Platinum prices have been on the downtrend this year, and things are not looking up going into next year. Here’s a look at the platinum price forecast for 2016.

Platinum prices have certainly been on a downtrend this year. Between pressure on the broader precious metals complex and fear of reduced platinum demand in the wake of Volkswagen’s (ETR:VOW3) vehicle emissions scandal, there’s been plenty working against the white metal.

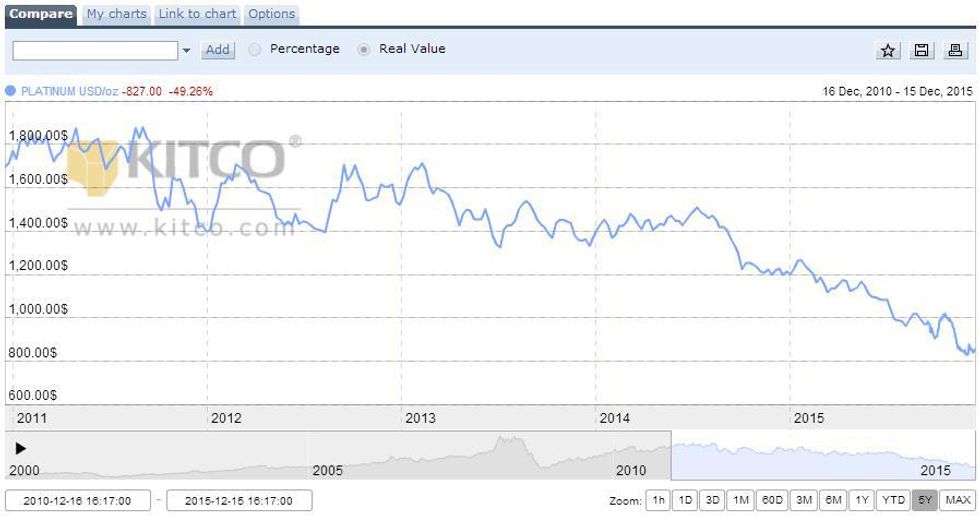

Overall, spot platinum prices are down 28 percent, or $344, year-to-date, currently trading at roughly $853 per ounce. The metal has been cheaper than gold since mid-January.

Here’s a look at Kitco‘s platinum price chart for 2015:

Unfortunately, the platinum price forecast for 2016 isn’t looking much better. Back in October, Reuters polled 30 traders and analysts and found that the average platinum price forecast for 2016 came in at $1,105.50, 12 percent lower than the previous quarter.

Pressure on platinum prices in 2015

So what’s been driving platinum down? As mentioned above, a broader selloff for the entire metals sector has certainly been affecting platinum. More specifically, fears that the US Federal Reserve will raise interest rates have been weighing on the gold price, but that factor is extending to other precious metals as well.

Weaker demand from China and a continued ramp up of production in South Africa following last year’s five-month mining strike have also been affecting the platinum price.

Certainly, Volkswagen’s emissions cheating scandal didn’t help matters either. The automaker was found to have used defeat devices that allowed its diesel vehicles to put out lower emissions in order to pass tests in the US, and eventually admitted to using the devices in 11 million vehicles worldwide.

Demand for platinum, which is used in catalytic converters for diesel engines, was expected to drop in the wake of the scandal, along with anticipated lower demand for diesel cars. Since then, Volkswagen has announced that it will move into the electric vehicle space.

Indeed, that environment has been tough on platinum producers. Anglo American Platinum (JSE:AMS) sold its Rustenburg platinum operations in South Africa to Sibanye Gold (NYSE:SBGL) for roughly $331 million as part of a move to focus on lower-cost production.

Platinum price forecast

That said, the World Platinum Investment Council (WPIC) found that there was an overall market deficit for the third quarter of 2015, and the organization is calling for a deficit for 2015 overall. Paul Wilson, WPIC CEO, has suggested that effects of the Volkswagen scandal have been “greatly overstated.”

“While October’s vehicle sales showed some slowing of growth, diesel cars in Western Europe are set to remain a major part of the car market and the largest global consumers of platinum for autocatalysts, so the prospects for this sector remain key to platinum demand growth,” he said.

Indeed, Platts reported more recently that European auto sales rose 14 percent in November, suggesting that platinum and palladium could stand to gain on the back of those numbers. The firm quotes Commerzbank (ETR:CBK) as saying that the rise in auto sales “suggests robust demand for platinum and palladium, especially since more new cars should be registered in the EU next year too.”

Still, the WPIC also expects the platinum market to balance in 2015, meaning that this year’s deficit will shrink to a small surplus by the end of 2016. And overall, the organization is predicting a small surplus for next year. Certainly, it appears that while the WPIC believes there is “as much upside, as downside, for platinum demand,” platinum investors may have to wait a little longer before things turn around.

Securities Disclosure: I, Teresa Matich, hold no direct investment interest in any company mentioned in this article.

Related reading:

Platinum Outlook 2015: A Brighter New Year

Updated Platinum Price Forecast for 2015