Could Cobalt-free Batteries Dominate the EV Space?

Experts discuss the possibility of LFP batteries taking over the EV space as announcements from Tesla and Volkswagen put cobalt in the spotlight.

Cobalt is a key element in the lithium-ion batteries used to power electric cars, but costs and risks associated with the metal’s supply chain have driven the market to wonder about the possibility of using cobalt-free batteries in electric vehicles (EVs).

News headlines hit the markets every now and then about battery chemistry innovation, such as the cobalt-free batteries China’s Svolt is working on, but it’s lithium-iron–phosphate (LFP) cathodes for passenger vehicles that have been receiving plenty of attention in the past several months.

The market has seen moves into LFP from companies like Tesla (NASDAQ:TSLA) and Volkswagen (OTC Pink:VLKAF,FWB:VOW) as cost reductions, improvements and the scaling back of Chinese EV subsidies have revived the interest for this cobalt-free cathode chemistry.

Speaking with the Investing News Network (INN), Benchmark Mineral Intelligence’s Andrew Miller said that longer term the cathode market continues to shift towards nickel-cobalt-manganese (NCM) and nickel-cobalt-aluminum (NCA) variations that are higher in nickel.

“But an interesting development over the past 12 months has been the renewed focus on LFP — this has come from a cost perspective and from improvements in technology, as you’ve seen the likes of CATL (SZSE:300750) and BYD (SHA:002594) make progress with,” Miller said.

Earlier this year, Reuters reported that Elon Musk’s Tesla was in talks with CATL to use LFP batteries in its lineup in China. The Chinese EV battery maker has been working on its cell-to-pack technology to boost the density and safety of its LFP batteries. Meanwhile, BYD has been working on improving its LFP batteries, also claiming to have achieved higher energy density and significant safety improvements.

For Miller, these improvements will increase the role of LFP in the longer-term and could even see LFP used in some specific passenger EV markets, as the space has seen with Tesla in China. But ultimately LFP will continue to play a role in heavy-duty applications and energy storage systems.

“Western OEMs remain committed to NCM/NCA chemistries, with the push to reduce cobalt within the technologies as much as possible,” he added.

Speaking about what’s been happening in the EV space in terms of cathode chemistries, Adam Panayi of Rho Motion told INN that LFP is at the moment a China story, for passenger cars at least.

“We don’t expect a massive increase in LFP this year, but it certainly made a revival in the passenger car space, and it still dominates the bus space,” Panayi said.

LFP vs. NCM/NCA: Challenges and benefits

When looking at each type of cathode, there are benefits and challenges that remain for both chemistries — this is why they are used broadly in specific applications.

“The benefits of LFP are that it is a more stable chemistry and lower cost due to its inputs and the existing infrastructure that has been built for LFP (particularly in China),” Miller said.

Panayi agreed, saying the key selling point of LFP is around its cyclability from a technical point of view as it is very robust, and it lasts a long time.

“For LFP, one of the key advantages is that you don’t have cobalt in there, and from a supply chain point of view that’s a big advantage,” he said. “In the past six to eight months, LFP as a battery chemistry has improved quite a lot, or at least improved batteries have been commercialized in that period … (but) they are still not getting that range of the energy density that NCM does.”

In fact, the move towards high-nickel NCM chemistries has come from the push to greater energy density required for widespread EV adoption in western markets.

“The challenge with LFP is to push the energy density to a point where it’s competitive with NCM, but ultimately it won’t be able to meet the same capabilities of NCM, which limit its prospects in the passenger EV market,” Miller, product director at Benchmark Mineral Intelligence, explained.

Removing cobalt from cathodes has proven difficult so far, and even the adoption of cathodes with less cobalt such as NCM 811 have faced hurdles in the past years. But for Panayi it doesn’t mean it can’t be done as the technology is improving all the time.

“The issue you have is that you’ve got EV model rollouts where the battery chemistry has to be confirmed relatively early, and then those models stay on the market for a period of time,” he said.

When new chemistries are adopted they have to be approved, which again takes time.

“And again, those cobalt-free chemistries, that’s all very well and good, but then you’ve got issues around thermal management and the battery management, so there might be a cost increase there,” he said.

For the expert, experimental technologies are good, and they push the market forward, and they will eventually come in some form for the right applications in the future.

“But you’re dealing with a customer which is inherently risk averse,” he added.

What’s ahead?

For investors interested in the battery metals space, keeping an eye on how cathode chemistries evolve may give an idea of where demand for raw materials is heading.

For Benchmark Mineral Intelligence, LFP will maintain a significant market share, but the firm still expects the bulk of the growth in the cathode market to come from variations of NCM.

“NCM will make up over 50 percent of production in 2020, and over 57 percent of cathode capacity expansions in the pipeline are targeting NCM production,” Miller said. “By contrast, only 27 percent of expansions are targeting LFP.”

With transportation being the big growth driver for batteries, this will be dominated by NCM/NCA in passenger vehicles and LFP in heavy-duty or lower-range transportation.

“As we’ve been saying for a while now, it’s not really an either or between the two battery chemistries. It’s both, and it’s application driven,” Panayi said.

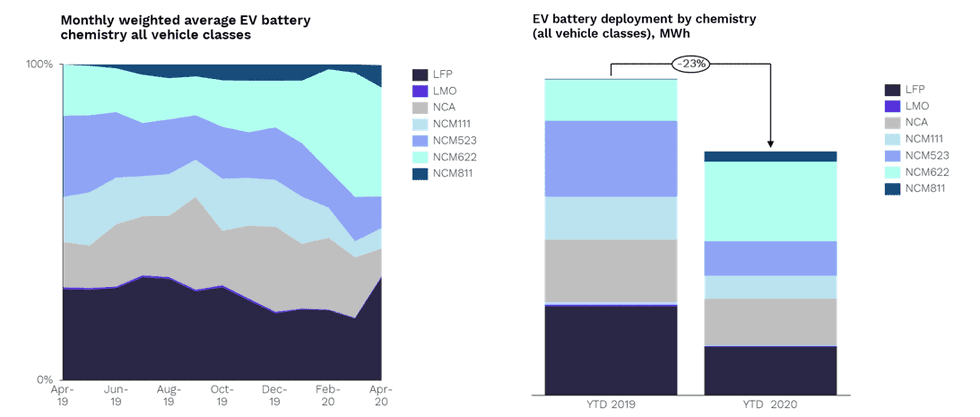

Charts via Rho Motion.

Outside of LFP and NCM/NCA chemistries, Miller added, the market will continue to see LCO play the leading role in portables, and there is likely to be a wider range of technologies used in energy storage systems applications.

“However, ultimately the cost benefits from the scale of NCM, NCA and LFP production will make these mainstream chemistries very competitive,” Miller said.

Speaking about the diversity of chemistries and whether there will be room for all going forward, Panayi said one to watch is the development of NCMA.

“It looks like some of the challenges that we’ve seen around NCM 811 adoption can be solved by the use of NCMA. So that’s one definitely to think about,” he said. “But the reality is that the EV market is going to become more diffuse in terms of applications and types of vehicles on the road; as a result of that, so will the battery chemistries being employed.”

Miller also expects new chemistries and variations to continue to develop and to begin to be seen in niche and high-value sub-segments of the market in the coming years, as they move along their pathway to more widespread commercialization.

As mentioned above, one key thing every investor should keep in mind is that different cathode chemistries will emerge for different markets.

“The biggest misconception about cathode chemistries is that new technologies will emerge and displace existing chemistries,” Miller said to INN. “The roadmap to developing new technologies can be decades long, and even tweaks to established chemistries take time and require a huge amount of qualification and testing.”

A good example of this has been the transition to NCM 811 cathodes, Miller added, which a couple of years ago were seeing a lot of excitement from the market. Time has proved that it is difficult for any chemistry to take over the market overnight.

For Panayi, the biggest misconception investors have is around the idea that battery chemistries are set and inflexible, as for example NCM 811 for one battery manufacturer means something completely different for another battery manufacturer.

“The idea that there’s these set categories is a complete misnomer,” he said. “You have to exercise a degree of caution around the fact that those are exact categories, and also the rate of change in battery chemistries is relatively slow, based on the vehicle cycle rather than the battery cycle.”

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.