ASX Release

Westgold is a leading, ASX200 Australian gold producer, with a clear purpose - to unearth enduring value for all our stakeholders.

Our vision is to become the leading Australian gold company, sustaining safe, responsible and profitable production.

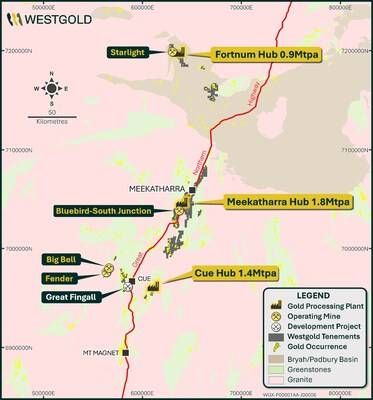

Our operations comprise four mining hubs, with combined processing capacity of ~6Mtpa across the Murchison and Southern Goldfields, two of Western Australia's most prolific gold-producing regions.

Financial values are reported in A$ unless otherwise specified.

This announcement is authorized for release to the ASX by the Board.

Underlying Quarterly Cash Build Doubled to a Record $365M

PERTH, Western Australia, Jan. 21, 2026 /CNW/ - Westgold Resources Limited (ASX: WGX,OTC:WGXRF) (TSX: WGX) (Westgold or the Company) is pleased to report results for the period ending 31 December 2025 (Q2 FY26), with record gold production, higher volume third-party ore purchase, and a record achieved gold price effectively doubling the underlying cash build compared to Q1 FY26.

HIGHLIGHTS

SAFETY

Total Recordable Injury Frequency Rate (TRIFR) increased to 9.32 / million hours worked

PRODUCTION

Record Group gold production of 111,418oz Au @ AISC of $3,500/oz - excluding ore purchases, Westgold produced 89,101oz at AISC of $2,945/oz

- 33% increase in gold produced quarter on quarter

- Reef mining recommenced at Great Fingall Mine

- Higher volume of HG oxide ore purchased from NMG

TREASURY

Gold sales of 115,200oz - at an average price of A$6,356/oz generating revenue of A$732M

Underlying cash build of $365M - before outflows of stamp duty on Karora transaction ($76M), debt repayments ($50M), investments in growth ($48M), dividends and buybacks ($29M) and exploration ($6M) and inflows from asset sales of $26M

$654M in closing cash, bullion, and liquid investments @ 31 December 2025 - a $182M increase Q on Q

Westgold is 100% debt free and remains unhedged

CORPORATE

Ongoing portfolio optimisation to unlock shareholder value:

- Mt Henry-Selene divested for $64.6M

- Reedy's and Comet assets to demerge into a new ASX‑listed company, Valiant Gold Limited

FY25 dividends paid and FY26 share buyback continues

FY26 Guidance Maintained

Westgold Managing Director and CEO Wayne Bramwell commented:

"In Q2, FY26 Westgold delivered record quarterly cash build of $365M and production of 111,418 ounces.

Continued operational improvement from our assets continued and we had the opportunity to super charge our cash build by purchasing a higher volume of third-party ore. This third party ore delivered 22,317 ounces and monetising it further strengthened our balance sheet. These factors culminated in the Group closing the quarter with a treasury of $654M.

Costs this quarter, reflected deliberate choices made to maximise value.

Operational outputs continued to improve in the Murchison, whilst the Southern Goldfields were stable. The election to process higher volumes of softer, higher-grade oxide in the Murchison allowed us to significantly increase milling throughput at Meekatharra and accelerated cash generation, even though this third‑party ore carries a higher unit cost.

Looking ahead, our 3‑Year Outlook (3YO) clearly maps a pathway to structurally lower our cost base.

The ramp up of our Bluebird–South Junction mine at Meekatharra, Great Fingall at Cue and increasing outputs from Beta Hunt in Kambalda will underpin higher grade ore replacing the low‑grade stockpiles milled to maintain processing throughputs at our largest processing hubs. In parallel we are actively advancing a range of Westgold owned open pit targets to bring value forward in the 3YO.

As we enter the second half of FY26 our focus remains on more consistent operational delivery. Our key growth projects are advancing to plan and alongside a non-core divestment programme, the planned demerger and IPO of Valiant Gold during H2, FY26 can create additional ore supply for our Murchison processing hubs and unlock latent value for our shareholders.

Westgold's momentum continues to build. The business has scale, is debt free, unhedged and with a clear plan to reduce our cost structure, this team is committed to unlocking greater value from our portfolio."

Executive Summary

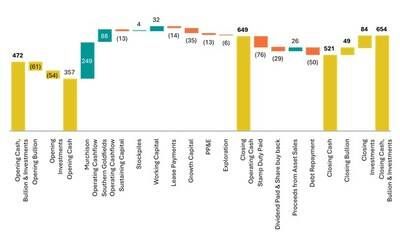

Cash Position as of 31 December 2025

Westgold closed Q2, FY26 with cash, bullion and liquid investments of $654M – representing a build of $182M in total cash, bullion and liquid investments.

Underlying cash build was $365M before one off payments (stamp duty ($76M), debt repayments ($50M), dividends and share buy backs ($29M), growth and exploration spend (invested $48M on non-sustaining capital and $6M on exploration), and one off cash inflows of $26M (proceeds from asset sales).

This result was driven by a substantial increase in Group gold production and an increase in realised gold price to $6,356/oz.

Notes for Q2 Cash, Bullion and Liquid Investment Movements

- Proceeds from Asset Sales of $26M - relating to the Lakewood Sale and Alicanto deposit received in the quarter.

- The FY25 dividend payment to shareholders (3cps) of $28M was declared during Q1 FY26.

- Stamp duty of $76M paid for the Karora transaction.

- Debt repayment of $50M - resulting in Westgold being debt free.

- Closing Q2, FY26 investments include 1.7B NMG shares - but exclude 19.8M shares in Blackcat Syndicate Limited (ASX: BC8 - under escrow until 31/03/2026) and 31.8M shares in Kali Metals Limited (ASX:KM1 - under escrow until 8/01/2026).

- Westgold remains unhedged and fully exposed to the spot gold price.

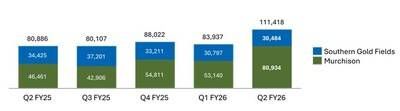

Group Production Highlights – Q2, FY26

Westgold is pleased to report a record quarterly Group gold production for Q2, FY26 of 111,418oz (Q1 FY26: 83,937oz). The Murchison produced 80,934oz (Q1 FY26: 53,140oz) and the Southern Goldfields produced 30,484oz (Q1 FY26: 30,797oz).

Q2, FY26 production was significantly higher than Q1, FY26 driven by improving output in the Murchison, largely as a result of higher grades at Fortnum and higher grade and production sourced from Westgold's Ore Purchase Agreement (OPA) with New Murchison Gold (ASX:NMG) at Meekatharra.

All-In Sustaining Cost (AISC) for Q2, FY26 was $390M (Q1 FY26: $240M), and on a per ounce basis was $3,500/oz (Q1 FY26: $2,861/oz). The higher quarter-on-quarter costs primarily reflect the decision to maximise cash generation. In particular, the election to purchase a higher volume of high grade oxide ore under the OPA provided an opportunity to increase milled grade at Meekatharra, which, while carrying a higher unit cost to Westgold, delivered stronger Group cash flow.

The OPA added $14M to the cash build in Q2 FY26.

The softer OPA ore also served to increase milling throughputs at our Meekatharra processing hub - lifting the run rates to over 2Mtpa. With short-term ventilation constraints at Cue restricting ore flow from Big Bell, the expanded capacity of the Meekatharra Hub was supplemented with additional low margin stockpile ore. While these factors elevated AISC for Q2, FY26 - they were deliberate, value-accretive choices that further strengthened the Group's cash flow.

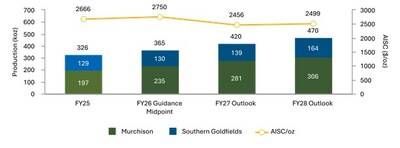

Westgold's 3-Year Outlook outlines a clear pathway to structurally lower costs as lower-grade stockpile feed is progressively replaced with higher-grade sources across the portfolio. Westgold is also actively advancing organic opportunities to bring value forward in the 3YO and this includes a range of Westgold owned open pit targets.

Excluding gold production from ore purchased under the OPA, Group AISC was $2,945/oz with higher royalty payments linked to gold price contributing to the increased cost.

For the first half of FY26, Westgold produced 195Koz of gold at an AISC of $3,225/oz inclusive of the OPA.

Westgold maintains its production guidance for FY26 of 345 – 385koz.

Production from Westgold's assets was in line with expectations over the half and while the Company continues to expect progressive efficiency improvement across its portfolio in H2 FY26, Q3 FY26 will see increased planned maintenance at all four (4) processing hubs. Despite production from the OPA having outperformed in Q2 FY26, Westgold maintains a conservative outlook on OPA production for the remainder of the year.

Westgold maintains its cost guidance of $2,600 – $2,900/oz, exclusive of the gold price linked OPA costs.

While Westgold maintains its margin, the OPA costs have dramatically increased in conjunction with the rising gold price, driving the ASIC inclusive of the OPA higher. Westgold's OPA margin will increase in Q3 FY26 in accordance with the OPA terms.

Across the gold industry, the rising gold price is also increasing the impact of royalty cost in AISC. Year to date this has added $12M to Westgold's AISC expectations.

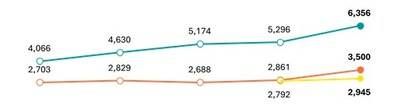

The Company sold 115,200oz of gold for the quarter achieving a record price of $6,356/oz, generating $732M in revenue. With Westgold hedge free, operations generated $319M of mine operating cashflows and a strong AISC margin of $2,856/oz.

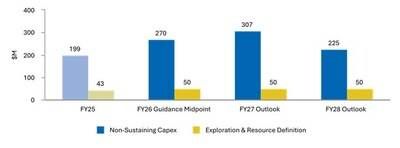

Total non-sustaining capital expenditure during Q2 FY26 of $48M (Q1 FY26: $60M) includes $35M of investment in growth projects (Bluebird-South Junction and Great Fingall development) and $13M in plant and equipment (processing facilities, ventilation, water, power and paste infrastructure across the Group).

Investment in exploration and resource development of $6M (Q1 FY26: $12M) for the quarter continued focusing on Bluebird-South Junction and Starlight in the Murchison, and the Fletcher Zone at Beta Hunt in the Southern Goldfields. Westgold remains on track to invest the FY26 exploration guidance of $50M with a ramp up in exploration activity focused on Bluebird South Junction and the Fletcher Zone in H2 FY26.

The net mine cash inflow for Q2 FY26 was $265M (refer Table 1 under Group Performance Metrics).

3-Year Outlook

Building on the FY26 guidance, Westgold released a detailed 3-Year Outlook (3YO) on 1 October 2025 that presents a high-confidence, executable plan to increase the Group's annual gold production to ~470,000oz per annum by FY28, while reducing AISC to around $2,500/oz from FY27 onwards.

This organic growth plan is modelled on Westgold's existing portfolio of operating assets, 2025 Ore Reserves (56Mt at 1.93g/t for 3.5Moz of gold), and four processing hubs with a combined current processing capacity of approximately 6Mtpa.

Importantly, the 3YO excludes tangible opportunities which, if realised, represent further upside to the plan.

These opportunities are being actively advanced to bring value forward into the 3YO.

For more information, refer to "Westgold Provides 3-Year Outlook" lodged on the ASX on 1 October 2025.

Group Performance Metrics

Westgold's quarterly physical and financial outputs for Q2 FY26 are summarised below.

