EV Market Update: H1 2024 in Review

EV sales were up year-on-year in H1 2024. Here's a look at EV market trends so far this year, plus data on the top brands and long-term forecasts.

Electric vehicles (EVs) are a key part of the green transition, but 2023 brought slower growth in adoption and led market watchers to make lower predictions for EV sales heading into the new year.

However, with 2024 now half over, trends have emerged that show the outlook may not be quite so simple.

What factors are at play this year, and what are the key EV trends to watch? Here the Investing News Network takes a look at what's moving the EV market in 2024, as well as what’s on the horizon for the EV sector longer term.

Global EV sales up in H1 2024

While EV sales looked rough early in the year from a month-on-month perspective, they were up significantly year-on-year. According to EV market research firm Rho Motion, January sales dropped by 26 percent from December to 1.1 million vehicles sold, only to fall another 25 percent month-on-month in February to 0.8 million vehicles sold.

However, taking a look at year-on-year figures shows that combined EV sales for the first two months of the year were actually up by 32 percent over the January/February period in 2023.

Sales for EVs pushed past the million mark once again in March and in the months that followed. By the end of May, more than 5 million EVs had been sold around the world in the first five months of the year.

Compared to the same period last year, the number of EVs purchased was up by 20 percent.

This growth isn't even across the board, though. One of the key trends to watch in this year’s EV market landscape is the marked difference in growth trajectories for the three major regional markets.

EV market trends in China, North America and Europe

China continues to lead the world in EV adoption rates, based on Rho Motion’s data.

The Chinese EV market grew by 31 percent in the January to May period versus 2023, compared to just 5 percent growth in North America (excluding Mexico) and 4 percent in Europe.

Looking at May alone, China’s sales were up 36 percent year-on-year. The numbers were not so hot for the other two key markets, which were down by 3 percent and 9 percent, respectively.

The US and Canada, states a mid-June report from Charles Lester, Rho Motion’s leading EV data analyst, are “suffering a blow to sales figures this year as Tesla (NASDAQ:TSLA) struggles to get back into the fast lane and President Biden announces tariffs for Chinese EV and battery imports.”

The world’s largest EV manufacturer is China’s BYD (OTC Pink:BYDDF,HKEX:1211), which launched an affordable EV model priced below US$10,000 earlier this year. The company plans to grow its annual sales by 20 percent to reach 3.6 million EVs in 2024, with a goal of selling about 500,000 units internationally.

Rho Motion reports that BYD’s market share in Europe has reached 1 percent, up from about 0.5 percent in 2023, and the company sold 176,000 units overseas in the first five months of the year. These cheaper Chinese EV models pose a problem for the other two major auto markets, North America and Europe, which are already grappling with trying to grow their own domestic EV industries to challenge China’s overwhelming dominance in the global EV market.

In May, the Biden administration effectively quadrupled tariffs on Chinese EVs to 100 percent, and disqualified imported EVs from the US$7,500 federal tax credit, in a move to protect the US auto industry.

Shortly after, the European Union (EU) imposed its own tariffs on Chinese EVs, which Reuters reports range from 17.4 percent for BYD to 38.1 percent for SAIC Motor Company (SHA:600104), another major Chinese EV maker.

This is on top of the standard 10 percent car duty.

Lester warned against the tariffs on Chinese EV imports imposed by the EU. “If they hope to achieve their ambitious climate goals, they will want to maintain good trade relations with the fastest-growing EV market,” he said.

In late June, the Canadian government said it is also looking to protect its investments in the country’s burgeoning EV industry through new tariffs on China EV imports.

"A surge of low-cost EV imports from China will undermine everything being done right now to rebuild and grow a strong and truly national auto industry," Unifor President Lana Payne said.

In the US, the apparent stagnation in EV sales so far this year is largely a reflection of falling demand for Tesla vehicles. In its Q1 earnings report, the company reported a 13 percent drop in revenue compared to last year, which was attributed to a more competitive EV market and more consumers choosing hybrid models over pure EVs. Tesla deliveries declined by 9 percent year-on-year, while total revenue dropped to US$21.3 billion from US$23.3 billion.

Tesla CEO Elon Musk told shareholders that more affordable Tesla models are in the works and could be brought to market in “early 2025, if not late this year.” However, in May his company laid off 10 percent of its global workforce.

