Nicola Mining: $51 Million Invested in 4 Assets, Market Cap $6 Million, Cash Flow Next Year

CEO Peter Espig believes the company has the potential to become a consolidator of small, high-grade gold and silver deposits, and associated base metals.

Disclosure: Nicola Mining has a small market cap. Small market cap stocks are highly speculative, not suitable for all investors. I, Peter Epstein, own shares of Nicola Mining. Mr. Epstein, CFA, MBA is not a licensed financial advisor. Readers should take that fact into careful consideration before buying or selling any stocks.

Readers are encouraged to consult with their own investment advisors before buying or selling any stock, especially speculative ones like Nicola Mining. At the time this article was posted, Nicola Mining was a sponsor of: https://EpsteinResearch.com

The July 2013 announcement of Peter Espig’s accepting the role of CEO may have come as a surprise to some; however, to Mr. Espig it was a natural career progression. He grew up around mines and exploration projects, having spent 8 years working as a diamond driller in the 1980s. His career as an internationally renowned turnaround specialist and financier, including working at Goldman Sachs & Olympus Capital, places him in an ideal position to advance Nicola Mining Inc. [NIM.V] (the “Company” or “Nicola”).

Mr. Espig has structured greater than US$2.5 billion globally in private and public deals. According to Mr. Espig, “…regardless of the industry, turnarounds require hard work, professionalism and creativity. Mining is not the Wild West anymore, but managers have to constantly monitor cash burn, assets, debt and cash flow opportunities.” Prior to accepting the full-time role as CEO, Mr. Espig served as an Independent Director to the Company, a role that allowed him to better understand the value of its assets and to hit the ground running.

The following interview of Peter Espig, CEO Nicola Mining, was conducted by phone and email in the week ended October 30th. The views and opinions of Mr. Espig are entirely his own. The interviewer, Peter Epstein, CFA, MBA believes that the information provided by Mr. Espig is accurate, but cannot guarantee that it is.

Can you please explain the history of Nicola’s predecessor company Huldra Silver as far back as you care to go?

Huldra Silver Inc. (“Huldra”) was incorporated in 1980 and focused on the exploration and development of its wholly-owned group of mineral tenures located in British Columbia, Canada. The silver-lead-zinc Treasure Mountain property, situated 29 km northeast of Hope B.C., comprises 52 mineral tenures in an area covering 3,187 hectares (7,875 acres). After discovering a 250 meter long silver rich vein in 1985, which was tested in 1986, Huldra Silver Inc. went public in 1987. Between 1987 and 1989, Huldra explored 4 underground levels with 2,743 meters (9,000 feet) of crosscuts, drifts & raises and punched another 1,676 meters (5,500 feet) of underground drill holes. An additional 3,048 meters (10,000 feet) of surface drilling was completed as well.

A bulk sample of 407 Metric tonnes, “Mt” of high-grade material was shipped to Cominco’s & Asarco’s smelters for testing. The shipped material was compatible with the smelters’ requirements, and Huldra was paid $344,265. However, progress towards achieving continuous production was halted in 1989 due to difficult financial market conditions.

Despite low metals prices in the 1990s and until 2006, Huldra was able to perform modest exploration programs at Treasure Mountain. Notably, management updated property maps, particularly mine plans, and conducted rotary drilling to investigate parts of the property evidencing significant mineralization. In 2007, mine workings were re-entered on two levels and check sampling was done to prepare a National Instrument 43-101 (“NI 43-101”) compliant resource.

On the basis of updated, digitized versions, a NI 43-101 report of Treasure Mountain was completed in 2009. Total Indicated Resource above a 10.0 oz/ton (311g/Mt) cut-off was estimated at 33,000 Mt @ 24.2 opt (753g/Mt) silver, plus 4.16% lead & 3.80% zinc, an Inferred Resource estimated at 120,000 Mt @ 27 opt (840 g/Mt) silver, plus 2.79% lead & 4.36% zinc.

