LME Zinc Stocks Falling: Zinc Bull Run on the Horizon?

LME zinc stocks are falling, and that has zinc market watchers thinking once again that it could be time for the base metal to shine.

Zinc investors have been calling for skyrocketing prices for several years now, but so far, a sustained zinc bull run has yet to materialize. However, falling London Metal Exchange (LME) zinc stocks have market watchers thinking once again that it could be zinc’s time to shine.

Zinc spot prices appeared to be on the rise early last year, but the base metal saw a precipitous drop in the latter half of 2015, along with falling prices for most other commodities. However, zinc prices are up 25 percent so far in 2016, and that trend looks set to continue.

Spot zinc prices were sitting at $0.854 per pound as of 4:46 p.m. EST.

Falling LME zinc stocks

Driving that price rise has in part been a continuing fall in LME zinc stocks. Stefan Ioannou of Haywood Securities noted that LME zinc inventories had fallen below 400,000 tonnes, leaving supplies at roughly 10 days of global demand.

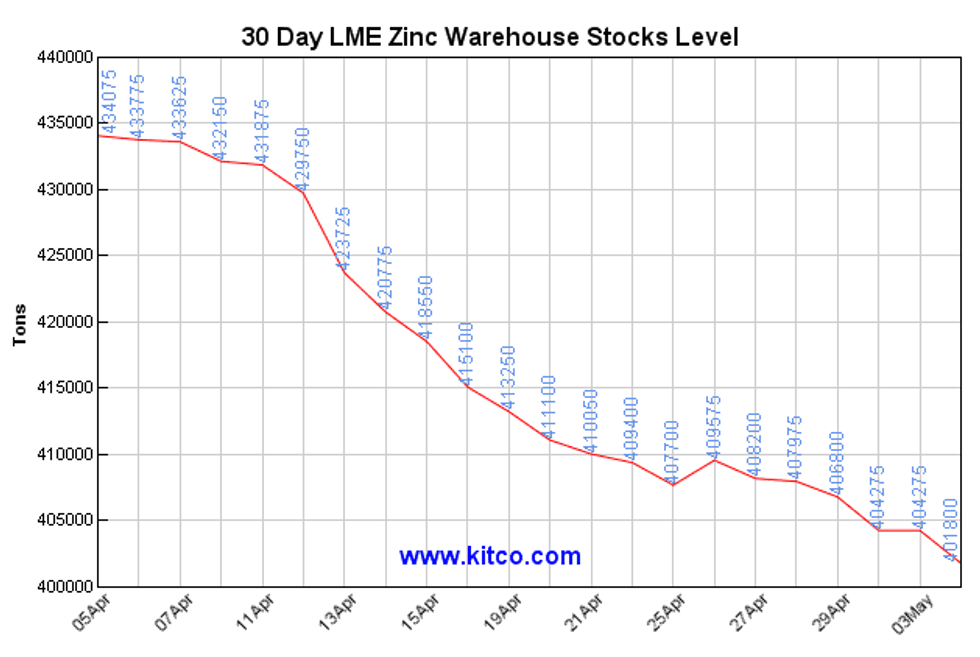

“It’s just a number, but it’s an optical benchmark at the very least,” he said. To put things in perspective, inventories have historically been as high as 1.2 million tonnes, and Bloomberg reported on April 11 that LME zinc stocks were at their lowest level in nearly seven years. The chart below shows how LME zinc warehouse stocks have depleted over the last month:

The last time LME zinc inventories were this low was in 2005, at which point prices for the base metal spiked up to $2 per pound. That begs the question, why hasn’t a similar jump happened this time around?

“There is also zinc in off-market inventories, and the amount is somewhat vague,” Ioannou said. As with most metals traded on the LME, stocks held in warehouses tracked by the exchange are just one part of the supply picture.

Other factors

Still, as mentioned above, zinc prices are definitely on the rise. And beyond historically low LME zinc inventories, there are plenty of positive factors to consider when it comes to the zinc price outlook:

- Lower treatment charges; Ioannou noted that he is seeing significantly lower treatment charges from zinc refiners, which to him, indicates preparation for a supply issue coming down the road. “No one knows the market better than the actual refiners,” he said. Higher refining charges indicate an abundance of supply, while lower treatment charges indicate that refiners are aiming to secure supply amidst falling stock levels.

- Demand holding steady; China still largely drives the boat when it comes to zinc demand, according to Ioannou, and while zinc demand growth is slowing in the country, it is still on the rise. Overall, global demand is set to rise 3.5 percent to 14.33 million tonnes this year, according to an April 2016 report from the International lead-zinc study group (ILZSG).

- Growing deficit; The ILZSG is forecasting a 352,000 deficit for 2016. That might not seem like much relative to the estimated 14.3 million tonne per year zinc market, but Ioannou admitted that this is “still a growing number,” and one that came in much higher than the market was expecting. “People were previously talking about 150,000 tonnes,” he said.

- Mine shutdowns; Finally, an ongoing theme in the zinc space has been the shutdown of larger mines with little new supply set to come online to replace them. The Brunswick mine shut down in 2013, the first of a number of larger zinc operations. Now, Ioannou estimates that 10 percent of world supply has come off, not including more recent cuts from Glencore (LSE:GLEN) and Nyrstar. MMG’s Century Mine (responsible for 4 percent of global supply, according to Ioannou), was shuttered late last year.

All in all, while Ioannou admitted that a runup in zinc prices is taking longer than many may have expected, he suggested that the stage is now set for an inflection point. While he doesn’t think prices will go to the moon—China has plenty of potential zinc capacity that could come online if zinc prices spike high enough—he does see rising zinc prices on the horizon.

Zinc price predictions

Haywood Securities has set its formal zinc price predictions (which are conservative to keep company valuations in check) at $0.80 per pound for zinc this year, $1.00 in 2017 and $1.20 in 2018.

Here are a few other 2016 LME zinc price predictions, as per FocusEconomics:

- Capital Economics—$2,000 per tonne

- JP Morgan—$1,550 per tonne

- Macquarie Research—$1,845

- Deutsche Bank (NYSE:DB)—$1,734

In the latest FocusEconomics market survey, conducted in April, eight of 11 analysts revised their price forecasts upwards.

Zinc companies

As mentioned above, many of the world’s larger zinc mines have come offline as of late with few projects set to come online to replace them. For investors looking to get into the zinc space, it might be worth taking a look at zinc companies with projects set to come online in the medium term.

For example, Margaux Resources (TSXV:MRL) holds an option on the Jersey Emerald tungsten-zinc property in British Columbia, which company CEO Tyler Rice notes could be roughly two years out from production.

“We’re very bullish on zinc primarily because of the lower stock levels that we’re seeing for the LME, coupled with the supply that’s coming offline,” Rice said. “We’ve got a brownfield project with lots of historical infrastructure, and we’re proximal to a lead and zinc smelter, which provides enhanced economic benefits to us.”

Other examples of junior mining stocks in the zinc space include:

- InZinc Mining (TSXV:IZN)

- Solitario Exploration (TSX:SLR)

- Canada Zinc Metals (TSXV:CZX)

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Teresa Matich, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

InZinc Mining is a client of the Investing News Network. This article is not paid for content.