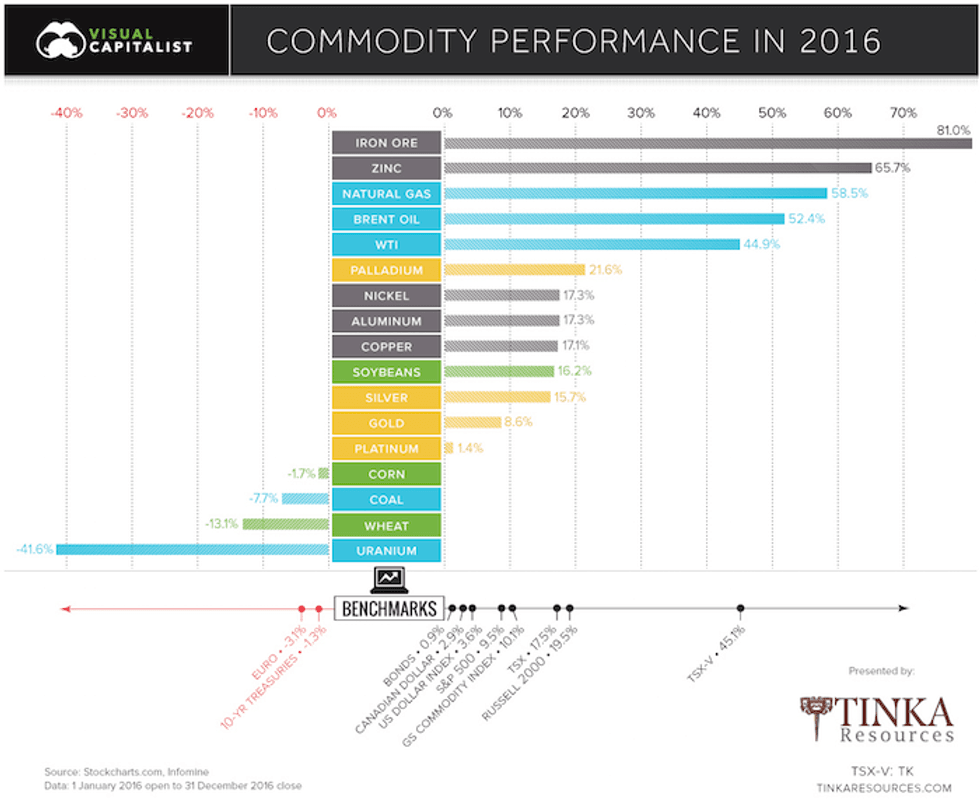

Iron ore was the best performing commodity in 2016, but will it carry over to 2017?

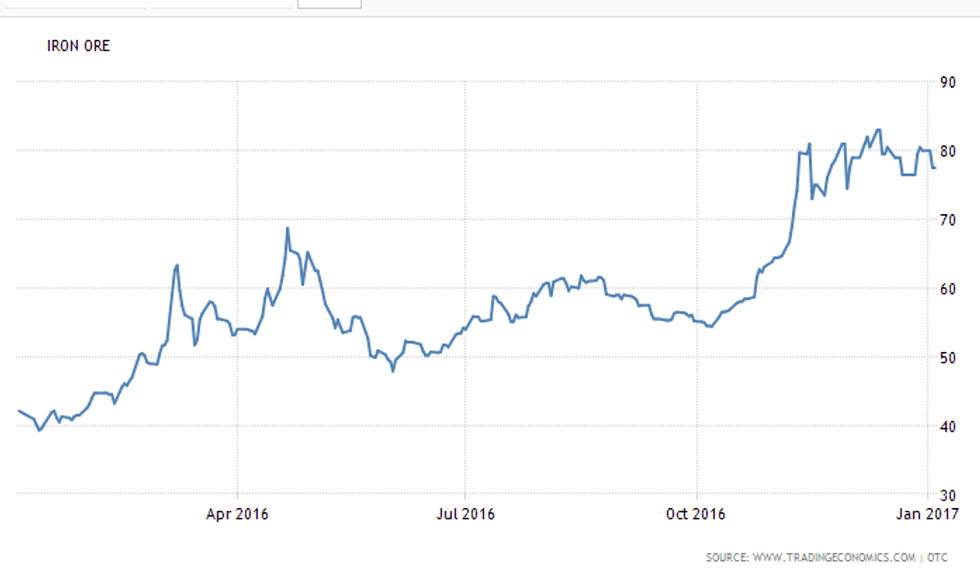

Despite a bleak outlook, iron ore was easily the best performing commodity in 2016. Prices surged during the year, resulting in an 81 percent jump in price, “in a rally that caught out many investors after stimulus in China helped to sustain steel output.”

