Understanding the Relationship Between the Gold Price and the ASX

Interested in the relationship between the gold price and the ASX? Here’s how the two interact and how you can benefit from it.

As the gold space becomes more prominent in Australia, it can be beneficial for investors to understand the unique relationship between the gold price and the ASX.

The two sources of trade are able to push and pull one another, although in general the price of gold tends to indirectly follow the movements of the ASX.

Read on for a breakdown of gold’s history in Australia and what’s currently affecting the price of gold. We’ll also explain the relationship between gold and the ASX, and how you can benefit from it as an investor.

Gold price and the ASX: The history of gold in Australia

Gold’s significance in Australia began in 1832 with James McBrien, who found traces of the yellow metal near Bathurst, New South Wales. However, for the most part, early discoveries of gold were kept under wraps, because authority figures were concerned that convicts, soldiers and public servants would abandon their work and other responsibilities to search for the metal.

That changed in 1851 when Edward Hargraves and his colleagues found gold, again near Bathurst. This time, the discovery was made public, and within a month, close to a thousand men were searching for the metal in an area called Ophir, named after the biblical story about King Solomon’s gold city.

There were more gold discoveries in the state of Victoria in 1854 following the rush in Bathurst. Tens of thousands of immigrants from around the globe headed to the Australian colony in search of the yellow metal, with Ballarat and Bendigo in Victoria becoming major gold sites.

Between 1848 and 1858, Australia’s population tripled to more than 1 million people. Gold fever then hit Coolgardie and Kalgoorlie in Western Australia in the early 1890s, when key discoveries were made in those areas.

During this time, exciting gold finds were spurring the development of inland towns, communications, transport and foreign trade. In fact, since Australia’s first recorded gold discovery, the metal has changed where and how people live within the country. Many towns were developed using wealth generated from mining gold, and Australia is also home to ghost towns that were deserted when the gold sources that kept them afloat ran out.

Even though the precious metal has made large contributions to Australia’s development, its importance declined during most of the 20th century as other metals became more prevalent and economically significant. Gold later underwent a resurgence in the 1980s and 1990s, when the use of new technology allowed lower-grade ores to be processed economically.

Today, Australia is stepping back into the spotlight as one of the most prolific gold-mining regions in the world. In terms of gold prices throughout the years, the metal has experienced a mostly upward trajectory in Australian dollars.

Gold price and the ASX: What’s moving the gold price

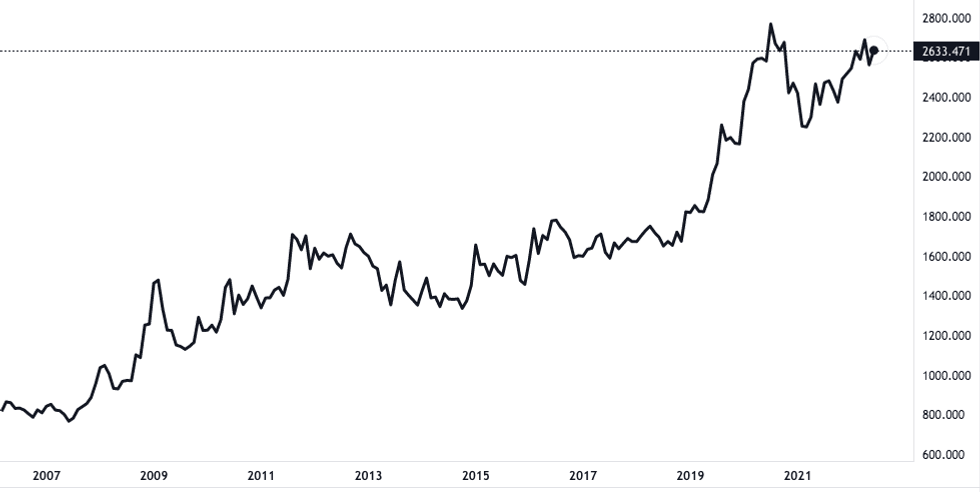

At the start of 2022, the gold spot price was around AU$2,500 per ounce, which is much higher than it was almost 20 years ago. In the year 2000, gold hit AU$481.68, a high at the time, and 10 years later it was still climbing, breaching the AU$1,400 mark.

The metal made more gains between 2009 and 2011 before backsliding. However, the downturn did not last long, and by 2015 gold prices were slowly ramping up again, reaching its highest in August of 2020 at AU$2,618.67.

