The yellow metal eased after the announcement as investors had anticipated the Fed’s decision.

The gold price fell on Wednesday (June 14) following the US Federal Reserve’s decision to raise interest rates for the second time this year.

Investors had highly anticipated the hike, which will see the central bank’s benchmark target increase by a quarter point to a new range of 1 to 1.25 percent.

“Near-term risks to the economic outlook appear roughly balanced, but the committee is monitoring inflation developments closely,” the Federal Open Market Committee (FOMC) said in a statement following its two-day meeting.

The committee chose to raise rates again despite an economic slowdown at the start of 2017, which it predicts will be temporary.

“We continue to feel that with a strong labor market and with a labor market that’s continuing to strengthen, the conditions are in place for inflation to move up,” Fed Chair Janet Yellen said in a press conference following the decision.

Gold was trading at $1,278.04 per ounce ahead of the FOMC meeting, but fell to $1,268.18 minutes after the announcement.

“The FOMC’s decision to execute its normalization plan despite recent soft economic data has forced gold to retreat after its earlier exaggerated rally,” said Tai Wong, director of base and precious metals trading for BMO Capital Markets in New York.

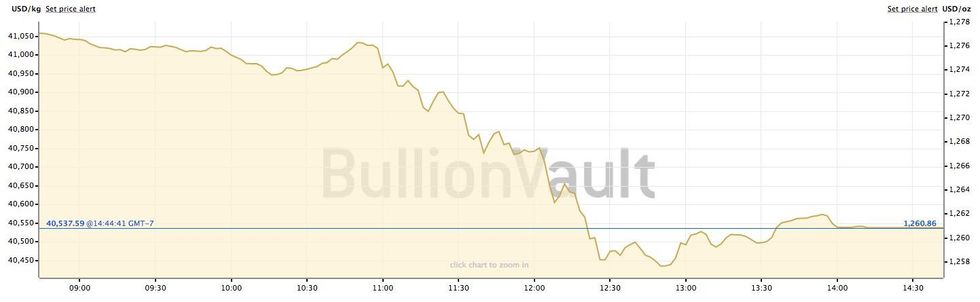

The chart below shows gold’s price activity from 9:00 a.m. PST to 2.30 p.m. PST on Wednesday.

Chart via BullionVault.

The yellow metal tends to fare better when interest rates are low and often struggles when interest rates increase. That’s because higher rates curb the investment appeal of non-interest-bearing assets like gold.

“The last three hikes have marked cycle lows for gold,” Suki Cooper, an analyst at Standard Chartered (LSE:STAN), said in a June 12 note. “Coupled with a softer physical floor in coming weeks, dips towards $1,200 an ounce are likely to offer attractive entry levels again.”

The Fed foresees one additional rate hike this year, unchanged from its previous forecast and in line with experts’ expectations.

“Overall, nothing here to change our forecasts for another hike in September and then the balance sheet unwind to start later in December, given little apparent concern regarding the recent weak data,” said Andrew Grantham, senior economist at CIBC Economics.

On top of the rate hike, the FOMC said it will begin the process this year of letting some of its balance sheet portfolio run off.

“What I can tell you is that we anticipate reducing reserve balances and our overall balance sheet to levels appreciably below those seen in recent years but larger than before the financial crisis,” Yellen said. She suggested that balance sheet normalization could be put into effect “relatively soon.”

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.