Table 1: Westgold Q2 FY26 Performance

| Physical Summary | Units | Murchison | Southern | Group |

| ROM - Ore Mined | t | 706,987 | 481,127 | 1,188,114 |

| Grade Mined | g/t | 2.5 | 2.4 | 2.4 |

| Ore Processed | t | 1,084,704¹ | 444,722 | 1,529,426 |

| Head Grade | g/t | 2.5¹ | 2.3 | 2.4 |

| Recovery | % | 92 | 94 | 93 |

| Gold Produced | oz | 80,934¹ | 30,484 | 111,418 |

| Gold Sold | oz | 84,077 | 31,123 | 115,200 |

| Achieved Gold Price | A$/oz | 6,356 | 6,356 | 6,356 |

| Cost Summary | Units | Murchison | Southern Goldfields | Group |

| Mining | A$'M | 203¹ | 60 | 263 |

| Processing | A$'M | 40¹ | 18 | 58 |

| Admin | A$'M | 8 | 9 | 17 |

| Stockpile Movements | A$'M | 2 | 2 | 4 |

| Royalties | A$'M | 16 | 19 | 35 |

| Sustaining Capital | A$'M | 11 | 2 | 13 |

| All-in Sustaining Costs | A$M | 280 | 110 | 390 |

| All-in Sustaining Costs | A$/oz | 3,457 | 3,614 | 3,500 |

| All-in Sustaining Costs – Excluding OPA | A$'M | 152 | 110 | 262 |

| All-in Sustaining Costs – Excluding OPA | A$/oz | 2,597 | 3,614 | 2,945 |

| Notional Cashflow Summary | Units | Murchison | Southern Goldfields | Group |

| Notional Revenue (produced oz) | A$'M | 515 | 194 | 709 |

| All-in Sustaining Costs | A$'M | 280 | 110 | 390 |

| Mine Operating Cashflow | A$'M | 235 | 84 | 319 |

| Growth Capital | A$'M | (29) | (6) | (35) |

| Plant and Equipment | A$'M | (8) | (5) | (13) |

| Exploration Spend | A$'M | (2) | (4) | (6) |

| Net Mine Cashflow | A$'M | 196 | 69 | 265 |

| Net Mine Cashflow | A$/oz | 2,421 | 2,247 | 2,373 |

| 1. Includes 181kt of OPA ore processed at 4.0g/t for 22,317oz. The OPA added $128M to Westgold's group AISC. |

Q2 FY26 Group Performance Overview

Westgold processed 1,529 kt (Q1 FY26: 1,355kt) of ore in total at an average grade of 2.4g/t Au (Q1 FY26: 2.1g/t Au), producing 111,418oz of gold (Q1 FY26: 83,937oz). Processing improvements were driven predominantly by the exceptional performance at the Meekatharra hub influenced by the higher percentages of soft oxide material in the blend and incremental improvements in throughput rates at other operations driven by systematic work to optimise productivity.

Group AISC in Q2 FY26 was $390M, higher than the previous quarter (Q1 FY26: $240M).

Westgold mined a total of 1,188kt at 2.4g/t Au (Q1 FY26: 1,225kt at 2.2g/t Au) declining slightly quarter on quarter as expected, driven by the completion of Lake Cowan open pits (~73kt lower quarter on quarter) and scheduled slower mining rates at Fender (~24kt lower quarter on quarter). All other mines were steady or slightly improved compared to the prior quarter.

MURCHISON

The Murchison hubs produced 80,934oz of gold (Q1 FY26: 53,140oz). Quarterly production increased significantly due to improved throughput and grade at the three Murchison processing hubs.

The Fortnum Hub contributed to the production improvement with strong production from higher grade stoping areas at the Starlight mine. The Meekatharra Hub also significantly improved, with Bluebird UG performing to plan and OPA oxide material outperforming. The blending of soft oxide ore from the OPA enabled the Meekatharra Hub to process at rates well above historical averages, unlocking capacity to purchase and process extra OPA ore, whilst also continuing to feed fresh UG ore from Bluebird UG and low grade stockpiles.

The Cue Hub also lifted quarter on quarter with fewer planned shutdowns in Q2 and grade increasing with the addition of Great Fingall main reef ore.

Total AISC of $280M (Q1 FY26: $163M) was higher than the prior quarter, mainly due to the gold price linked OPA ($128M). While OPA ore carries a higher unit cost, Westgold consciously elected to process increased volumes given the opportunity it provided to maximise cash flow.

AISC per ounce of $3,457/oz (Q1 FY26: $3,061/oz) increased primarily due to the OPA purchases. Excluding the OPA, the Murchison AISC per ounce was $2,597/oz.

Total Non-Sustaining Capital Expenditure of $37M, includes Growth Capital ($29M) and Plant and Equipment ($8M) across the Murchison. Growth Capital mainly related to the continuation of Great Fingall development and expansions to the Bluebird UG.

SOUTHERN GOLDFIELDS

The Southern Goldfields hub produced 30,484oz of gold in Q2 FY26 (Q1 FY26: 30,797oz).

Higginsville throughput was in line with expectations for the quarter with the small Two Boys underground outperforming on both grade and ounce production.

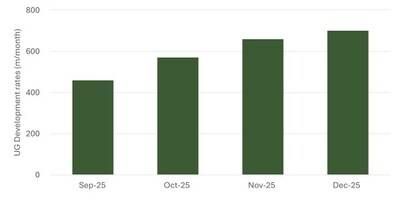

Beta Hunt also delivered steady mining outputs in line with expectations. With major ventilation and pumping infrastructure completed in Q1, mine development rates improved in Q2, positioning Beta Hunt to increase mining rates from Q3, FY26 onwards.

The total AISC in the Southern Goldfields increased quarter on quarter (Q2 FY26 AISC: $110M vs Q1 FY26 AISC: $77M). On a per ounce basis, AISC was higher at $3,614/oz in Q2 FY26 (Q1 FY26: $2,516/oz). This is due predominantly to gold price linked royalties, and increased development positioning the operation for a ramp up in production in Q3.

Total Non-Sustaining Capital Expenditure of $11M, includes Growth Capital ($6M) and Plant and Equipment ($5M) across the Southern Goldfields Operations mainly relating to water management, primary ventilation and underground infrastructure at the Beta Hunt mine.

