Radisson Mining Releases NI 43-101 PEA For O'Brian Gold Project

Radisson Mining Resources Inc. (TSXV:RDS) announced the results for the NI 43-101 compliant PEA carried out on the O’Brien gold project.

Radisson Mining Resources Inc. (TSXV:RDS) announced the results for the NI 43-101 compliant PEA carried out on the O’Brien gold project.

As quoted in the press release:

The PEA served to:

- Validate the technical and logistical advantages of the O’Brien project;

- Estimate the initial investment for a production scenario. The PEA establishes the basis for the development of the O’Brien project by:

- Supporting a phase 1 phase of work including drill program to further delineate and expand current mineral resources followed by a update for the mineral resource estimate and the PEA;

- Supporting a phase 2 phase of work (contingent to success of phase 1) including an underground development program including a bulk sample to confirm metallurgy and mineralized zones in a second phase of work continent to the success of the first phase of work;

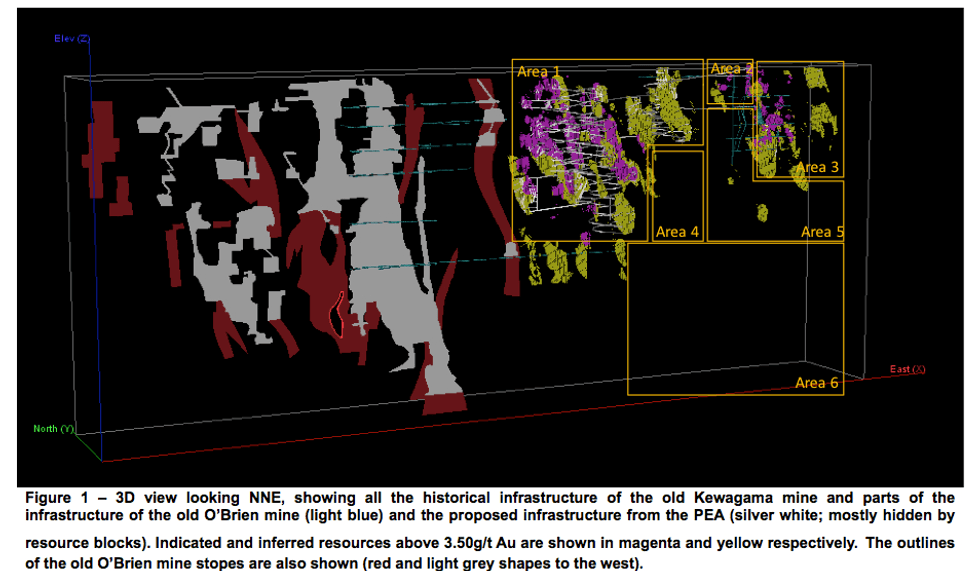

The PEA reaches a vertical depth of 550m on the 36E area and 250m on the Kewagama area, 600m east and along strike of the former O’Brien mine shaft (1,197,147 metric tons at 15.25 g/t Au for 587,121 ounces of gold from 1926 to 1957; InnovExplo, April 2015).

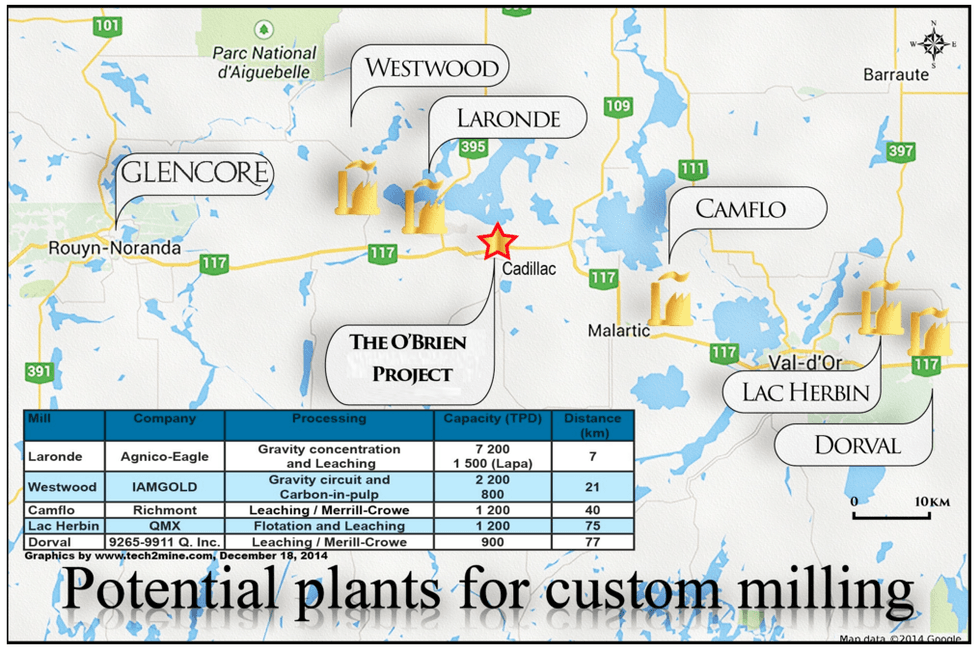

One of the five processing plants located within a 77-kilometer radius of the project has been selected for custom milling.

PEA highlights

- Total revenue in the amount of 199.6M CAD $

- Total production of 135,308 Au ounces over a 6 year period

- Underground mine with access by decline to a vertical depth of 550 m

- 6.8 M CAD $ pre-production capital cost that includes 18% contingency

- Average operating cost of 752 US$ per Au ounce 1

- Net cumulative cash flow before taxes of 7.2M CAD $

- Based on simple and proven mining and development methods

Radisson Mining President and CEO, Mario Bouchard, stated:

This study is a positive step forward for Radisson in spite of the difficult times for the industry. It underlines a positive pre-tax development scenario based only on 48% of current mineral resources. The study confirms what are the necessary steps to the development of our project. We are confident we can add value to the project with further exploration at shallow depth in areas that have not been explored to date and that are located in and around the areas included in the PEA.

The current PEA is based on an underground mine with access by decline to a vertical depth of 550 meters on the 36E area and only 250 meters on the Kewagama area. Mining infrastructures projected are located 600 meters east and along strike of the old O’Brien mine shaft, which reaches a depth of 1,045 meters and renowned for it’s historic production of 587,121 ounces of gold at a grade of 15.25 g/t Au.

The sensitivity analysis shows that an increase in head grade will increase cash flow generated, thus improving the project’s NPV (Net Present Value). The metallurgical study conducted in 2014 (see press release) returned an average grade of 11.13g/t Au on ore from the 36E area. PEA study scenario is based on a 6.46 g/t Au diluted head grade. Assuming a 30 % variation bringing diluted head grade to 8.39 g/t Au, the project’s pre-tax NPV goes from 0.2 M CAD $ to 49M CAD $. Our plan is to begin an extensive drilling program in order to increase and better define the current mineral resources to warrant an investment for an exploration decline.

With the percentage of free gold in the old O’Brien Mine and the metallurgical results obtained, we can say with confidence that the real potential of the deposit will be defined once we will have access to ore zones underground. The drilling program underway extending into 2016 marks the beginning of a very exciting development phase for the project. The drilling will help define and expand current mineral resources by extending current planned stopes and current identified ore shoots.

Connect with Radisson Mining Resources Inc. (TSXV:RDS) to receive an Investor Kit.