What happened to cobalt in Q1 2020? Our cobalt market update outlines key market developments and explores what could happen moving forward.

Click here to read the latest cobalt market update.

The coronavirus pandemic took center stage in the first quarter of 2020, hitting commodities across the board, including cobalt, as demand for electric vehicles (EVs) declined and lockdowns to fight the virus created supply chain challenges.

But many believe the future of cobalt, a key metal in the lithium-ion batteries used to power EVs, remains bright in the long term, despite ongoing debate about changing battery chemistries.

Read on to learn what happened in the cobalt market in Q1, including the main supply and demand dynamics and what market participants are expecting for the rest of the year.

Cobalt market update: COVID-19 impacts EVs and miners

The main driver in the cobalt market is the EV industry, as the metal is essential in batteries. But the coronavirus has hit the space hard, with many changing forecasts since the start of the year.

Wood Mackenzie was previously expecting EV sales growth of 20 percent year-on-year in 2020, but the firm is now looking at a contraction of up to 40 percent, Gavin Montgomery, research director, battery raw materials, told the Investing News Network (INN).

“We had projected the cobalt market to be relatively balanced this year as the excess stocks that characterized 2019 started to ease off, plus we have Glencore’s (LSE:GLEN) Mutanda mine offline this year. Now we see the market contending oversupply again as all end-use sectors are impacted.”

Prior to the virus outbreak, Roskill’s 2020 base case forecast was for a 60 percent year-on-year increase in EV sales compared to 2019, rising from 2 million to around 3.2 million EVs in 2020.

“We now forecast EV sales to be between 30 to 45 percent lower than (previously expected), with sales of approximately 1.8 million EVs under the worst-case six month lockdown scenario,” Roskill consultant Jake Fraser explained to INN.

For Benchmark Mineral Intelligence Head of Price Assessment Caspar Rawles, the key issue so far in 2020 can be summed up with one word: uncertainty.

“The world is going through an unprecedented situation with an unknown timeline of direct impact (i.e. closures/lockdowns/demand loss) through the peak of the pandemic, and the following recovery period,” Rawles told INN in an interview.

The impact of the pandemic has also been felt by producers and junior miners, as they now face the challenge of weaker demand and prolonged lower prices.

Roskill has so far recorded closures or scalebacks at 21 operations as a result of the outbreak; that represents US$48 million of lost cobalt production value over Q1 and Q2 to date.

Around 44 percent of this is being attributed to Vale’s (NYSE:VALE) Voisey’s Bay operation, which is now planned to be offline for up to three months.

“For juniors, it will be a struggle to raise finance for projects given the prospect of a prolonged recession,” Montgomery commented.

Rawles said with the pandemic, most cobalt-focused companies have faced similar challenges, which include a breakdown in demand and supply chains, and uncertainty going forward — these are making planning for the future very hard.

“We have seen a lot of companies in the supply chain take a ‘wait-and-see’ approach, which means everything is on hold,” he said. “I guess one of the major challenges of this is can these companies weather the storm financially?”

For Woodmac’s Montgomery, there’s still a bright side for explorers and developers of cobalt projects.

“One positive note is that we are seeing increasing interest in regionalized supply chains, which could prove a boon to cobalt projects in North America, for example,” he said.

Cobalt market update: Supply and demand to fall

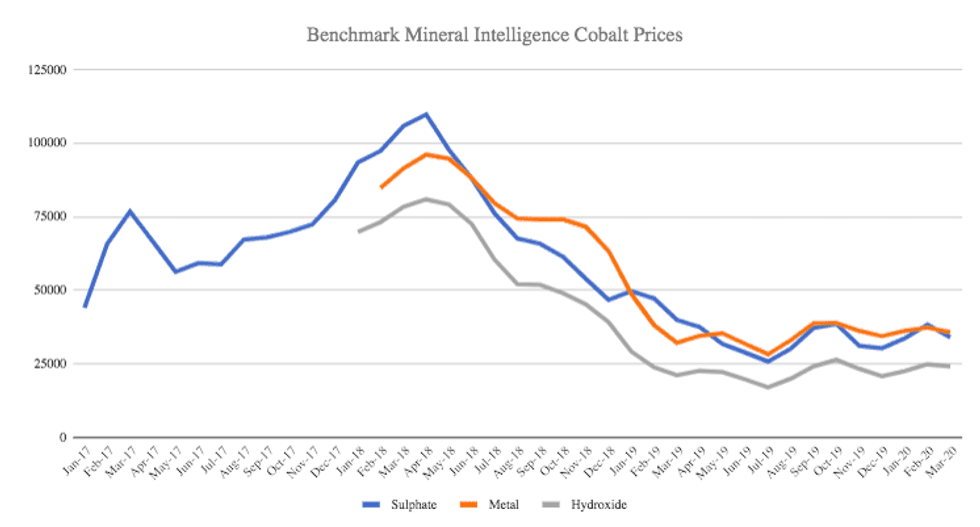

In its Q1 forecast, published at the end of March, Benchmark Mineral Intelligence downgraded both its supply and demand outlooks for cobalt in 2020. Demand is now expected to fall 8.6 percent.

“The situation is evolving, so we may see further declines depending on how long the impact of the virus is felt,” Rawles explained.