.Table 2: Q2 FY26 Group Mining Physicals

| Ore Mined ('000 t) | Mined Grade (g/t) | Contained ounces (Oz) | |

| Murchison | 707 | 2.5 | 56,688 |

| Bluebird | 171 | 2.5 | 13,827 |

| Fender | 34 | 2.7 | 2,989 |

| Big Bell | 280 | 1.8 | 16,379 |

| Great Fingall | 10 | 2.4 | 749 |

| Starlight | 212 | 3.3 | 22,744 |

| Southern Goldfields | 481 | 2.3 | 35,219 |

| Beta Hunt | 396 | 2.2 | 27,603 |

| Two Boys | 36 | 4.3 | 5,029 |

| Lake Cowan OP | 49 | 1.7 | 2,587 |

| GROUP TOTAL | 1,188 | 2.4 | 91,907 |

Table 3: Q2 FY26 Group Processing Physicals

| Ore Milled ('000 t) | Head Grade (g/t) | Recovery (%) | Gold Production (Oz) | |

| Murchison | 1,085 | 2.5 | 92 | 80,934 |

| Bluebird | 180 | 2.5 | 95 | 13,840 |

| Fender | 3 | 2.2 | 88 | 182 |

| Ore Purchase | 181 | 4.0 | 96 | 22,317 |

| Open Pit & Low Grade | 151 | 1.0 | 89 | 4,391 |

| Meekatharra Hub | 515 | 2.6 | 95 | 40,730 |

| Big Bell | 271 | 1.8 | 86 | 13,775 |

| Fender | 58 | 2.4 | 86 | 3,909 |

| Great Fingall | 10 | 2.2 | 86 | 625 |

| Open Pit & Low Grade | 3 | 0.6 | 85 | 55 |

| Cue Hub | 342 | 1.9 | 86 | 18,364 |

| Starlight | 199 | 3.5 | 95 | 21,063 |

| Open Pit & Low Grade | 29 | 0.9 | 97 | 777 |

| Fortnum Hub | 228 | 3.1 | 95 | 21,840 |

| Southern Goldfields | 444 | 2.3 | 94 | 30,484 |

| Beta Hunt | 365 | 2.2 | 94 | 24,192 |

| Two Boys | 33 | 4.6 | 92 | 4,455 |

| Lake Cowan | 39 | 1.3 | 93 | 1,494 |

| Open Pit & Low Grade | 7 | 1.6 | 92 | 343 |

| GROUP TOTAL | 1,529 | 2.4 | 93 | 111,418 |

Operations

Safety

Strategic Focus

Westgold is committed to enhancing our safety systems to keep our people safe. Our current focus addresses three key priorities: Fatality Prevention, Injury Reduction and Leadership. Continued investment in these areas will have integrated benefits to our operations while keeping our people's safety front of mind.

During the quarter, our Critical Risk Management (CRM) framework was reviewed and refreshed, with rollout on track to commence in H2 to ensure our frontline employees understand what they need to do to keep themselves and their workmates safe.

The refreshed CRM approach covers risk identification, ensuring controls are in place, and importantly, stopping working if and when the controls are not effective. This approach is empowering. It supports our people to make the right decisions with the right information, and promotes the integration of sustainable, effective controls across the business.

TRIFR

During the quarter, Westgold recorded a Total Recordable Injury Frequency Rate (TRIFR) of 9.32 injuries per million hours worked. This represents an increase compared to the previous quarter attributed primarily to a rise in restricted work injuries, with approximately half of these involving hand and finger incidents.

In response, targeted hand safety education was delivered in November, reinforcing our ongoing commitment to operational safety and risk management.

During the quarter, an audit of all injuries was undertaken for H1 FY26 as part of our enhanced governance process. The audit identified four injuries in Q1 FY26 that were reclassified as recordable injuries resulting in a restatement of Q1 FY26 TRIFR from 5.04 to 6.01 injuries per million hours worked.

As part of this review, we updated our Incident Reporting Procedure and Injury Classification Guidelines and strengthened monitoring and verification processes to enhance the accuracy and consistency of safety reporting. This uplift in data quality, combined with an increased focus on positive reporting and deeper analysis of injury mechanisms, will support more targeted and effective injury‑prevention programs for our workforce.

The Murchison

- Fortnum Hub

In Q2, the Fortnum Hub processed 228kt at 3.1g/t with 95% recovery for 21,840oz (Q1 FY26: 223kt at 2.3g/t with 94% recovery for 15,487oz).

Fortnum performed exceptionally well with both mining and processing physicals exceeding expectation driven particularly by higher grades from the Nightfall area.

- Meekatharra Hub

In Q2 the Meekatharra Hub processed 515kt at 2.6g/t with 95% recovery for 40,730oz (Q1 FY26: 392kt at 2.0g/t with 93% recovery for 23,367oz).

Meekatharra's production continues to improve on the back of higher grades from the Bluebird-South Junction underground mine and the introduction of softer oxide feed from the Crown Prince open pit (OPA ore source). During the quarter, Westgold processed 181kt at 4.0g/t for 22,317oz from the OPA. Westgold agreed to purchase additional ore from Crown Prince above the OPA terms on account of the exceptional performance of the mill creating additional milling capacity.

Bluebird-South Junction continued to ramp up in line with expectation with mined production amounting to 171kt at 2.51 g/t for 13,827oz (Q1 FY26: 144kt at 3.2 g/t for 14,615oz). The updated design methodology and enhanced ground control regimes, announced last quarter, have continued to deliver strong results in effectively managing ground conditions. As a result, jumbo outputs remain robust, with each jumbo consistently achieving over 280 development metres per month for the quarter under the new designs.

- Cue Hub

In Q2 the Cue Hub processed 342kt at 1.9g/t with 86% recovery for 18,364oz (Q1 FY26: 291kt at 1.8g/t with 85% recovery for 14,286oz).

Big Bell and Fender mined a combined 314kt at 2.0g/t for 19,368oz (Q1 FY26: 327kt at 1.8g/t for 19,189oz).

Mining at Big Bell improved quarter on quarter, with load and haul performing well and more work areas becoming available in the upper cave. With the Fender strike length shortening at depth and forecast production reducing, the operation has been consolidated into Big Bell in order to efficiently manage costs and equipment utilisation.

During the quarter, Westgold commenced an upgrade to the Big Bell vent fans, which when completed in Q4 FY26 should enable further increases to mining outputs.

