Chris Berry of House Mountain Partners and the Disruptive Discoveries Journal recently published an in-depth look at the magnesium market. Here’s a look at all things magnesium, including end uses, market participants and potential growth areas.

By Chris Berry (@cberry1)

Originally published by the Disruptive Discoveries Journal on August 10, 2015. For a PDF version of this note, please click here.

Executive Summary

As materials science continues its inexorable push forward, a closer examination of the metals and minerals which underpin scientific breakthroughs seems prudent. While there is any number to choose from, this report focuses on magnesium, commonly referred to as the “lightest useful metal” which is 75% lighter than steel and 33% lighter than aluminum.

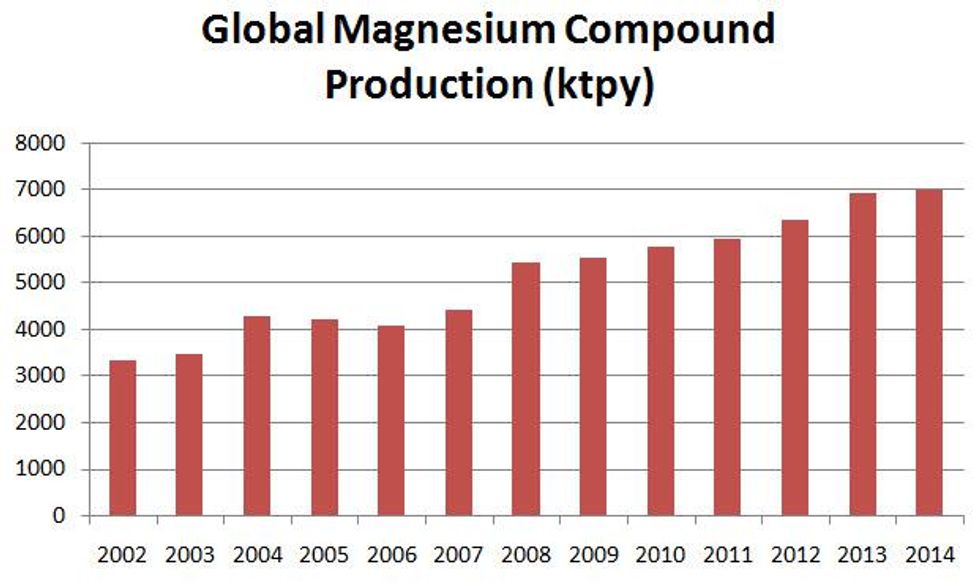

Numerous materials have the potential to substantially impact our quality of life (for the better) in the future. Lithium, titanium, and scandium also come to mind with their potential for impact. Magnesium effectively competes for attention here and so a deeper dive into the metal is the focus of this report. Production of magnesium compounds grew at a CAGR of slightly under 6% from 2002 to 2014 according to our estimates and demand grew at a slightly faster pace. This growth rate well in excess of global GDP is a strength. That said, the growth rate has moderated somewhat with the slowdown in emerging markets. China effectively controls the global magnesium market, responsible for anywhere from 70 to 80% of production. This has everything to do with cheap and abundant labor, lax environmental standards, and inexpensive magnesium processing technologies. Given the slowdown in China’s economic growth rate which many expect to continue, excess supply of magnesium compounds (magnesia) is a looming factor to weigh against any capacity expansion. It would appear that while there is no shortage of magnesium, security of supply may be the best lens through which to view this opportunity. This report is intended to look thoroughly at the magnesium market, from its discovery, to its uses, to the market participants, to the potential growth areas.

Discovery

Reports of the first uses of magnesium date back to ancient Greece, but the first reports of production date to 1808 by Sir Humphrey Davy with larger commercial quantities produced in Germany by 1886. With the atomic number 12 and as the eighth most abundant element in the earth’s crust by mass, magnesium is found in over five dozen minerals with only a handful of minerals of commercial significance including dolomite, magnesite, talc, carnalite, brucite, and olivine.

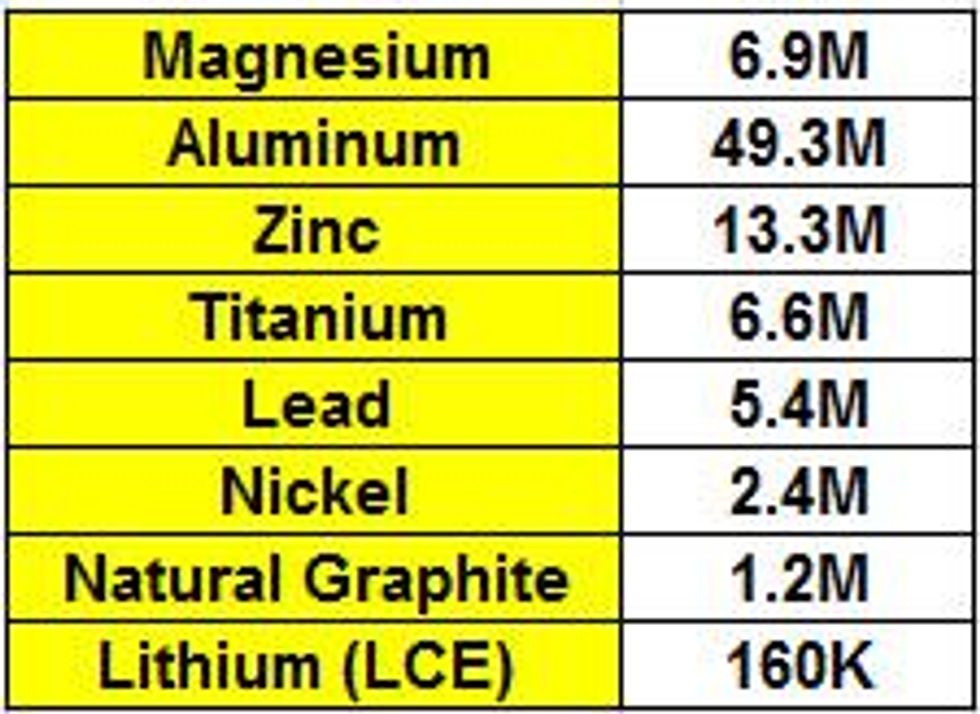

Regarding mined production, one can see how magnesium fares relative to its other minor metals cousins as per the USGS (M = million tonnes; K = thousand tonnes; totals exclude US production):

End Uses

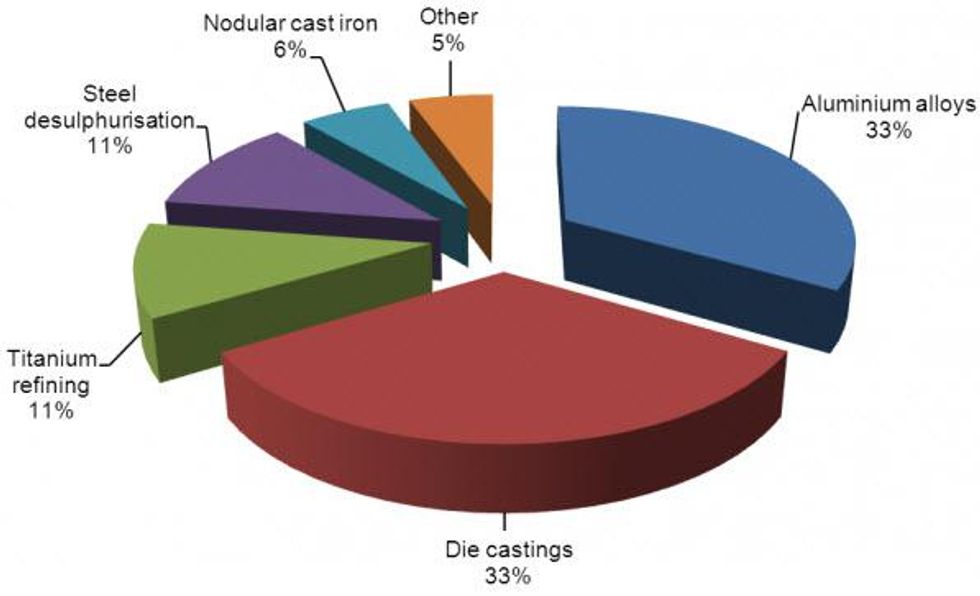

The market for magnesium compounds is estimated at just over 7 million tons in 2014 by the USGS with numerous end uses including alloys, fertilizer, refractories, flame retardants, and water purification. The ubiquity of magnesium in the global economy has provided a steady demand in recent years with supply and demand both growing well above global GDP. Cheap Chinese production has handily fed numerous industries. Supply grew at a compound annual growth rate (CAGR) of just under 6% between 2002 and 2014 while demand increased closer to 7%. The chart below shows the breakdown for magnesium metal uses.

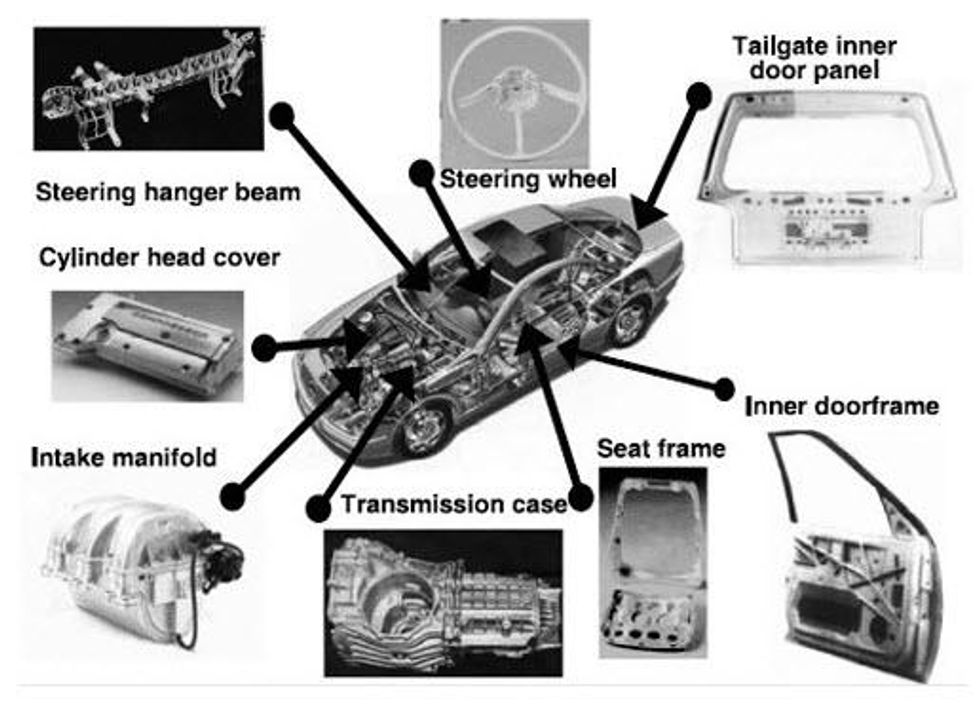

The largest market for magnesium metal is aluminum alloying and die casting, comprising two thirds of magnesium metal use. In the effort to achieve federally mandated fuel standards of 54.5 miles per gallon by 2025 in the United States, every major automotive manufacturer imaginable has focused an increasing amount of time and money on reducing the overall weight of their vehicle fleet. Magnesium has multiple uses in automobiles including in gearboxes, steering wheels, and seat frames, to name but a few and the typical automobile contains roughly 10 to 12 pounds of magnesium, though this can vary widely. For the sake of perspective, a report from the United States Automotive Materials Partnership (a collaboration between car makers GM, Ford, and Chrysler) concluded that this 12 pounds is relatively little “…compared to 260 lbs. of plastics, 280 lbs. of aluminum, and 2,150 lbs. of steel/cast iron” in an automobile in their current fleets.

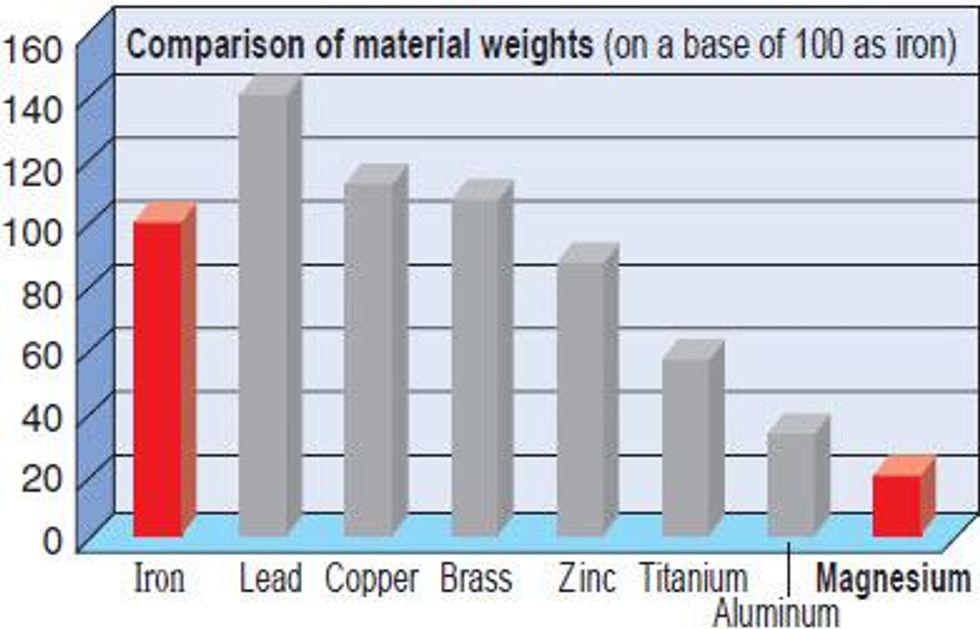

Steel is the most obvious material to be minimized given its weight and can be replaced with a number of alloys which provide an optimal blend of strength and durability. The chart below shows the material weight of magnesium relative to other metals. Obviously, cost of each raw material and compositional limitations like corrosion are factors here as well, but the evidence for utilizing magnesium based on its relative weight in various end uses is strong. There would appear to be ample opportunity for additional magnesium usage in automobiles as a substitute for heavier metals.

From the same report mentioned earlier:

“….estimates that by 2020, 250 pounds of magnesium will replace 500 pounds of steel and 90 pounds of magnesium will replace 130 pounds of aluminum per vehicle, resulting in an overall 15% weight reduction.”

Growth rates in the automobile sector are a key factor to watch in increased magnesium consumption in the future. With dozens of automakers all over the world producing all different types of vehicles and global growth rates diverging, determining a singular growth rate, not to mention the growth rate of magnesium alloys in this sector, is a herculean task. Various sources estimate that 88.5 million vehicles were produced in 2014 with the strongest markets in the US and China. A conservative assumption may be to assume automotive demand grows in line with global GDP going forward (roughly 3.3% according to the IMF), with magnesium alloy demand tracking this trajectory.

The second major use (and the largest use for magnesium compounds) is in refractories – directly related to steel production. This is due to the strength of the crystal structure of magnesium, its high melting point, and its ability to remove sulfur from steel. The primary magnesium compound used in the refractory sector is dead burned magnesium (DBM), also referred to as refractory magnesia. In the United States, roughly 48% of magnesium consumption is attributed domestic steel production with the rest attributed to agriculture and other end uses. A watchful eye on steel demand growth is warranted in determining the future growth of magnesium compounds. Additionally, a watchful eye on any tariffs is warranted as magnesium, amongst other metals, has a history of being at the center of anti-dumping disputes from cheap Chinese production. Import tariffs can dramatically alter the ultimate price paid.

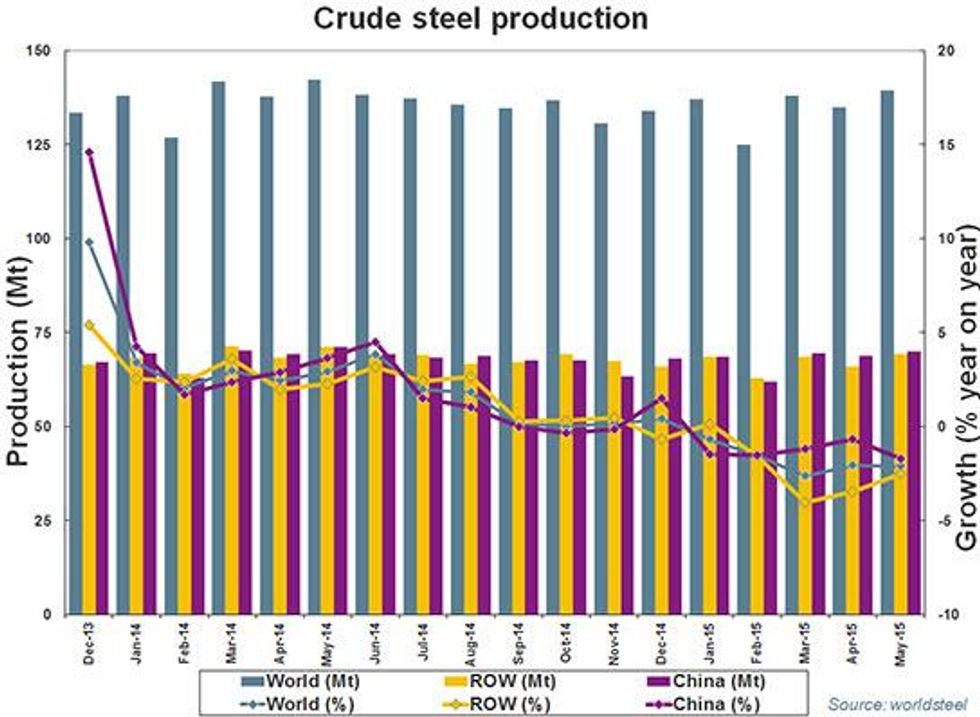

Based on the charts below from the World Steel Association, steel production growth has moderated in 2015 and has been shrinking on a percentage basis in large part due to the economic slowdown in major steel consuming countries such as China.

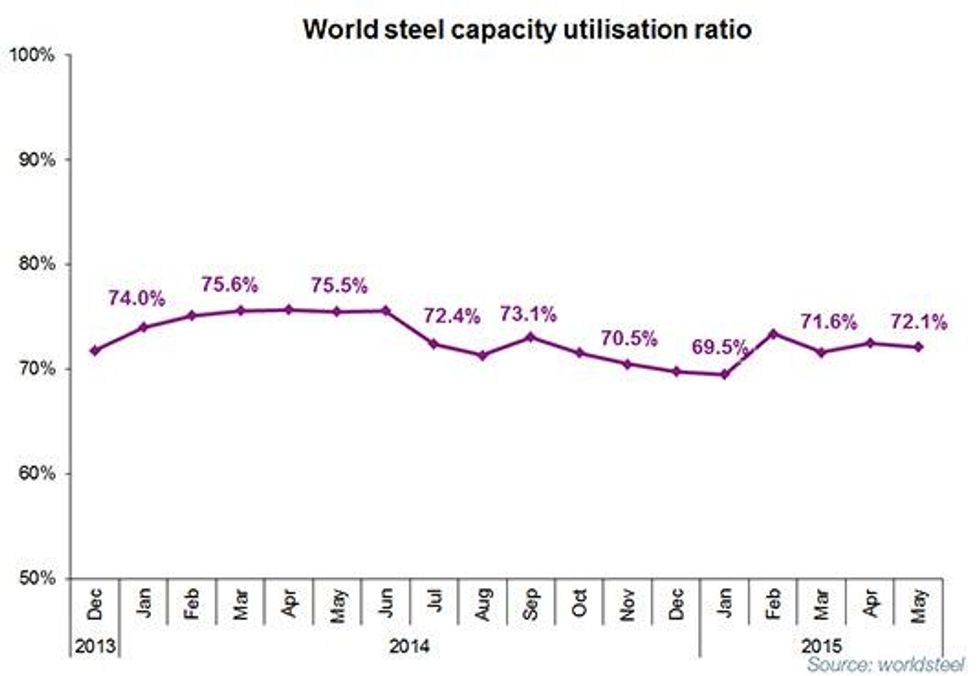

Additionally, capacity utilization remains relatively flat:

According to a recent Roskill report, 50g of magnesium compounds are used per tonne of steel produced. As the Chinese economy moderates its growth rate and as refractories become more efficient, this ratio may decrease. This would suggest that finding additional end uses for magnesium compounds where growth rates may be higher is prudent.

Pricing

As is the case with other industrial metals, there is no formal market for magnesium. The price for various magnesium compounds is set based on agreed upon prices between producers and end users. As the majority of the business takes place in China, a focus on the Chinese export price for 99.8% magnesium metal and the European price (Rotterdam) are the most reliable indicative levels.

The general downward trend in magnesium prices (99.8% China FOB shown below) is indicative of economic conditions in China as well as the health of the global steel market – both deteriorating.

