Q2 Uranium Results Are In - Key Takeaways from Top Producers

Find out how top uranium producers dealt with rising prices, COVID-19 lockdowns and supply disruptions during the second quarter of 2020.

Uranium began exhibiting strength in March and continued trending up throughout April and May, marking the first time the U3O8 spot value was above US$30 per pound since 2016.

June saw prices begin to pull back from their four year high of US$33.93, but the energy fuel has been able to hold above US$30 for four consecutive months.

Despite that relative price strength, like many other sectors the uranium industry has been severely impacted by the unprecedented COVID-19 pandemic, perhaps even more so than other resource spaces because of the persistently low spot prices that preceded the coronavirus outbreak.

Those factors make the current environment challenging. Companies are finally seeing positive price activity that incentivizes activity, but have been grappling with implementing safety protocols and simultaneously dealing with logistical and transportation challenges.

Despite some expected delays, uranium sector majors have released their Q2 and half-year results. Below are highlights from the top North American producers by market cap.

1. Cameco (TSX:CCO,NYSE:CCJ)

Market cap: C$5.3 billion; share price: C$13.87; year-to-date move: +19.47 percent,

Multinational uranium company Cameco was heavily effected by COVID-19 measures, spending C$37 million in additional care and maintenance costs after suspending operations at its Cigar Lake mine in Saskatchewan due to the virus.

With its last remaining solely owned asset on curtailment, Cameco produced no uranium in Q2 and has been reliant on spot market purchases to fulfill contracts.

Highlights from Cameco’s Q2 results:

- Net loss of C$53 million, adjusted net loss of C$65 million

- Strong balance sheet with C$878 million in cash and short-term investments

- 39 percent increase in sales volume

- Planned September restart of Cigar Lake mine

Although Cameco has planned for a fall reopening at Cigar Lake, the company will likely not meet its previous production targets for 2020.

“We will not be able to make up the lost production and are therefore targeting our share of 2020 production to be up to 5.3 million pounds in total,” the company’s financial report notes.

For comparison, during the first half of 2019 Cameco produced 7.5 million pounds of U3O8. For the same period in 2020, Cameco’s output totaled 2.1 million pounds, with all of the production coming in Q1.

2. Energy Fuels (TSX:EFR,NYSEAMERICAN:UUUU)

Market cap: C$281.2 million; share price: C$2.26; year-to-date move: -7 percent

Diversified miner Energy Fuels owns a portfolio of more than a dozen all-American assets. Specializing in uranium and vanadium production, the company currently operates the White Mesa mill in Utah and has two in-situ recovery projects on standby in Texas and Wyoming.

During Q2, the US firm made an entrance into the rare earths market, a space that has featured prominently in the US and China trade war.

While the majority of the company’s recent focus has been the rare earths space, the first half of 2020 also signaled a limited uranium production restart at the White Mesa asset in Utah.

Highlights from Energy Fuels’ Q2 results:

- US$28.3 million in cash and marketable securities

- 83,000 pounds of uranium recovered

- Uranium inventory of 575,000 pounds; vanadium inventory of 1,675,000 pounds

- Operating loss of US$6.5 million

With White Mesa back in operation, the company forecasts that its total production will total 125,000 to 170,000 pounds for 2020.

“Assuming current production and sales guidance, we expect to continue to build and hold between 640,000 and 690,000 pounds of uncommitted uranium in inventory at the end of 2020,” reads Energy Fuels’ Q2 overview.

As a US-based producer, Energy Fuels has also been a supporter of the country’s efforts to strengthen its domestic nuclear fuel supply chain over the last two years. In early August, Paul Goranson, COO of Energy Fuels and president of Uranium Producers of America, testified before a US Senate committee in support of the American Nuclear Infrastructure Act.

One of the proposals is for the US the build a domestic uranium stockpile through an annual expenditure of US$150 million over the course of a decade.

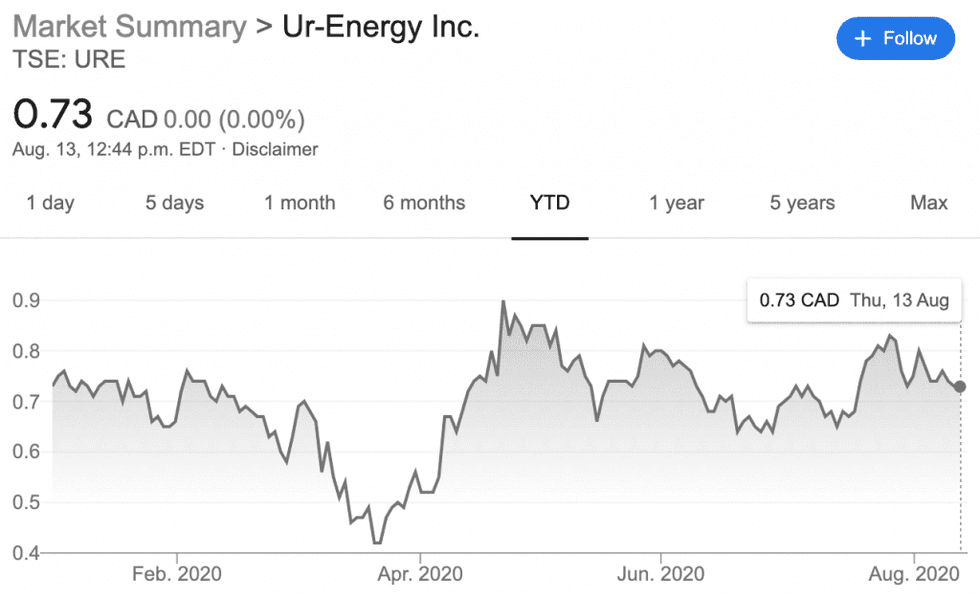

3. Ur-Energy (TSX:URE,NYSEAMERICAN:URG)

Market cap: C$125.4 million; share price: C$0.73; year-to-date move: 0 percent

Operating in Wyoming, Ur-Energy’s primary asset is the Lost Creek in-situ recovery site. As a US producer, Ur-Energy is also hopeful about the national effort to bolster domestic uranium production.

After more than two years of study, Q2 saw the anticipated release of a Nuclear Fuel Working Group report, a by-product of the Section 232 uranium import investigation. The company, which helped to initiate the investigation in 2018, recapped the report’s findings in its Q2 results.

“Ur-Energy continues to be an active participant and a stakeholder in the ongoing processes to secure and protect our industry,” its statement reads. “We have confidence the Working Group and the Administration will implement the report’s recommendations in ways which will, in fact, reinvigorate our industry and allow us to return to full production levels at Lost Creek.”

Hghlights from Ur-Energy’s Q2 results:

- 4,119 pounds of uranium recovered

- Inventory of 268,552 pounds

- US$4.1 million unrestricted cash position

- Closed direct offering for US$4.6 million

During the second quarter of the year, Ur-Energy sold 167,000 pounds of purchased inventory. The company has not sold any of its produced uranium during the first half of the year and does not anticipate that there will be sales from its produced coffers in the later half.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Energy Fuels is a client of the Investing News Network. This article is not paid-for content.