Performance of gold price from 2006 to the present.

Chart via TradingView.

While there are a variety of factors that influence the price of gold, some have more weight than others. Below is a guide on the main elements that are shifting and shaping the price of metal.

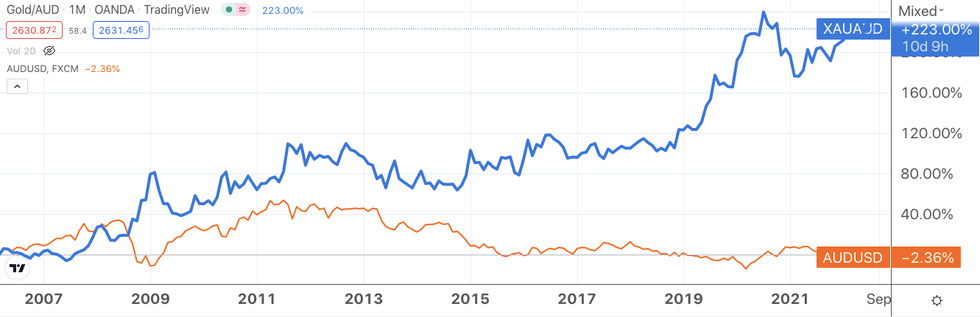

The Australian dollar

The first element supporting the yellow metal is the fact that the Australian dollar did not have the strongest year in 2020. In general, as the dollar declines, the yellow metal will see an upward price movement.

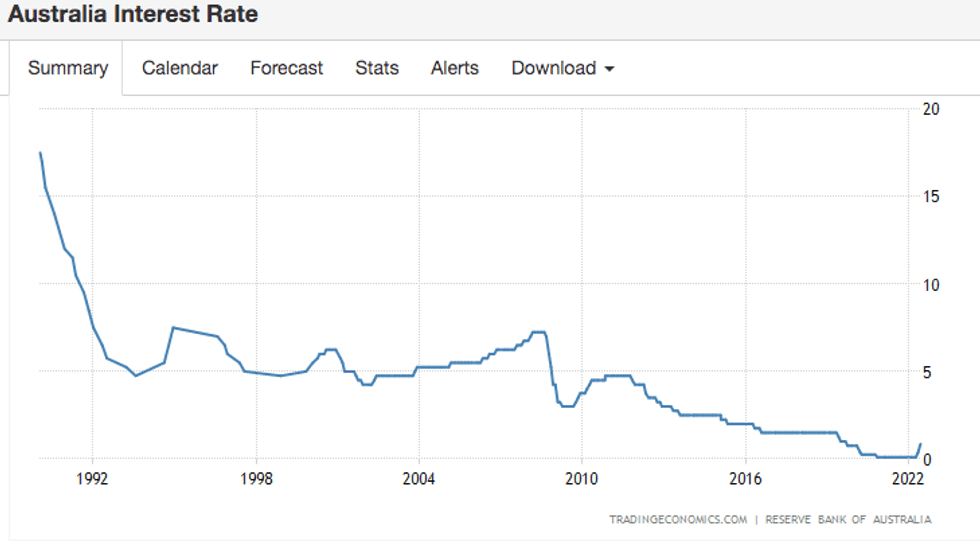

Reserve Bank of Australia

Much like with the US, interest rates have been raised in Australia as of late. In May 2022, the central bank lifted rates for the first time since 2010 by a quarter point basis, with investors expecting it to continue to increase rates at that pace.

However, following its June policy meeting, the Reserve Bank of Australia moved its cash rate by 50 basis points to 0.85 percent — its highest hike in 22 years.

Gold tends to retreat directly after rates are increased, but it is not always the case. Higher interest rates make stocks, government bonds and other investments more attractive to investors.

The United States

The ongoing trade war between the US and China has affected overall global markets, and in Australia it has sent investors running towards the safe haven nature of gold. The spat between the two powerhouse countries has been ongoing for four years, causing a tariff tit-for-tat that has resulted in volatility in the markets.

These tensions have been eased slightly in recent years by the signing of a phase one trade deal in January of 2020 between the two nations, and recent talks between the leaders of both countries.

Geopolitical events

Any time global tensions rise, the price of gold will rise as well. Usually, these events only trigger a short-lived rise in precious metals like gold, as investors turn to gold for a safe investment in the face of international conflict. Most recently, the war in Ukraine has caused gold prices to shoot up.

