Oil prices in the US have seen their fair share of ups and downs over the years. By understanding what has caused these market fluctuations, as well as what they’ve led to, investors can position themselves to make more informed — and more profitable — decisions.

Oil prices in the US have seen their fair share of ups and downs over the years. By understanding what has caused these market fluctuations, as well as what they’ve led to, investors can position themselves to make more informed — and more profitable — decisions.

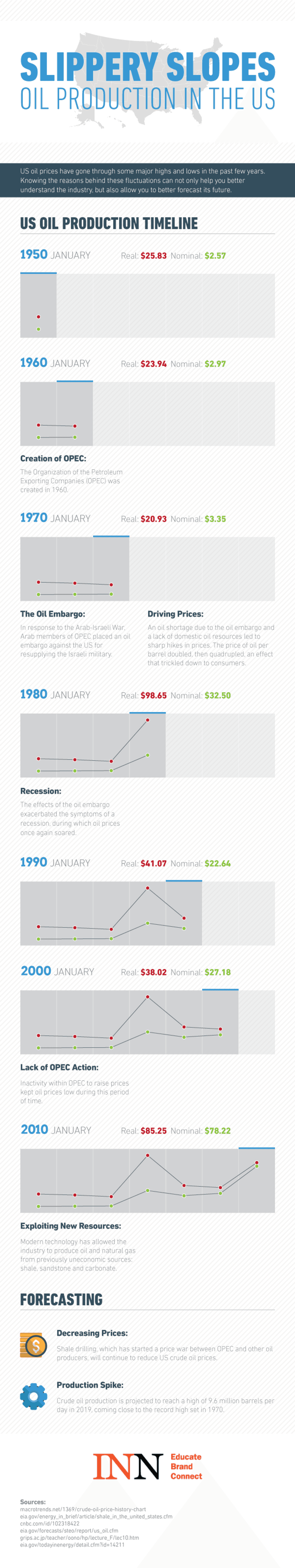

Take a look at the infographic below to get the basics, then read on for a write up on the points included.

Creation of OPEC

1960 marked the launch of the Organization of the Petroleum Exporting Companies, or OPEC. An intergovernmental organization of 12 oil-exporting nations, OPEC is focused on coordinating oil-exporting countries to create united policies in the petroleum industry.

The current makeup of OPEC includes Iran, Iraq, Kuwait, Saudi Arabia, Venezuela, Qatar, Libya, the United Arab Emirates, Algeria, Nigeria, Ecuador and Angola.

The oil embargo

The Arab-Israeli War took place during the 1970s, and one result was that Arab members of OPEC placed an embargo on the US due to its support of the Israeli military. That led to an oil shortage in the US that ultimately caused a huge spike in prices. The price of oil per barrel doubled, then quadrupled, leading to heftier price tags at the pump for consumers.

Recession

The oil embargo contributed to other negative economic factors, including a recession in the US. That caused oil prices to rise even further. By 1980, the real price of oil had reached $98.65 — up from $20.93 in 1970. Meanwhile, nominal prices rose from $3.35 in 1970 to $32.50.

Here and now

Oil prices dropped substantially from 1990 through 2000, thanks in part to inactivity within OPEC to raise prices. By 2010, however, prices had risen considerably yet again. However, new technologies have allowed industry professionals to produce oil and gas from previously unused sources, such as shale, sandstone and carbonate.

Experts believe that shale drilling will continue to reduce crude oil prices in the US. Additionally, crude oil production is on track to reach highs not seen since the 1970s. This abundance of oil is also forecast to lead to lower prices.