Oil and Gas Outlook 2022: Uncertainty and Risk to Drive Prices

Oil prices surged to their highest level since 2014 in late January 2022, but is that point sustainable? Here's what experts expect for the oil and gas outlook.

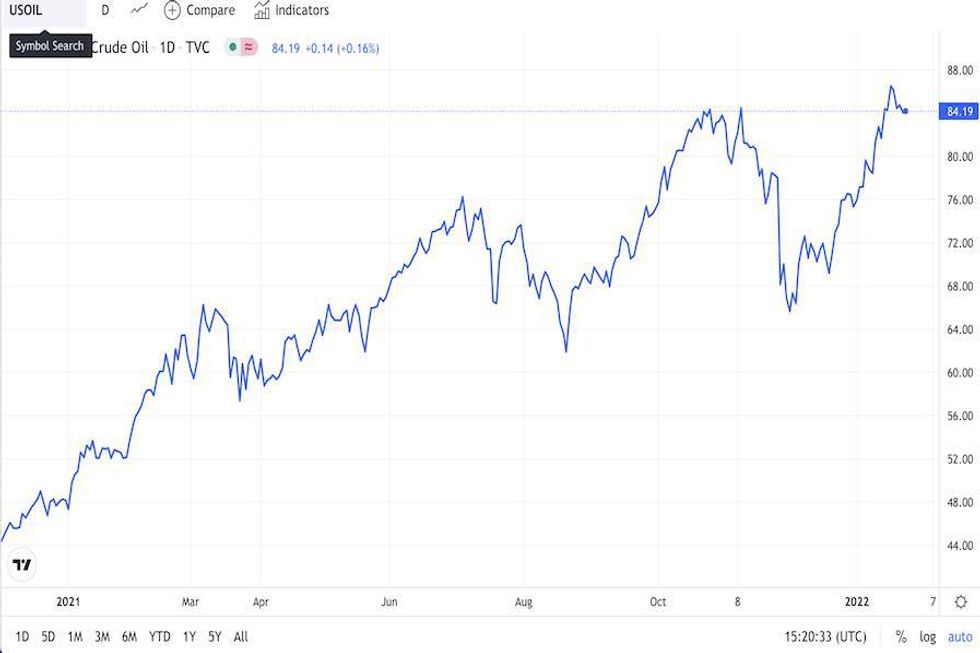

In 2021, the oil and gas sector recovered most of its 2020 losses as concerns over the energy crisis drove West Texas Intermediate (WTI) crude to a seven year high of US$83.76 per barrel in October.

