Silver Price Surges Above US$44 Following Fed Rate Decision

The silver price hit a 14 year high on Monday, continuing a rise that started last week after the US Federal Reserve's 25 basis point interest rate cut.

The silver price surged on Monday (September 22), breaking US$44 per ounce to rise as high as US$44.11.

Silver was last above US$44 in 2011, and many of the same factors that drove it to that level are present in today’s market, including significant uncertainty around the economy, a global debt crisis and a dovish US Federal Reserve.

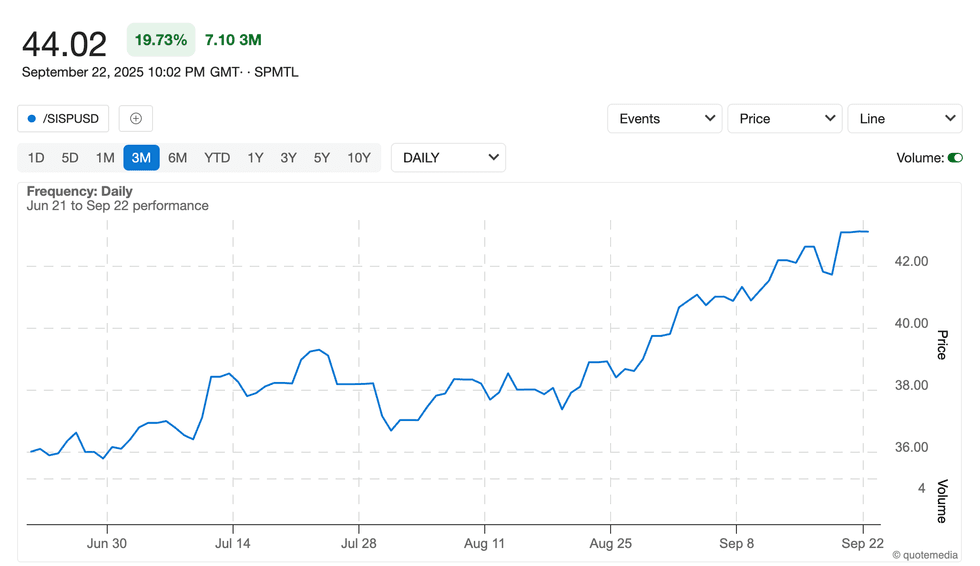

Silver price chart, December 31, 2024, to September 22, 2025.

Chart via the Investing News Network.

The gold price also reached a fresh all-time high on Monday, climbing to US$3,748.80 per ounce. The gains for both metals follow an interest rate cut from the US Federal Reserve at its meeting last week.

Although inflation has been moving further from the Fed’s 2 percent target, there has been greater uncertainty in the labor force. August’s nonfarm payroll report indicates greater slowing in the jobs market, with just 22,000 jobs added during the month; it also came with a downward revision showing the economy lost 13,000 jobs in June.

In its post-meeting statement, the Fed focuses on the worsening jobs market, noting that a 25 basis point cut allows it greater flexibility should the effects of tariffs on inflation be more sustained.

However, 90 percent of analysts are predicting that the central bank will make another cut when it next meets on October 28 and 29. That would provide additional tailwinds for precious metals markets.

The silver market is also benefiting from a high gold price as some investors turn to alternative safe-haven assets with lower entry prices. Additionally, silver has been in a structural deficit for the past several years as demand increases from industrial segments, providing significant upward momentum.

So far this year, the silver price has increased 52 percent, outpacing gold, which has gained 42 percent.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

- When Will Silver Go Up? ›

- US$200 Silver? 3 Experts Talk Price, Supply and Demand ›

- Could the Silver Price Really Hit $100 per Ounce? ›

- Silver Price Update: Q1 2025 in Review ›

- Silver Price 2024 Year-End Review ›