Speaking about demand, Roskill’s Fraser said buying from end-use markets has largely been hit by a slowdown in the need for cobalt sulfate, which is required in lithium-ion battery manufacturing.

He added that this happened due to decreased EV sales domestically within China in Q1, coupled with automakers shutting or slowing down production lines as a result of COVID-19.

“With EVs remaining the growth driver of the cobalt market, a speedy uptick in EV sales in Q2 is considered unlikely,” he said. “This comes following the uncertainty that surrounds quantifying the impact the virus will have on consumer disposable income levels globally.”

Woodmac’s Montgomery agreed, saying EV demand has been seriously disrupted since the start of the year, with a huge contraction in China and overseas, but cobalt demand is being impacted on all fronts.

“Cobalt demand is also being hit by weaker demand from consumer electronics, superalloys (as the aerospace sector contends with worst conditions in history) and catalysts as the refining sector is disrupted by low demand,” he said.

Speaking about Q2, Montgomery said China is likely to have recovered somewhat in Q2 — although it will still be feeling the effects. “Europe and North America are only beginning to lift lockdown measures in early May, so demand will still be very weak.”

In terms of supply, Montgomery said a number of cobalt refineries adopted temporary closures over March and April to contain COVID-19, but most have now returned to production.

“There were some temporary shutdowns there, but for the time being, business appears largely as normal,” he said. “Export channels through to Zambia and onwards to Durban in South Africa are reportedly operating, albeit with slightly lower capacity and some delays.”

However, the Democratic Republic of Congo’s (DRC) supply will still be hit by coronavirus-driven decisions, with Katanga Mining (TSX:KAT,OTC Pink:KATFF) lowering its 2020 guidance and Chemaf suspending some of its operations. The DRC is the world’s top-producing country.

Considering all the shutdowns and suspension seen so far, at this point cobalt supply is expected to fall by 7 percent in 2020, according to Benchmark Mineral Intelligence — but this is still a moving target as the impact of government lockdowns continues to hinder production, Rawles said.

For the analyst, ultimately the impacts of uncertainty are likely to last into Q2 and beyond. “This will stifle investments at a time when the supply chain is dependent upon them to function,” he added.

The experts said a shortage in the cobalt space, although possible, is not yet on the horizon.

Fraser said that’s because prior to COVID-19 the market was already sufficiently supplied and had built up a sizeable volume of intermediate stocks, specifically within China.

Roskill estimates that 15,000 to 20,000 tonnes of cobalt in hydroxide are tied up at both refineries and ports, which equates to US$600 million of metal value in stocks, representing approximately 13 percent of mine output in 2019.

“At current production levels, this level of stocks could sustain refinery feedstock needs for a minimum of two to three months, with a tightening of intermediate supply expected sometime in Q3/Q4,” Fraser said. “Naturally, this is predicated on refinery production rates, which could be lower than levels prior to COVID-19, and so the stocks could last longer.”

For Woodmac’s Montgomery, it’s hard to see any major shortage in the near future given that demand is also likely to suffer a prolonged impact.

That said, he did warn that it’s possible, since if the market experiences a prolonged downturn with weak prices for copper, nickel and cobalt, some higher-cost facilities could be put on care and maintenance.

Similarly, Rawles said a shortage of cobalt is possible, but would likely be temporary — and if it does happen, it would be a shortage of cobalt hydroxide going into the Chinese market.

“For the squeeze to occur, it really depends how long it takes for demand in China to recover. Ultimately there still remain stocks in China which can be consumed that will cover the near-term depressed demand,” he explained.

If lockdowns impacting the DRC supply chain are extended and demand increases at a faster pace, a temporary squeeze could take place — although this would be resolved when normal logistics return.

“It is key to remember very little cobalt will have been shipped to China throughout April, which won’t be fully realized until May/June due to the transport time lags. Time will tell if on-hand stocks/demand can balance before more material is shipped,” he explained.

Cobalt market update: What’s ahead?

The second quarter is already here, and investors are wondering what to expect in the cobalt market.

Commenting on whether a price recovery for cobalt is in the cards in the near future, Rawles said it depends on a huge number of factors

“(But) I think for some products in the supply chain we will see some form of price recovery this year, although don’t expect this until into H2, so we have some time to go yet,” he said. “This really depends on the shape of the recovery curve.”

Chart via Benchmark Mineral Intelligence.

In terms of prices, Woodmac’s Montgomery thinks a recovery is unlikely at this stage given how weak demand is from all sectors, and the minimal disruption to supply the market has seen.

For Fraser, cobalt sulfate prices are expected to remain relatively flat over the course of 2020. That’s due to softer EV demand and ample industry production capacity at present.

Looking ahead at what could impact the cobalt market in the months to come, Montgomery said it will be interesting to see how Chinese EV sales recover post-virus.

“Also, cases of coronavirus in the DRC do not seem to have been too bad so far,” he said. “Obviously a deterioration there and increased virus spread could have a large impact on supply.”

Fraser agreed, saying all eyes will remain on the DRC to see the scale of the virus’ impact on mine output.

“This will be the swing factor in how quick the cobalt market will return to balance following a period of mine and feedstock oversupply,” he said.

The ongoing impact to aviation and the aerospace and auto industries will also be key to watch for the cobalt market, Rawles added.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.