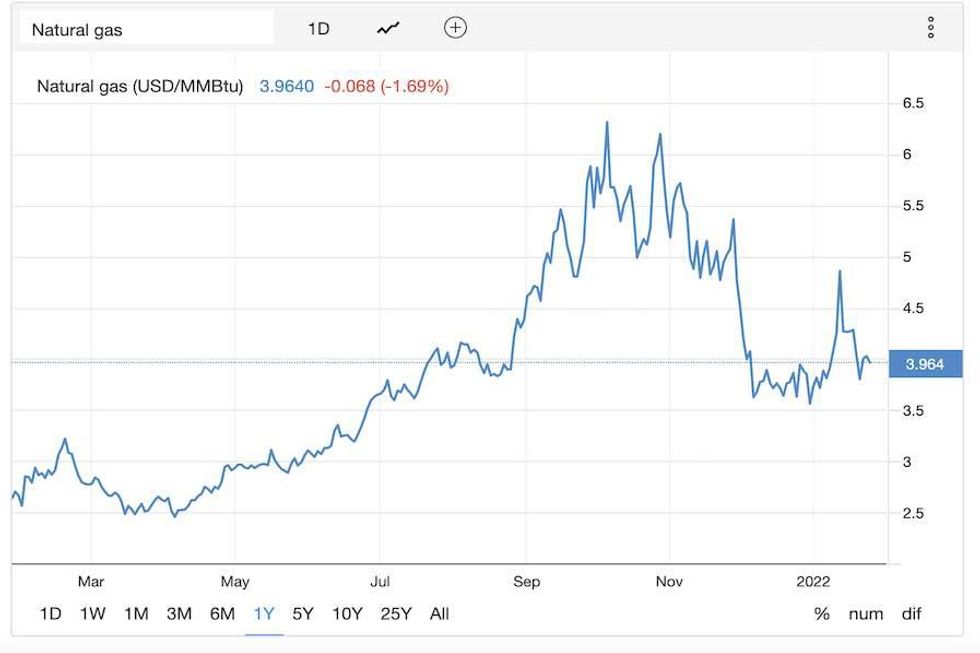

For its part, natural gas rallied to highs unseen since 2014 over the first 10 months of 2021, adding a whopping 142 percent to its value in the January to October period.

Overall, broad volatility brought on by production challenges supported oil and gas for the majority of last year. However, consolidation late in Q4 weighed on both markets, eroding some of the gains made previously. What's in store for 2022? The Investing News Network (INN) asked experts to share their thoughts.

Oil and gas trends 2021: Supply and demand imbalance

After 2020 saw oil demand briefly decline by as much as 30 million barrels per day and prices sink to a 21 year low, 2021 proved to be about recovery as prices rebounded.

This was most evident late in Q3 and early Q4, when prices touched the aforementioned seven year highs.

As Eric Nuttall, partner and senior portfolio manager at Ninepoint Partners, explained, this recovery was led by efforts to recoup demand, but was also largely facilitated by a mounting supply problem.

“I believe we're in a multi-year bull market for oil,” Nuttall told INN. “What we saw throughout 2021, continuing into 2022, is the lack of significant production growth from all over the world.”

Watch Nuttall delve into factors impacting the oil sector.

Nuttall added that the period of “hypergrowth” that was exhibited in the US shale sector over the last eight years is ending, and additional Organization of the Petroleum Exporting Countries (OPEC) production in 2021 was low to non-existent, signaling a “massively bullish event.”

Furthermore, as noted by the World Bank’s Commodity Markets Outlook, Hurricane Ida and OPEC’s decision to keep production at current levels added tailwinds to the sector.

“Some oil-importing countries had called for larger increases, as the group continues to hold significant amounts of production capacity off the market,” the report reads. “Oil prices have also been supported by higher natural gas prices as oil is becoming more competitive as a substitute in heating and electricity generation.”

For Dmitry Marinchenko, senior director at Fitch Ratings, this measured approach allowed prices to grow.

2021 WTI crude oil price performance.

Chart via Trading Economics.

“OPEC+‘s coordinated actions and improved demand have resulted in oil prices recovering from around US$50 early in the year to US$70+,” he said. OPEC+ incudes OPEC as well as non-OPEC allies like Russia. “The average price of around US$70 exceeded expectations of most market participants.”

He also described the 2021 natural gas market as “a perfect storm” of activity that sent prices 142 percent higher between January and October, from US$2.53 per metric million British thermal units (MMBtu) to US$6.13.

2021 natural gas price performance.

Chart via Trading Economics.

“Everything went wrong — from a cold 2019/2020 winter and warm summer in the northern hemisphere, to increased demand in China and reduced supplies from Russia,” Marinchenko said. “As a result, prices soared to unprecedented levels and remain unsustainably high.”

Oil and gas outlook 2022: Geopolitics infusing risk into energy sector

2022 could be a pivotal year in the natural gas sector as Russia increases its military presence near Ukraine, a move that has provoked an international response. Russia is one of the largest producers of natural gas, supplying that material, as well as petroleum products, to Europe and the US.

As the World Bank's report notes, global natural gas inventories are currently very low in comparison to other years, especially in Europe, making geopolitical tensions more impactful.

“Severe sanctions against Russia are unlikely given its significant share of the global oil and European natural gas markets, but cannot be completely ruled out if political tensions intensify,” Marinchenko said.

