The Met Coal Market in 2014: Conditions to Improve, Says Joe Aldina

At the 2014 Coal Association of Canada Conference and Trade Show, held in Vancouver from September 10 to 12, several analysts shared their views on the thermal and metallurgical coal markets. In particular, Wood Mackenzie analyst Joe Aldina gave an excellent overview of both markets and provided attendees with an idea of when they may start to “turn the corner.”

In particular, Wood Mackenzie analyst Joe Aldina gave an excellent overview of both markets and provided attendees with an idea of when they may start to “turn the corner.” For metallurgical coal, Aldina said that the market is still a few years away from getting out of the woods, but he does believe conditions will improve soon.

Supply

Aldina wasn’t hesitant to blame our neighbors down under for oversupply. He noted that Australia is slated to increase its output to 52 million metric tons (MT), a stark contrast to what’s happening in other countries around the world. The analyst is calling for the US “to cut 11 million MT of production in 2014,” and expects Canadian met coal exports to come down on the back of Walter Energy’s (NYSE:WLT) shutdown of some of its operations in British Columbia.

Aldina blamed fixed costs and take-or-pay agreements for “distorting the market and making the shutdown decisions particularly hard in Australia,” but did concede that “Australia is not the only bad actor.” He added, “the US remains stubborn in the face of low prices, and exports should have come off quicker.”

Another factor to consider is that Chinese domestic supply is up slightly this year, meaning that imports into the country have become more difficult. “Coke exports from China have reached an annualized pace of 8 million MT,” Aldina said. However, he doesn’t see that supply as a material long-term problem, and cited variable coking coal prices as the reason China won’t end up being a primary supplier of coking coal.

Demand

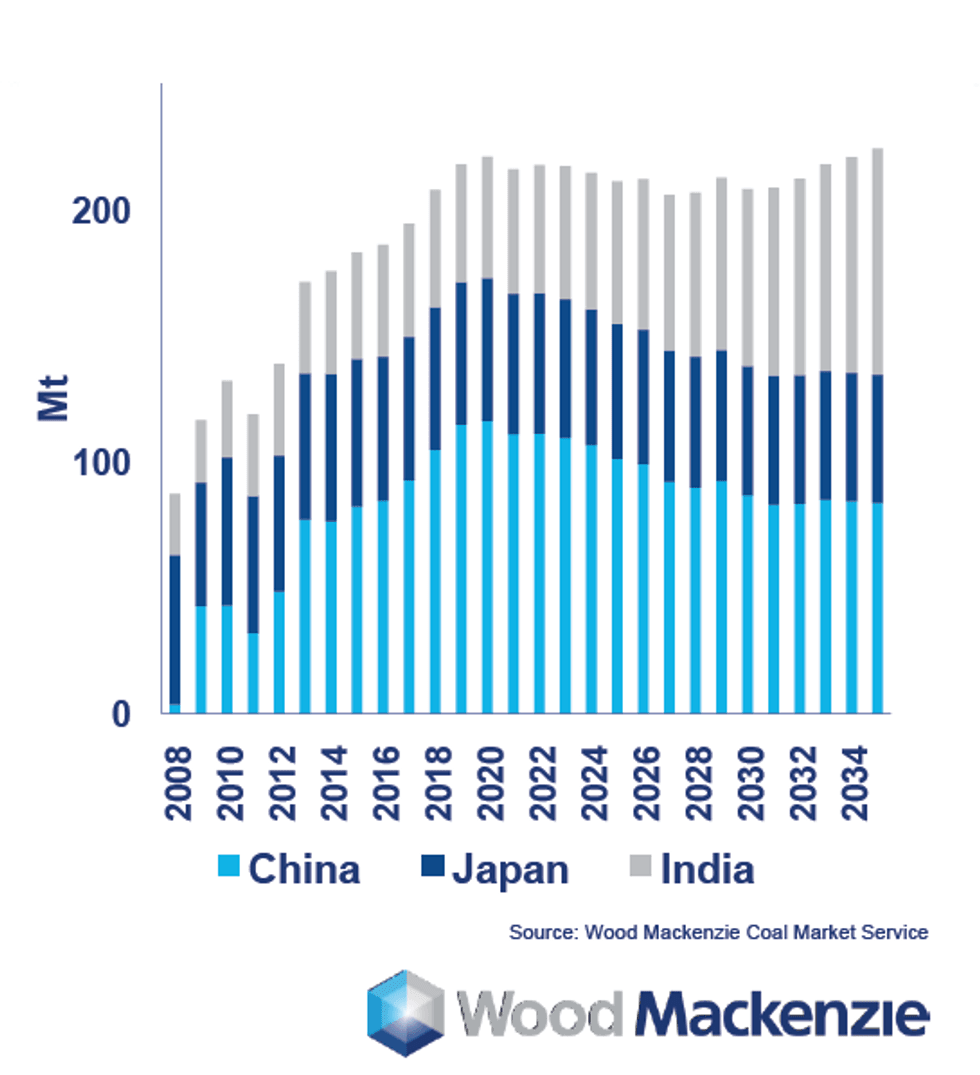

“For met coal demand, it’s still China and India in the driver’s seat,” Aldina said, specifically stating that China is leading demand in the medium term, with India set to overtake it around 2020. To be sure, the key steel-making ingredient is critical for growing economies and expanding infrastructure, making coking coal extremely important for those two countries. Long term, the analyst sees “a meaningful increase in traded seaborne met coal volumes — 100 million MT out to 2035.”

