Nickel Price Update: Q2 2022 in Review

Here’s an overview of the main factors that impacted the nickel market in Q2, and what’s ahead for the nickel price forecast in the rest of the year.

Click here to read the latest nickel price update.

After unprecedented price levels prompted the London Metal Exchange (LME) to suspend trading in the first quarter, nickel has declined to trade around US$22,000 per metric ton (MT).

Nickel surpassed the US$100,000 per MT mark in early March, jumping over 250 percent in just two days. However, the base metal has fallen significantly since then.

What else happened to nickel in Q2? Read on to learn about the main trends in the sector, including key supply and demand dynamics and what market participants are expecting for the rest of the year.

Nickel price update: Q2 overview

The first quarter saw the nickel market melt down after prices reached historic highs. The chaos in trading was attributed to the massive short position held by Chinese tycoon Xiang Guangda, who controls the world’s largest nickel producer, Tsingshan Holding Group, and was facing billions of dollars in mark-to-market losses.

The 145-year-old exchange resumed trading in mid-March, with prices retreating to trade at around US$28,000.

“Given the developments for nickel price action over Q1, with the LME having to halt trading from March 8 to 16 and the falling volumes of trade since then, it is fair to say the nickel price has largely been disconnected to its underlying fundamentals,” Natalie Scott-Gray of StoneX told the Investing News Network (INN).

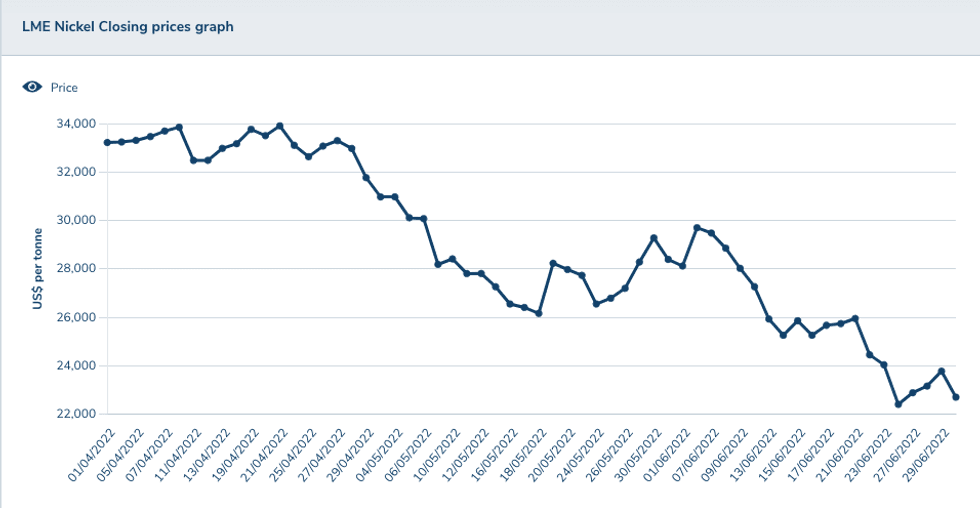

Nickel's price performance in Q2.

Chart via the London Metal Exchange.

Despite the fallback, nickel prices remained generally elevated in April thanks to a tight supply backdrop.

“With Russia being the world’s third largest producer of nickel, the war in Ukraine and associated international sanctions kept global supply and inventories tight, thus boding well for prices,” FocusEconomics said in June.

But with global economic recession fears increasing, nickel prices fell throughout the second quarter, recording three consecutive monthly losses.

“Although the LME nickel 3-month price has been trending lower since nickel trading on the LME restarted mid-March, the price is still up 7.9 percent since end-2021, finding support from the continued drawdown in Class 1 nickel stocks at exchange warehouses,” Jason Sappor of S&P Global Commodity Insights said in a report.

Speaking with INN about the nickel market in the second quarter, Sean Mulshaw of Wood Mackenzie said he expected prices to retreat a little faster than they have.

“We are now broadly back where we started pre-LME trading halt,” he said. “We expect a downward trend in nickel prices over the rest of this year and, given where we are now, we could be heading below US$22,000 in Q3.”

Nickel prices ended the quarter trading at US$22,698, declining more than 31 percent since the beginning of April.

Nickel price update: Supply and demand dynamics

During the first three months of the year, the market saw a downgrade to demand within China for stainless steel and electric vehicles (EVs), alongside strict COVID-19 lockdown measures in the country.

Commenting on demand from China in the second quarter, Mulshaw said it was weaker than expected on the back of the COVID-19 outbreak. But even now, as restrictions are easing, the rebound is not as strong as forecast.

“Stainless steel production rates have been falling since March, and this will continue at least through July,” he said. “Generally, with nickel prices falling, and therefore stainless prices, stainless customers have become cautious, not wanting to buy product that then loses value. So orders have dropped.”

Mulshaw added that the third quarter tends to be slower for demand due to summer vacation and maintenance breaks; therefore, demand is not expected to pick up before September.

Meanwhile, StoneX has downgraded its demand outlook for stainless steel due to individual economic slowdowns driven by factors such as tighter monetary policy in the west, high energy prices and a slow start in China in H1.

“(That said), we expect demand from the EV sector to jump by about 30 percent this year, driven by policy targets and further supported by an extension to subsidies in China,” Scott-Gray said.

On the supply side, StoneX has modestly increased its forecast, with record levels of nickel pig iron (NPI) production and ex-NPI production in Indonesia, which is being lifted by the expansion of NPI to nickel matte and continued growth in high-pressure acid leach production.

“Although we do factor in a potential downside risk coming from Russian production, giving the ongoing war,” Scott-Gray said. StoneX believes the European Union is unlikely to place an export ban on Russian nickel.

Supply increased in H1, and this is seen continuing in H2, predominantly through the increase in NPI and nickel intermediates production in Indonesia.

“Indonesia is essentially supplying the nickel units China needs for both stainless, as NPI, and now batteries, as matte and MHP for nickel sulfate production,” Mushlaw said. “(That means) demand for other nickel that China has traditionally depended on, like Class 1 and 'western' ferronickel, is falling.”

This increase in supply will see the global nickel market be in surplus this year and next, which will put downward pressure on prices, according to data from WoodMac.

StoneX has the nickel market in a modest surplus of about 60,000 MT for this year. “Although any disruption to the Class I side could tilt the market into a deficit, which would support higher prices,” Scott-Gray said.

Nickel price update: What’s ahead?

Looking ahead, economic uncertainty, inflation and increasing interest rates will reduce demand and prices, heightened by the Russia-Ukraine war and higher energy costs.

Russia is responsible for 9 percent of global nickel production and 15 percent of Class I nickel supply — on which Europe has a very high reliance.

Mulshaw said factors to watch next quarter include "the ongoing potential for sanctions against Russian nickel producer Norilsk Nickel (MCX:GMKN) and the possibility that LME nickel stocks could start to increase."

He also added that investors should keep an eye on the balance in production between NPI and matte in Indonesia — how many NPI lines are being converted to matte — because this dictates the balance of nickel going to China’s stainless and batteries sectors.

For Scott-Gray, further sanctions over the Russia-Ukraine war are a catalyst to be aware of.

“Although we continue to forecast that the chance of an outright sanction being placed on nickel exports from Russia by the EU remains low,” she said.

There’s also the potential for a 2 percent export tax to be placed on Indonesian exports of NPI.

“While this wouldn’t necessarily change the overall supply picture in volume terms, it would negatively impact China’s output and further increase Indonesia’s dominance for nickel production,” Scott-Gray said.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- LME Halts Nickel Trading Again on Technical Issue Soon After ... ›

- Top Nickel Stocks on the TSX and TSXV | INN ›

- Nickel Outlook 2022: Balanced Market Ahead, Prices to Remain ... ›