Silver Trends 2020: Volatility Reigns, Silver Price Thrives

What were the main silver trends of 2020? In this article we run through the year’s key supply, demand and price catalysts.

Click here to read the latest silver trends article.

While many commodities struggled in 2020, silver was a top performer, adding more than 30 percent to its value for the year as of the second week of December.

The white metal’s duality benefited its price movement — silver capitalized on its safe haven appeal in March and April, and then was bolstered by rebounding industrial demand in the summer months.

Reaching a seven year high in August of US$28.32 per ounce after sinking to an 11 year low of US$11.59 highlights silver’s ability to outperform sister metal gold. From its lowest to highest point this year, silver climbed an impressive 137 percent, while gold increased a modest 38 percent.

Silver’s resilience also appeared in the gold/silver ratio, which spiked to an all-time high of 126:1 in March, then fell to a three year low of 69:1 in August.

The main catalyst for silver’s price performance was COVID-19’s effects on the markets and the economy, although there were several other motivators, including surging exchange-traded product (ETP) inflows, physical demand and positive industrial fundamentals. Read on to learn more.

Silver trends Q1: COVID-19 slump hits silver

2020 started with silver trading at US$18.02, a level the metal had not held at since 2017. January and February saw its price remain rangebound on the back of steady safe haven demand. Investors seeking refuge from worsening relations between the US and Iran purchased silver and gold.

2020 silver price performance. Chart via Kitco.

The attention prompted the Silver Institute to forecast a 3 percent increase in silver demand for the year.

“The outlook for silver remains positive, with the annual average price projected to rise by 13 percent to a six-year high of US$18.40 in 2020,” its report notes.

“This rally is premised mainly on a positive spill-over from gains in gold, as the yellow metal will continue to benefit from macroeconomic and geopolitical uncertainties across critical economies.”

In the February overview, the Silver Institute also suggested that COVID-19’s impact on the Chinese economy would be a headwind to industrial demand.

By February 21, silver had hit its quarterly high of US$18.77. A month later, the coronavirus had spread across the globe, leaving no economy unscathed. Markets fell dramatically in response to supply chain upheaval and mass lockdowns, and silver slumped to a seven year low of US$11.94 in March.

“Many investors have turned away from silver because of its weak price performance in recent years. More companies that sell precious metals have been marketing gold more than silver,” CPM Group’s Jeffrey Christian said in April.

He also noted that the market was well supplied with the metal, preventing a demand spike from impacting the price significantly.

By the end of the quarter, silver had edged slightly higher to US$14.93, but remained 17 percent off its January value.

Silver trends Q2: ETP growth drives price higher

Silver’s dip below US$12 prompted a major investor rush to silver ETPs.

The sector saw holdings swell to an all-time high of 925 million ounces, of which 196 million ounces were added in the first six months of 2020.

“There just seems to be a sense of people rushing to the safety of safe haven assets, such as silver,” said Michael DiRienzo, executive director of the Silver Institute.

By the end of June, the white metal was back near its January value of US$18.02, marking 50 percent growth since March’s dive.

“I think it’s really important to note the high level of silver investment in ETPs at the end of June, which were at 925 million ounces,” said DiRienzo during a July interview.

“(Also) the intra-year shift upwards with respect to 196 million ounces in the first half of the year, already surpass(ing) the annual total of 149 million ounces in 2009.”

Q2 also brought a 60 percent uptick in retail bullion coin demand. The surge during a transportation disruption led to longer-than-anticipated wait times for fresh supply amid depleting stocks.

A second quarter report from consultancy firm Metals Focus projected sustained growth in the segment for the remainder of the year.

“Silver physical investment is forecast to extend its gains this year, with a projected 16 percent rise to a five year high as investors rotate out of equities in search of safe haven vehicles,” states the joint report from Metals Focus and the Silver Institute.

Buoyed by safe haven status, industrial demand continued to be battered in Q2. CRU Group said in June that it expected the disruption to be exacerbated by decreased demand in the solar panel sector.

In 2019, 100 million ounces of silver were used to manufacture photovoltaic (PV) panels, roughly 11 percent of total demand. According to CRU Group, 100 million ounces indicates peak sector demand.

“We forecast a slow decline in silver demand from 2020 to 2023 as PV capacity added per year dips, while attempts at silver thrifting in PV panels continues at a diminished rate,” as per CRU Group.

Silver trends Q3: Price hits seven year high

The third quarter saw silver make its most dramatic year-to-date gain, when it surged from US$18.02 in July to a 7 year high in August.

Watch David Smith, senior analyst at the Morgan Report, discuss silver’s price rise.

