Nickel Price Update: H1 2021 in Review

Here’s an overview of the main factors that impacted the nickel market in H1 2021, and what’s ahead for the rest of the year.

Click here to read the latest nickel price update.

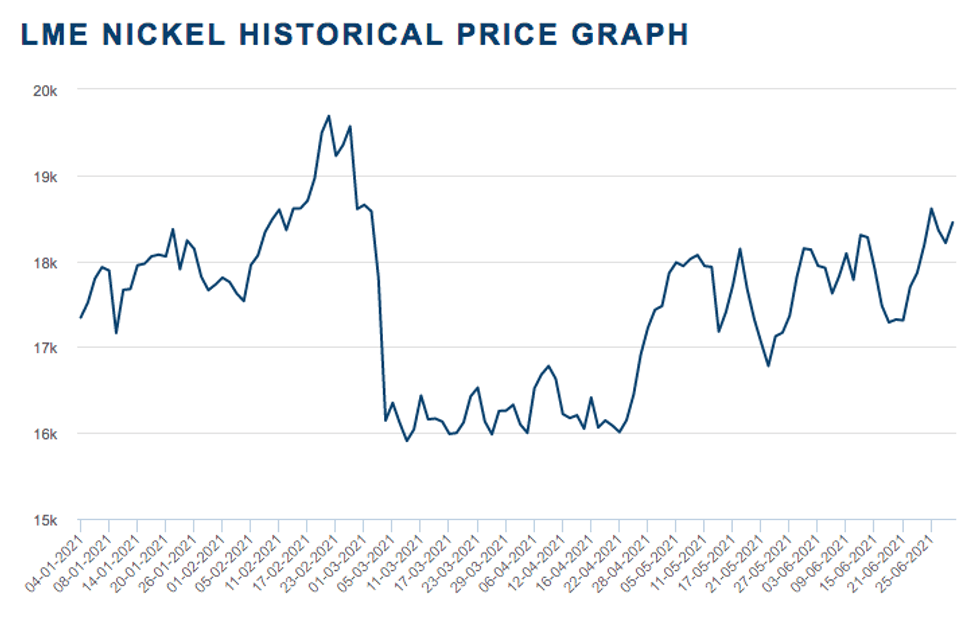

Nickel performed with volatility in the first six months of the year, with prices touching almost US$20,000 per tonne during H1.

The metal was unable to hold its gains and fell sharply, only to rebound again by the end of Q2.

With the second half of the year now in full swing, the Investing News Network (INN) caught up with analysts, economists and experts alike to find out what’s ahead for nickel supply, demand and pricing.

Nickel price update: H1 overview

Nickel started the year trading at US$17,344, following an uncertain 2020 that saw the metal fall in Q1, but bounce back by the end of the year. Speculation surrounding demand for electric vehicle (EV) batteries drove prices last year, with many analysts agreeing that the metal’s valuation was not reflecting market fundamentals.

So far in 2021, nickel’s story has been volatile. Prices hit their lowest point in early March at US$15,907 — just a few days after hitting their highest level of the period in late February at US$19,689.

H1 2021 nickel price performance. Chart via the London Metal Exchange.

The nickel price tanked in early March after Tsingshan’s announcement that it would convert nickel pig iron (NPI) into nickel matte to serve the battery sector, Jack Anderson of Roskill told INN.

Further explaining the news and its impact on the sector, Karen Norton of Refinitiv said that this raised concern that potentially a substantial amount of the country’s vast NPI industry could adapt to satisfy demand for both the stainless steel and battery sectors. “Production of matte via this route is not the cheapest, has yet to be proven on a commercial scale, but at the very least it might provide a short-term solution to an anticipated supply crunch in nickel sulfate,” she noted.

Nickel continued to perform in a choppy fashion throughout the first half and ended the six month period trading above US$18,000.

“(This was due to) strong demand from the stainless steel and battery sectors,” Anderson said. “The narrative for strong nickel demand from batteries amid President (Joe) Biden’s US Green New Deal for an economic recovery, and general tightness in the nickel market, has also helped to support prices.”

Nickel price update: Supply dynamics

As the second half of the year unfolds, Anderson expects supply to increase in H2 as the rapid ramp up of NPI operations in Indonesia takes place; this will feed integrated stainless steel operations in Indonesia and exports to Chinese mills.

“Jiangsu Delong commissioned the second phase of its stainless steel operation in April in Indonesia, resulting in a strong rise in stainless steel production in the country,” Anderson said. “Additional NPI lines are expected to be commissioned in Weda Bay, Indonesia, which should push supply higher still.”

Chinese NPI production could also be higher than initially expected as producers increasingly import nickel ores from the Philippines.

