Finding the Silver Lining in the TSX Venture’s Worst Close Ever

Oil’s fall Monday to a five-year low helped push the S&P/TSX Composite index to its worst close ever. But there may be a bright side.

The TSX Venture Exchange turned 15 just a couple of weeks ago, but since then it’s marked another much less pleasant milestone.

The Globe and Mail reported that on Monday, the S&P/TSX Venture Composite index (INDEXTSI:JX) closed at an all-time low of 679.83, breaking its previous record of 684.31. Its performance was even worse on an intraday basis — it hit a low of 678.64, only slightly above 678.62, its lowest point ever. Both of those previous lows were hit during the 2008 financial crisis.

The index has been on the decline since gold peaked in 2011, states the news outlet, but it’s performed particularly poorly in the last few months due to oil’s price crash. On Monday Brent crude sank to $66.19 a barrel, its lowest price since October 2009, while US crude dropped to $63.05, its lowest level since July 2009.

That said, the Globe notes that it’s not just oil stocks that are suffering — unfortunately “[t]he crash of the Venture has been so thorough as to encompass resource and non-resource stocks alike, leaving few places to hide from the selloff.” Meanwhile, the S&P/TSX Composite index (INDEXTSI:OSPTX) has also performed poorly — Monday saw it record its worst fall since 2011.

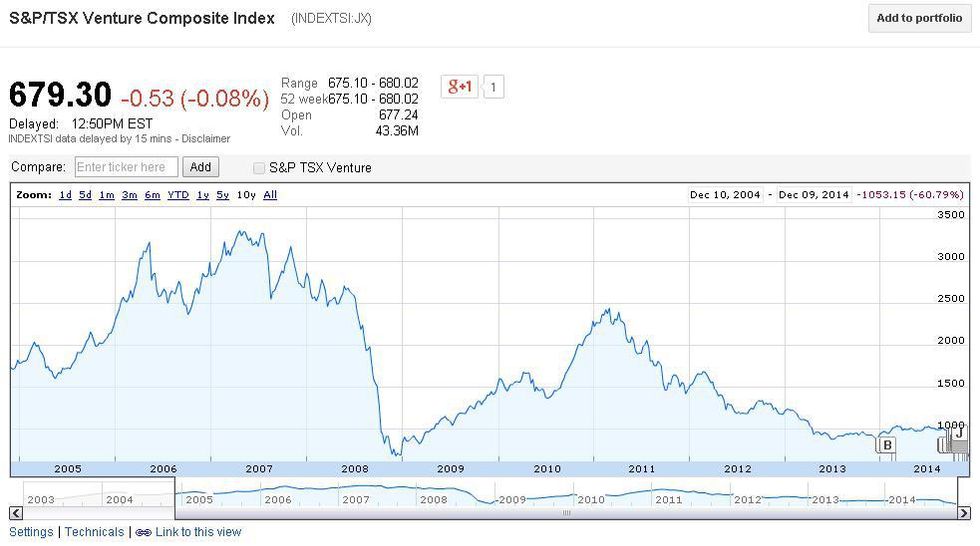

All of that sounds pretty bad, but a look at the chart for the S&P/TSX Venture Composite index provides a little hope. Here’s a shot of what it looked like at about 1:00 p.m. EST on Tuesday:

As the chart shows, after the index’s bad performance at the end of 2008, it began to rise, enjoying fairly steady upward momentum until 2011. And while market participants are currently hesitant to call the bottom, some have stepped forward to offer some hope.

For instance, Vikas Dwivedi, oil economist at Macquarie, told Kitco News Tuesday that he sees the oil price consolidating between $60 and $70 a barrel for the bulk of 2015 before “rallying back to $90 a barrel by the end of the year or the first half of 2016.” Reassuringly he also pointed out that oil’s poor price is “being mostly driven by excess supply and not weak demand.” As a result, he said, “[w]e might find, then, that an oil price fall is not so bad for metals prices as the market thinks.”

Investors can thus perhaps rest a little easier in terms of yesterday’s S&P/TSX Venture Composite index performance.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.