Overview

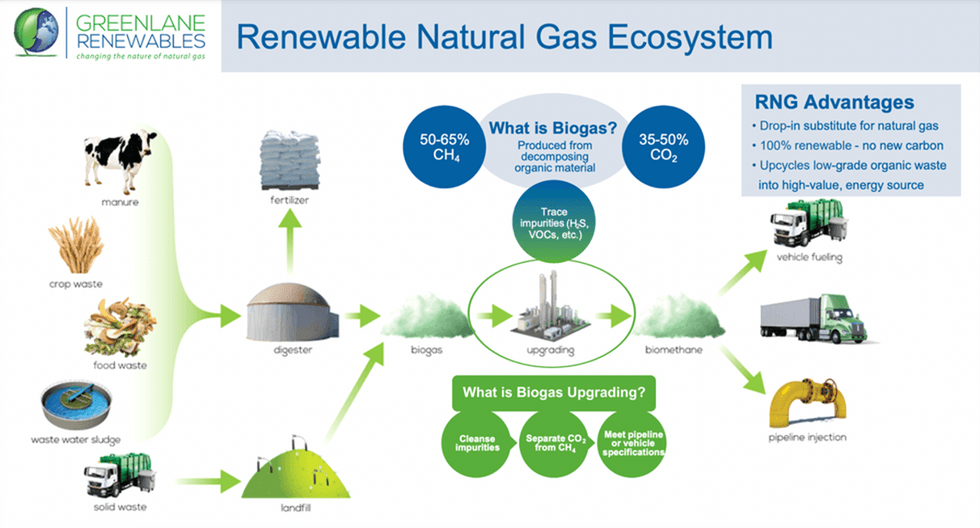

Greenlane Renewables (TSX:GRN) is a leading global provider of biogas-upgrading systems that are capable of contributing to decarbonizing the natural gas grid and transportation network. The company’s systems produce clean, low-carbon, renewable natural gas (RNG) from organic waste sources such as landfills, wastewater treatment plants, farms and food waste facilities. The RNG is then used as fuel for vehicles, such as those adopted by UPS (NYSE:UPS), or for injection into the natural gas grid.

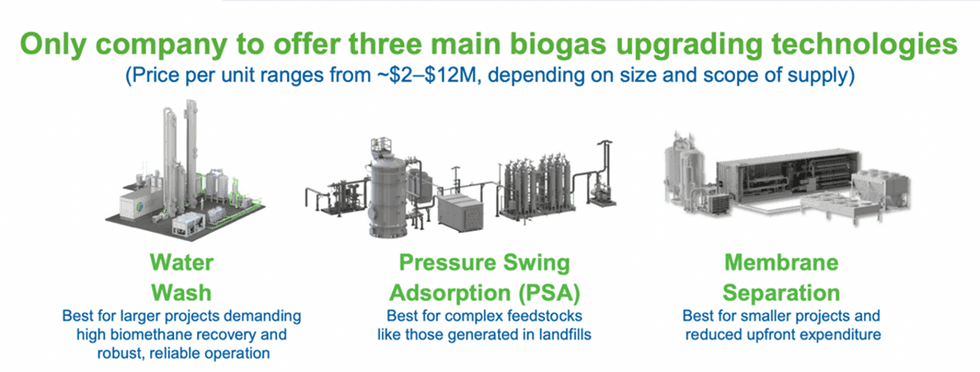

In response to end-user demands for a lower carbon footprint and renewable fuels, Greenlane Renewables is the only RNG pure-play that offers the three main biogas upgrading technologies. These technologies remove impurities and separate biomethane in raw biogas to create clean RNG for pipeline injection, liquefaction or direct use as a vehicle fuel. The company works with customers from around the globe to find the right solutions for the type and scope of the project.

Focused on providing turnkey solutions for its clients, Greenlane Renewables offers three technologically advanced solutions to its clients: its patented water-wash system, pressure swing adsorption (PSA) and membrane separation. All three are designed to meet project specifications without breaking the budget. More than that, Greenlane Renewables brings core competency and outright expertise built on decades of experience to get the job done. Units are priced from $2 million to $12 million depending on the size and scope of the project, generating more than $71 million in revenue for the company in 2022.

Greenlane Renewables has installed over 140 units in 19 countries across the globe. The company has installed one of the largest RNG operations in both Europe (Germany) and Canada (Quebec). Greenlane Renewables has also completed a project in California that upgrades and injects RNG into the SoCalGas (OTCMKTS:SOCGP) (part of the Sempra group of utilities) natural gas pipeline network.

In August 2022, Greenlane Renewables signed new contracts with a combined value of $13.5 million to supply its biogas-upgrading technology for two landfill RNG projects in South America. Greenlane will provide two water-wash upgrading systems capable of processing enough landfill gas to produce up to approximately 850,000 MMBTU. The company also secured a US contract for C$8.7 million for a project to convert dairy manure to RNG and an $11.4 million contract with a single customer for the supply of its pressure swing adsorption biogas upgrading systems for new food-waste-to-RNG projects across three US states. Most recently, Greenlane was awarded a $7.2 million contract through Synthica St. Bernard LLC for a food-waste-to-pipieline renewable natural gas project in Ohio. Greenlane will supply an integrated sulphur removal and water wash system for upgrading biogas generated from food waste streams into pipeline-spec renewable natural gas for direct injection into the local natural gas pipeline network.

In an effort to accelerate the development of renewable natural gas projects, Greenlane Renewables announced two development capital deployments in 2022, with a combined total of up to US$1.8 million. The two capital deployments — one for a company developing RNG projects based on a dairy cluster model in California, and the other for a company developing landfill gas-to-RNG projects in the US midwest — support Greenlane Renewables’ effort to accelerate RNG projects to ready-for-construction phase.

With over 35 years of industry experience, patented technology and over 140 biogas units installed in 19 countries, Greenlane Renewables is committed to help eliminate waste and provide a greener future for generations to come.

Greenlane Renewables is also one of the founding members of the Integrated Biogas Alliance (IBA), an organization designed to help provide the global biogas industry with unique and fully-integrated organic waste to renewable energy solutions.

Company Highlights

- Greenlane Renewables is a market leader in upgrading low-energy biogas to RNG.

- The company has 14 patents and 28 device titles.

- The company offers three patented biogas-upgrading technologies to customers across the globe.

- Each technology unit is worth between $2 million and $12 million.

- Revenue generated in 2022 totaled more than $71 million.

- The company has installed more than 140 units in 19 countries.

- Expanding beyond equipment sales, Greenlane Renewables has embarked on two deployment capital agreements in 2022, in an effort to accelerate projects to the construction phase.

- The company is composed of industry leaders with more than 30 years of experience.

- Insiders own approximately 10 percent of the company’s shares.

- Greenlane Renewables acquired Airdep S.R.L., a provider of biogas desulfurization and air deodorization products based in Vicenza, Italy.

- Greenlane Renewables has a robust sales pipeline worth $900 million.

Get access to more exclusive Cleantech Investing Stock profiles here