Is Tesla Rolling the Dice With Their Lithium Supply?

What’s going on with Tesla’s lithium supply? Joe Lowry of Global Lithium LLC recently shared his thoughts on just that. We’ve republished the post here, with his permission.

By: Joe Lowry

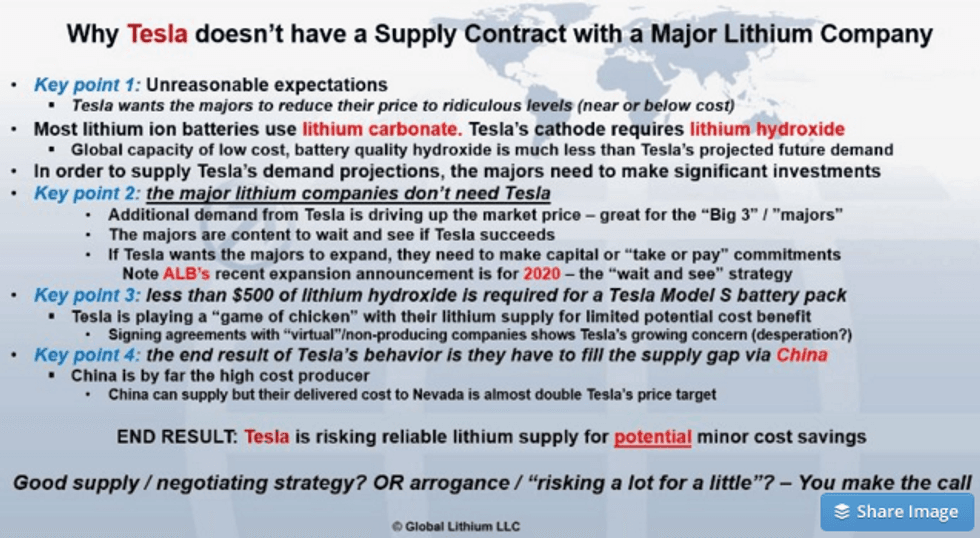

Last week I was asked on Twitter why Tesla doesn’t have a supply agreement with a “currently producing” lithium company.

Tesla clearly isn’t afraid to gamble on their future lithium supply. Nevada, home of America’s gaming industry, seems like the perfect venue for Elon Musk’s big bet on lithium and lithium ion batteries. As far as their lithium hydroxide supply for the gigafactory is concerned, in risk management terms, Tesla is “risking a lot for a little”.

Tesla’s rise and growth has been great for the lithium business. Unfortunately Tesla seems to overestimate their importance. Tesla needs lithium but the major lithium players aren’t going to bow to Tesla’s pressure to sell to them at ridiculously low prices. Only desperate juniors hoping to use the Tesla name to attract investors are willing to agree to terms they are unlikely to ever be able to meet.

The oddest part of the “lithium standoff” is that lithium is a very minor cost in a Tesla Model S or Model X. For a lower priced Model 3, lithium becomes a bit more significant but is still well under 1% of the total car cost.

I posted this on Twitter to answer the “Tesla” lithium question

Elon Musk got where he is by doing things differently and, in many cases, getting the taxpayers to subsidize his companies. The major lithium companies are enjoying the increase in lithium demand and price created in part by Tesla but the lithium market is going to continue to grow with or without a successful Tesla. Lithium suppliers don’t need to and won’t subsidize Tesla with low or no margin prices. Sorry Elon, JB and Kurt……

The Big 3 and major China producers don’t need Tesla. The real irony is that Tesla’s hardball tactics will only ensure their cost of lithium hydroxide is higher over the next few years. The Gigafactory will spike lithium hydroxide demand significantly and only the high cost Chinese suppliers will have the spare capacity to supply.

Albemarle will sit on the sidelines until they see whether Tesla actually spikes hydroxide demand to the extent currently forecast or if they are better served building additional carbonate supply for the rest of the battery industry. ALB will profit in any scenario via their 49% ownership of Talison who supplies raw material to the Chinese hydroxide and carbonate producers.

FMC will do nothing significant. SQM could employ newly developed purification technology at a reasonable cost to upgrade their current hydroxide capacity to a competitive level.

It will be an interesting few years watching the Tesla drama sort itself out.

After more than two decades with a major lithium producer holding senior leadership positions at lithium operations in the US, Japan and China; Mr. Lowry formed Global Lithium LLC – an advisory firm that works with lithium producers, users, investors, hedge funds and governments on four continents. He has an extensive network of contacts with the leadership of the world’s leading lithium suppliers and users. His knowledge of lithium supply and demand, pricing, the lithium ion battery market and industry trends enables him to provide unique insights into the world of lithium.

Originally published by Joe Lowry on September 27, 2015. Click here to view the original article.