Even if global tensions cool, bureaucratic red tape could further delay the commissioning of Nord Stream 2, a 1,230 kilometer pipeline that will double the capacity of Nord Stream, which is the current undersea route from Russia’s gas fields into Europe.

“Continued delays with Nord Stream 2 could prevent Russia from meaningfully increasing exports to Europe — even though Russia could technically increase deliveries through the Ukrainian route — and result in natural gas prices in Europe remaining high,” Marinchenko added.

Nord Stream 2 could also be an area of contention amid the rising tensions between Russia and the US. The potential outcomes are outlined in S&P Global Market Intelligence's January 25 market update.

“Because Europe depends on Russia for the majority of its crude oil, natural gas, and solid fossil fuel supplies, the Russia-Ukraine tensions have stirred anxiety within Europe over potential outcomes — if financial sanctions are imposed on Russia or Nord Stream 2 or if Russia slashes Europe’s energy supplies or cuts capacity through Ukraine,” the report highlights. “Some market participants see Germany’s strategic energy partnership with Russia over the Nord Stream 2 pipeline as a conflict of interest in diplomatic dealings involving Ukraine."

Oil and gas outlook 2022: Prices to trend higher

According to the International Energy Agency, global oil stores were reduced by 600 million barrels in 2021, a 200 million barrel discrepancy from the forecast tally. This difference could lead to a tighter market in 2022.

For Nuttall, this has only strengthened his belief in the current market.

“The bullish thesis revolves around demand growth for at least the next 10 to 15 years,” he said. “It means the world is hurtling into an oil supply crisis, and the oil price will have to go high enough in order to kill discretionary demand. And so the question you've probably asked is, 'Well, what oil price is that?’ ... It would be an all-time high oil price ... about US$140 to US$150, if not higher.”

Veteran investor and speculator Rick Rule also sees investment potential in the 2022 oil and gas market.

“I think that yield-oriented investors — not speculators, but yield-oriented investors — will be drawn increasingly to the oil and gas business,” Rule told INN in late December.

Listen to Rule discuss where the resource market may go in 2022.

“The circumstances are in place that I think continue to guarantee higher prices for oil, because the oil industry as a whole is deferring sustaining capital and new project investments, which continues to impair their ability to produce oil, which reduces supply,” Rule said.

Oil could also see an uptick in demand as it becomes increasingly used as substitute for natural gas in heating and electricity generation.

The World Bank expects oil prices to average US$74 in 2022 as demand continues to recover to pre-pandemic levels in H2. On the other hand, it anticipates a steady decline in natural gas prices in 2022 and into 2023. The decrease will likely be the result of shrinking demand growth outside Asia, plus production and export increases.

“More broadly, the events of (2021) have highlighted how changing weather patterns due to climate change are a growing risk to energy markets, affecting both demand and supply," the organization's October report notes. “From an energy transition perspective, concerns about the intermittent nature of renewable energy highlight the need for reliable baseload and backup electricity generation.”

Marinchenko and Fitch Ratings also see oil prices steadying in the US$70 range. “We expect average oil prices remaining broadly stable year-on-year at around US$70,” the senior director said. “This is based on our expectation that OPEC+ will continue to actively manage supply to avoid large surpluses or deficits in the market.”

In terms of gas, prices are expected to come down significantly. “In Europe, we assume average natural gas prices to subside from around US$16 per mcf (1,000 cubic feet) to US$8,” Marinchenko added. “However, this assumes that Russia will continue to operate as the 'last resort' marginal supplier (the role it played in the past).”

He also pointed out that geopolitical tensions and delays with Nord Stream 2 could result in natural gas prices remaining elevated for longer.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Oil and Gas Price Update: H1 2022 in Review ›

- 10 Top Natural Gas Producers by Country (Updated 2022) ›

- Top 10 Oil-producing Countries | INN ›

- What is Driving the Price of Natural Gas? | INN ›

- Top US Oil and Gas Dividend Stocks | INN ›

- Have We Reached Peak Oil? ›