“We have seen supply disruption due to flooding of two of Norilsk Nickel’s (MCX:GMKN) Polar mining operations during H1, but these issues have now been resolved and supply should return to normal during H2,” Anderson said. “We will be paying close attention to Vale’s (NYSE:VALE) Sudbury operation, which has been hit by strike action amid negotiations over workers’ terms.”

Despite these disruptions, Anderson said Class I nickel production from Ambatovy in Madagascar will continue to ramp up through H2, as will mixed hydroxide product (MHP) supply from Prony Resources’ Goro operation in New Caledonia.

Commenting on the biggest challenge for nickel miners today, Anderson said one of them is increased scrutiny of the environmental, social and governance (ESG) credentials of projects and operations.

“Particularly producers of nickel destined for the EV batteries, where customers are inherently conscious of the environmental and social impacts of their purchase,” he said.

Anderson explained that nickel miners will increasingly face competition from high-pressure acid leach (HPAL) projects. These are being developed very quickly in Indonesia at relatively low capital costs (for HPAL technology), and will produce large volumes of battery-grade nickel products.

“But one difficulty these projects have faced is demonstrating their ESG credentials, relating to greenhouse gas emissions and tailings disposal methods,” he said. “Investors involved in these Indonesian projects last year bowed to pressure from stakeholders along the supply chain when they opted against deep sea tailings placement as a controversial method of tailings disposal.”

For Norton, one of the biggest challenges for miners going forward is the technology they are relying on to deliver a large part of the additional nickel units needed for EV battery demand growth, as well as this technology’s ability to come online without hiccups and in a timely fashion.

“Prices being sufficiently high to secure financing for some of these projects, along with increasing environmental concerns that may increase opposition (are an issue),” she said. “Also companies increasingly will have to prove their environmental credentials to key consumers.”

A bit further ahead, Norton added, recycling will play a greater role, such that the ability to secure funding may meet considerable obstacles.

Nickel price update: Demand drivers

Despite the speculation around demand from the battery segment, production of stainless steel, which accounts for around 70 percent of nickel demand, will be the key driver for years to come, Norton said.

“Indeed, stainless output in both China and Indonesia has grown strongly in the first part of 2021,” she said. “In China, the picture benefits in part from comparison with the COVID-19-related decline in the early months of 2020, while Indonesia’s still fairly nascent stainless sector continues to ramp up.”

Refinitiv forecasts that the nickel market overall will be either side of balanced both this year and next, as strong supply growth offsets a sharp jump in demand in 2021, which will be followed by more subdued (albeit still reasonable) growth next year.

Commenting on how demand will perform overall this year, Olivier Mason of Roskill said demand from the stainless steel market is likely to remain strong.

“Crude stainless steel production in China is likely to remain higher on a year-on-year basis, and Indonesian stainless steel mills are ramping up towards capacity,” he said.

Demand from the battery segment should also stay strong as sales of EVs are expected to continue rising. “EV sales are expected to be higher year-on-year in the second half of 2021,” Mason added.

Nickel price update: What’s ahead?

Looking ahead to how prices could perform the rest of 2021, volatility in the nickel price is likely to remain through H2.

“However, as production of low-cost NPI from new rotary kiln electric furnace lines in Indonesia continues to ramp up quickly through the year and production returns to normal at Nornickel’s operations, there could be some downward pressure on the nickel price, or less of an impetus to push prices higher,” Anderson said.

When asked about factors to watch out for that could impact the nickel market in the second half, Anderson said to keep an eye on Indonesia.

“The continued acceleration of NPI ramp up from Indonesian operations in H2 will likely lead to a market surplus despite strong demand from stainless steel mills in Indonesia and China,” he said.

On the battery side, investors will be keeping tabs on the ramp up of the PT HPAL operation to produce MHP and nickel sulfate on Obi Island, Indonesia, which commissioned operations in May.

“If ramp up takes place according to plan, the operation will represent a blueprint for future HPAL developments in the country,” he said. “Another source of nickel for the battery market will come from matte produced via NPI conversion.”

In terms of long-term supply, availability of recycled material is expected to increase considerably over the next decade as more batteries reach their life span, and collection rates for both battery and non-battery scrap are seen improving over the coming years, Anderson said.

“This would represent an additional feedstock source for future nickel sulfate production alongside intermediate nickel products and dissolving of Class I nickel,” he added. “The majority of growth from recycled sources is expected to come from recycling of batteries.”

For Norton, if demand falls short of expectations as China’s economy slows, prices may suffer a setback.

“Indonesian stainless steel production may help to compensate if it maintains current stellar growth, but if it falls short, the demand picture will look considerably less bullish,” she said.

On the supply side, what happens in Indonesia, particularly with regard to Tsingshan’s production and supply of high-grade nickel matte for EV batteries, is a key catalyst to pay attention to in H2.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Top Nickel Stocks on the TSX and TSXV | INN ›

- Nickel Outlook 2022: Balanced Market Ahead, Prices to Remain ... ›