In preparation of a 10,000 Mt sample, Huldra’s Level 1 portal of underground workings was re-timbered. That same year, Huldra conducted an exploration program including stripping, trenching and diamond drilling to further explore a prospective area of silver lead-zinc mineralization. Several studies related to environmental and mine planning were also commenced. In 2011, the Company acquired additional surface rights adjoining historic mineral tenures for $350,000. Camp construction at Treasure Mountain, with facilities capable of supporting 50 workers, was completed at a cost of $1.2 million. Huldra also purchased mining equipment for $1.5 million to commence underground mining.

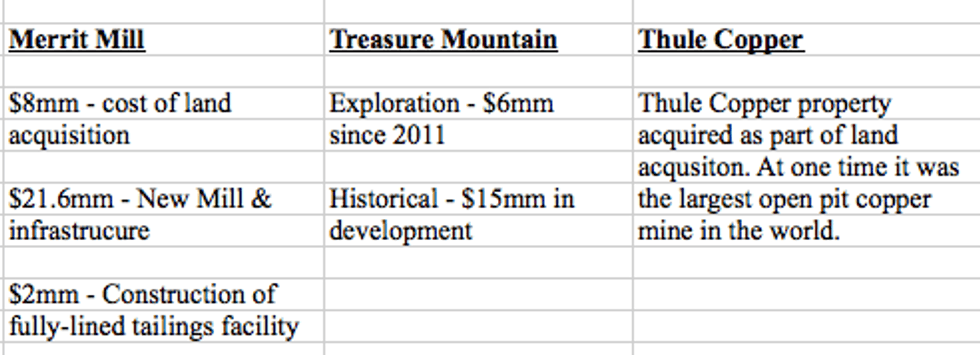

In 2011, Huldra acquired 100% ownership of Craigmont Holdings for consideration of $8 million. The Craigmont property is located near Merritt, B.C., 70 km north of Treasure Mountain. Huldra’s intent was to acquire a property that already maintained an existing mining and milling permit, as it would expedite the process of developing and mining Treasure Mountain. Given amicable weather, water, electrical infrastructure and proximity to Huldra’s former mining operations, Craigmont’s property was an ideal location to develop a mineral processing facility. The Company invested $21.6 million into a new mill plus $2.0 million into a lined tailings facility. Huldra built the Merritt Mill in 2011-2012, completing it November 2012.

Given a new management team and Board, a new company focus, what are KEY takeaways from the Company’s history?

Huldra Silver is an example of a company that had viable assets and a working business plan, yet was unable to service its debt. In short, it encountered the, “perfect storm” of excessive debt, falling commodity prices and diminished liquidity in both debt and equity markets. As a result, Nicola owns superior assets (see below) with near-term cash flow and longer-term exploration potential. We expect to deploy cash flow from our milling partnerships to fund other promising assets.

Importantly, the economic environment which continues to be illiquid and unsupportive of junior miners, creates highly attractive M&A opportunities. As a former M&A banker and distressed turnaround specialist, I understand how to acquire (companies / assets) and structure transactions. We continue to look at assets that can be acquired at discounts to total capital invested. However, ultimately it’s not just the discount that matters, but also synergies created by consolidating a valuable property with our new mill site.

Why did you change the name from Huldra Silver Inc. to Nicola Mining Inc.?

The name change is simple. Some may view it as extermination of the stigmatism attached to the previous company which entered into creditor protection and saw its market capitalization collapse, but this is not the reason. Actually, Huldra Silver Inc. was exactly what the name implies, a silver-focused junior mining company, but Nicola has become much more than that. We have the potential to become a consolidator of small high-grade gold and silver deposits, (and associated base metals), located throughout British Columbia. We changed the name to Nicola Mining because we are in the Nicola Region.

Legacy Huldra Silver Debt Structure:

| Debt Holder | Description | Amount |

| Waterton 1 | DIP Financing | $3,200,000 |

| Waterton 2 | Senior Debt | $7,300,000 |

| Convertible Debenture Holders | Unsecured | $11,000,000 |

| Trade Payables | Subordinated | $3,000,000 |

| Total | $24,500,00 |

Can you please describe the recently accomplished financial / debt restructuring?

