Radisson Announces 95% Increase in Indicated resources at the O’Brien Gold project

Radisson Mining Resources Inc.(TSXV:RDS) (OTC:RMRDF) (FRANKFURT:2RX) (“Radisson” or the “Company”) is pleased to announce the release of an updated resource estimate for its 100% owned O’Brien gold project (“O’Brien”) located along the Larder-Lake-Cadillac Break (“L-L-C”), halfway between Rouyn-Noranda and Val-d’Or, two mining towns in the Province of Quebec, Canada (See figure 1 and 2).

Radisson Mining Resources Inc.(TSXV:RDS) (OTC:RMRDF) (FRANKFURT:2RX) (“Radisson” or the “Company”) is pleased to announce the release of an updated resource estimate for its 100% owned O’Brien gold project (“O’Brien”) located along the Larder-Lake-Cadillac Break (“L-L-C”), halfway between Rouyn-Noranda and Val-d’Or, two mining towns in the Province of Quebec, Canada (See figure 1 and 2). The resource estimate was prepared in accordance with National Instrument 43-101 (“NI 43-101”) by independent firm InnovExplo and is dated March 20, 2018. The 36E and Kewagama zones of O’Brien are located within a 1.5 km corridor directly south of the L-L-C. The Vintage zone is parallel to and between 30 to 85 meters (“m”) north of the L-L-C and has now been identified over a strike length of 825 m. Due to their close proximity all zones of the O’Brien gold project could eventually be accessed via same mining infrastructures.

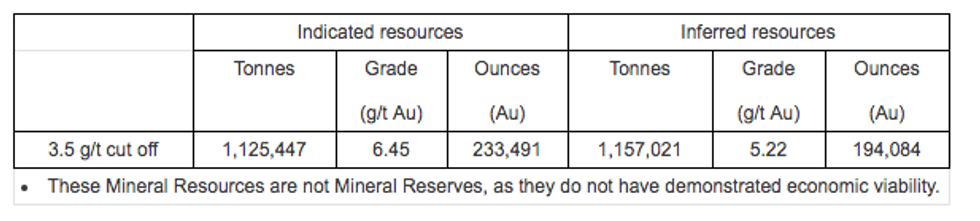

O’Brien Resource estimate1

Press release highlights:

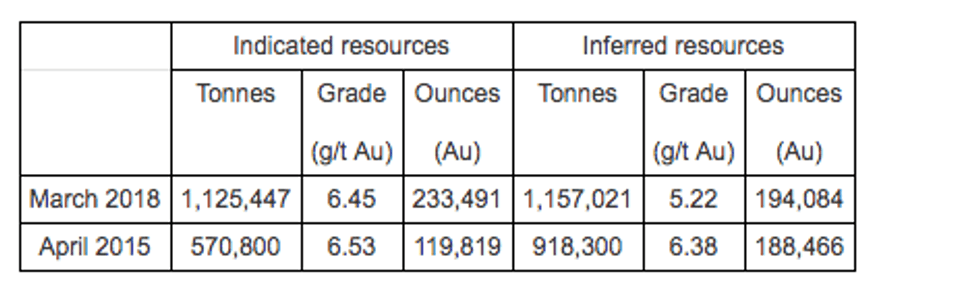

- Using a 3.5 grams/tonne gold (“g/t Au”) cut-off grade, the O’Brien Indicated resources increased 95% from 119,819 ounces to 233,491 ounces of gold at a grade of 6.45 g/t Au.

- O’Brien deposit remains open at depth below 600 meters.

- Partial portion of the Vintage Zone was included in the resource update. Additional work is warranted on other areas such as the F Zone in order to be incorporated into a 43-101 compliant resource estimate.

- Excellent exploration potential remains along strike and at shallow depth, supported by;

- Strong vertical continuity in the resource, averaging 80 degree dip and;

- The 587k ounces of historical production from contiguous old O’Brien mine which produced to vertical depth over 1,100 m.

- Benefiting from the excellent location of the O’Brien gold project (See figure 1 and 2), the company completed 32,000 m of drilling at an average all-in cost of $95 CAD per meter in 2016 and 2017, of which 29,787 m were incorporated into the resource estimate announced today.

- Approximately 5,000 m of drilling were completed on the Vintage Zone since the resource estimate cut-off date.

- One drill rig currently in operation focused on the discovery of new gold zones in the Vintage Zone and resource expansion.

“We are extremely pleased with this substantial increase in resources at the O’Brien gold project. These results come from the work of a high-calibre team supported by a visionary group of shareholders. 94% of the increase coming from the Indicated category supports both the confidence level we have in the geological model of the deposit and the exploration potential that remains to be unlocked at O’Brien,” commented Mario Bouchard, President and CEO.

“The O’Brien project is one of the few low capex, high-grade gold assets left within a stable jurisdiction like Quebec and a historical mining camp like the one of Bousquet-Cadillac. With a limited exploration budget, Radisson’s growing team has done an incredible job advancing O’Brien to this point. The team remains focused on delivering growth to its shareholders by expanding the deposit and unlocking the exploration potential left at O’Brien in a sustainable manner with respect to all stakeholders.”

