Drill Tracker Weekly: Skeena Extends Mineralization to Depth at Spectrum

Highlights from current drilling include 26.15 meters grading 8.21 g/t gold. That includes a high-grade interval of 2 meters of 74.5 g/t gold at a core depth of 163.85 meters.

Drill Tracker Weekly is not exclusive to Resource Investing News and is published with permission from Mackie Research Capital Corporation. It highlights drilling results in context with our database of over 10,000 drilling and trenching results. The purpose of this report is to highlight drilling and trenching results that stand out from the pack and compare them to their peer group. This report does not constitute initiation of coverage or a recommendation.

Skeena Resources (TSXV:SKE)

Price: $0.08

Market cap: $21 million

Working capital: $8 million

Project: Spectrum

Country: Canada

Ownership: 100 percent

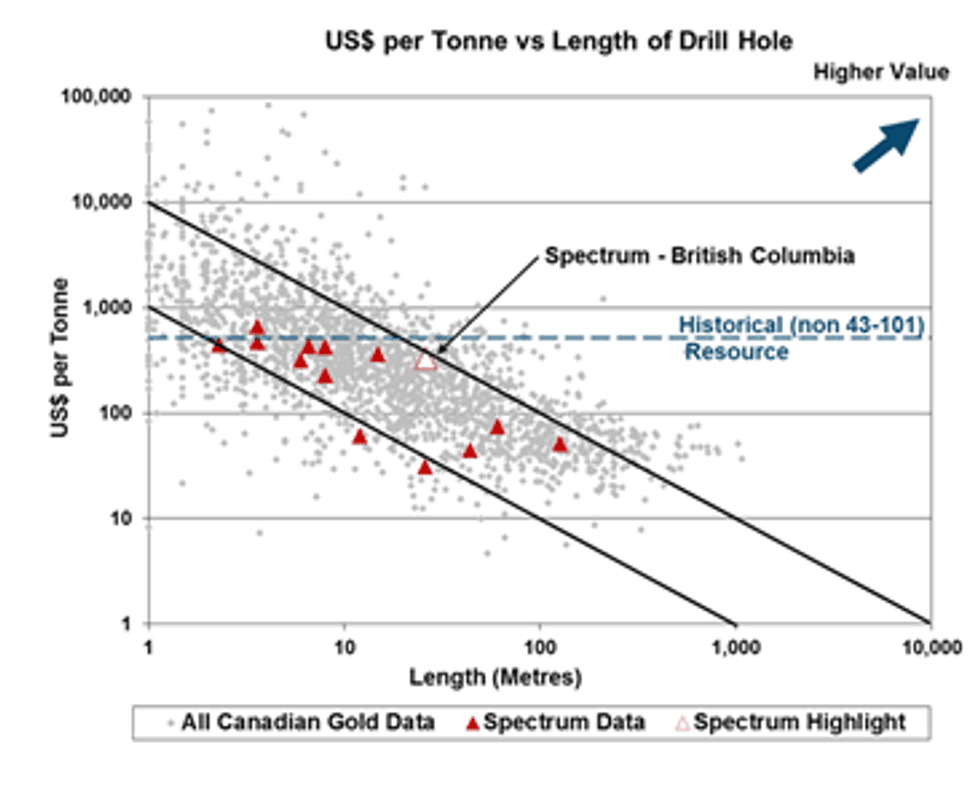

Reserves: Historical (non 43-101) resource — 474,625 tonnes @11.4 g/t Au (Mining Associates – 2003)

Project status: Confirmation and step-out drilling

- Skeena Resources announced results from the second batch of 15 holes from its 100% owned Spectrum project in northwestern British Columbia. The Spectrum project is located 25 kilometres west of Highway 37 and 35 kilometres west of Imperial Metals (TSX:III) Red Chris Mine development. The project is surrounded on three sides by the Mount Edziza Provincial Park and Recreation Area. In 2003, the area covering the Spectrum claim block was rescinded to allow for resource development.

- The Spectrum project has been subject to a series of sporadic exploration, drilling and tunnelling programs dating back to 1957 when the hawk vein was first explored. By 1992, four drilling campaigns totalling 11,963 metres in 92 diamond drill holes were completed. The first resource estimate (Non 43-101) was completed in 1991 but was subsequently discredited by a later report in 2004 due to reported errors in true widths and grades as well as the absence of a top cut on high-grade samples. The Mining Associates recalculated the resource to JORC standards in 2004. The historical resource totals 474,615 tonnes grading 11.4 g/t using a 5.0 g/t cut-off, a minimum mining width of 1.0 metres and a 62 g/t Au top-cut.

- The objective of the current 12,000 metre drill program is to “expand the steeply dipping 500 Colour and Central Zones both at depth and along strike”. The drilling is designed to provide pierce points at 50 metres centres vertically and horizontally through the multiple narrow and steeply dipping zones. Based on the drill map and sections provided by the Company, most drilling to date has focused on infill drilling and depth extension.

- Highlights from the current drilling include 26.15 metres grading 8.21 g/t Au including a high-grade interval of 2.0 metres of 74.5 g/t Au at a core depth of 163.85 metres. Other intervals include 2.90 metres of 38.5 g/t Au. To date few intervals in the deeper drilling have equalled the grade of 11.4 g/t Au as reported in the historical resource.

Exploration history (1950s to 1991): Several companies explored and drilled the project prior to it being included in Mount Edziza Park — subsequently “removed” from Recreation Area in 2003. Two historical resources were completed in 1991 and 2003.

Current holes: 26.15 metres @ 8.21 g/t Au (uncut) including 2.0 metres @ 74.5 g/t Au (uncut)

Risk Analysis

Data contained in DRILL TRACKER WEEKLY is based on early stage exploration activity. The results are obtained at the very early stages of exploration and therefore, individual results may not be reproducible with additional trenching or drilling, nor may the results ultimately lead to the discovery of an economic deposit. Delineation of a resource body requires an extensive data gathering exercise according to guidelines set out in National Instrument 43-101 before investors can be reliably assured of a competent body of mineralization that may be of economic interest. DRILL TRACKER WEEKLY is designed to highlight individual trench or drill results, which stand out as being materially anomalous and are particularly worth of note – a type of early warning flag for a particular property that warrants further attention. Hence, DRILL TRACKER WEEKLY does not provide a recommendation to buy, sell or hold a specific equity – it is an information reference source to help quantify the meaning and relevance of early stage exploration results.

Relevant Disclosures Applicable to: Drill Tracker Weekly

- The research analyst or a member of the research analyst’s household owns and/or has options to acquire shares of the subject issuer. At the date of this release the author, Wayne Hewgill, owns no shares in the companies in this report:

Analyst Certification

I, Wayne Hewgill certify that the information in this report is sourced through public documents that are believed to be reliable but accuracy and completeness as represented in this report cannot be guaranteed. The author has not received payment from any of the companies covered in this report. This report makes no recommendations to buy, sell or hold. Each analyst of Mackie Research Capital Corporation whose name appears in this report hereby certifies that (i) the recommendations and opinions expressed in this research report accurately reflect the analyst’s personal views and (ii) no part of the research analyst’s compensation was or will be directly or indirectly related to the specific conclusions or recommendations expressed in this research report.