Silver appears to be trying to redeem itself for its less-than-stellar price action in December. Meanwhile, a number of stocks have posted gains alongside the white metal.

It’s not even a week into the new year, but already silver appears to be trying to redeem itself for its less-than-stellar price action in December.

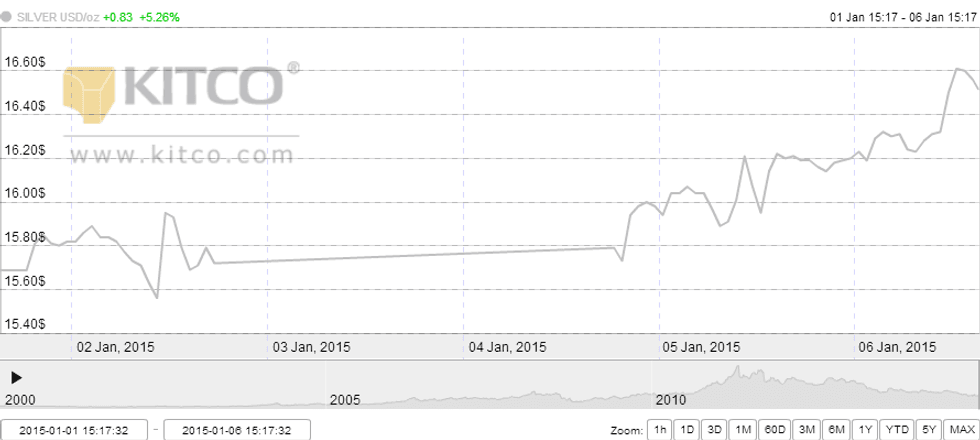

Aside from a few slumps, including a brief foray to $15.56 per ounce on January 2, the white metal has been on the rise since 2015 began, peaking at $16.22 on Monday before continuing up higher on Tuesday. As of 3:15 p.m. EST, silver was sitting at $16.53.

Silver’s positive performance has come on the back of a strong US dollar — that’s unusual given that a strong dollar generally decreases investors’ desire for safe-haven assets like precious metals. Explaining how that happened, iNVEZZ.com states in a Monday article that “strong physical demand … offset pressure from US dollar strength.”

Silver price, January 1, 2015 to January 6, 2015.

Silver’s rise has also come alongside an uptick in the price of gold, which rose above $1,200 on Monday and is currently at $1,218.40 per ounce. Like silver, it’s normally driven down by a strong dollar, but in the last couple of days a number of factors have outweighed that downward pressure. According to Kitco’s Jim Wyckoff, those include concerns that poor crude oil prices will lead to general price deflation, as well as worries about the European Union’s economy — together they’ve made investors more averse to risk and more interested in precious metals.

That sounds pretty promising not only for gold, but also for silver; however, investors would perhaps do well not to get too excited about the white metal just yet. For one thing, the consensus amongst analysts and other market participants seems to be that its price may not make any substantial upward move until the end of 2015.

Nevertheless, silver market participants have no doubt been pleased to see the year begin on a positive note.

Stocks round-up

Unsurprisingly, the share prices of many silver-focused companies have mimicked the white metal’s rise. Here’s a quick look at five stocks that were up at time of publication on Tuesday.

- First Majestic Silver (TSX:FR,NYSE:AG) — up 12.45 percent on the NYSE at $6.23; up 11.54 percent on the TSX at $7.25.

- IMPACT Silver (TSXV:IPT) — up 8.7 percent on the TSXV at $0.25.

- Silver Standard Resources (TSX:SSO,NYSE:SSRI) — up 8.04 percent on the NYSE at $5.82; up 7.87 percent on the TSX at $6.85.

- Great Panther Silver (TSX:GPR,NYSEMKT:GPL) — up 7.22 percent on the NYSE MKT at $0.691; up 2.56 percent on the TSX at $0.80.

- Endeavour Silver (TSX:EDR,NYSE:EXK) — up 5.44 percent on the NYSE at $2.52; up 5 percent on the TSX at $2.94.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Related reading: