Precious Metals Weekly Round-Up: Gold Down Following Fed Hike

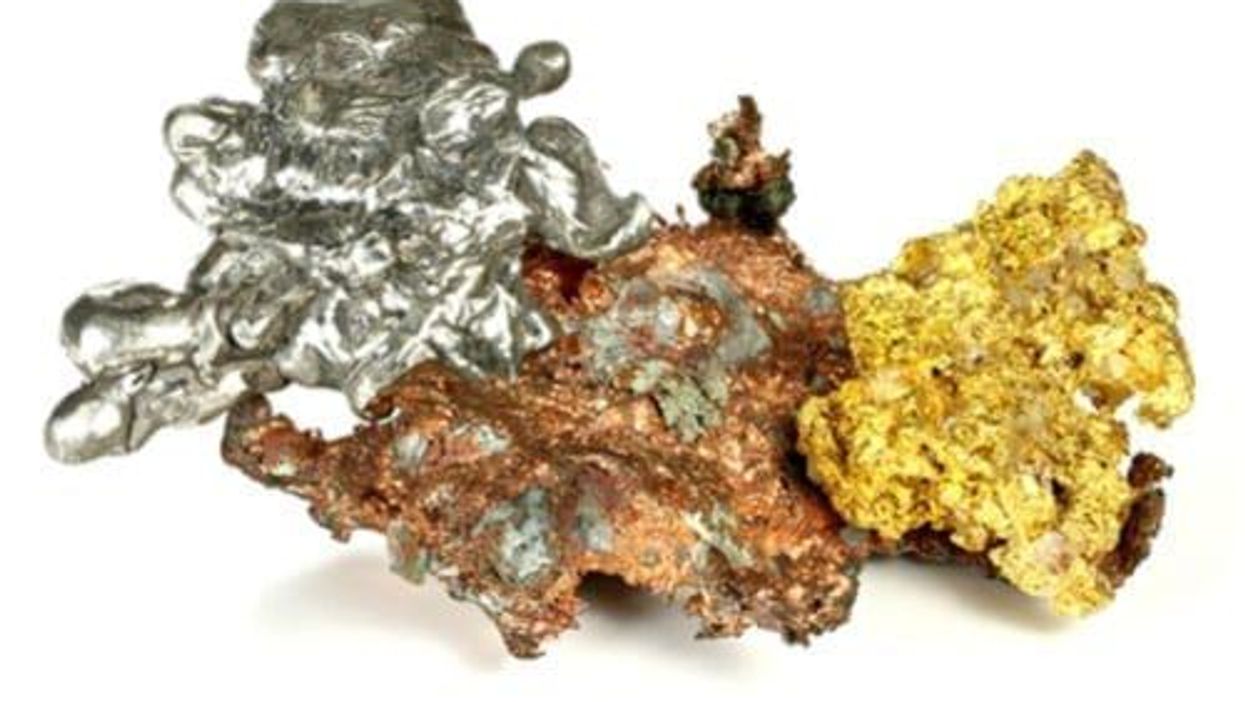

Gold tumbled following the Fed’s decision to increase interest rates to 2.25 percent, but other precious metals found their footing and made gains for the week.

Gold prices continued to fall on Friday (September 28), while silver made some gains following positive US economic data that encouraged the Federal Reserve to increase interest rates for a third time this year, to 2.25 percent on Wednesday (September 26).

As of 9:50 a.m. EST, the yellow metal was trading at US$1,185.90 per ounce, putting it at a new six-week low and on track for its longest monthly losing streak since January 1997. As for the white metal, it started to correct the decline it took immediately after the hike was announced and had climbed to US$14.56 per ounce as of 10:09 a.m. EST.

At the time of the Fed hike and in the days that followed, the US dollar returned to its path of acceleration, pushing gold downwards.

“The outlook for gold prices in the current term remains dim as such in lieu of rising rates and yields amidst buoyant US economic conditions,” said Benjamin Lu, commodities analyst at Phillip Futures.

Also keeping the greenback up and the yellow metal down was the new phase in US-China tensions thanks to US President Donald Trump accusing the Chinese of meddling in the upcoming US elections.

“The trade war continues to favor the US dollar and this will generally dampen gold’s upside,” said Nicholas Frappell, global general manager at ABC Bullion in Australia.

For their part, platinum and palladium both increased for the week. As of 10:23 a.m. EST platinum was trading at US$817 per ounce, while palladium continued its climb, landing at US$1,086 per ounce.

Precious metals top news stories

Our top precious metals stories this week featured the US$18.3-billion merger between gold miners Barrick Gold (TSX:ABX,NYSE:ABX) and Randgold Resources (LSE:RRS), and how the price of silver reacted to the Fed’s interest rate hike.

1. Barrick and Randgold to Merge in US$18.3-billion Deal

Canada’s Barrick Gold has agreed to buy Randgold Resources in a US$18.3-billion share deal to create the world’s largest gold company by value and output.

As per the agreement, each Randgold shareholder will receive 6.128 new Barrick shares for each share of the African rival in a deal that Barrick states will create an industry-leading gold company with “the greatest concentration of tier one gold assets in the industry.”

Once the deal is finalized, Barrick shareholders will own approximately 66.6 percent of the new company, while Randgold shareholders will obtain a roughly 33.4-percent stake.

“There are no premiums in the merger because we strongly believe in the opportunity to add significant value for our shareholders from the disciplined management of our combined asset base and a focus on truly profitable growth,” stated John L. Thornton, executive chairman of Barrick.

2. Here’s What the Barrick-Randgold Merger Could Mean for the Gold Sector

Following the Barrick and Randgold announcement, many expressed optimism that the deal will be a bullish event for gold and will act as positive reinforcement for the sector as a whole.

The transaction has caused a plethora of industry insiders to theorize that the deal could act as a catalyst for additional M&A, while creating reasons for investors to get excited about the yellow metal again.

“For the gold industry as a whole I think it is a shot in the arm that the industry needs. It’s showing that M&A [merger and acquisition] activity can happen and it can happen in a way where you can have a shakeup of an old-style, massive company like Barrick Gold,” Charles Cooper, head of mine economics at Metals Focus, told the Investing News Network.

3. Silver Price Takes Slight Dip After Fed Raises Interest Rates

After two days of meetings regarding monetary policy, the Fed officially announced the third interest rate hike for 2018 on Wednesday.

The Fed, led by Chairman Jerome Powell, lifted the target federal funds rate by 25 basis points, from 2 percent to 2.25 percent, causing the US dollar to once again pick up steam and pushing silver prices down modestly.

This will be the Fed’s eighth hike in two years, and, as Powell stated in a press conference following the policy meeting, “[t]his gradual return to normal is helping to sustain this strong economy.” He added, “this is a pretty good moment for the US economy.”

Also in the news

Also making news this week was Wesizwe Platinum (JSE:WEZ) and its H1 2018 profit decline of R14.9 million. That’s down from a R19-million profit in the first half of 2017.

Despite the drastic loss, the miner assured shareholders that its Bakubung platinum mine in Rustenburg remains viable.

Wesizwe further reported that its appointed development and construction contractor has started preparation for production and construction for levels 69 and 72, with the first blast for the mine achieved on August 10.

In a downside to Barrick and Randgold’s historic merger, the Congo’s state miner Sokimo warned Randgold on Friday that it would “assert its rights” in Barrick Gold’s acquisition of Rangold’s stake in the Kibali project under a takeover deal.

Despite the warning, Sokimo did not clarify its plan of action going forward.

The Kibali mine is one of Africa’s biggest gold mines and the project is a joint venture with AngloGold Ashanti (NYSE:AU,JSE:ANG) and Congolese state miner Sokimo, with 45 percent owned by Randgold, 45 percent by AngloGold and 10 percent by Sokimo.

The company also noted that the transaction represents an effort by the foreign companies “to impose themselves, without any prior discussion, in the countries from which the resources that make up their wealth are extracted.”

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Nicole Rashotte, hold no direct investment interest in any company mentioned in this article.