O’Brien Comparison with Previous Resource Estimate (3.5 g/t Au cut-off)

Vintage zone exploration program

The Vintage zone is a parallel zone of the O’Brien project located approximately 85 meters north of the L-L-C in the Cadillac Group of meta-sediments comprising sequence of polymictic conglomerate, banded iron formation (BIF) and grauwacke. The Vintage Zone was incorporated in the latest resource update, with 36E and Kewagama zones located in the Piche Group, south of the Cadillac Break. Due to their proximity all zones could eventually be accessed via same mining infrastructures.

Recent exploration work completed on the Vintage Zone helped define the vertical continuity and favourable geometry of the gold system, with presence of quartz veins, arsenopyrite and multiple Visible Gold intercepts. The deepest drill hole completed on the Vintage Zone (OB-17-49) intersected a sulphides rich Banded Iron Formation (10% pyrite and 10% pyrrhotite as opposed to arsenopyrite) which returned 6.9 g/t Au over 4 m. Up to date, this system remains open laterally and at depth.

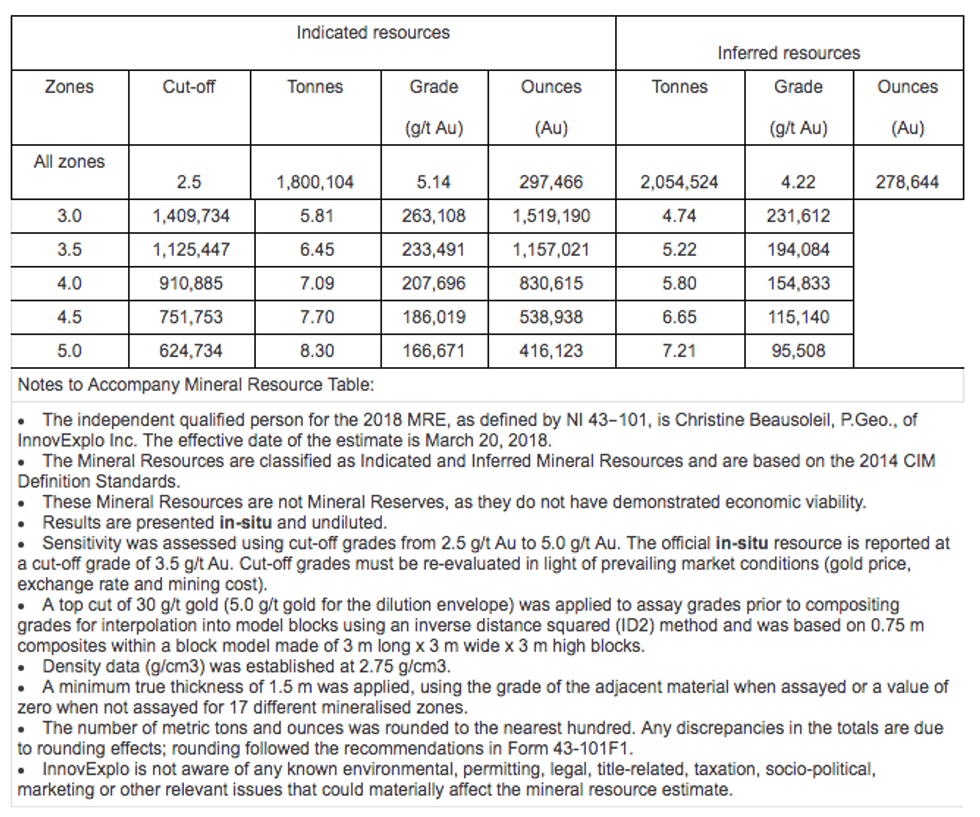

2018 O’Brien Project Mineral Resource Estimate at a 3.50 g/t Au cut-off,

sensitivity at other cut-off scenarios

Qualified Person

Tony Brisson, P. Geo, independent consultant, acts as a Qualified Person as defined in National Instrument 43-101 and has reviewed and approved the technical information in this press release.

The Independent and Qualified Person for the Mineral Resources Estimate update, as defined by NI 43-101, is Christine Beausoleil, P.Geo., of InnovExplo Inc and confirms she has reviewed this press release and that the scientific and technical information is consistent.

About Radisson Mining Resources Inc.

Radisson is a Quebec-based mineral exploration company. The O’Brien project, cut by the regional Cadillac Break, is Radisson’s flagship asset. The project hosts the former O’Brien Mine, considered to have been the Abitibi Greenstone Belt’s highest-grade gold producer during its production (1,197,147 metric tons at 15.25 g/t Au for 587,121 ounces of gold from 1926 to 1957; InnovExplo, April 2015).

For more information on Radisson, visit our website at www.radissonmining.com or contact:

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements: This press release may contain certain forward-looking information. All statements included herein, including the scheduled Closing date, but other than statements of historical fact, is forward-looking information and such information involves various risks and uncertainties. There can be no assurance that such information will prove to be accurate, and actual results and future events could differ materially from those anticipated in such information. A description of assumptions used to develop such forward-looking information and a description of risk factors that may cause actual results to differ materially from forward looking information can be found in Radisson’s disclosure documents on the SEDAR website at www.sedar.com.