Mining of the first virgin stope at Great Fingall commenced during the quarter, delivering 10kt at 2.4g/t for 749oz. Ongoing development and the geometry of the upper virgin zones mean subsequent stopes will take time to access, and as a result, mining rates from these areas are not expected to materially contribute during FY26.

The Southern Goldfields

- Higginsville Hub

The 1.6Mtpa Higginsville processing plant processed 389kt at 2.3g/t with a 94% recovery for 27,185oz (Q1 FY26: 404kt at 2.3g/t with 94% recovery for 28,043oz).

Beta Hunt achieved slightly improved mining rates quarter on quarter, mining 396kt at 2.2g/t for 27,603oz (Q1 FY26: 381kt at 2.3g/t for 27,642oz).

Key infrastructure upgrades were completed in Q1 at Beta Hunt, including the primary ventilation fans and installation of the new rising main. These enhancements are now enabling increased underground development, which is expected to open additional mining fronts and strengthen the mine's operational flexibility (see Figure 7). With these foundations in place, production is positioned to lift in Q3 as the upgraded infrastructure reaches full design capacity. Westgold continues to target mining rates of 2Mtpa from Beta Hunt by the end of FY26.

Toll milling of Beta Hunt ore at the Lakewood mill processed 55kt at 1.9g/t with 92% recovery for 3,298oz (Q1 FY26: 45kt at 2.1g/t with 92% recovery for 2,754oz).

During the quarter, Westgold progressed a strategic accommodation initiative through its proposed acquisition of the Bluebush Accommodation Village in Kambalda, having been selected as the Shire of Coolgardie's preferred bidder. Westgold's $22.1M cash offer covers the entire Bluebush Village land package and supports the Company's strategy to secure long‑term accommodation capacity for its expanding Southern Goldfields operations. The modern 327‑room village enhances operational resilience and reduces reliance on third‑party providers. The Shire has now commenced a public comment period on the proposal, with a final Council decision expected in February 2026 ahead of a planned settlement in late March 2026 (subject to Council final approval).

Exploration

During the quarter, Westgold invested $6M (Q1 FY26: $12M) in Exploration and Resource Definition.

Westgold continued resource definition drilling several open pits in the Murchison. In the Southern Goldfields, extensional exploration / resource definition drilling was focussed on routine work on all active mines. At Beta Hunt, definition of Fletcher continued, inclusive of initial testing of the Stage 2 area, and extensional drilling in the Mason Zone.

In the Murchison, greenfields exploration drilling was focused on targets in the Jubilee-Golden Treasure and Murphy Creek targets at Peak Hill, and the Meekatharra North target north of Bluebird. In the Southern Goldfields drilling commenced at various targets including Aragon and Mead Hall.

Corporate

At the end of Q2 FY26, Westgold's total cash, bullion and investments totalled $654M.

Cash, Bullion and Investments

| Description | Sep 2025 | Dec 2025 | Variance | Variance |

| Cash | 357 | 521 | 164 | 46 |

| Bullion | 61 | 49 | (12) | (20) |

| Investments1 | 54 | 84 | 30 | 56 |

| Cash, Bullion and Investments | 472 | 654 | 182 | 30 |

| 1. Investments exclude investment in Blackcat Syndicate (BC8) under escrow until 31 March 2026 and Kali Metals Limited(KM1) under escrow until 8 January 2026. |

Debt

Westgold has access to a debt facility of $100M under the Syndicated Facility Agreement with ING Bank (Australia) Limited and Societe Generale. During the 31 December 2025 quarter, Westgold repaid all outstanding debt ($50M) resulting in the Group being debt free at the end of the period.

Gold Hedging

Westgold is fully unhedged and completely leveraged to the gold price. It achieved an average gold price of $6,356/oz for Q2 FY26 (Q1 FY26 $5,296/oz).

Higginsville Expansion Study (HXP)

The detailed Higginsville expansion study is nearing completion and is expected to be reviewed by the Board for an investment decision in Q3 FY26. The study is evaluating a production uplift at the Higginsville hub to 2.6Mtpa, with a further option to expand to 4Mtpa.

Divestment of Non-core assets

During the quarter, Westgold executed a binding Asset Sale Agreement with Alicanto Minerals Limited (ASX: AQI) for the divestment of the Mt Henry–Selene Gold Project near Norseman, Western Australia.

With the transaction expected to close in February 2026, the total consideration of $64.6M comprises $15M in cash, approximately $19.6M in Alicanto shares (representing a 19.9% strategic stake), and up to $30M in deferred consideration payable in cash or shares upon the achievement of agreed project milestones.

This transaction is consistent with Westgold's strategy to focus on its core operating assets and unlock value from non-core holdings, while retaining exposure to future upside through a strategic shareholding in Alicanto. Westgold continues to progress the planned divestment of its Peak Hill and Chalice gold assets.

Valiant Gold Demerger

Westgold announced the demerger of its non‑core Reedy's and Comet gold assets in the Murchison region into a new ASX‑listed company, Valiant Gold Limited, via a proposed demerger and concurrent initial public offering subject to approval from the Australian Securities Exchange (ASX)1. The transaction is intended to unlock value from these assets which are not included in Westgold's long term plans, while simplifying the Company's portfolio and sharpening its focus on larger, core operations.

Valiant is expected to be a well‑funded, standalone gold company with a dedicated management team and a clear pathway to near‑term cash flow through an ore purchase agreement to be entered into with Westgold, providing access to Westgold's processing infrastructure at Cue and Meekatharra. Following completion of the demerger and IPO, Westgold is expected to retain a significant equity interest in Valiant, preserving exposure to exploration and development upside.

Share Capital

Westgold closed the quarter with the following capital structure:

| Security Type | Number on Issue |

| Fully Paid Ordinary Shares | 944,753,663 |

| Performance Rights (Rights) | 9,957,015 |

Capital Management

During quarter, Westgold paid $28M for the 3cps dividend declared in Q1 FY26.

In August 2025, Westgold's Board authorised an on-market share buyback program of up to 5% of the company's ordinary shares, to be executed over the next 12 months. This buyback, approved and announced during the September quarter, is designed to enhance capital management and reflects the Board's confidence in Westgold's intrinsic value and future cash flow generation.