“Demand is good,” he said. “Eventually we’ll work off the oversupply and we’ll be in better shape.”

Metallurgical coal demand

The problem with cutting costs

As anyone watching the coal space will know, prices for both metallurgical and thermal coal have been relatively weak of late, and that’s put quite a few producers underwater.

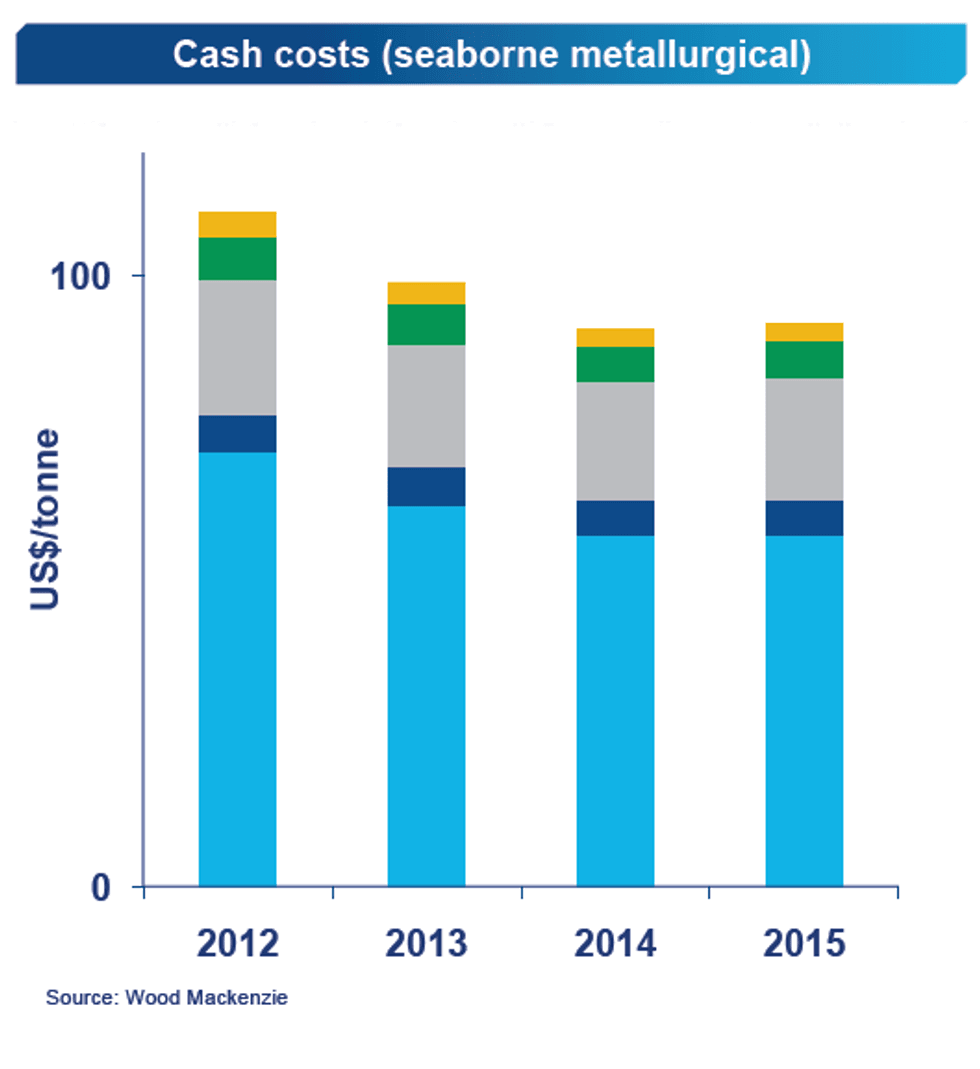

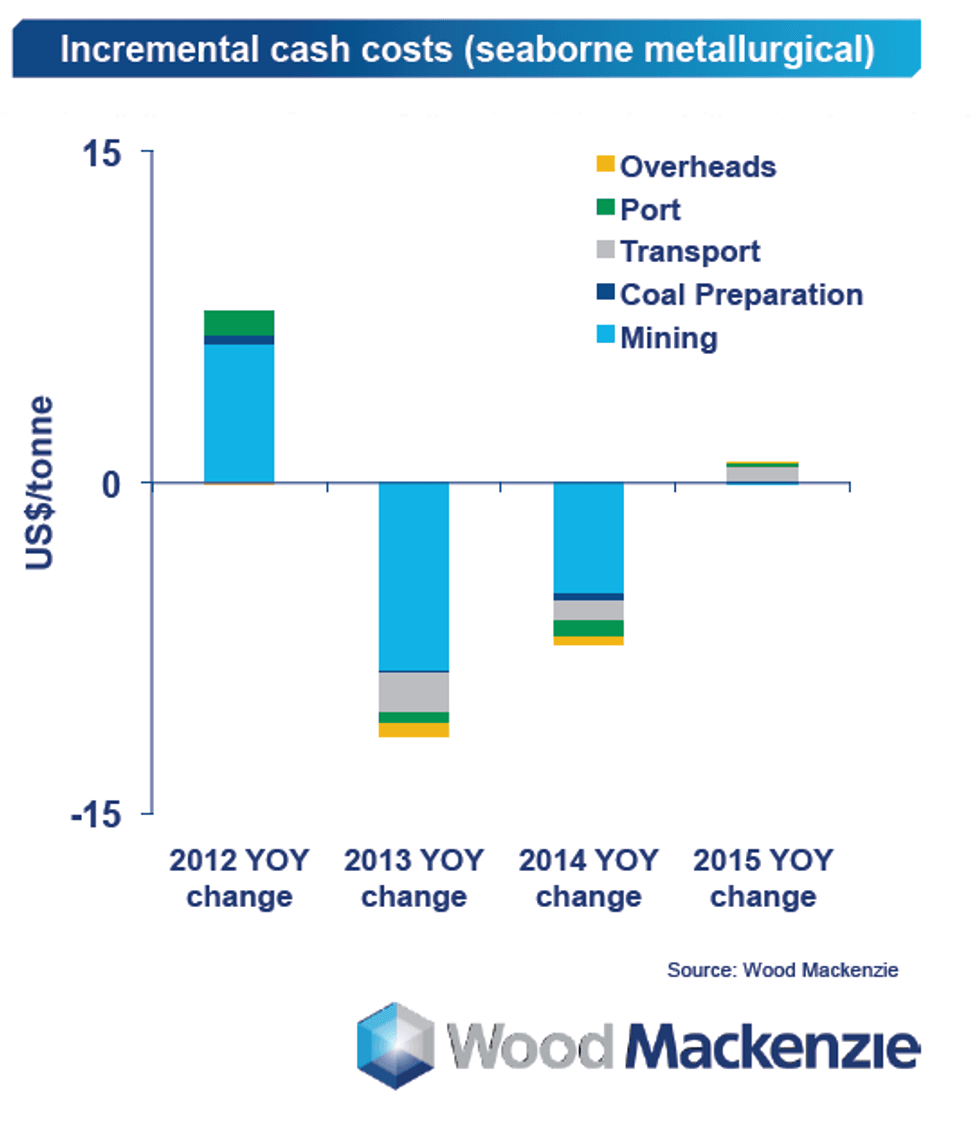

Of course, many met coal producers have cut costs in response to falling prices, but as Aldina said, that could be part of the problem. “If you’re a producer, you don’t want to be the first to cut production, so you’re going to try to cut your costs,” the analyst said. He pointed out that closing mines is “a very difficult decision.” However, cost cutting without a drawdown on production can actually prolong oversupply.

“When you reduce cost, you actually increase efficiencies,” he explained. “You increase how much you’re producing, and you also keep setting the floor for the market lower and lower.” With all of that supply on the market, prices have fallen faster than many producers can cut costs. Using a benchmark price of US$120 per MT, he suggested that almost 50 percent of global seaborne production currently has a negative profit margin — not a statistic any sector wants to see.

Still, there is some good news. “Cost can’t appreciably go lower,” Aldina said, noting that low met coal prices also mean that “finally, at long last, the US producers are starting to drop out of the market.” The analyst noted that Australian mines, “aided by currency declines,” have weathered the storm well, and that assets owned by Canada’s Teck Resources (TSE:TCK.B) are still seeing positive margins.

With the market turning, Aldina believes mines in Canada and Australia are best positioned to do well. “Canada is, medium and longer term, one of the best-positioned players,” Aldina said, and overall, his outlook for metallurgical coal seems to be positive. “It’s going to be a few years,” he said, “but at some point, we’re going to get out of the woods here and conditions are going to improve. I think the key thing is that cost can’t appreciably go lower.”

Prices

Of course, for many investors the key concern is what will happen with prices. For his part, Aldina thinks that in 12 months’ time met coal will be sitting in the “high $130s, closer to $140 by the end of the year.” Here’s what two other conference presenters said:

- Dr. J. Neil Bristow, principal and managing consultant at H&W Worldwide Consulting in Australia: “$130 to $135″

- Chris Urzaa, director of commercial services at HDR|Salva: “I think it’ll go down from here and then back up to $120″

However, Gerard McCloskey, senior advisor at Renaissance Capital’s Global Coal Sector, predicted the highest price by far. Citing closures in British Columbia’s Peace River region and predictions that the US will move away from coking coal exports, he stated, “my figure is $180.”

Certainly, investors in the metallurgical coal space will be pulling for McCloskey to win.

Securities Disclosure: I, Teresa Matich, hold no direct investment interest in any company mentioned in this article.

Related reading: