The Conversation (0)

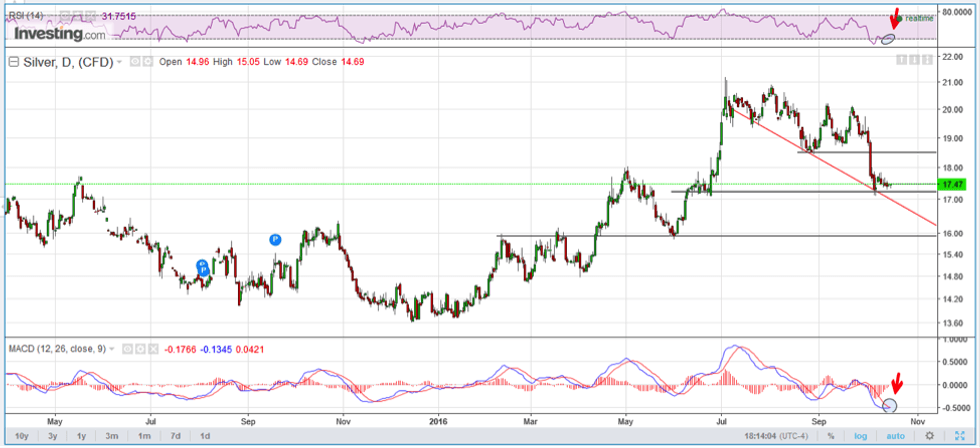

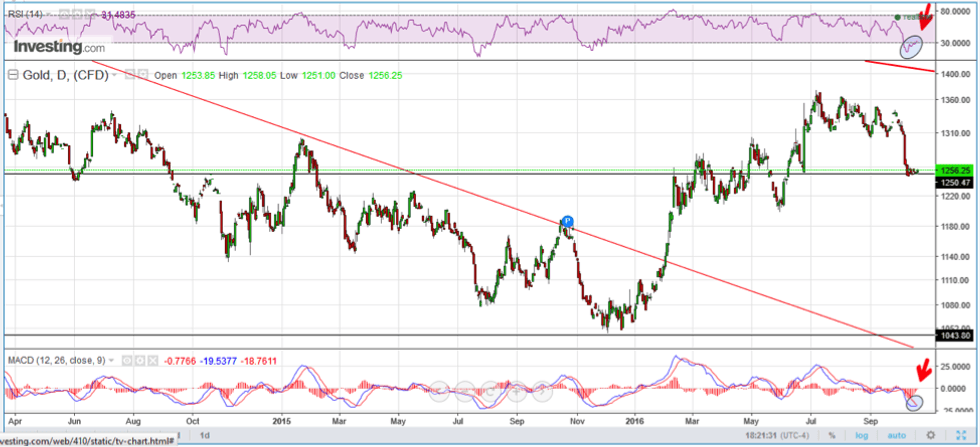

Moving Average Convergence Divergence is about to cross over on the daily chart — could we be at an interim bottom?

Moving Average Convergence Divergence (MACD) is about to cross over on the daily chart, along with Relative Strength Index (RSI) strengthening from an oversold condition indicating we MAY be at an interim bottom.

This is not to say that the correction in precious metals has run its course and a breakdown to the lows and beyond may yet be in the cards. It does, however, look like a reprieve is imminent.

First significant resistance for silver is US$18.50.

A similar condition exists for gold with resistance at US$1300.

Don’t forget to follow us @INN_Resource for real time updates!

Terry Yaremchuk is an Investment Advisor and Futures Trading representative with the Chippingham Financial Group. Terry offers wealth management and commodities trading services. Specific questions regarding a document can be directed to Terry Yaremchuk. Terry can be reached at tyaremchuk@chippingham.com.

This article is not a recommendation or financial advice and is meant for information purposes only. There is inherit risk with all investing and individuals should speak with their financial advisor to determine if any investment is within their own investment objectives and risk tolerance.

All of the information provided is believed to be accurate and reliable; however, the author and Chippingham assumes no responsibility for any error or responsibility for the use of the information provided. The inclusion of links from this site does not imply endorsement