At the end of Q2 FY26, between blackout periods, 77,901 Westgold shares were purchased and subsequently cancelled as part of the on-market buy back, averaging $5.46 per share for a total cash outflow of $425,300.

| 1 Refer to ASX announcement titled "Westgold to Spin-Out Non-Core Assets to Valiant", dated 15 December 2025 |

Quarterly conference call details

Wayne Bramwell (Managing Director & CEO), Tommy Heng (Chief Financial Officer) and Aaron Rankine (Chief Operating Officer) will present the results via webcast on Wednesday 21 January 2026 at 8:00AM AWST / 11:00AM AEDT, followed by a Q&A session.

To listen to the Webcast live, please click on the link below and register your details. After registering, you will receive a confirmation email containing information about joining the webinar.

DECEMBER 2025 QUARTERLY WEBCAST

https://attendee.gotowebinar.com/register/2711443405817645918

Please log on a few minutes before the scheduled commencement time to ensure you are registered in time for the start of the call.

Compliance Statements

Forward Looking Statements

These materials prepared by Westgold Resources Limited (or the "Company") include forward looking statements. Often, but not always, forward looking statements can generally be identified by the use of forward looking words such as "may", "will", "expect", "intend", "believe", "forecast", "predict", "plan", "estimate", "anticipate", "continue", and "guidance", or other similar words and may include, without limitation, statements regarding plans, strategies and objectives of management, anticipated production or construction commencement dates and expected costs or production outputs.

Forward looking statements inherently involve known and unknown risks, uncertainties and other factors that may cause the Company's actual results, performance, and achievements to differ materially from any future results, performance, or achievements. Relevant factors may include, but are not limited to, changes in commodity prices, foreign exchange fluctuations and general economic conditions, increased costs and demand for production inputs, the speculative nature of exploration and project development, including the risks of obtaining necessary licenses and permits and diminishing quantities or grades of Ore Reserves, political and social risks, changes to the regulatory framework within which the Company operates or may in the future operate, environmental conditions including extreme weather conditions, recruitment and retention of personnel, industrial relations issues and litigation.

Forward looking statements are based on the Company and its management's good faith assumptions relating to the financial, market, regulatory and other relevant environments that will exist and affect the Company's business and operations in the future. The Company does not give any assurance that the assumptions on which forward looking statements are based will prove to be correct, or that the Company's business or operations will not be affected in any material manner by these or other factors not foreseen or foreseeable by the Company or management or beyond the Company's control.

Although the Company attempts, and has attempted, to identify factors that would cause actual actions, events or results to differ materially from those disclosed in forward looking statements, there may be other factors that could cause actual results, performance, achievements or events not to be as anticipated, estimated or intended, and many events are beyond the reasonable control of the Company. In addition, the Company's actual results could differ materially from those anticipated in these forward looking statements as a result of the factors outlined in the "Risk Factors" section of the Company's continuous disclosure filings available on SEDAR+ or the ASX, including, in the Company's current annual report, half year report or most recent management discussion and analysis.

Accordingly, readers are cautioned not to place undue reliance on forward looking statements. Forward looking statements in these materials speak only at the date of issue. Subject to any continuing obligations under applicable law or any relevant stock exchange listing rules, in providing this information the Company does not undertake any obligation to publicly update or revise any of the forward-looking statements or to advise of any change in events, conditions or circumstances.

Mineral Resources

The information in this report that relates to Mineral Resources is provided by Westgold technical employees and contractors under the supervision of the General Manager of Technical Services, Mr. Jake Russell B.Sc. (Hons), who is a member of the Australian Institute of Geoscientists and who has verified, reviewed, and approved such information. Mr Russell is a full-time employee to the Company and has sufficient experience which is relevant to the styles of mineralisation and types of deposit under consideration and to the activities which he is undertaking to qualify as a Competent Person as defined in the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the "JORC Code") and as a Qualified Person as defined in the CIM Guidelines and National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101"). Mr. Russell is an employee of the Company and, accordingly, is not independent for purposes of NI 43-101. Mr Russell consents to and approves the inclusion in this report of the matters based on his information in the form and context in which it appears. Mr Russell is eligible to participate in short and long-term incentive plans of the Company.

It is a requirement of the ASX Listing Rules that the reporting of Mineral Resources, Ore Reserve Estimates in Australia complies with the JORC Code. Investors outside Australia should note that while Ore Reserve and Mineral Resource estimates of the Company in this report comply with the JORC Code (such JORC Code-compliant Ore Reserves and Mineral Resources being "Ore Reserves" and "Mineral Resources" respectively), they may not comply with the relevant guidelines in other countries. The JORC Code is an acceptable foreign code under NI 43-101. Information contained in this announcement describing mineral deposits may not be comparable to similar information made public by companies subject to the reporting and disclosure requirements of US securities laws, including Item 1300 of Regulation S-K. All technical and scientific information in this report has been prepared in accordance with the Canadian regulatory requirements set out in NI 43-101 and has been reviewed on behalf of the Company by Qualified Persons, as set forth above.

This report contains references to estimates of Mineral Resources and Ore Reserves. The estimation of Mineral Resources is inherently uncertain and involves subjective judgments about many relevant factors. Mineral Resources that are not Ore Reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation, which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that may ultimately prove to be inaccurate. Mineral Resource estimates may require re-estimation based on, among other things: (i) fluctuations in the price of gold; (ii) results of drilling; (iii) results of metallurgical testing, process and other studies; (iv) changes to proposed mine plans; (v) the evaluation of mine plans subsequent to the date of any estimates; and (vi) the possible failure to receive required permits, approvals and licenses.

