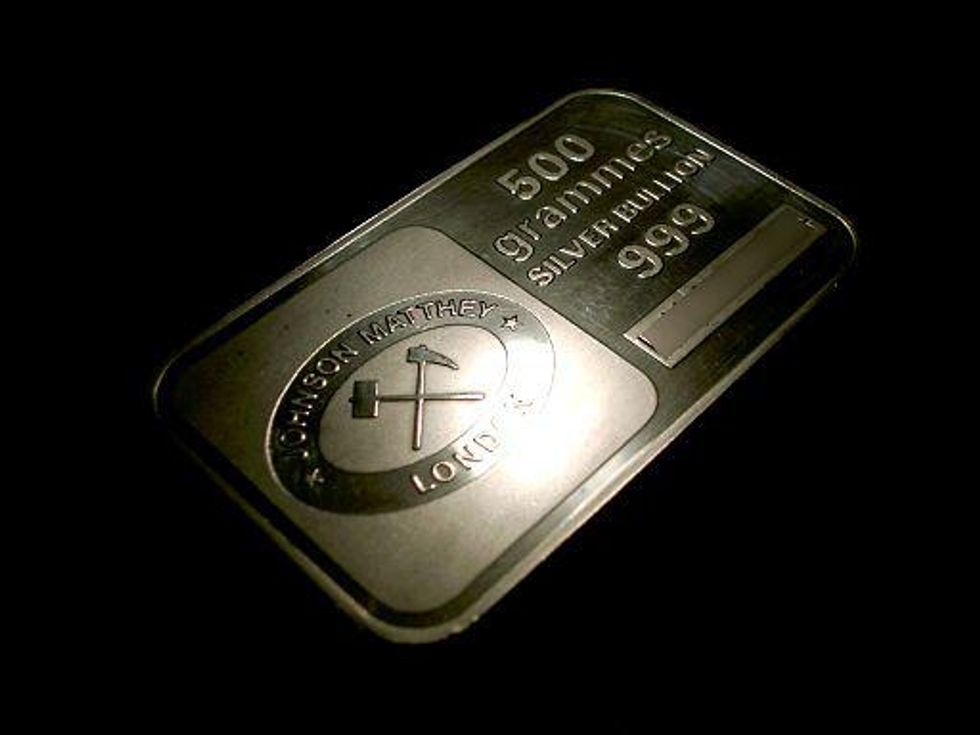

Johnson Matthey Takes Step Back from Precious Metals

As yet another big name distances itself from the precious metals space, is it time for investors to worry?

The UK’s Johnson Matthey (LSE:JMAT) was formed nearly two centuries ago by a gold assayer, but on Monday the company took a step back from those roots, announcing plans to divest its gold and silver refining business to Asahi Holdings (TSE:5857).

Asahi, a collector, refiner and recycler of precious and rare metals from waste materials, will pay Johnson Matthey US$186 million in cash for the unit, with the deal expected to close in March 2015.

Explaining the move, Johnson Matthey CEO Rob MacLeod said it fits with the company’s “long term strategy to focus on areas where [it] can use [its] expertise in chemistry and its applications to deliver high technology solutions or that provide a strategic service to the wider Johnson Matthey group.”

It’s easy to see why the company chose now to hone that focus. As resource market participants well know, the space has been hit hard in 2014, and Johnson Matthey hasn’t escaped the carnage — its half-year results, released on November 20, reveal that its gold and silver refining business saw sales drop 23 percent from the year-ago period. Its underlying profit also sank.

The decision is also unsurprising given how many players have distanced themselves from commodities recently — examples include Sheldon Inwentash and his company Pinetree Capital (TSX:PNP), as well as Sprott (TSX:SII). Both are known for their ties to resources, but like Johnson Matthey are now looking to diversify — rumor has it — into the tech arena.

For investors, the question is whether it’s time to start worrying. After all, if such big players are stepping away from commodities, isn’t it reasonable to follow?

Individual investors will have to come up with the answer to that question themselves, but it’s worth noting that the firms discussed here aren’t exiting the resource space entirely. Pinetree retains investments in precious metals and other commodities, and Sprott has emphasized that it is by no means giving up on the arena. For its part, Johnson Matthey is retaining its platinum-group metals refineries.

It thus seems that diversification — not all-out flight from precious metals — is the favored option, at least for those firms.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Related reading:

Do Sheldon Inwentash and Pinetree Capital Want Out of Resources?