Our team’s proactive restructuring of debt while in CCAA is one of the most compelling parts of the Nicola Mining story. At the time of my taking over as CEO the Company had defaulted on $24.5 million in debt and payable obligations that required immediate restructuring. Post Tranche 3 Financing the Company will have senior secured 3% debt note of $1,287,500 and a Secured Convertible Debenture of approximately $8.5 million, which is due in 2 and 3 years.

Restructured Nicola Mining Debt Structure:

| Debt Holder | Pre-Offering | Post Debt Conversion |

| Waterton 1 (DIP Financing) | $3,200,000 | $1,287,500 (3 years) |

| Waterton 2 | $7,300,000 | $0 |

| Unsecured Convertible Debt | $11,500,000 | $0 |

| Payables & CRMC Settlement | $3,000,000 | $0 |

| Secured Convertible Debt | $8,500,000 (2 – 3 years) |

You have described Nicola Mining as a package of 4 distinct, non-correlated assets. Can you please outline those 4 assets?

Asset # 1: The Merritt Mill is fully operational, requiring no CAPEX to commence milling up to 300 Mt per day, “tpd.” We would require roughly $150k in CAPEX to install equipment allowing us to utilize a back up crushing system. If installed, Nicola would be able to concurrently process mill feed from two sources. Depending on material, our break-even milling is $50 to $70/Mt. Our mining partners pay mining & transportation costs and a tailings disposal fee. We pay milling costs. Nicola sells the concentrate, with resulting profits split 50 / 50.

A key component of our partnerships is that they are exclusive contracts. It`s truly a win / win. We unlock value of the miner’s properties by giving them an opportunity to monetize. Without Nicola, the miners would probably not be mining at all. We are their only outlet. We intend to share profits equally with our partners to ensure repeat business. It`s extremely difficult and costly to get a milling permit so we’re in a very advantageous position. Currently we have 3 partnership agreements in place; the first guarantees delivery 15 g/Mt gold, the second 1,306 g/Mt silver and the third, 7 g/Mt gold.

Asset # 2: Treasure Mountain, a former operating mine, has $460,000 of remaining costs to mine Level 1 Stope 2 and another $308,000 to ship mill feed to Merritt Mill. Proceeds from our 3 milling partnerships are expected to repay a portion of Waterton’s debt, fund exploration and bolster working capital. Nicola Mining owns 100% of Treasure Mountain’s silver deposit consisting of 51 mineral tenures, 21 legacy claims, 100 cell units and five crown grants totaling 2,850 hectares (7,043 acres). The Company maintains the option of reopening Level 1 to extract silver from Stope 2. However, given depressed silver prices, our near-term focus remains on exploring 3 prospective targets.

Asset # 3: Thule Copper has, without question, tremendous blue-sky potential. I don’t use the term, “blue-sky” lightly, Thule Copper was once the largest open pit copper mine in the world. Thule’s mining leases and rights comprise 20 mineral claims covering 8,457 hectares (20,898 acres), of which 10 claims are contiguous. Thule Copper is known to host mineralization in the form of copper-iron skarn and copper porphyry. It’s located 20 km south of Teck Resources’ Highland Valley Copperoperation, 10 km from Merritt, BC.

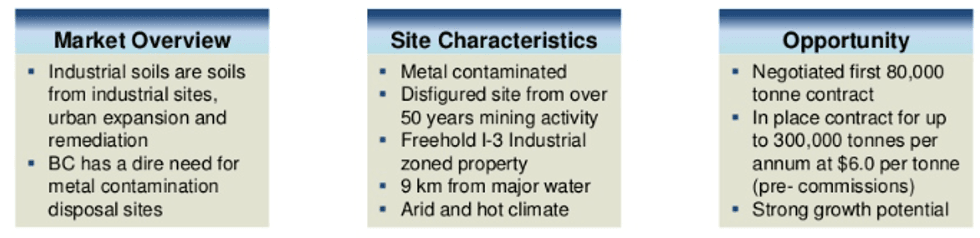

Asset #4: Industrial Soil. Our 4th asset was recently developed by Nicola Mining. It’s a portion of our property permitted to accept contaminated (industrial) soil. As mentioned, this asset and the utilization of the Merritt Mill, are the nearest-term cash flow opportunities. By 2h 2016, we expect to be cash flow positive. In the meantime, we don’t anticipate requiring equity capital, except for compelling, accretive acquisitions.

That’s a good question. Huldra Silver owned the Mill, Treasure Mountain and Thule Copper. Prior management spent a very considerable amount advancing these assets. As can be seen, a total of $52 million has been sunk into our assets. This is noteworthy given that our current market cap is just $6 million. A portion of the $52 million deployed was completed many years ago. In today’s dollars, the cost of replicating these expenditures would be meaningfully greater.

There are several important catalysts to watch for, milling operations, M&A, possible non-core asset sale and industrial soil handling. Milling of miner partnerships’ ore is expected to commence by the 2nd Qtr 2016. Given the distress in the mining industry, we expect very attractive and accretive M&A opportunities. We are reviewing a couple now. We have a contract in place to accept up to 300,000 Mt of industrial sand per year at $6.0/Mt of net revenue to Nicola. We have an offer for a non-core property listed for $2.5 million.

What’s the approximate valuation of the assets in an orderly (non fire sale) liquidation? Does this represent a reasonable fundamental downside scenario?

I don’t want to imply that the sale of our asset(s) has value because in a distressed environment characterized by limited liquidity, there’s no telling what any asset is worth. We do have a potentially valuable hard asset, the Merritt Mill, constructed at a cost of $21.6 million. Our Mill could allow a new owner to generate cash flow next year. However, in this market we would rather be buyers at steep discounts, not sellers.

The opportunity for us to consolidate in this epic downturn for TSX:V listed companies is exciting and compelling. We could also be an attractive takeover target for international players hoping to secure off-take. I should add that we’ve already been approached. The most important thing is to demonstrate that our assets can generate cash flow. That’s when our valuation could improve very significantly. It’s really hard to come up with a sum of the parts analysis pre cash flow. It’s prudent to assume that the value of a non-cash flowing assets in this environment is essentially zero. I believe we need to look at our assets as an NPV exercise.

Funding requirements are minimal, although we will be required to spend approximately $100k (50.1% of our Thule Copper ownership) to maintain our permits on Thule Copper. We are really excited about Thule given the work done to date. Other CAPEX will be contingent upon cash flow, leading to cash accumulation. Unless there’s an exceptionally accretive opportunity, we will be highly conservative with our cash. It’s sometimes best to acquire assets at a huge CAPEX discount, rather than pay full price for developing new assets.

If the market fails to reward Nicola with a proper valuation (by your metrics) could the Company go private, declare a special dividend or spin out assets?

No, it’s not our goal at all to, “go private,” but rather focus on getting to a point that would entice senior secured debenture holders to convert into equity. More likely, listed miners with solid BC-based assets, but lacking cash flow, will find it difficult to pay listing, accounting and administrative fees. Shareholders of these companies will lose interest and management will look to consolidate with a stronger player like Nicola Mining.

Are there any misconceptions on Nicola Mining that you would like to address?

Thank you Peter [Epstein], I think we covered a lot of ground. In terms of misconceptions, one might be that we’re merely another junior natural resource company requiring ongoing, dilutive, capital raises to fund losses. This is clearly not the case given that we expect to generate revenues and cash flow next year. Our stock price and trading liquidity might be an indicator of that perception, but again, that’s no reflection on our assets and cash flow potential.

I believe our undervaluation could be due to a lack of understanding of the new Nicola Mining. We are just starting to tell our compelling story and to educate shareholders and prospective shareholders. Few may notice that we’re quite advanced on Treasure Mountain. As a past producing mine, the infrastructure is in place, the capital sunk and permits are pending. Finally, our market cap is just $6 million, yet the total amount of capital spent on our assets is $52 million. I believe there’s a disconnect between those figures. Hopefully, over time, our market cap will better reflect the large sum of capital invested and our ability to generate cash flow.