Reaching US$28.32, prices were up 137 percent from the March low of US$11.94. Continued growth in the ETP space paired with steadily increasing physical demand contributed to the price surge.

Economic growth in China, which led to a resurgence in industrial activity, also added tailwinds to the silver price. US stimulus efforts were another catalyst for silver’s safe haven allure throughout Q3.

“We have to remind people that silver is not just poor man’s gold. It has tracked with gold better than I expected through this time of economic turmoil,” said Lobo Tiggre of Independent Speculator.

Tiggre went on to explain that while some maintain that silver is no longer a currency metal, it does benefit from its duality.

“It does clearly have its industrial side and got whacked harder than gold in March during the meltdown — that’s true. But silver is still tracking gold, and many days where markets have been down and industrial commodities have been down, silver has held up with gold.”

By early September, the price had slid to US$26.57. Although silver’s higher value proved unsustainable, the price action did propel several miners and explorers higher as the fundamentals for their endeavors improved. The remainder of the month saw silver continue its downward trajectory, and the metal ended the quarter at US$23.20.

Silver trends Q4: Silver maintains US$22 level

Following a positive summer that saw instances of COVID-19 decrease, the fall saw cases surge again in many key countries. The pandemic-related activity was worsened by uncertainty around the US election.

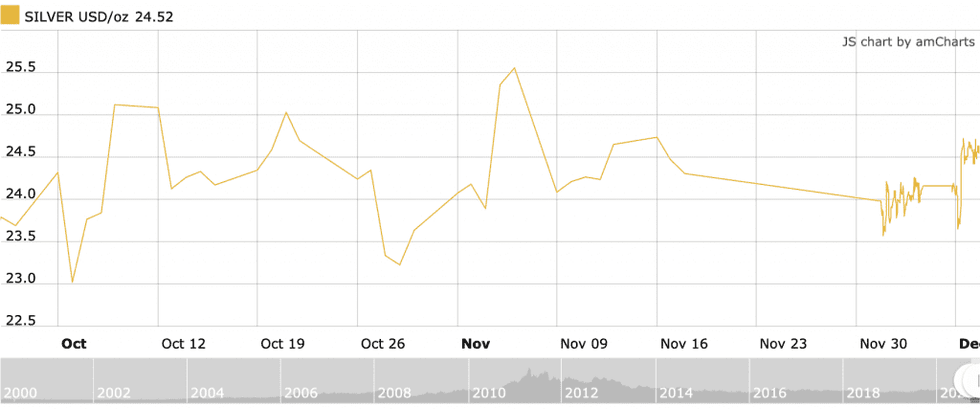

This was reflected in the silver price, which fluctuated between US$23 and US$25 in October.

Q4 2020 silver price performance. Chart via Kitco.

In the days following the US presidential election, the price again edged higher, hitting US$25.59. At the time, David Morgan of the Morgan Report said he thought underlying economic turmoil was a more important silver motivator than the vote.

“It might on a temporary basis as far as for a few weeks or months post-election one candidate or the other might cause a different reaction slightly, but the overall trend cannot be reversed regardless of which political party has the platform,” he said.

Watch David Morgan of the Morgan Report describe catalysts for the silver and gold market.

The impact of monetary policy is a key driver behind silver’s sustained growth, and as nations look to implement more stimulus it is likely to continue its upward momentum.

“We continue to borrow more and more money. It’s basically running in place on the treadmill with the carrot out in front,” said Morgan. “Sooner or later we think we’re going to get that carrot, but we really don’t, and we have to continue to run faster — which means print more money. It’s a sad condition that unfortunately doesn’t usually end very well.”

Mid-November saw silver begin to pull back. The reversal came as several pharmaceutical companies made announcements regarding their COVID-19 vaccines.

The news that inoculations would commence in several countries ahead of the new year weighed on safe haven buying, with investors taking on more risk.

By the end of the month, silver had sunk to a three month low of US$22.24. Even so, COVID-19-related disruptions and heightened investor appetite have made 2020 a breakout year for silver.

Metals Focus expects the silver price to rise by 27 percent year-over-year to average US$20.60 in 2020, states this year’s interim silver market review from the Silver Institute. “This would represent the highest annual average since 2013.”

Of this year’s trends, growth in the ETP space has been the most significant in terms of price movement. As of November 13, that space had seen inflows of 326 million ounces (Moz) for the year. The large influx ballooned global holdings to more than 1 billion ounces for the first time ever.

“For the full year, Metals Focus forecasts an increase of 350 Moz on end-2019 levels, which compares extremely favorably with a rise last year of 81.7 Moz,” reads the interim review.

Since reaching a quarterly low at the end of November, the silver price has edged 10 percent higher, again holding in the US$24 range.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.