Here’s an overview of the main factors that impacted the nickel market in H1 2020, and what’s ahead for the rest of the year.

Click here to read the latest nickel price update.

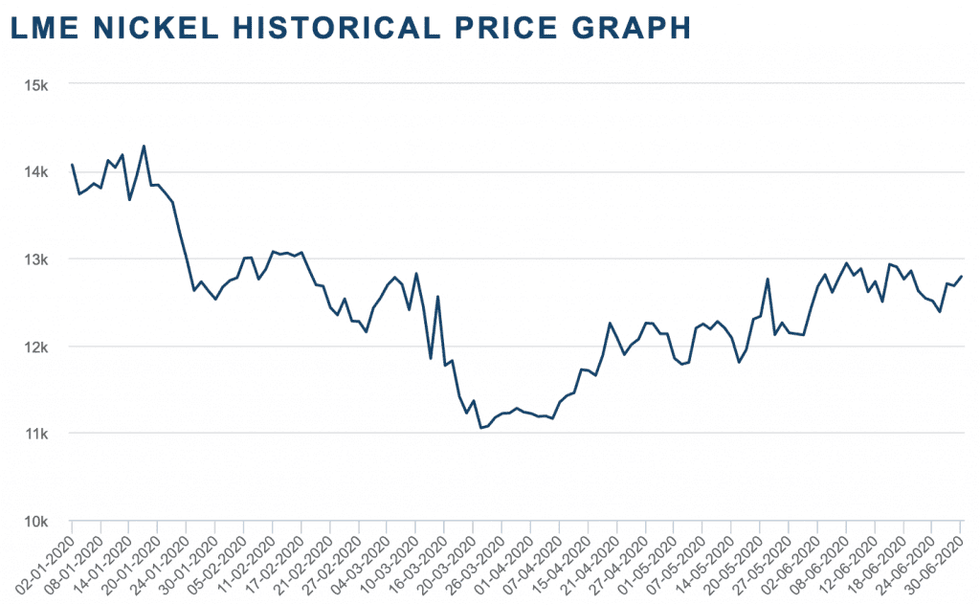

Nickel prices were volatile in the first six months of the year, with prices touching their lowest level of U$11,055 per tonne in March when the pandemic hit commodities across the board.

But the metal was able to rebound in the second quarter, making its way back above US$12,000 by the end of the period on the back of China’s recovery.

The recent call for more nickel mining from Tesla’s (NASDAQ:TSLA) Elon Musk suggests that the base metal‘s future in batteries for electric cars continues to be bright — but in the short-term stainless steel will be the main driver of the market.

With the second half of the year now in full swing, the Investing News Network (INN) caught up with analysts, economists and experts alike to find out what’s ahead for nickel supply, demand and pricing.

Nickel price update: H1 overview

Nickel started the year trading at US$14,070, but as mentioned in March it fell to US$11,055, its lowest level so far this year. That was when pandemic fears were hurting all markets.

Chart via the London Metal Exchange.

Prices made a comeback in Q2, and even though they did not reach their highest level of the year, they ended the quarter up by 15 percent from their lowest mark, reaching US$12,790 on June 30.

Nickel’s price performance has been a surprise to the upside year-to-date, according to Andrew Mitchell, Wood Mackenzie’s research director.

“This is not supported by fundamentals, (it’s) more sentiment and perception,” he said.

CRU Group’s Nikhil Shah also told INN that the surprise has been how quickly the rebound in prices happened given nickel’s fundamentals.

“I think that is a concern, given that fundamentally we look at the market being in surplus this year,” he said. “There’s potential for nickel prices to correct from current levels in the second half of the year.”

Averaging US$12,440 during the first half of 2020, nickel’s price performance was marginally lower than what Roskill had expected at the start of the year.

“Low demand has resulted in the market switching to surplus and a swelling of stocks,” Roskill Senior Analyst Jack Anderson told INN. “We anticipate the price to improve a little through H2 2020, supported by a partial demand recovery, especially in China.”

Nickel price update: Supply

During the first half of 2020, mining and refining facilities for nickel were disrupted at a global scale, from the Philippines to Canada, as a result of coronavirus containment measures.

“We expect primary refined nickel supply to decline by a little more than 1 percent year-on-year in 2020 because of the disruptions,” Anderson said. “However, Indonesian nickel pig iron (NPI) production has soared through early 2020, which has helped to make up for falls in refined nickel supply elsewhere.”

Commenting on what could happen to supply in the coming months, he said risk exists this year in terms of whether Indonesian NPI supply could be disrupted by a COVID-19 outbreak in Sulawesi, the region where these companies operate.

“These regions have, so far, remained unimpacted by COVID-19. This is possibly a function of their remote location and stringent company policies, aimed at minimizing the risk of an outbreak,” he said. Indonesia has become a key supplier of refined nickel in the form of NPI, a stainless steel feed.

Moving forward, risk also comes from how much NPI supply will be put into operation.

“This is because of the speed at which additional NPI projects become operational after being announced,” Anderson said. “NPI projects can be announced and operational within a couple of years, so that additional supply could be added on top of an oversupplied (post-COVID-19) market.”

