Gold stocks were on a tear Thursday morning as the yellow metal broke $1,260 following the Swiss National Bank’s decision to remove a cap on the Swiss franc. The surprise move, which essentially decouples the currency from the euro, sent the euro and dollar dropping against the Swiss franc, and has boosted demand for gold as a safe haven.

Gold stocks were on a tear Thursday morning as the yellow metal broke $1,260 per ounce, climbing as high as $1,261.38, following the Swiss National Bank’s (SNB) decision to remove a cap on the Swiss franc.

The surprise move, which essentially decouples the currency from the euro, sent the euro and dollar dropping against the Swiss franc, and has boosted demand for gold as a safe haven. As of 1:00 p.m. EST, the top gaining junior and mid-tier companies included:

- Calibre Mining (TSXV:CXB) — up 29.17 percent on the TSXV at $0.155.

- Richmont Mines (TSX:RIC,NYSEMKT:RIC) — up 15.73 percent on the TSX at $4.12; up 15.38 percent on the NYSE MKT at $3.45. The company may also have been boosted by the release of its 2014 production results and 2015 guidance.

- Continental Gold (TSX:CNL) — up 12.79 percent on the TSX at $2.47.

- True Gold Mining (TSXV:TGM) — up 12.2 percent on the TSXV at $0.23. The company’s share price was pummeled Wednesday after it suspended operations at its Karma project.

- B2Gold (TSX:BTO,NYSEMKT:BTG) — up 10.11 percent on the NYSE MKT at $2.07; up 9.87 percent on the TSX at $2.45.

Majors who had seen gains by that time included:

- Goldcorp (TSX:G,NYSE:GG) — up 10 percent on the NYSE at $22.55; up 8.73 percent on the TSX at $26.64.

- Newmont Mining (NYSE:NEM) — up 9.26 percent on the NYSE at $21.59.

- Kinross Gold (TSX:K,NYSE:KGC) — up 8.42 percent on the TSX at $4.12; up $8.75 percent on the NYSE at $3.48.

- Barrick Gold (TSX:ABX,NYSE:ABX) — up 7.06 percent on the NYSE at $11.15; up 6.2 percent on the TSX at $13.18.

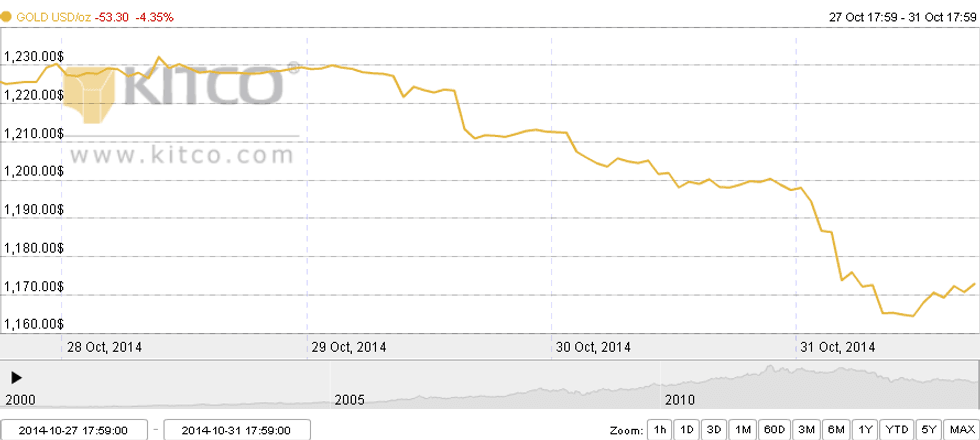

Gold price: January 12, 2015 to January 15, 2015.

Though the market’s reaction to the SNB’s decision has certainly been strong, the move was not a surprise for some analysts. Indeed, CBC notes that many thought it was inevitable given rumors that the European Central Bank plans to announce a stimulus package as large as $1 trillion euros next week.

“The first thing it says is that the SNB clearly expected to see a huge surge of inflows in the week ahead and saw little reason to provide these buyers of francs with an artificially cheap rate,” explained Simon Derrick, chief currency strategist at BNY Mellon.

The policy tying the Swiss franc to the euro was introduced just over three years ago, in September 2011, and was aimed at preventing the Swiss franc from rising against the euro when the Eurozone debt crisis was at its most intense. To prevent the franc from rising too much now that the cap is gone, the SNB has changed the interest rate it charges to commercial banks to make deposits, states CBC. The intention is to push banks to invest in the Swiss economy rather than leave their money at the SNB.

No word yet on how long gold’s price rise may last. However, it was not the only commodity bumped up by the SNB news — the silver price also gained Thursday morning, hitting a high of $17.21 per ounce.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Related reading: