Radisson Mining Releases O'Brien PEA; Further Drilling Planned

The company’s share price ended the day up 9.52 percent, at $0.115.

In today’s difficult markets it can be tough for gold-focused companies to make progress. The gold price is down just over 11 percent year-to-date, and some believe this week’s US Federal Reserve meeting may bring more difficulties.

Nevertheless, it’s certainly possible to find companies in the gold space that are continuing to move forward. Case in point: Radisson Mining (TSXV:RDS) released a preliminary economic assessment (PEA) for its Quebec-based O’Brien gold project on Tuesday, and thus far has enjoyed a positive reaction from investors.

By the numbers

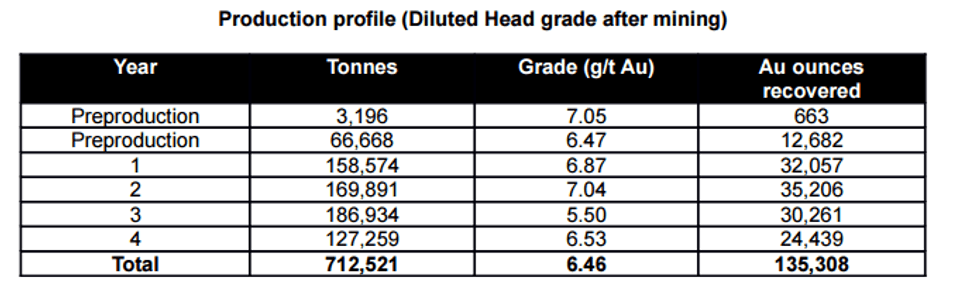

The PEA considers O’Brien’s current indicated and inferred mineral resources, which together amount to 712,521 tons at 6.46 g/t gold. It uses a gold price of US$1,180 per ounce (C$1,475 at an exchange rate of 1.25), and a mill recovery rate of 91.5 percent. All in all, O’Brien is expected to produce an average of 440 tons per day — that adds up to gold production of 135,308 ounces over six years.

A more specific production profile for O’Brien is outlined in the chart below:

Looking at financials, the PEA pegs O’Brien’s total gross revenue at C$199.6 million. Its pre-production capex stands at C$36.8 million, and it will have an average operating cost of US$725 per ounce. Based on those numbers, the project’s pre-tax NPV comes in at C$0.2 million, while its pre-tax IRR is 5.18 percent (both at a 5-percent discount). Its payback period is set at 5.6 years.

Market context key

A gold price of US$1,180 might sound ambitious in today’s markets — after all, so far in December it’s barely managed to clear US$1,080. However, in conversation with the Investing News Network, Hubert Parent-Bouchard, director of finances at Radisson, encouraged investors to consider the Canadian dollar when looking at O’Brien.

“The gold price used of C$1,475 [and] grade cut off of 5.21 g/t gold are in line with current market conditions. The current exchange rate is profitable for Canadian producers,” he said.

He also emphasized that while it’s currently tough to generate interest in gold projects, it’s important to remember that the gold market is cyclical. “Our vision is that it is time to develop the project to profit from the next gold bull market,” he said, adding, “I think investors should be looking at gold on a five-year horizon, thus accommodating producers and juniors that are economic at [current] price points. For Radisson, if we develop this project in the current price environment … [it] will be profitable in the long run.”

Radisson also has an advantage in that the pre-production capex for O’Brien is just C$36.8 million. That’s “really low for a mining project,” according to Parent-Bouchard, and should help attract interest to the project.

Finally, Parent-Bouchard noted that there are opportunities to increase the value of O’Brien. He explained, “the diluted head grade used for the base case is 6.46 g/t gold. If we increase it to 8.39 g/t gold, we denote a C$48-million increase for the pre-tax NPV. In parallel, metallurgical testing done on ore from the 36E area returned an average 11.13 g/t gold head grade.”

“Every project has its technical challenges, and due to the high nugget effect, we believe the real value of this project will only be known once we have access to ore shoot underground,” Parent-Bouchard added.

Next steps

The PEA for O’Brien is exciting, and it looks like moving forward there will be even more activity there. Parent-Bouchard said that a drill is already in place at the project for a 6,200-meter Phase 1 drill program that’s set to begin in January, and noted that by the end of the year Radisson hopes to complete “over 20,000 meters with the purpose of adding resources in areas 2, 4 and 3.”

Overall, he believes that “there is still strong potential for further discoveries on the scale of the project, [and] a part of the drilling program will cover this. We will look to add people to the team and also pursue environmental studies and permitting.”

As mentioned, Radisson’s share price gained on Tuesday’s news. At close of day, the company’s share price was up 9.52 percent, at C$0.115. Year-to-date it’s up an impressive 27.78 percent.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Radisson Mining is a client of the Investing News Network. This article is part of the company’s advertising campaign.