Zacks Equity Research wrote that the price surge was likely due to strong infrastructure investment in China, mixed with a slowdown in growth after Beijing released its Adjustment and Upgrade Plan for 2015-20, where the government announced its plan to cut 100-150mn tons of steel capacity, and an annual decline of 1.8 to 2.8 percent.

The price surge had a positive impact on other iron producers. In September 2016, Australia, a key producer of iron ore, increased its forecast for 2016-2017 in anticipation of a boost in prices. Analysts, however, do not share the same sentiment.

Iron prices rose sharply in the beginning of November due to speculation that US President-elect Donald Trump would drive higher demand together with his infrastructure plans.

However, FocusEconomics, in their December 2016 Forecast, wrote, “China’s struggle to sustain its real estate bubble could lead to a downturn in demand for iron ore.”

By mid-2016, shares of iron ore mining companies started rising. These top pure-play iron ore mining companies ended with three-digit gains for the year: Cliffs Natural Resources (NYSE:CLF) at 451.9 percent, Assore (JSE:ASR) 295.36 percent, Kumba Iron Ore (JSE:KIO) 299.22 percent. ASX-listed Fortescue Metals (ASX:FMG) 224.6 percent.

In S&P Global Platts’ publication entitled Insights, Senior Managing Editor Paul Bartholomew said that Rod Beddows, a steel industry veteran, predicts steel demand to go up as, “a large portion of Chinese housing stock will need to be replaced by steel-intensive high rise apartment blocks over coming years, while another 300 million people will move to cities and become larger consumers of cars and appliances.”

Iron Price Forecast for 2017

RBC Capital Markets, touted as the most accurate forecaster for the commodity, said in a report that iron prices are due for a retreat in 2017. “We believe iron ore prices are not sustainable at current levels and expect a pullback in 2017,” they wrote. RBC Capital Markets expects prices to average $58.75 a ton in 2017.

A retreat is also expected by UBS Group AG, citing new mine supply coming online and surplus as reasons.

Morgan Stanley, on the other hand, is bearish on the steelmaking commodity and has listed iron among its bottom three metals picks, while Barclays expects prices to be back below $50 by Q3 of 2017. In a note, Morgan Stanley analysts cited Trump’s infrastructure vision as a new upside risk. However, they wrote, “Yes, we do believe China is in the mature stage of its 25-year-old materials growth cycle, and that the US may only be at the start of a new one. But the potential exists for a medium-term competitive overlap for selected commodities.”

In a poll by Reuters, analysts predict that the iron ore price will go to an average of $55/t in 2017, and set to go lower in 2018 at $51.1 per ton.

Goldman Sachs upgraded its forecast on iron ore prices to US$65, US$63, and US$55 per tonne in three months, six months and 12 months. The bank forecasted that iron ore prices will be back to $55 per tonne by the end of 2017.

JP Morgan analysts also upped their 2017 iron ore price target to US$60 per tonne from the a previous target of US$54. JP Morgan analysts expect a “strong start to 2017,” with short-term drivers likely to remain through the first quarter. The bank also foresees an oversupply in 2018 by 58 million tonnes, with markets looking to be more balanced in 2019 and 2020.

Toronto-Dominion forecasts an average of $55 a ton in the first half of 2017, RBC Capital Markets expects prices will average $58.75 a ton in 2017.

Investor Takeaway

For 2017, analysts still hold their bearish sentiments despite a strong start to the year and potential for higher infrastructure spend from US President-elect Donald Trump. Investors should still keep an eye on iron as the base metal performed surprisingly well in 2016 despite bearish sentiments by analysts.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Pia Rivera, hold no direct investment interest in any company mentioned in this article.