August 18, 2024

Cyprium Metals Limited (ASX: CYM) (Cyprium) is pleased to announce the 2024 Mineral Resource Estimate (MRE) for the existing above-surface material stacked on the heap leach pads at the Nifty Copper Mine (Nifty) in Western Australia.

Highlights include:

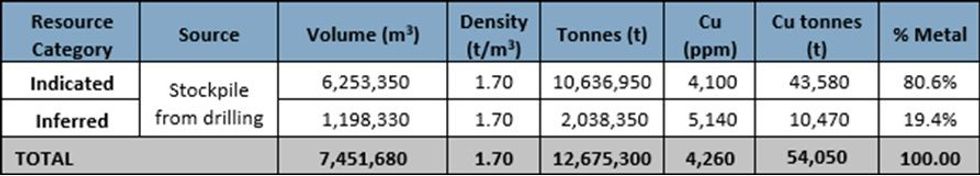

- Indicated and Inferred Mineral Resource Estimate of 12.7 million tonnes grading 0.43% Cu for contained copper of 54,050 tonnes

- 2021 sonic drill campaign incorporated into drill database

- Potential for further upside as drill data does not extend to the bottom of the material on the heap leach pads

“This is back-to-basics execution,” said Cyprium Executive Chair, Matt Fifield. “Restarting the cathode plant is the next logical step for Cyprium’s new management team and the first phase of Nifty’s redevelopment. To move towards operations, we need comprehensive and up to date resource information. Our team produced this MRE by going back to first principles, organising and incorporating all prior existing data, and including new analysis from the 2021 sonic drill program. The result is the first updated MRE since 2015 for the unrecovered copper on Nifty’s heap leach pads. It’s a strong foundation on which we can build our forward plans.”

The 2024 Heap Leach MRE defines an indicated and inferred copper resource containing approx. 54,000 tonnes of copper that is supported to JORC standards through drilling information – see Table 1 below. A review of historic production data indicates that there is substantial potential resource upside from unsampled stockpiled material. This unsampled material is not able to be supported through drilling information as all drill holes were halted short of the pads to maintain the integrity of the pad and liner.

The 2024 MRE incorporates new data from a 2021 sonic drill program which was run in support of previous feasibility studies. Analysis of samples obtained from the sonic program have supported important metallurgical inputs on the drilled resource.

The 2024 Heap Leach MRE is the first update of an MRE on this material since 2015. The mineral resource in Table 1 represents the portion of the stockpile that was estimated from drill data in accordance with the JORC (2012) code.

Click here for the full ASX Release

This article includes content from Cyprium Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CYM:AU

Sign up to get your FREE

Cyprium Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

17 March 2025

Cyprium Metals

Advancing Western Australia’s historic Nifty copper mine for near-term production and long-term growth

Advancing Western Australia’s historic Nifty copper mine for near-term production and long-term growth Keep Reading...

23 January

Capital Raise Presentation

Cyprium Metals (CYM:AU) has announced Capital Raise PresentationDownload the PDF here. Keep Reading...

22 January

A$41M Capital Raise via Placement & Entitlement Offer

Cyprium Metals (CYM:AU) has announced A$41M Capital Raise via Placement & Entitlement OfferDownload the PDF here. Keep Reading...

19 January

Paterson Exploration Review Update

Cyprium Metals (CYM:AU) has announced Paterson Exploration Review UpdateDownload the PDF here. Keep Reading...

19 November 2025

Cathode Restart Approved by Cyprium Board

Cyprium Metals (CYM:AU) has announced Cathode Restart Approved by Cyprium BoardDownload the PDF here. Keep Reading...

13 November 2025

Senior Loan Facility Refinanced with Nebari

Cyprium Metals (CYM:AU) has announced Senior Loan Facility Refinanced with NebariDownload the PDF here. Keep Reading...

12h

ASX Copper Mining Stocks: 5 Biggest Companies in 2026

Copper prices have been volatile throughout 2025 and into 2026, fueled by economic uncertainty from an ever-changing US trade policy and strong supply and demand fundamentals. The International Copper Study Group, the leading copper market watcher, reported an apparent refined copper surplus of... Keep Reading...

12h

What Was the Highest Price for Copper?

Strong demand in the face of looming supply shortages has pushed copper to new heights in recent years.With a wide range of applications in nearly every sector, copper is by far the most industrious of the base metals. In fact, for decades, the copper price has been a key indicator of global... Keep Reading...

19 February

Northern Dynasty Shares Plunge as DOJ Backs EPA Veto of Alaska’s Pebble Mine

Northern Dynasty Minerals (TSX:NDM,NYSEAMERICAN:NAK) shares plunged on Wednesday (February 18) after the US Department of Justice (DOJ) filed a court brief backing the Environmental Protection Agency’s (EPA) January 2023 veto of the company’s long-contested Pebble project in Alaska.The brief... Keep Reading...

18 February

BHP Reports Strong Half-Year Copper Results, Boosts Guidance for 2026

BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has published its financial results for the half-year ended December 31, 2025.The mining giant said its copper operations, which span multiple continents, accounted for the largest share of its overall earnings for the first time, coming in at 51 percent of... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

Latest News

Sign up to get your FREE

Cyprium Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00