Tesla sales lag as other US EV brands grow

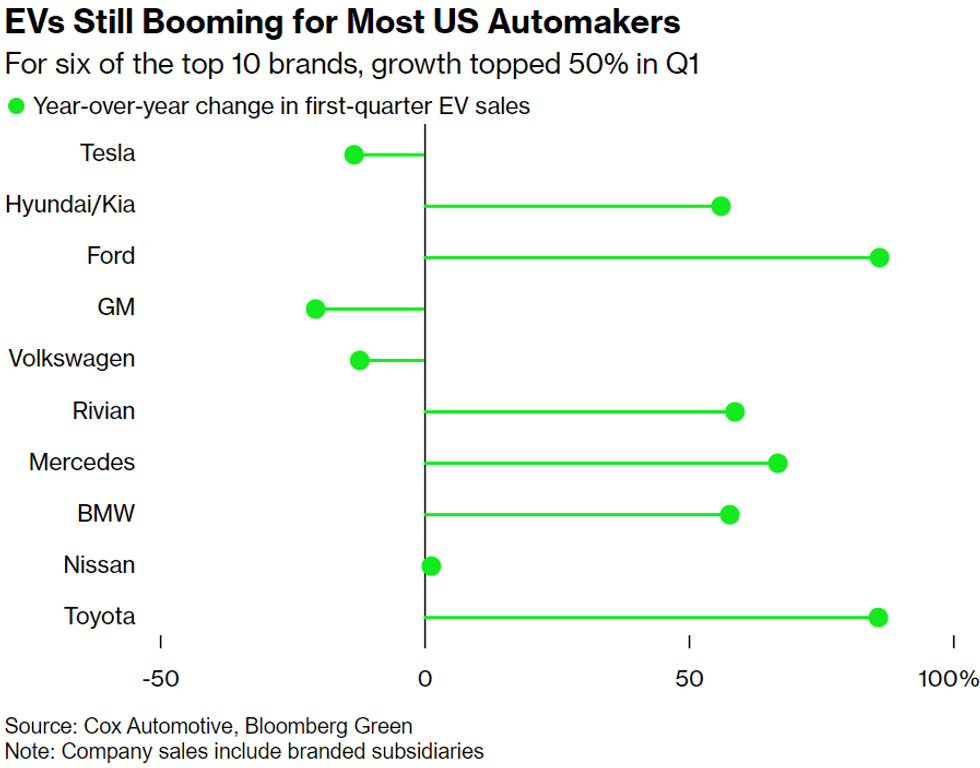

The roadblock Tesla is struggling to overcome hasn’t led other major US EV brands to hit the brakes, according to Bloomberg, which shared data from US auto industry authority Cox Automotive. The graph below shows that six of the 10 top brands saw EV sales growth in the US of over 50 percent year-on-year in the first quarter.

Q1 2024 year-on-year EV sales growth by brand in the US.

Chart via Cox Automotive and Bloomberg Green.

The companies in the US EV market that saw the biggest increases are Ford (NYSE:F) at 86 percent, Toyota (NYSE:TM,TSE:7203) at 85.9 percent, Mercedes-Benz (OTC Pink:MBGAF,ETR:MBG) at 66.9 percent, Rivian (NASDAQ:RIVN) at 58.8 percent and Hyundai (KRX:005380) and Kia (KRX:000270), which were both up 56 percent.

Bloomberg's Tom Randall notes that removing the two worst performers for the quarter — Tesla, down 13.3 percent, and General Motors (NYSE:GM), down 20.5 percent — puts US EV sales growth for Q1 at 23 percent year-on-year.

General Motors' sales drop had little to do with a drop in demand, but rather because it stopped production of its Chevy Bolt, one of the best-selling EV models in the US. Its new EV, the Chevy Equinox, is expected to release in 2024.

However, despite a stellar start to EV sales in 2024, both Ford and Toyota have now shifted into reverse on their once-ambitious EV manufacturing targets. While Ford first made cuts to its expansion plans in late 2023, as recently as June 24, the auto giant said it was suspending the release of new battery electric vehicle (BEV) models because it doesn’t see the economic case for them in the current market environment.

"We will not launch a second-gen (EV) product unless it's profitable within the first year and we are going to get a return on that capital we're investing," said Ford CFO John Lawler.

This is telling, coming from the second best-selling EV brand in the US so far in 2024.

And then there’s Toyota, which is looking to delay the planned 2025 launch of EV production in the US to 2026. In April, Toyota Chair Akio Toyoda expressed his company’s belief that a “multi-pathway approach” is the best route to decarbonizing transportation, and that “customers, not regulations or politics,” will dictate the path forward.

In addition to BEVs, the Japanese car maker is focused on hybrid and hydrogen-powered vehicles; it is also continuing with its internal combustion engine (ICE) models.

So what’s in store for the rest of 2024? Much optimism still remains for the EV market for the remainder of the year.

In its Global EV Outlook 2024, released in late April, the International Energy Agency (IEA) forecasts that EV sales will hit 17 million worldwide by the end of the year — representing one in five of new car purchases.

“Electric cars continue to make progress towards becoming a mass-market product in a larger number of countries,” the IEA states. “Tight margins, volatile battery metal prices, high inflation, and the phase-out of purchase incentives in some countries have sparked concerns about the industry’s pace of growth, but global sales data remain strong.”

Long-term EV market outlook

Looking further out, the IEA expects that EVs will represent half of total global auto sales in 2035. That figure could increase to two-thirds if governments are able to meet all their energy and climate mandates on schedule.

Speeding up the adoption of EVs will also require automakers to bring more affordable models to market that are price competitive with their internal combustion engine equivalents. China is already doing well in this facet of the market; however, much ground needs to be covered in the North American and European markets, which are struggling with supply chain issues for EV battery metals, as well as a lack of public charging infrastructure.

According to IEA estimates, more than 60 percent of EVs sold in China last year were cheaper than their ICE counterparts. In Europe and the US, depending on the geographic location and the vehicle type, the agency reports that EVs are 10 percent to 50 percent more expensive than ICE vehicles. On the plus side, based on current trends, the IEA forecasts that price parity between EVs and ICE vehicles could be reached in ex-China markets by 2030.

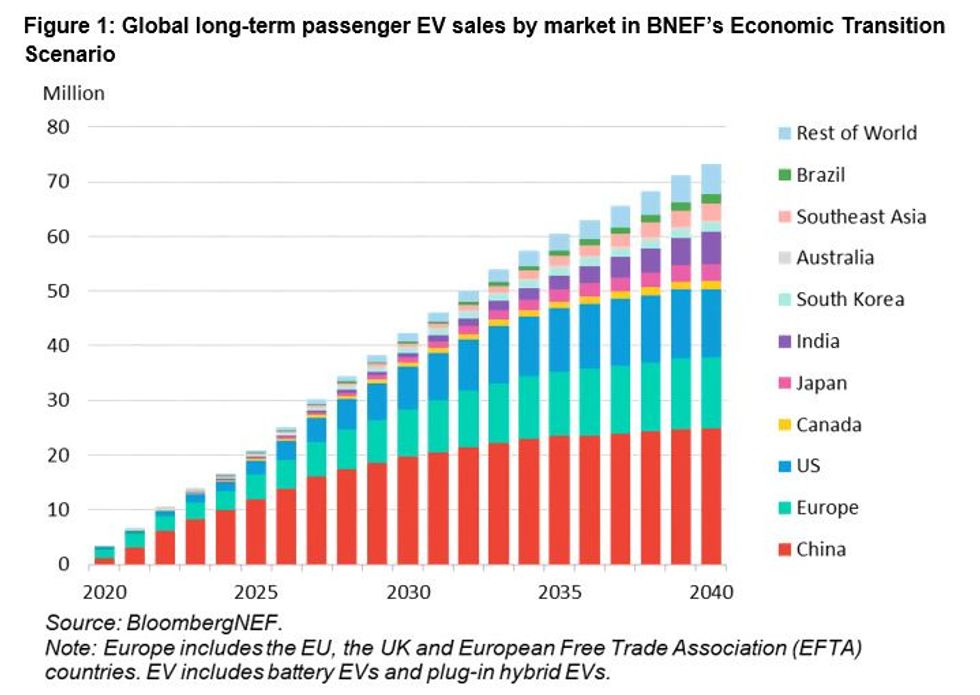

EV sales forecast by region through 2040.

Chart via BloombergNEF.

For its part, BloombergNEF released its Long-Term Electric Vehicle Outlook in June.

Using its base-case scenario, the firm's analysts predict that by 2027, annual passenger EV sales will reach 30 million, representing 33 percent of total global vehicle sales, and forecast that EV sales will top 40 million in 2030. By 2040, they predict this figure will hit 73 million, making up 73 percent of total vehicle sales worldwide.

This base-case scenario is based on consumer demand replacing policy-driven demand as battery prices decline, costs become competitive with ICE vehicles and battery technologies improve range and performance.

Investor takeaway

In 2024, the global EV market is sending clear signals that this is very much a growth-stage market.

The early adopters have bought in, and now automakers must prove that their products are worth the average consumer's hard-earned dollars. Additionally, if governments want car buyers to come along for the ride on the road to net zero, they’ll have to play a bigger role incentivizing both consumers and producers to go all in on EVs.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

- Adam Rozencwajg: Will EVs Succeed? Efficiency, Emissions and a Potential Catalyst ›

- Electric Vehicle Stocks: 10 Biggest Companies in 2023 ›

- Electric Vehicles Need Battery Metals Mining, Investing Opportunities Ahead ›