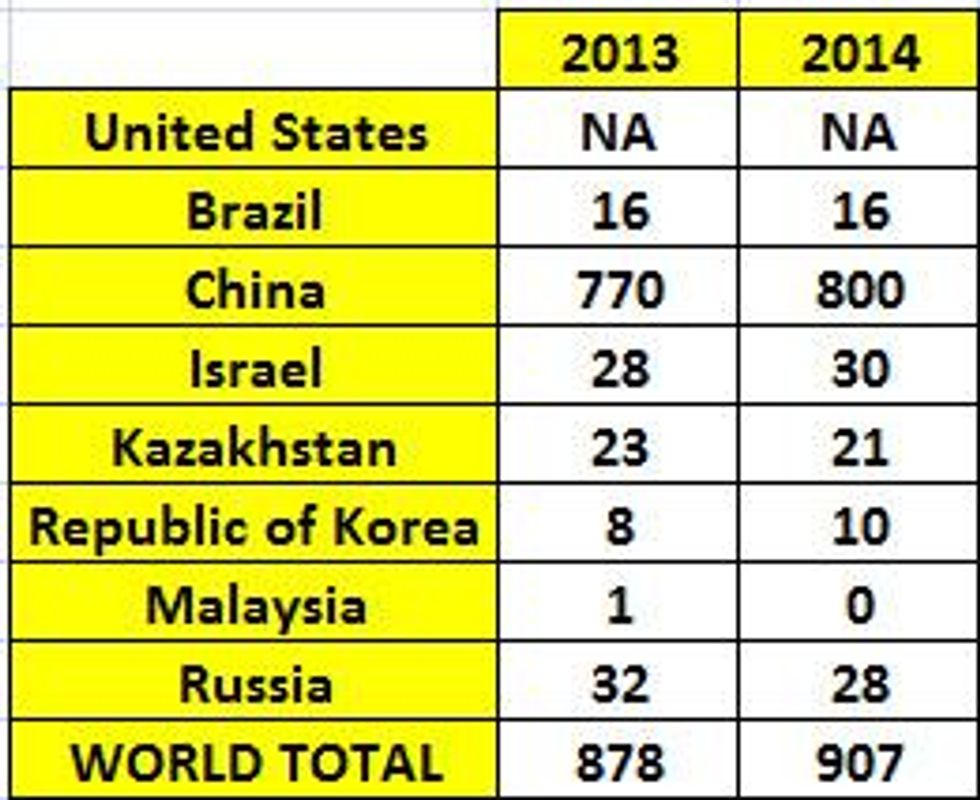

As of 2014, magnesium was mined in the following countries and in the following amounts:

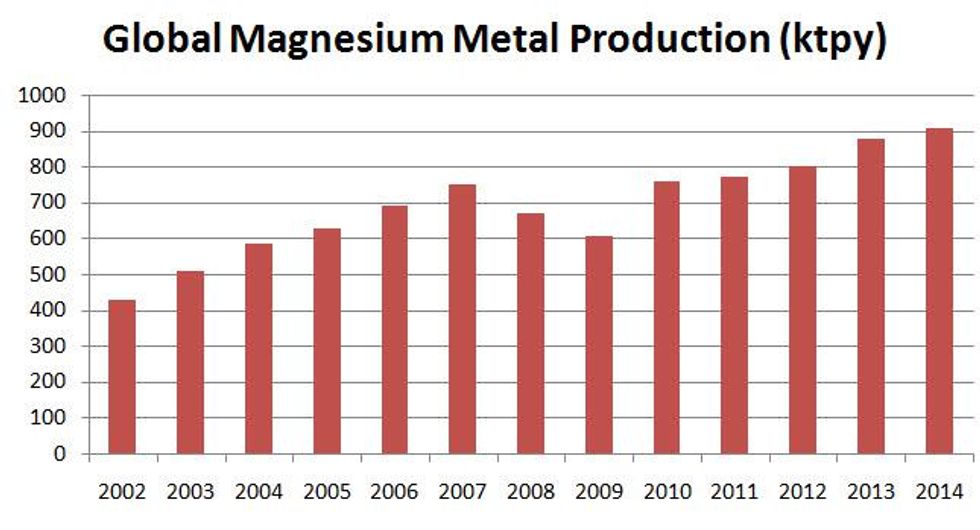

Here is the path of magnesium compound production from 2002-2014 (excluding the US). This is an approximate 6% CAGR:

Source: USGS

China looms large here as a producer of 70% of global mine supply as of 2014. The rationale for this is the same for every raw material produced in China: supply chain dominance ensures control of the price. Lax environmental standards and abundant coal as the primary fuel for magnesium production have ensured that China is the lowest cost producer, ensuring market share dominance. At current consumption rates, the known reserves of magnesium would last for over 340 years and this doesn’t include the amount of magnesium that could be produced from seawater – a technically inexhaustible resource. While overall supply may not be an issue, security of supply is likely a better lens with which to view the magnesium market.

