Silver Price Update: Q2 2022 in Review

What happened in the silver market in Q2? This silver price update covers supply, demand and other key factors impacting the metal.

Click here to read the latest silver price update.

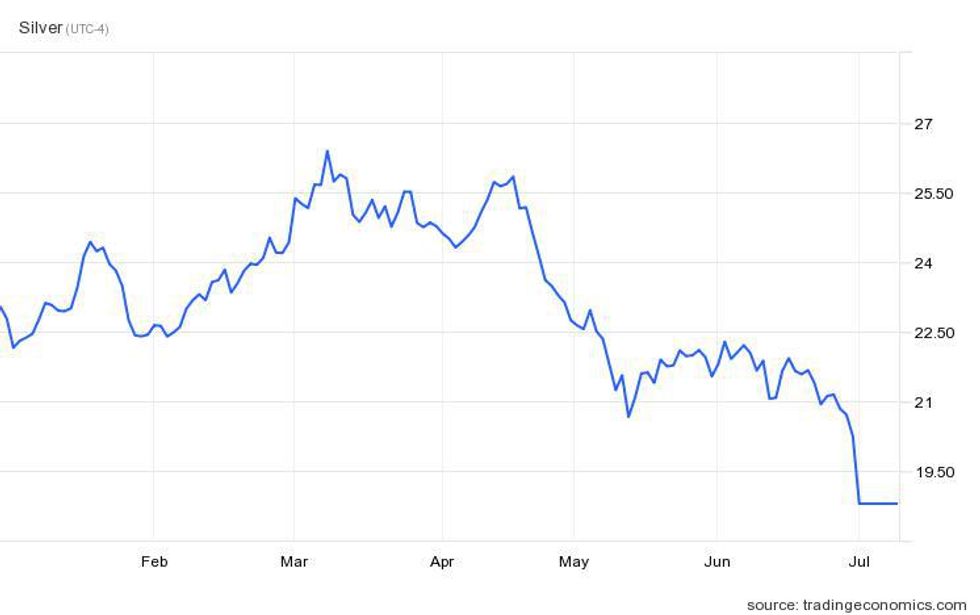

Vulnerable to widespread uncertainty in the broader markets, the silver price sank to a two year low of US$20.23 per ounce at the end of the second quarter.

After starting the year at US$23.04, the versatile metal saw an H1 high of US$26.46 on March 8. Silver faced some consolidation after that rise, but remained elevated until April 18, when it reached a Q2 top of US$25.91.

The metal then faced a dramatic decline through May 18, when it bottomed at US$20.59. Silver remained rangebound below US$22 for the rest of the quarter.

Supply chain challenges in key demand segments, along with rising interest rates and record inflation, made silver more volatile than gold, which has been able to reap some benefits as a safe haven and inflation hedge.

As Maria Smirnova of Sprott and Sprott Asset Management explains in a recent report, silver's performance is not particularly surprising. “Since silver’s outperformance in 2020, the global macroeconomic environment has changed dramatically and become increasingly volatile,” she explains in the document.

"Markets continue to grapple with the impacts of the COVID pandemic, geopolitical concerns have increased substantially, and the recent sell-off of stocks has not yet found a stopping point.”

With market turbulence eroding investor sentiment, the silver price declined 17 percent in the second quarter.

Silver's year-to-date price performance.

Chart via TradingEconomics.

Moving forward, silver is forecast to see more headwinds into Q3, according to Jeffrey Christian.

“Our expectation is that we are going to see a continuation of that consolidation period for the rest of this year, and possibly through 2023,” said Christian, who is managing partner at CPM Group, during his June presentation at the Prospectors and Developers Association of Canada conference.

He explained that silver's price will largely be contained by its correlation to competing assets, specifically currencies, along with stock markets and bond markets. “Because that heavily affects investment demand, which is probably the primary factor driving silver prices higher or lower,” he said.

Silver price update: Investment demand still a key driver

In 2021, physical silver demand rose by 36 percent, contributing to the year's 96.8 million ounces of net investment demand, a 50 percent increase from 2020 and the highest tally since 2016.

“Investment demand during 2021 rose because of negative real rates, increased concern about inflation, ongoing political tensions and expectations of strong demand from the solar panel and electric vehicle industries,” Rohit Savant, CPM Group's vice president of research, noted during a May silver webinar.

For 2022, investment demand is expected to contract to 76.2 million ounces as electric vehicle production is hampered by the semiconductor shortage plaguing the auto sector.