Appendix A – Key metrics by operating asset

| Q2 FY25 | Q3 FY25 | Q4 FY25 | Q1 FY26 | Q2 FY26 | ||

| Fortnum Mill | ||||||

| Ore milled | kt | 208 | 202 | 231 | 223 | 228 |

| Milled grade | g/t | 2.5 | 2.1 | 2.6 | 2.3 | 3.1 |

| Recovery | % | 94 | 93 | 93 | 94 | 95 |

| Gold Produced | oz | 15,517 | 12,506 | 18,149 | 15,487 | 21,840 |

| Bluebird Mill | ||||||

| Ore milled | kt | 219 | 240 | 377 | 392 | 515 |

| Milled grade | g/t | 2.4 | 2.0 | 1.7 | 2.0 | 2.6 |

| Recovery | % | 90 | 92 | 94 | 93 | 95 |

| Gold Produced | oz | 14,933 | 14,136 | 19,640 | 23,367 | 40,730 |

| Tuckabianna Mill | ||||||

| Ore milled | kt | 322 | 310 | 333 | 291 | 342 |

| Milled grade | g/t | 1.8 | 1.9 | 1.8 | 1.8 | 1.9 |

| Recovery | % | 87 | 88 | 88 | 85 | 86 |

| Gold Produced | oz | 16,011 | 16,264 | 17,022 | 14,286 | 18,364 |

| Southern Goldfields | ||||||

| Ore milled | kt | 593 | 545 | 467 | 449 | 444 |

| Milled grade | g/t | 2.0 | 2.3 | 2.4 | 2.3 | 2.3 |

| Recovery | % | 90 | 92 | 93 | 94 | 94 |

| Gold Produced | oz | 34,425 | 37,201 | 33,211 | 30,797 | 30,484 |

| Starlight UG | ||||||

| Ore mined | kt | 168 | 147 | 197 | 202 | 212 |

| Mined grade | g/t | 2.7 | 2.6 | 2.9 | 2.5 | 3.3 |

| Contained gold | oz | 14,374 | 12,495 | 18,457 | 16,436 | 22,744 |

| Bluebird-South Junction UG | ||||||

| Ore mined | kt | 88 | 109 | 170 | 144 | 171 |

| Mined grade | g/t | 3.4 | 2.7 | 2.6 | 3.2 | 2.5 |

| Contained gold | oz | 9,649 | 9,483 | 14,027 | 14,615 | 13,827 |

| OPA | ||||||

| Ore Purchased | kt | - | - | - | 33 | 185 |

| Ore grade | g/t | - | - | - | 3.3 | 4.0 |

| Contained gold | oz | - | - | - | 3,231 | 23,731 |

| Big Bell UG | ||||||

| Ore mined | kt | 333 | 247 | 279 | 269 | 280 |

| Mined grade | g/t | 1.8 | 1.8 | 1.8 | 1.7 | 1.8 |

| Contained gold | oz | 19,338 | 14,251 | 16,416 | 14,975 | 16,379 |

| Great Fingall UG | ||||||

| Ore mined | kt | - | - | 32 | 15 | 10 |

| Mined grade | g/t | - | - | 1.44 | 1.3 | 2.4 |

| Contained gold | oz | - | - | 1,498 | 597 | 749 |

| Fender UG | ||||||

| Ore mined | kt | 76 | 79 | 90 | 58 | 34 |

| Mined grade | g/t | 2.3 | 2.4 | 1.9 | 2.3 | 2.7 |

| Contained gold | oz | 5,531 | 6,048 | 5,551 | 4,214 | 2,989 |

| Beta Hunt UG | ||||||

| Ore mined | kt | 407 | 363 | 383 | 381 | 396 |

| Mined grade | g/t | 2.3 | 2.8 | 2.3 | 2.3 | 2.2 |

| Contained gold | oz | 29,555 | 32,498 | 28,533 | 27,642 | 27,603 |

| Two Boys UG | ||||||

| Ore mined | kt | 43 | 52 | 56 | 37 | 36 |

| Mined grade | g/t | 2.2 | 2.5 | 2.9 | 3.3 | 4.3 |

| Contained gold | oz | 3,125 | 4,213 | 5,210 | 3,868 | 5,029 |

| Lake Cowan OP | ||||||

| Ore mined | kt | - | - | 57 | 119 | 49 |

| Mined grade | g/t | - | - | 1.4 | 1.4 | 1.7 |

| Contained gold | oz | - | - | 2,582 | 5,446 | 2,587 |

Appendix B – Group metrics

| Physical Summary | Units | Q2 FY25 | Q3 FY25 | Q4 FY25 | Q1 FY26 | Q2 FY26 |

| ROM - Ore Mined | t | 1,115,123 | 996,641 | 1,264,056 | 1,225,331 | 1,188,114 |

| Grade Mined | g/t | 2.3 | 2.5 | 2.3 | 2.2 | 2.4 |

| Ore Processed | t | 1,342,005 | 1,296,656 | 1,408,120 | 1,355,192 | 1,529,426 |

| Head Grade | g/t | 2.1 | 2.1 | 2.1 | 2.1 | 2.4 |

| Recovery | % | 91 | 91 | 92 | 92 | 93 |

| Gold Produced | oz | 80,886 | 80,107 | 88,022 | 83,937 | 111,418 |

| Gold Sold | oz | 86,879 | 78,398 | 71,500 | 94,913 | 115,200 |

| Achieved Gold Price | A$/oz | 4,066 | 4,630 | 5,174 | 5,296 | 6,356 |

| Cost Summary | ||||||

| Mining | A$'M | 124 | 120 | 152 | 156 | 263 |

| Processing | A$'M | 56 | 57 | 54 | 58 | 58 |

| Admin | A$'M | 16 | 15 | 15 | 17 | 17 |

| Stockpile Movements | A$'M | (3) | 5 | (7) | (23) | 4 |

| Royalties | A$'M | 17 | 16 | 12 | 20 | 35 |

| Sustaining Capital | A$'M | 10 | 14 | 11 | 12 | 13 |

| All-in Sustaining Costs | A$'M | 219 | 227 | 237 | 240 | 390 |

| All-in Sustaining Costs | A$/oz | 2,703 | 2,829 | 2,688 | 2,861 | 3,500 |

| All-in Sustaining Costs – Excluding OPA | A$'M | 219 | 227 | 237 | 227 | 262 |

| All-in Sustaining Costs – Excluding OPA | A$/oz | 2,703 | 2,829 | 2,688 | 2,792 | 2,945 |

| Notional Cashflow Summary | ||||||

| Notional Revenue (produced oz) | A$'M | 329 | 371 | 456 | 445 | 709 |

| All-in Sustaining Costs | A$'M | 219 | 227 | 237 | 240 | 390 |

| Mine Operating Cashflow | A$'M | 110 | 144 | 219 | 205 | 319 |

| Growth Capital | A$'M | (29) | (31) | (27) | (39) | (35) |

| Plant and Equipment | A$'M | (27) | (15) | (12) | (21) | (13) |

| Exploration Spend | A$'M | (9) | (11) | (9) | (12) | (6) |

| Net Mine Cashflow | A$'M | 45 | 87 | 171 | 133 | 265 |

| Net Mine Cashflow | A$/oz | 554 | 1,094 | 1,937 | 1,583 | 2,373 |

Murchison

| Physical Summary | Units | Q2 FY25 | Q3 FY25 | Q4 FY25 | Q1 FY26 | Q2 FY26 |

| ROM - Ore Mined | t | 664,568 | 582,184 | 767,751 | 687,951 | 706,987 |

| Grade Mined | g/t | 2.3 | 2.3 | 2.3 | 2.3 | 2.5 |

| Ore Processed | t | 749,182 | 751,207 | 940,810 | 906,500 | 1,084,704 |

| Head Grade | g/t | 2.1 | 2.0 | 2.0 | 2.0 | 2.5 |

| Recovery | % | 90 | 90 | 91 | 91 | 92 |

| Gold Produced | oz | 46,461 | 42,906 | 54,811 | 53,140 | 80,934 |

| Gold Sold | oz | 50,263 | 43,824 | 42,879 | 59,947 | 84,077 |

| Achieved Gold Price | A$/oz | 4,066 | 4,630 | 5,174 | 5,296 | 6,356 |

| Cost Summary | ||||||

| Mining | A$'M | 72 | 72 | 84 | 98 | 203 |

| Processing | A$'M | 32 | 33 | 34 | 41 | 40 |

| Admin | A$'M | 9 | 9 | 10 | 8 | 8 |

| Stockpile Movements | A$'M | (6) | 4 | (6) | (1) | 2 |

| Royalties | A$'M | 5 | 6 | 7 | 7 | 16 |

| Sustaining Capital | A$'M | 7 | 11 | 9 | 10 | 11 |

| All-in Sustaining Costs | A$'M | 119 | 136 | 138 | 163 | 280 |

| All-in Sustaining Costs | A$/oz | 2,556 | 3,160 | 2,503 | 3,061 | 3,457 |

| All-in Sustaining Costs – Excluding OPA | A$'M | 119 | 136 | 138 | 150 | 152 |

| All-in Sustaining Costs – Excluding OPA | A$/oz | 2,556 | 3,160 | 2,503 | 2,960 | 2,597 |

| Notional Cashflow Summary | ||||||

| Notional Revenue (produced oz) | A$'M | 189 | 199 | 284 | 282 | 515 |

| All-in Sustaining Costs | A$'M | 119 | 136 | 138 | 163 | 280 |

| Mine Operating Cashflow | A$'M | 70 | 63 | 146 | 119 | 235 |

| Growth Capital | A$'M | (26) | (28) | (25) | (30) | (29) |

| Plant and Equipment | A$'M | (15) | (9) | (6) | (8) | (8) |

| Exploration Spend | A$'M | (5) | (5) | (3) | (7) | (2) |

| Net Mine Cashflow | A$'M | 24 | 21 | 112 | 74 | 196 |

| Net Mine Cashflow | A$/oz | 509 | 508 | 2,045 | 1,392 | 2,421 |

Southern Goldfields

| Physical Summary | Units | Q2 FY25 | Q3 FY25 | Q4 FY25 | Q1 FY26 | Q2 FY26 |

| ROM - Ore Mined | t | 450,555 | 414,457 | 496,305 | 537,380 | 481,127 |

| Grade Mined | g/t | 2.3 | 2.8 | 2.3 | 2.1 | 2.4 |

| Ore Processed | t | 592,823 | 545,449 | 467,310 | 448,692 | 444,722 |

| Head Grade | g/t | 2.0 | 2.3 | 2.4 | 2.3 | 2.3 |

| Recovery | % | 92 | 93 | 93 | 94 | 94 |

| Gold Produced | oz | 34,425 | 37,201 | 33,211 | 30,797 | 30,484 |

| Gold Sold | oz | 36,616 | 34,574 | 28,621 | 34,966 | 31,123 |

| Achieved Gold Price | A$/oz | 4,066 | 4,630 | 5,174 | 5,296 | 6,356 |

| Cost Summary | ||||||

| Mining | A$'M | 52 | 48 | 68 | 58 | 60 |

| Processing | A$'M | 24 | 24 | 20 | 17 | 18 |

| Admin | A$'M | 7 | 5 | 5 | 9 | 9 |

| Stockpile Movements | A$'M | 3 | 1 | (1) | (22) | 2 |

| Royalties | A$'M | 12 | 10 | 5 | 13 | 19 |

| Sustaining Capital | A$'M | 3 | 3 | 2 | 2 | 2 |

| All-in Sustaining Costs | A$'M | 100 | 91 | 99 | 77 | 110 |

| All-in Sustaining Costs | A$/oz | 2,903 | 2,446 | 2,992 | 2,516 | 3,614 |

| Notional Cashflow Summary | ||||||

| Notional Revenue (produced oz) | A$'M | 140 | 172 | 172 | 163 | 194 |

| All-in Sustaining Costs | A$'M | 100 | 91 | 99 | 77 | 110 |

| Mine Operating Cashflow | A$'M | 40 | 81 | 73 | 86 | 84 |

| Growth Capital | A$'M | (3) | (3) | (2) | (9) | (6) |

| Plant and Equipment | A$'M | (12) | (6) | (6) | (13) | (5) |

| Exploration Spend | A$'M | (4) | (6) | (6) | (5) | (4) |

| Net Mine Cashflow | A$'M | 21 | 66 | 59 | 59 | 69 |

| Net Mine Cashflow | A$/oz | 605 | 1,758 | 1,759 | 1,919 | 2,247 |

SOURCE Westgold Resources Limited

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/January2026/20/c6863.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/January2026/20/c6863.html

News Provided by Canada Newswire via QuoteMedia