Roxgold CEO John Dorward told Gold Investing News that Credit Suisse’s departure wasn’t unexpected given the firm’s decision to exit the commodities space. He believes a new backer for Yaramoko will be found in the first quarter of 2015.

Despite the recent departure of Credit Suisse (NYSE:CS) as a backer for Roxgold’s (TSXV:ROG) Yaramoko project, CEO John Dorward said it’s “business as usual” for the company and remains confident of finding a new backer in the first quarter of 2015.

Credit Suisse and Societe Generale (EPA:GLE) signed a deal on September 25 to help finance the project, pledging to contribute $37.5 million apiece, but on Monday Roxgold confirmed Credit Suisse has pulled out, leaving a multimillion-dollar hole for the company to fill.

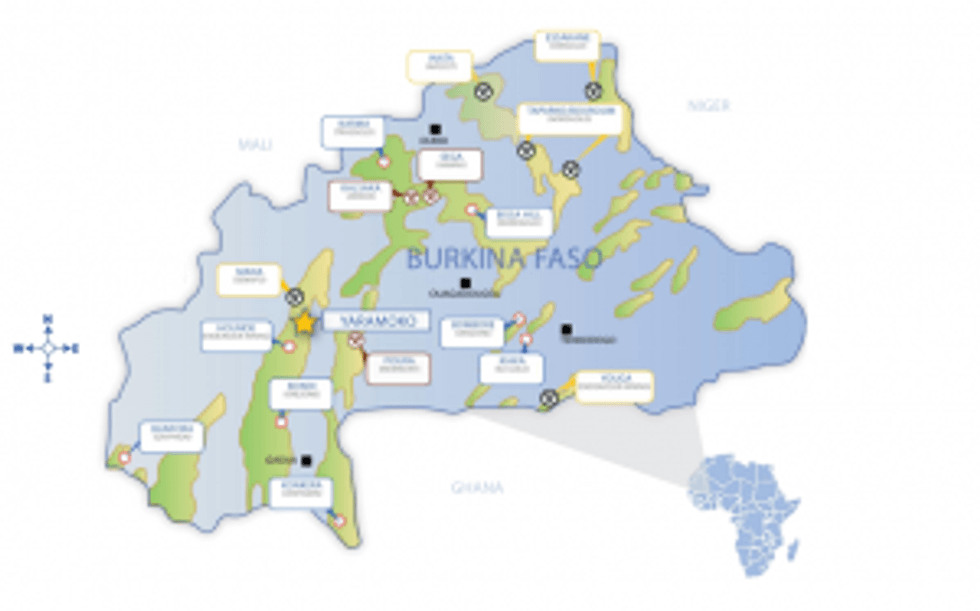

The firm’s decision follows political turmoil in Burkina Faso caused by longtime president Blaise Compaore’s deposition in a military coup. Though the West African country is a large player in the mining industry, and is ranked as the fourth-largest gold producer on the continent, the unrest has caused concerns about the future of Yaramoko.

But despite losing one of the project’s largest backers, Dorward is upbeat.

“It’s certainly inconvenient. I wouldn’t say I’m concerned. The intentions of Credit Suisse on a broader level have been well flagged,” he said, alluding to Credit Suisse’s announcement six months ago that it will be pulling out of the commodities market. “We got caught to some extent as part of the bigger game.”

He admitted that the unrest in Burkina Faso probably didn’t help, but believes it wasn’t a driving reason behind Credit Suisse’s exit.

The current deal with Societe Generale does not include political risk insurance, but Dorward said Roxgold has been told by several companies that the insurance is available if needed.

Societe Generale is now approaching several parties about project financing, and has rolled its commitment over until February. Dorward said he expects the bank to extend it further if, for example, final paperwork with a new partner isn’t completed by then.

“Our project is quite unique. Unique is a word that is thrown around a lot, but when you have a 15-plus gram ore body with a mill feed grade of 12 grams per tonne, then it’s a project that is going to be built,” he said. “We remain confident that we will get the financing. It’s just not going to be some gift, wrapped with a bow on top, like it was looking a month or so ago.”

Roxgold is still waiting for its mining decree from the interim government in Burkina Faso. The project was approved by the former government, but the president was deposed before he could sign the decree, leaving the company in limbo. “We don’t believe it’ll be a long period, hopefully it’ll be in the next few weeks,” said Dorward.

Despite the lack of a mining decree, Dorward said it’s “business as usual” at the project, and emphasized that the uncertainty hasn’t had any impact on day-to-day operations.

The Yaramoko project has an after-tax internal rate of return of 47.7 percent with an after-tax value of $192 million. Gold production is scheduled for early 2016.

Securities Disclosure: I, Nick Wells, hold no direct investment in any of the companies mentioned in this article.

Related reading:

Credit Suisse Pulls Out of Roxgold, Leaves Company Looking for Backers