“While that's a fairly strong decline, when you compare it to where it's been historically, it's going to be higher than periods between 2017 through 2020, as well as the period between 1988 and 2008,” Savant added.

For CPM Group, silver investment demand will hinge on macroeconomics, particularly real rates, which will be the “biggest headwind to silver investment demand” for the rest of 2022.

“Our expectation is that real rates will remain very low due to strong inflation, at least over the next few quarters,” Savant said. “However, they will be higher than they were during the past two years, which we think will act as a headwind to both silver prices, as well as silver demand this year.”

On the flip side, there is some potential upside to investment demand as well. “Investment demand during 2022 … will be supported by the metal’s role as a portfolio diversifier,” Savant explained.

“Russia's invasion of Ukraine was a good reminder about the need for portfolio diversifiers as an expectation of strong demand from the green energy sector," he said. "We also think that's something that would continue to provide support to silver investment this year.”

Silver price update: Solar panel sector could offer price support

In the face of shrinking investment demand, experts believe other segments of the silver market are likely to keep prices from slipping too far below US$20.

In 2021, the solar panel sector accounted for the strongest silver demand at 104 million ounces. The rise was driven by an uptick in the production of photovoltaic (PV) cells that collect and convert sunlight into energy.

Silver’s importance in the green energy sector is key in Sprott’s bullish outlook for the white metal.

“Silver inputs for solar panel production is a prime example, growing 13 percent as a category in 2021 and contributing to a new record high for global silver demand in 2021,” Smirnova wrote. “This rebound, even in the face of the supply-chain constraints that have plagued global manufacturing since COVID began, reflects the substantial green-energy investment that is underway.”

The war in Ukraine may also be a catalyst for increased PV production as energy security becomes increasingly important ahead of the weather transition to fall and winter in Europe and North America.

“The outlook for new PV capacity is therefore extremely positive, which in turn will feed through into robust silver demand,” Metals Focus notes in a weekly report from the end of June.

Although the metals consultancy expects growth in the PV industry, the precious metals report does mention the headwinds silver demand could see from the solar sector.

“The somewhat more cautious approach we have adopted reflects solar panel makers’ long-standing concerns about the impact on margins of volatile silver price. As a result, they have continued to reduce costs through various thrifting and substitution programs, especially in optimizing the metallisation process to reduce the amount of silver usage," as per Metals Focus.

Thrifting and price growth will not stand in the way of silver demand from the PV sector this year, and totals are expected to grow by 10 million ounces to a total of 114 million ounces.

A large portion of that will likely be earmarked for the US, where a group of solar energy developers have agreed to jointly spend US$6 billion to expand the domestic industry. The mega cash infusion is designed to build America’s green energy capacity, while also weaning the country off its dependence on Chinese panels.

In the announcement, Andrés Gluski, president and CEO of AES (NYSE:AES) — a member of the group — said the consortium is "committed to supporting America's clean energy transition."

Silver price update: Gold-silver ratio shows value in silver

When explaining why Sprott remains bullish on silver, Smirnova compared its price performance to gold.

“From a pricing standpoint, silver is historically undervalued relative to gold right now, and offers an attractive investment opportunity," she noted.

This is most evident in the gold-silver ratio, which has been steadily growing since late March, reaching a Q2 high of 87.55 on May 13, and falling slightly to 86.15 at the end of June. That margin has increased since the start of July, reaching a two year high of 92.5 as prices fell to a 24 month low of US$18.20.

“The gold-to-silver ratio that had declined during the first half of 2021 has now risen back to the upper end of its historical range,” Savant told webinar attendees. “While the increase in ratio does not guarantee high silver prices, silver's relative underperformance to gold improves its appeal to some investors.”

Both gold and silver have contracted to year-to-date lows over the first two weeks of July. However, both metals are expected to see value increases as economic conditions worsen.

“As we look at various economic trends, including capacity utilization, housing market trends, consumption trends, economic growth in various countries, we think that a recession still probably holds off until 2024,” Christian said.

“But we acknowledge that there are increased volatilities and uncertainties in the world, Russia's invasion of Ukraine being one of the key factors there, and the effects of rising interest rates. And it is possible that we would see a recession sooner rather than later.”

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Silver Trends 2021: Demand Grows as Supply Shrinks | INN ›

- Silver Outlook 2022: Supply/Demand Trends Could Catalyze Price ... ›

- Should You Invest in Silver Bullion? | INN ›

- What Was the Highest Price for Silver? | INN ›

- When Will Silver Go Up? | INN ›