The rise in precious metals investing by our readers and the fact that silver’s investment popularity is now on par with that of gold are both very much in line with the developing trends we are seeing in worldwide gold and silver investing.

By Melissa Pistilli—Exclusive to Silver Investing News

Since the 2008 Crash more and more investment dollars have been flowing into precious metals as investors look for a safe place to store their wealth.Dig Media’s 2011 Resource Investing News Network Audience Survey revealed that our readers are as passionate as the rest of the world when it comes to silver as a safe haven investment.

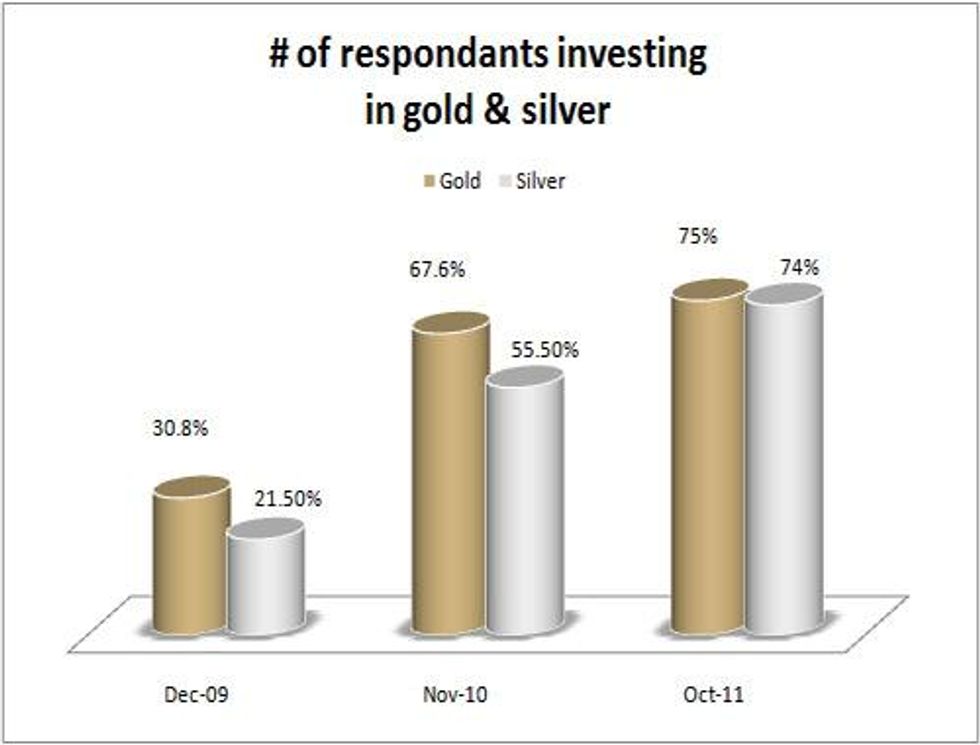

Fear and uncertainty in the global markets have greatly increased the level of investor demand for precious metals over the last three years. The safe haven appeal of gold and silver has also increased remarkably among our readership. In December of 2009, a year following the 2008 Crash, our investor survey revealed that 30.8 percent and 21.5 percent of respondents were invested in gold and silver stocks, respectively. By November of 2010, those numbers had exploded to 67.6 percent for gold stocks and 55.5 percent for silver stocks.

In our latest survey for 2011, when asked what resource stocks they had invested in over the past year 74 percent responded, “Silver Stocks.” When we compared this figure to the results of our previous surveys, we found that not only is silver investing up considerably since our November 2010 survey, but silver investment is now on par with gold. Not surprisingly, when asked which commodity groups do they believe offer the greatest investment potential, 65 percent of respondents chose “Precious Metals.”

The rise in precious metals investing among our readers and the fact that silver’s investment popularity is now on par with that of gold are both very much in line with the developing trends we are seeing in worldwide gold and silver investing. By April of 2011 the price of silver was up 126 percent over the past year to nearly $50 an ounce compared to a rise of 26 percent in the price of gold.

While demand for physical silver predominately comes from the industrial sector, investment demand has been the primary source for soaring silver prices in much of 2010 and the first half of 2011. According to a report compiled by GFMS for the Silver Institute, global silver investment rose 40 percent in 2010 to 279.3 million ounces for a net flow of $5.6 billion (nearly double that of 2009).

We also asked, “What is your motivation for investing in commodities?” to which some of our readers revealed the factors motivating their silver and gold investments.

“Silver and Rare Earth metals will experience extreme demand as industry commands their use coupled with the demand for silver from not only industry but also from the private sector who wants to own silver as a protection against the collapse of the US dollar and a hedge against inflation.”

“For the moment with the debt crisis the precious metals, especially gold, will continue to rise. Gold stocks will probably continue their way up. Even if the gold price stops climbing, gold stocks will probably climb further. A lot of companies will be bought by other companies and this will lead to increasing prices.”

“When gold hits $2K, I think silver will rocket to $70.”

The notable rise in silver investment demand compared to that of its yellow cousin can be greatly attributed to the white metal’s distinction as “the poor man’s gold.” When gold prices continue to rise over an extended period of time investors in the futures, ETFs and physical markets often turn to silver — called “the investment of this decade” by Sprott Asset Management founder Eric Sprott—as a cheaper alternative to gold.

Silver as an alternative to gold has been especially attractive to the growing middle class in China and India, as well as among those who have traditionally used gold as a store of wealth including India’s farmers. Between 2008 and 2010, demand for silver in China rose 67 percent and the Hong Kong Mercantile Exchange recently began trading US dollar and Yuan denominated silver futures contracts.

Despite the fact that the majority of demand has traditionally come from the industrial sector, silver really has become a precious metal in the years since the 2008 Crash — but the recent market sentiment that has pushed prices down significantly has left many to wonder if another global economic downturn will lead to a resurgence in the price influence of silver’s industrial side.

Confidence in the ability of investment demand to help buoy prices in the near term still exists, but investors should remain cautious. “Investor interest in silver is expected to keep prices at or close to current levels over the near term, supported by a high level of open interest and activity at COMEX silver future contracts, a large amount of silver-backed silver ETFs, and strong demand for silver coins,” said Chris Thompson, Haywood metals analyst, in a recent Mineweb article. “Nonetheless, we caution that more sharp declines in silver prices, similar to that recently experienced, should not be ruled out, considering the volatile nature of silver prices and the relative ease with which ETF investors can exit the market.”

The dramatic dive in silver prices over the past few weeks has really emphasized the risks inherent in this volatile market notoriously prone to large swings in prices — there’s a reason it’s called “the devil’s metal.”

What remains to be seen is whether or not we’ll see a near term return of silver’s penchant for supplying remarkable ROI compared to that of gold. “Investment demand has cooled off for awhile. People are on the sidelines now scared to enter the market,” said silver-investor.com founder David Morgan, in an interview with Kitco’s Daniela Cambone a few weeks ago. “Although in my view this would be the time to start entering the market.” Morgan believes it will be a few months before silver starts to “build a base and move up in a meaningful way.”

The famed silver guru gave Cambone a “conservative” silver price forecast of above $40 an ounce in the next six months.