Supply has been less impacted by the pandemic, according to Mitchell, as in most countries mining was deemed an important industry to maintain — that said, production was lost in Canada, the Philippines, New Caledonia and Madagascar, and to a lesser extent South Africa and Australia.

“The incredible growth in production in Indonesia, combined with the demand destruction of COVID-19, has moved our forecast from one of deficits and higher prices as of the end of 2019 to one of surplus and stagnating/lower prices,” Mitchell said.

Looking ahead, Shah said CRU is expecting to see strong supply growth in NPI from Indonesia.

“At the moment we are still expecting the nickel market to remain in surplus next year because of all the projects (moving forward) in Indonesia,” he said.

Nickel price update: Demand

For Anderson, nickel demand has been more severely impacted as the virus eventually forced governments across the world to impose measures aimed at slowing the spread of the disease.

“Those measures, however, also resulted in a sharp slowdown in economic activity, which is expected to lead to a sharp deceleration in primary nickel demand,” he said.

CRU’s Shah agreed, saying the impact from COVID-19 has been much greater on demand than supply. He also pointed to the demand impact in China from the stainless steel segment due to the pandemic.

But the second quarter saw nickel demand picking up, especially in the Asian country.

While the country was the first to be affected by the COVID-19 pandemic, it was also the first to begin to lift lockdown measures, Anderson said.

“Elsewhere, demand is expected to start recovering as lockdown measures begin to be lifted,” he added. “This should result in a gradual improvement in demand, albeit from a low base.”

When looking at nickel’s fundamentals, Mitchell told INN that the coronavirus has had a major impact on demand globally, and while China is now returning strongly, the rest of the world will take a few years to get back to 2019 levels.

“Stainless and superalloy being particularly affected, but also the electric vehicle (EV) sector,” he said.

According to Roskill, stainless steel will continue to dominate the demand side of the nickel market throughout the decade.

Significantly for nickel, the firm forecasts that the lithium-ion batteries that power EVs will utilize increasingly nickel-rich cathode chemistries (NCM622, NCM712 and NCM811).

“By 2030, we forecast nickel demand from the batteries sector to account for a little over 25 percent of the total nickel market,” Anderson said. “These nickel-rich cathodes will also be joined by non-nickel-containing cathodes such as lithium iron phosphate, which is favored in the Chinese market for its lower cost and safety record in powering EVs.”

Despite the economic weakening due to the COVID-19 pandemic, Europe and China have strengthened their EV subsidy programs and maintained their CO2 and EV targets, which Roskill believes will continue to support EV adoption and therefore nickel demand from the battery space.

Speaking about the use of nickel in batteries, Mitchell said one of the outcomes of COVID-19 could be an acceleration of the EV trend.

“One thing that may come out of the situation is that certainly ‘noises’ are being made about supporting companies via government grants; that focus will need to be on the cares of the younger generation, and in particular the environment,” he said. “EVs fall into this arena, and we could see ex-China a bit of an acceleration above what we currently forecast — but it will take time.”

CRU’s Shah said he is expecting nickel demand in batteries to slow this year in terms of growth. “But further out, we’re still looking at double digit growth,” he said.

Nickel price update: What’s ahead?

As the second half of the year begins, the world continues to be challenged by the uncertainty from COVID-19, with commodities being no exception.

“For nickel, we are waiting to see whether the Indonesian NPI producers are impacted by any outbreaks in the locations they operate,” Anderson said. “This is significant because it supplies NPI to Chinese stainless steel mills as well as integrated domestic operations.”

He also pointed to several battery-grade intermediate nickel projects under construction in Indonesia.

“The timely development of these projects to produce battery-grade nickel to feed the lithium-ion battery market could be under threat,” the expert said. “Roskill believes that battery-grade nickel intermediates are the pinch point in the EV battery supply chain.”

Looking at the next six months, Mitchell is expecting very little to happen on the demand side.

“China is coming back strongly, but questions remain as to whether end-use demand will return as opposed to just first use,” he said.

Woodmac is expecting nickel prices to decline in the second half of the year from current levels, leaving the average for the year at around the US$12,300 to US$12,500 range.

For investors interested in the nickel space, Mitchell said it will be key to watch the ongoing development of capacity in Indonesia in the NPI space.

Another key catalyst to pay attention to as the year comes to a close is the performance of the Indonesian high-pressure acid leach projects as they should get close to commencing production.

“Also, how China continues to raise its stainless production, and how Chinese NPI production rates begin to be impacted by declining ore availability and how this will stabilize to production levels in 2021.”

Additionally, he pointed to an ongoing trend in the battery space — the apparent increase in lithium-iron-phosphate battery use in China, which seems to have had a recent resurgence.

Shah also mentioned that the recovery in stainless steel demand from ex-China is a key factor to watch.

“On the supply side, NPI production has been growing in the past few years … so even despite the ore ban, which is going to lower the NPI production in China, the NPI growth is still strong with the increase we are seeing in Indonesia,” he said. “The risk is that the growth might be stronger than expected, leaving the market in a big surplus.”

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.