Silver is currently suffering from problems in both the industrial and precious metals markets.

Silver is well known for its duality. It’s both a precious and industrial metal, and as a result can take cues from both sectors.

Sometimes that’s a good thing. For example, if both the industrial and precious metals markets are strong, that of course is positive for silver. Similarly, if industrial metals are doing poorly, strength in the precious metals market can balance out that weakness, and vice versa. However, if both the industrial and precious metals markets are weak, that can spell trouble for the white metal.

Unfortunately for silver bugs, that last scenario is currently a reality. “Silver is either seen as aligned to gold or aligned to industrial metals, and right now both those stories suck,” Adrian Ash, head of research at BullionVault, told Bloomberg on Tuesday, adding, “[e]verything that’s hurting gold is hurting silver, and everything that’s punishing industrial metals is hurting it as well.”

He’s not the only one with that opinion. “Silver is suffering not only from a general malaise in precious metals, but also from the same in the industrial metals,” David Govett, head of precious metals at Marex Spectron Group, is quoted as saying in another recent Bloomberg article. “It has two hats — as a precious and an industrial — and both are in the doldrums.”

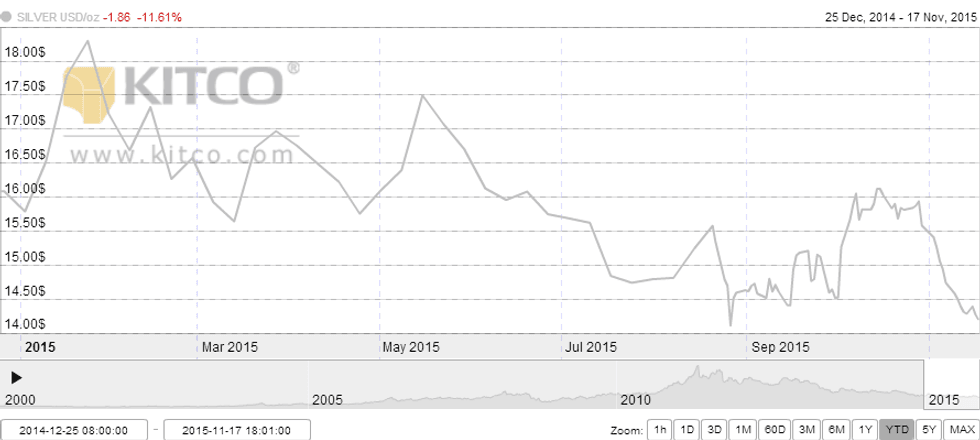

A quick glance at the chart below from Kitco shows exactly how bad silver is faring. It’s down 11.67 percent year-to-date, and as of 2:01 p.m. EST on Tuesday was sitting at $14.2045 per ounce. According to Bloomberg, the metal has fallen for 13 days, the longest rout since 1950, and is near where it was on August 26, when it hit a six-year low.

Given that performance, investors are understandably wondering whether a silver price recovery is possible in 2015. Unfortunately, at the moment there’s little consensus, as is illustrated by the wide range of recent price predictions — Thomson Reuters GFMS is calling for a 2015 average silver price of $15.51, while the Bank of America recently warned that it could hit $12 in the coming weeks. Meanwhile, Capital Economics sees silver hitting $20 by the end of 2016.

That said, there are certainly catalysts investors can watch for. While industrial demand for silver is largely being tamped down by weakness in the Chinese economy, a weight that will be hard to shake, the “general malaise in precious metals” mentioned by Govett may be a surmountable obstacle.

The key event to watch from that standpoint will be the US Federal Reserve meeting scheduled for December 15 to 16. Precious metals have suffered for much of 2015 on the back of concerns that the central bank will raise interest rates, and anxiety has only intensified since the Fed’s last meeting. According to Bloomberg, there’s currently a 66 percent chance that it will raise interest rates in December, up from 50 percent at the end of October — for now, however, investors will have to wait and see.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.