The primary magnesium metal market is even more slanted towards Chinese production:

Here is the path of magnesium metal production from 2002-2014 (excluding the US). This is a CAGR just under 6%:

Source: USGS

Production Methods

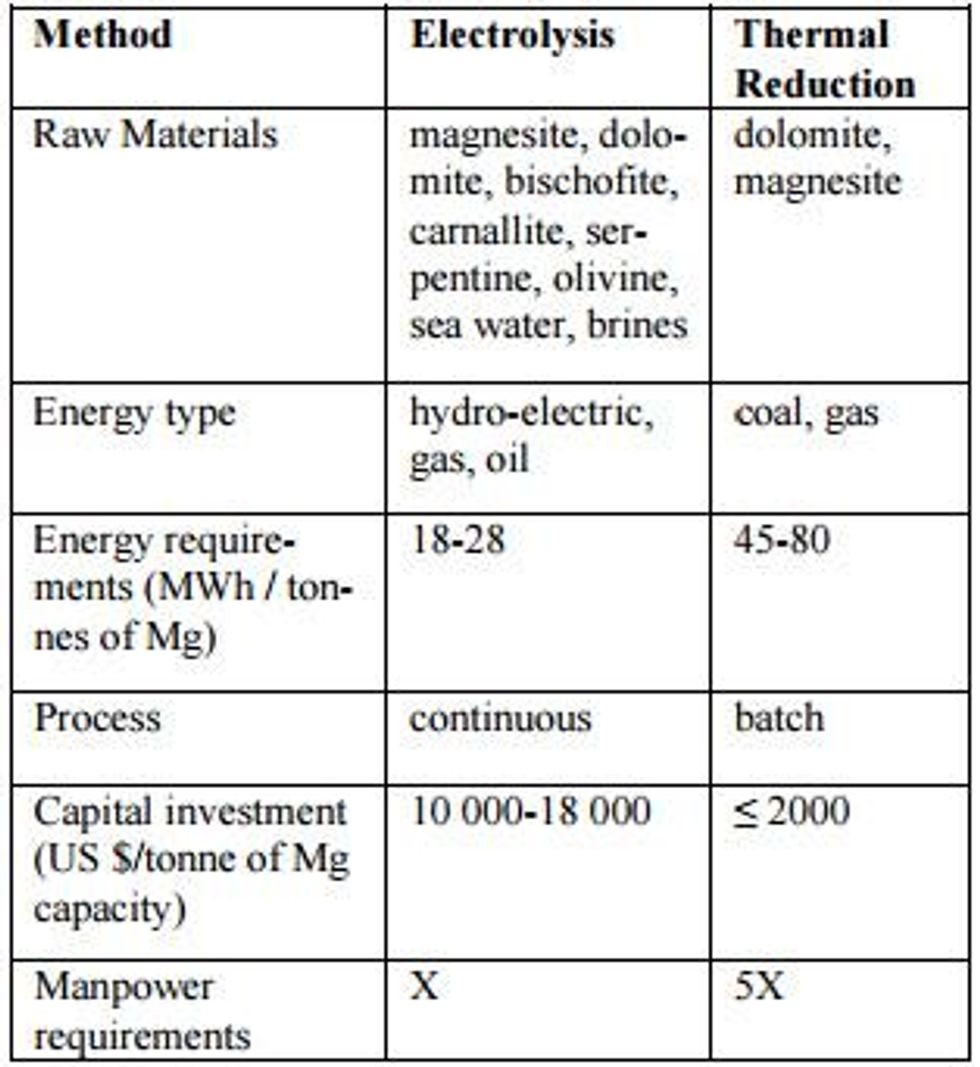

The main production method used by Chinese producers is the Pidgeon process, also known as thermal reduction technology. The process was developed in Canada in the 1940s by Dr. Lloyd Montgomery Pidgeon. While this is the cheapest process, it is also arguably the most environmentally unfriendly and inefficient with coal used as its main energy source.

It should come as little surprise that the Pidgeon process is widely used in China as lax environmental standards, plentiful labor, and availability of cheap coal have allowed the country to become the dominant force in magnesium production. As labor costs rise and China’s leaders finally start to reckon with environmental challenges, this market dominance may diminish minimally, but not anytime soon.

A very brief description of the Pidgeon process is as follows:

Dolomite ore is mined, crushed, and calcinated via roasting at temperatures up to 1,200ºC. This removes the carbon from the magnesium compound. The dolomite is then mixed with ferrosilicon (the reducing agent) to form a briquette. The briquettes are placed in retorts for deoxidization at temperatures as high as 1,250°C. This forms crowns of magnesium crystals which are then melted and recast as magnesium ingots.

Producers outside of China use electrolytic processes for magnesium production which are essentially mirror images of the Pidgeon process – higher cost, but more stable from an environmental perspective. Some of these processes include Magnetherm and Bolzano.

Magnesium is repurposed into various compounds which serve the numerous end markets. These compounds (along with select uses) include:

Dead Burned Magnesium (DBM) –refractories

Hard Burned Magnesium – interior building products, fiberglass, agricultural

Light Burned Magnesium – agricultural

Fused Magnesium (FM) – refractories

Dolomitic Lime – steelmaking, glassmaking

Caustic Calcined Magnesia (CCM)–water treatment, fertilizers, animal nutrition

Magnesium Hydroxide (MDH)– flame retardants, fuel additives, water treatment

Magnesium Chloride

Synthetic Magnesium Sulfate

The Market Participants

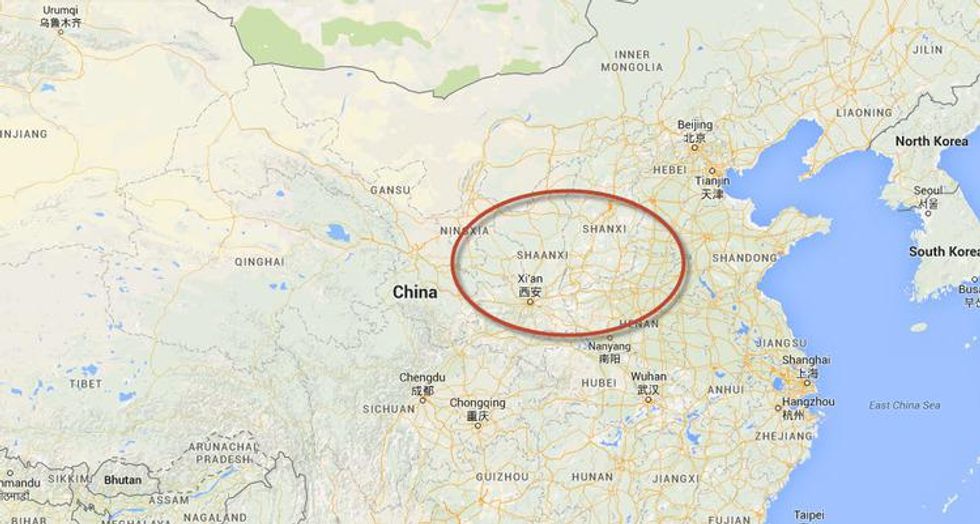

Given the ubiquity of magnesium in the Earth’s crust and the multiple end uses of the element (both in metal and compound form), a relatively large number of both public and private companies have arisen to integrate into the magnesium value chain. As mentioned earlier, China’s relative market dominance, with over 70% market share, has allowed numerous companies inside China to emerge as a collective force. This extends from mining through to production of metal and associated compounds. Our research indicates that there are at least 50 companies inside China involved in the magnesium business. Unfortunately, the clarity ends there as some of these entities are privately held and some are “public” (a loose term in China these days) rendering an apples-to-apples comparison impossible. The majority of these companies are located in Shaanxi and Shanxi Provinces with approximately 80% of magnesium production originating here.

The largest reported domestic magnesium producer in China is Shanxi Yinguang Magnesium Industry Group Co., Ltd. The company maintains a complete magnesium supply chain from mining exploration and production to alloy processing. The largest magnesium alloy producer in China is Nanjing Yunhai Special Metals Co., Ltd (002182:SHE) and has a market capitalization of 4.11B Renminbi (roughly $662 million USD) as of July 23rd. While equity market valuations in China may not accurately reflect the true “value” of an enterprise, this number should give one an estimate of the size of one of the largest companies in the magnesium business inside China. The company generated RMB 3.2B in revenues in FY 2014, 26% of which (RMB 839M) were generated from its magnesium alloys business.

Outside of China, numerous companies exist within the global magnesium supply chain. A search on Bloomberg returned 52 companies, both publicly listed and privately held and we suspect there could be more. Typically, these companies are located higher up on the value chain (we could only find two examples of magnesium mines in the United States) and are diversified in their business lines. It would appear that growth in these businesses is tied mainly to steel and construction and so a watchful eye on those sectors is warranted. This brief list of non-Chinese magnesium players is a reasonable overview of the sector. Examples include:

Dead Sea Magnesium, a subsidiary of ICL Israeli Chemicals Ltd (TLV:ICL) which produces pure metal magnesium and magnesium alloys from the Dead Sea.

US Magnesium, a privately held company in Utah and major producer of primary magnesium through an electrolysis process from brines in the Great Salt Lake.

Magnesita Refratarios (BVMF:MAGG3), based in Brazil, with a market cap of BRL 679.85M ($213M USD) is a vertically integrated refractory manufacturer with over “13,000 products” according to company documents. The company is the third largest producer of refractory products in the world.

Premier Magnesia LLC, a Nevada-based vertically integrated magnesia miner and processor.

RHI AG (ETR:RAD), an Austrian-based company which produces approximately 1.7 million tonnes of refractory products per year and generated EUR 1.72B ($1.87B USD) in revenue in 2014.

Terna Mag SA, a Greek magnesium miner and producer of magnesium compounds.

Magnezit Group, a Russian-based producer of refractory materials which is vertically integrated with its own raw material supply.

Ube Material Industries in Japan, a subsidiary of Ube Industries (TYO:4208) The parent company is split amongst four segments and has a market cap of ¥237B JPY ($1.9B USD).

Solikamsk Magnesium Works (MCX:MGNZ), a Russian magnesium metal producer with a market cap of RUB 2.71B ($47.1M USD).

Others include Ust-Kamenogorsk Titanium and Magnesium, Rima Industrial, and CVM Minerals.

A final major player in the magnesium sector is Martin Marietta Materials, Inc (NYSE:MLM) with a market cap of $10.7 billion. The company reported $2.9 billion USD in revenues in 2014 and the magnesia business was responsible for 9% of consolidated net sales (approximately $265 million USD). MLM’s magnesia business is targeted to customers in the industrial, agricultural, and environmental businesses with a particular focus on the steel business.

There is also a small crop of junior mining companies pushing forward with exploration and development plans for magnesium properties. They include: MGX Minerals (CSE:XMG; market cap: $19.12M CAD), West High Yield Resources (TSXV:WHY; market cap: $11.72M CAD), Nevada Clean Magnesium (TSXV:NVM; market cap: $5.94M CAD), and Korab Resources (KOR:ASX; market cap: $6.01M AUD).

SWOT Analysis

If beauty is in the eye of the beholder, then compiling a SWOT analysis on magnesium will no doubt leave some people viewing strengths as weaknesses and vice versa. As an example, I list the lack of a supply and demand imbalance as a strength. A mining company may disagree with this as they’re attempting to sell a product into an oversupplied market. However, an end user of magnesium may view the oversupply as a strength as it would allow them leverage in pricing negotiations and lower their operating expenses. That said, a clearer view of the potential pros and cons is always warranted and I concede that some who read this report may view the potential here through a markedly different lens.

Strengths

- The market appears to be in oversupply, implying lower prices going forward.

- As one of the lightest useful metals, demand for end uses where lightweighting is important could increase.

- A diversity of end uses ensures that deficient demand in a specific industry won’t crater the overall demand picture.

- Magnesium is literally found everywhere, even in seawater.

- Metallurgy and production processes of magnesium are well understood implying steady operating expenditure and capital expenditure projections.

Weaknesses

- Magnesium prices are essentially “handshake agreements” between buyers and sellers meaning an overall murky pricing structure.

- Chinese excess capacity looms large, with approximately 52% capacity utilization, according to Platts.

- With 70 to 80% of production in China, the potential for a supply disruption exists.

Opportunities

- Materials science and the drive towards lightweighting of materials offer the potential for unforeseen uses of magnesium.

- As the need to focus on environmental sustainability increases in China, this could open the door for ex-China magnesium production.

Threats

- Substitution.

- Persistent slack in global aggregate demand.

- Technology requiring less magnesium material through more advanced manufacturing techniques.

- As the Chinese Renminbi (RMB) is pegged to the US Dollar (USD), any continued USD strength will result in higher domestic production costs for Chinese magnesium producers, eroding their cost advantage.

Conclusion

There is no disputing the fact that as China’s economic growth rate slows, metals prices could continue their downward trajectory. For those brave enough to traffic in the metals sector now and going forward, finding those opportunities where demand is growing in excess of global GDP and who have multiple avenues of demand is absolutely crucial. Magnesium satisfies these categories and thus deserves further study. A particular focus on steel demand and advances or mandates in automotive lightweighting are primary areas which may offer clues to future consumption of magnesium compounds. Regarding changes in market structure, watching to see how Chinese officials focus their environmental cleanup efforts and how they manage the shutdown of inefficient enterprises is important as it may impact magnesium supply in the future.

Select Sources

https://www.intlmag.org

https://www.ima-na.org

https://www.nipponkinzoku.co.jp/en/

https://www.australianminesatlas.gov.au/education/fact_sheets/magnesium.html#mining

https://www.chinamagnesiumcorporation.com/our-business/the-pidgeon-process

https://www.lunt.com/

https://www.spartanlmp.com/

https://www.usgs.com

Chris is an independent analyst focused on strategic metals, innovation, and associated supply chain dynamics. After spending 15 years working across various roles in sales and brokerage on Wall Street, Chris shifted his attention to the forces propelling lifestyle convergence including urbanization, innovation, and technology and the opportunities that they are creating across numerous industries.

He has spoken at conferences all over the world and has visited dozens of countries first hand to gauge the pace of change in these topics as he thinks they are forces set to dramatically alter our way of life.

Chris has additional experience as the co-founder of a start up for investors which dealt with “computing with words” and co-authors The Disruptive Discoveries Journal. Chris holds a Master of Business Administration in finance with an international focus from Fordham University, and a Bachelor of Arts in international studies from The Virginia Military Institute.

He can be reached at info@discoveryinvesting.com

Editorial Disclosure: MGX Minerals, Nevada Clean Magnesium and West High Yield Resources are clients of the Investing News Network. This article was originally published by the Disruptive Discoveries Journal. The Investing News Network was not paid for this content. Please see author’s disclosure below:

The material herein is for informational purposes only and is not intended to and does not constitute the rendering of investment advice or the solicitation of an offer to buy securities. The foregoing discussion contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (The Act). In particular when used in the preceding discussion the words “plan,” confident that, believe, scheduled, expect, or intend to, and similar conditional expressions are intended to identify forward-looking statements subject to the safe harbor created by the ACT. Such statements are subject to certain risks and uncertainties and actual results could differ materially from those expressed in any of the forward looking statements. Such risks and uncertainties include, but are not limited to future events and financial performance of the company which are inherently uncertain and actual events and / or results may differ materially. In addition we may review investments that are not registered in the U.S. We cannot attest to nor certify the correctness of any information in this note. Please consult your financial advisor and perform your own due diligence before considering any companies mentioned in this informational bulletin.

The information in this note is provided solely for users’ general knowledge and is provided “as is”. We at the Disruptive Discoveries Journal make no warranties, expressed or implied, and disclaim and negate all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose or non-infringement of intellectual property or other violation of rights. Further, we do not warrant or make any representations concerning the use, validity, accuracy, completeness, likely results or reliability of any claims, statements or information in this note or otherwise relating to such materials or on any websites linked to this note. I own no shares in any companies mentioned in this note. I am a consultant to Zimtu Capital which owns a stake in MGX Minerals and I am paid a monthly fee by Zimtu.

The content in this note is not intended to be a comprehensive review of all matters and developments, and we assume no responsibility as to its completeness or accuracy. Furthermore, the information in no way should be construed or interpreted as – or as part of – an offering or solicitation of securities. No securities commission or other regulatory authority has in any way passed upon this information and no representation or warranty is made by us to that effect. For a more detailed disclaimer, please click here.