Uranium Exploration in Canada’s Athabasca Basin Holds Enormous Growth Potential

Although Canada is mostly known for its wealth of gold, copper and nickel, it is also the second largest global uranium producer, accounting for approximately 15 percent of global production.

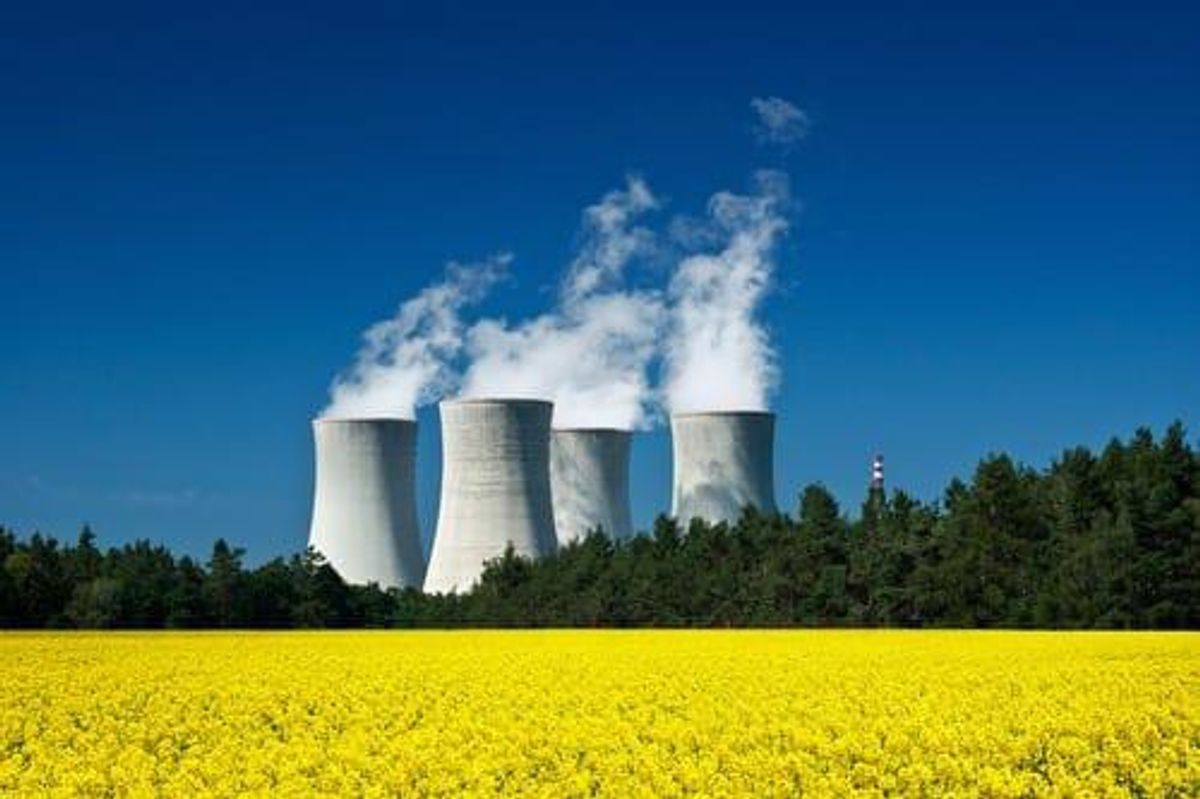

As the world continues to stare down an impending climate crisis, nuclear power has emerged as a compelling and reliable source of clean energy. Because of this, demand for uranium — a crucial nuclear fuel source — is expected to increase considerably in the coming years.

According to the International Energy Agency, nuclear power generation grew in 2021, with output rising to 8 percent above 2019 levels. Although early 2022 was marked by the shutdown of three German plants, the overall outlook for nuclear energy nevertheless remains positive, buoyed considerably by the global focus on climate change.

Case in point, there are currently 440 operable reactors worldwide and a total of 55 reactors being constructed in 19 countries, 11 of which are expected to begin producing power by the end of the year. According to the International Atomic Energy Agency, nuclear energy generation could potentially increase as much as 75 percent by 2050.

An increased focus on nuclear power means increased demand for its fuel: uranium. This is excellent news for Canada. Although the vast northern country is mostly known for its wealth of gold, copper and nickel, it's also the second largest global uranium producer, accounting for approximately 15 percent of global production.

All of this production comes from the Athabasca Basin, in Northern Saskatchewan, which is renowned for the largest, highest-grade uranium deposits in the world. As such, the Athabasca Basin will play a vital role in securing Canada's future position in the global nuclear energy market as society progresses towards a carbon neutral future.

The geopolitical side of uranium demand

The uranium market has been depressed for almost a decade. Prices plummeted from a market high of US$136.22 in June 2007 to a low of US$18 in 2016. However, a spot of hope for investors emerged in September 2021, when uranium prices hit a nine-year high of US$50.80.

This current rally is the result of built-up supply cuts by several major producers since 2017, more recently fueled by aggressive at-the-market uranium purchases by a new entry: the Sprott Physical Uranium Trust (TSX:U.UN). Though it may still be too early to definitively say if and when uranium will fully rebound to previous highs, uranium prices have already increased this year to a price that could incentivize new uranium production. As the world faces an upsurge in electricity production marked by limited supply and growing demand, the uranium market represents an opportunity for both junior and established uranium-focused companies.

Developing geo-political tensions in Eastern Europe caused a 13 percent price increase to the uranium spot price in one week and a high of US$60.40 per pound on March 10. With supply under threat by war and sanctions, old and new producers may need to step in and fill the gap. Cameco spokesperson Jeff Hryhoriw also believes that the ongoing conflict will accelerate another major trend: the country of origin for uranium will become more important than ever for investors as well as fuel purchasers. Geopolitical climate; security of supply; and environmental, social and governance factors may all soon play into company valuations and the cost of the resource itself.

Uranium exploration in a prolific Canadian jurisdiction

The Athabasca Basin region is a world-class district with the largest, highest-grade uranium deposits in the world. The district leverages a rich uranium-mining history, a stable political climate and pro-mining policies on the federal and provincial government levels.

Covering about 100,000 square kilometers of the Canadian Shield in Northern Saskatchewan and Alberta, the sandstone basin itself extends down to greater than 1,000 meters depth. The vast majority of high-grade uranium deposits have all been discovered at the sandstone unconformity, where younger sandstone is in direct contact with older crystalline gneissic basement rocks.

Uranium was first discovered in the Canadian prairies in the early 1950s, and the 1968 substantial discovery of uranium at Rabbit Lake in the Athabasca Basin led to the prolific region producing more than 500 million pounds of uranium over the following 45 years. Since this major discovery, 40 uranium deposits have been discovered in the Athabasca Basin, accounting for more than 2.6 billion pounds of uranium.

The mining-friendly government and rich uranium deposits also make the Athabasca Basin one of the most promising regions in a world transitioning to newer, decarbonized energy solutions.

Recent progress in the Athabasca Basin

There exists a wealth of promising exploration and asset development projects in the Athabasca Basin. Many of the companies working there are Canada-based, but the region is a hotbed for foreign investment activity as well. Several projects have made significant and noteworthy progress in recent months.

In February 2022, Baselode Energy (TSXV:FIND,OTCQB:BSENF) announced the initialization of a 10,000 meter diamond drilling program on the high-grade ACKIO uranium discovery, part of the 42,000 hectare Hook project in Northern Saskatchewan. The program will continue following its near-surface, basement-hosted mineralization, as well as testing for unconformity-style mineralization. In March 2022, a press release from the company announced a new sub-parallel mineralized discovery while drilling continuous 50 meter step-out holes along the strike of known mineralization. This new discovery revealed that one of its drill holes has intersected the highest levels of radioactivity seen on the project to date.

Fortune Bay (TSXV:FOR) announced plans to begin exploration of the Strike and Murmac uranium projects this year as well. Host to multiple high-grade historical uranium occurrences, both projects are situated close to extensive pre-established infrastructure.

Finally, at the beginning of the year, Australia-based Okapi Resources (ASX:OKR,OTCQB:OKPRF) closed an agreement with ALX Resources (TSXV:AL,OTC Pink:ALEXF) to acquire six advanced exploration projects within the Athabasca Basin, totaling 75 mineral claims covering over 55,000 hectares. Located along the margin of the Carswell Impact Structure's basin, all six projects have been identified as possessing excellent geological potential.

Takeaway

With the ongoing push for decarbonized energy sources, the world is increasingly looking to green alternatives such as nuclear power. As acceptance and proliferation of nuclear energy continue amidst geopolitical instability, demand for the critical commodity uranium will greatly increase. This represents a significant opportunity for Canada, where uranium exploration in the Athabasca Basin is poised to take advantage of one of the best sources of high-grade uranium on the planet, presenting great potential for investors.

This INNSpired article was written as part of an advertising campaign for a company that is no longer a client of INN. This INNSpired article provides information which was sourced by INN, written according to INN's editorial standards, in order to help investors learn more about the company. The company’s campaign fees paid for INN to create and update this INNSpired article. INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled. If your company would benefit from being associated with INN's trusted news and education for investors, please contact us.