition. The company has two additional, 100-percent-owned assets, the Oro Copper-Gold Project and the Hermanas Silver Gold-Silver project. These assets expose shareholders to additional markets beyond silver. These two assets are located in New Mexico, USA.

An experienced management team is leading Southern Silver Exploration toward its goals. Lawrence Page, president and director, has decades of experience working with precious metals and other natural resource companies, and now leads Southern Silver Exploration. Robert W.J. Macdonald, vice president of exploration, has overseen silver and gold projects throughout North America. The management team includes additional specialists and experts who help advance Southern Silver Exploration’s goals.

Multiple members of the management team have experience leading projects within Mexico. These leaders have an established network of relationships with Mexican nationals who work with the company in all aspects of exploration and development. Southern Silver Exploration is proud of its positive relationship with the local government.

Company Highlights

- Southern Silver Exploration is a silver-focused exploration company with three, 100-percent-owned projects in North America, including an undeveloped asset that’s poised to become one of the world’s top silver mines.

- The company’s flagship project, Cerro Las Minitas in Durango, Mexico, has an indicated resource of 42.1 million ounces of silver and an inferred resource of 73.6 million ounces of silver, placing it firmly in the top five silver assets on the planet.

- Cerro Las Minitas is located in a safe jurisdiction that has attracted other mining companies hoping to discover prolific deposits.

- Two additional 100-percent-owned assets expose investors to copper and gold markets.

- Southern Silver Exploration is led by a team of experienced mining professionals, who bring their specific expertise and established relationships with local governments to help the company achieve its goals.

Get access to more exclusive Silver Investing Stock profiles here