It’s likely that gold prices will continue to be volatile depending on how the war progresses. However, if historical precedent stands true, the support for gold will be short lived and drop once tensions ease and the need for a safe haven investment goes through a correction.

Performance of gold price during the 2014 Crimean annexation by Russia.

Chart via TradingView.

The above chart displays the price of gold in Australian dollars during the 2014 Russian invasion of Ukraine’s Crimea peninsula. It shows how the price of gold soared during February and March, when the invasion took place. After this period, gold returned to its previous trend. Although the current events are of a much larger scale and predicting how they will develop is impossible, the past history of gold’s price during geopolitical conflict is worth considering.

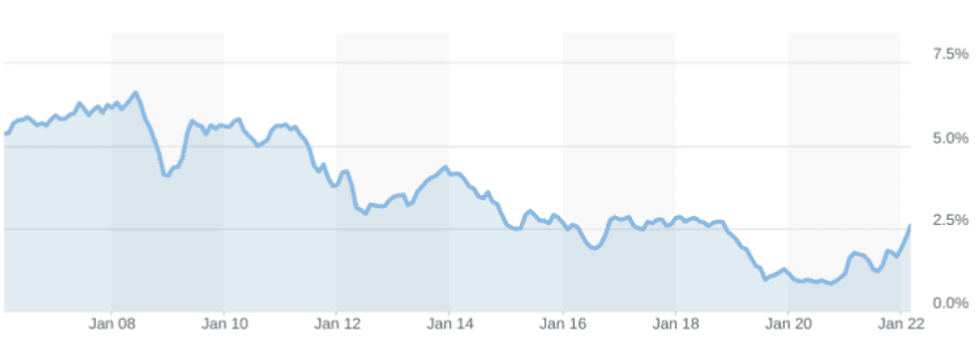

Bond market and exchange rate

Another element that is currently affecting the price of gold is a dwindling 10 year government bond yield. Since 2008, 10 year yields have dipped from over 6.59 percent to a low of under 1 percent in 2020. Currently, 10 year bonds are recovering from the pandemic low and sit at 2.77 percent.

Australian government 10 year bond yields since 2006.

Chart via Market Watch.

Compared to US 10 year yields, which have fallen from 4.05 percent to 2.47 percent over the same period, it is clear that the Australian bond market has taken a larger hit. Because of this, the exchange rate for Australian and US dollars has fallen and has led gold to outperform in Australian dollars.

“The bottom line is that, while the AUD gold price is high, it’s entirely justified why it is trading above AU$2,000 per ounce. Whether it’s a faltering local economy, a fragile property market, negative yield differentials, low and falling rates or a weakening currency, there are many good reasons why astute investors typically allocate 5 to 10 percent of a diversified portfolio to gold. The strategic case for gold is as strong as ever,” the World Gold Council explains.

Gold price and the ASX: How gold affects the market

Gold’s relationship with the ASX is unique in that the metal indirectly follows the movements of the market, as opposed to resources like oil and gas. The yellow metal has the tendency to be viewed as a counter-cyclical asset, which means that its value increases during market downturns.

Due to gold’s large global presence and high intrinsic value, the precious metal is often seen as a universal currency. When the outlook of the equity market looks bleak, or corporate earnings are destined for doom, investors will flock to the precious metal.

On the flip side, when the economy, and in turn the ASX, is on the rise, investors tend to abandon the yellow metal in favour of equities.

However, this is not to say that the relationship between gold and the ASX is a negative one. It is more of a give-and-take commitment. The metal continues to have an impact on jewellery and jewellery-related products. Additionally, gold is used in dentistry, aerospace and electronics — all of which affect publicly traded companies and as a result the ASX.

This relationship between the gold price and the ASX has turned the precious metal into something of a hedge when it exists within an individual’s portfolio as a source of diversification, which is when market participants hold investments that are not related to one another.

Since gold has a history of having a negative correlation to stocks, bonds and other financial instruments, it becomes important that investors get diversified by owning a portfolio that combines gold with stocks and bonds in order to reduce both volatility and risk. While it is true that the yellow metal goes through times of volatility, its spot price has always maintained its value over the long term.

This is an updated version of an article first published by the Investing News Network in 2020.

Don’t forget to follow us @INN_Australia for real-time updates!

Securities Disclosure: I, Matthew Flood, currently hold no direct investment interest in any company mentioned in this article.