Silver Trends 2017: Physical Surplus for First Time in Four Years

What were the main silver trends of 2017? In this article we run through the year’s key supply, demand and price catalysts.

After hitting a high of just over $20 per ounce in 2016, silver put on a more subdued performance in 2017.

Silver had not breached the $20 mark as of the end of November, and had averaged $17.13 as of midway through that month. Analysts at Thomson Reuters GFMS see the silver price maintaining its $17.13 average through 2017, on par with its 2016 annual average of $17.14.

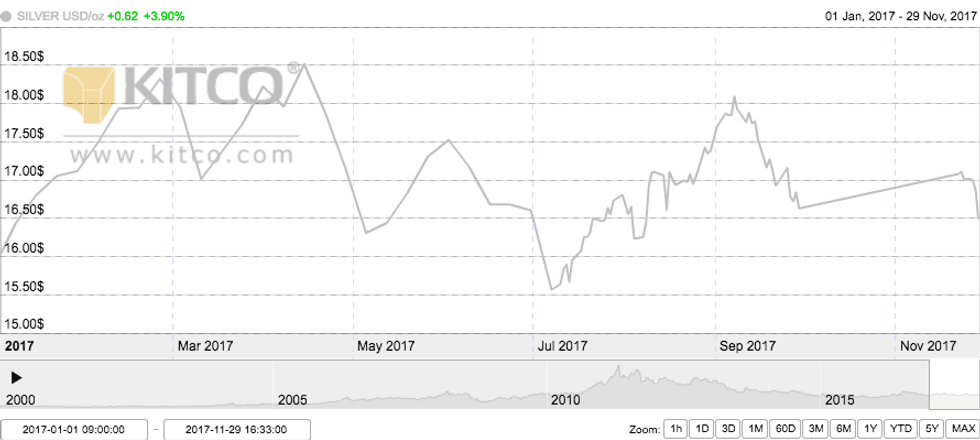

The white metal traded within a range of about $3 in 2017, recovering to over $18 at the start of 2017 before hitting a 15-month low of $15.19 in July. It rallied back to about $18 in early September and then sunk back down to the $16.50 level the next month. According to FocusEconomics, the price fall in October was due to stronger performance from US equity indexes, which reduced demand for silver.

Silver’s price performance from January 1, 2017 to November 29, 2017. Chart via Kitco.

The silver price gained some ground in early November on the back of developments in the US, including “recent news on the job market [that] was slightly downbeat, and the announcement of President Trump’s Federal Reserve chair nominee, [which] resulted in a weaker dollar.” FocusEconomics notes that the president’s proposed tax plan “is likely to deteriorate the nation’s fiscal standing,” and says that ongoing geopolitical tensions with North Korea will drive demand for safe-haven assets like silver.

As of November 29, the silver price was up 3.46 percent year-to-date, changing hands at about $16.50.

Silver trends 2017: Supply

The silver market is expected to reach a small annual physical surplus of 32.2 million ounces in 2017 after four consecutive years of physical shortfalls, according to Thomson Reuters GFMS’ interim silver market review, released on November 15.

Total silver supply is forecast to remain flat in 2017 at 1,008.4 million ounces, the firm says. Metals Focus gives a similar estimate of 1,024 million ounces for total silver supply for 2017. Global mine production is expected to clock in at 869.7 million ounces in 2017, which represents a year-on-year drop of 2 percent, due to declines in Chile and Australia. Before 2016, silver mine output had not dropped for 14 years.

Despite high levels of silver production overall, one of the largest primary silver mines experienced a disruption in 2017. Guatemala’s Supreme Court suspended the operating license for Tahoe Resources’ (TSX:THO,NYSE:TAHO) Escobal mine, halting operations between July and September.

Higher scrap supply and a drop in net dehedging are expected to offset lower mine production in 2017. After five years of declines, scrap supply is expected to rise to 141.6 million ounces, up 1 percent year-on-year, driven by higher Asian flows. The rise is reportedly also partly due to firmer industrial fabrication demand, which is generating higher volumes of fabrication waste.

Companies in the silver space continue to be optimistic about the market. Wheaton Precious Metals (TSX:WPM,NYSE:WPM) President and CEO Randy Smallwood recently said the company’s portfolio of assets is “doing very well” and is “continuing to generate very strong cash flows.” He added that the market for silver and gold was “pretty stable” during 2017.

Frank Basa, president and CEO of Castle Silver Resources (TSXV:CSR), said, “we expected to find more cobalt and silver at the Castle property [in 2017], and our exploration results were excellent. Our drill program hit a high-grade cobalt zone, we intersected mineralization in every hole and bulk and chip samples from underground showed high grades for cobalt as well as for gold, nickel and silver.”

Levon Resources (TSX:LVN) President and CEO Ron Tremblay was similarly optimistic, and said that he expects the market to start improving in 2017. “It is taking longer than I expected, but everything except the precious metals is improving, so that should be happening very soon,” he explained.

Silver trends 2017: Demand

Total physical silver demand is seen dropping 5 percent in 2017, reaching a total of 976.1 million ounces. Retail investment is set to fall sharply, but the decline is expected to be partially offset by a modest increase in jewelry and industrial fabrication.

Bar and coin demand — Silver coin and bar demand is expected to fall by 37 percent year-on-year in 2017, which Thomson Reuters GFMS attributes to “a rising appetite for riskier assets and growing optimism about the global economic outlook.”

2017 has so far marked the lowest level of US silver coin and bar demand since 2010, with India’s silver coin and bar market also on course for a weaker performance. Global physical silver investment is expected to drop by 20 percent in 2017 to about 167 million ounces, the lowest total in a decade.

Jewelry and fabrication demand — Silver demand from the jewelry fabrication sector is expected to hit 207.1 million ounces in 2017, up 1 percent year-on-year, with slowing demand in China being offset by stronger demand in India and North America. Meanwhile, silverware fabrication demand is forecast to rise by 10 percent year-on-year to reach 57.5 million ounces, largely on the back of demand from India.

Industrial demand — Industrial demand for silver is forecast to rise by 3 percent in 2017 to come in at 581.4 million ounces, led by strong gains in the solar industry and a modest rise in demand from electronics, brazing alloys and solders. Notably, global silver demand from the solar industry is forecast to increase by 20 percent in 2017, to almost 92 million ounces, as per Thomson Reuters GFMS.

This is an updated version of an article first published by the Investing News Network in 2016. Click here to read the 2016 version of the article.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Shaw, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

Levon Resources and Castle Silver Resources are clients of the Investing News Network. This article is not paid-for content.