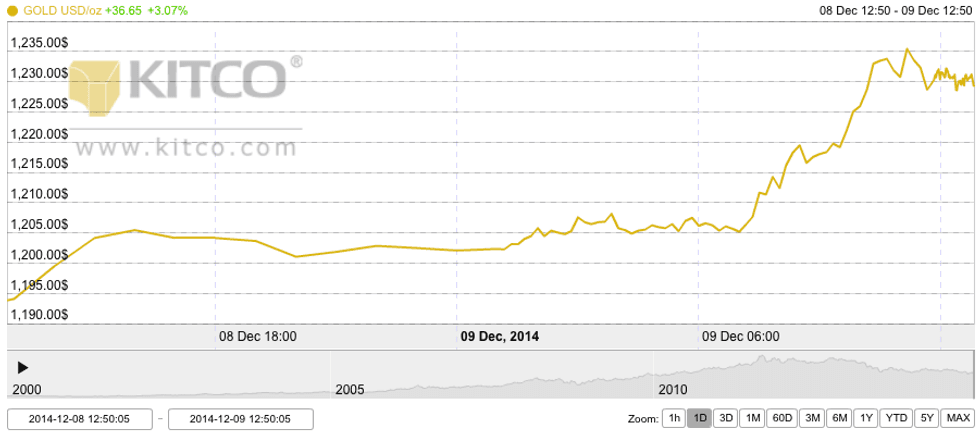

After languishing just below the $1,200 level in recent weeks, gold is off to more than a running start this week. The yellow metal hit $1,233.10 as of 10:20 a.m. EST on Tuesday.

After languishing just below the $1,200 level in recent weeks, gold is off to more than a running start this week. The yellow metal was at $1,233.10 as of 10:20 a.m. EST on Tuesday, and was still sitting around $1,232 three hours later.

According to Reuters, the 2-percent price spike was encouraged late Monday when Dennis Lockhart of the Atlanta Federal Reserve suggested he won’t push to drop interest rates any time soon. That move sent the dollar sliding, making gold stocks more appealing to investors.

Explaining what else may have driven the price spike, Mitsubishi analyst Jonathan Butler told the publication, “[i]t’s a combination of dollar weakness and a breakthrough of the 1,200 and 1,208 levels in quick succession.”

Not crying wolf this time?

When gold initially rose slightly above the $1,200 level on Monday, some analysts were understandably hesitant given the metal’s performance as of late. Eli Tesfaye, senior market strategist at RJO Futures, told CNBC, “[t]his is all technical buying … $1,200 is the line in the sand right now. Every time the market gets close to $1,200, you get a little bit of buying interest.”

He was not alone in expressing that sentiment. Gary Wagner of TheGoldForecast.com told MarketWatch, “we have been seeing gold swing in a range for a while. Without seriously new fundamental info, we don’t see that changing a whole lot.”

However, the gold price went on to take a massive jump on Tuesday, and as Bloomberg notes, the yellow metal could be helped further by falling global equities and signs that some of the world’s central banks may look at increasing money supplies.

James Cordier, founder of Optionsellers.com, stressed that while gold investors have fretted over the US increasing interest rates, it’s also important to consider what the rest of the world’s economies are up to. He told Bloomberg, “[s]timulus from every corner of the global economy is now entrenched, and that’s bullish for precious metals. This is a change of sentiment in a huge way.”

Safe-haven buying

On Monday, US and European stocks recorded losses, while the TSX dropped over 300 points and the TSX Venture Exchange recorded its worst close ever. Those losses continued today, and while that isn’t good news for the market overall, wider share price declines have had a positive effect on gold.

“There are equity market concerns and an increase in the flight away from risky assets to quality. Gold seems to be benefiting from that more than anything else,” HSBC Securities analyst James Steel told Reuters.

In any case, gold bugs will no doubt be pleased with Tuesday’s gains, and will be watching closely to see whether the gold price holds onto its advances.

Securities Disclosure: I, Teresa Matich, hold no investment interest in any of the companies mentioned.

Related reading:

Finding the Silver Lining in the TSX Venture’s Worst Close Ever