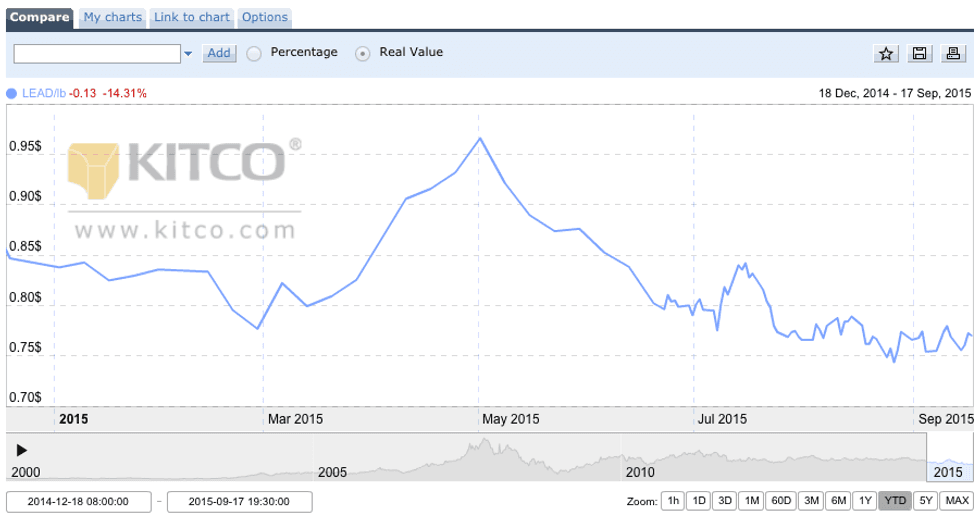

According to Kitco, the lead spot price saw a bit of a jump in July, but has been on a downward trend for most of the year, dropping 8.15 percent year-to-date.

Prices for most commodities have been hit hard this year, and the lead spot price is no exception.

According to Kitco, the lead spot price saw a bit of a jump in the middle of the year, but has faltered over the rest of the year, dropping 8.15 percent year-to-date. Meanwhile, three-month lead on the London Metal Exchange (LME) is down about 11 percent, at US$1,839 per tonne, according to Wenyu Yao, an analyst with Thomson Reuters GFMS.

Yao stated that data for the first half of the year shows that lead mine production, as well as refined production and consumption, show negative growth year-on-year. “China is the main driver behind these,” the analyst said, adding that markets for both lead concentrate and refined lead products are in a small surplus.

Meanwhile, Yao noted that all base metals are still being dragged down this year. “Zinc as an example, has slightly better fundamentals compared to the rest of base complex, but this is not reflected in the price performance,” the analyst explained.

Still, Thomson Reuters is expecting the lead spot price to hold steady for the remainder of the year. “For the full year average, we are looking at USD$1,900 because we are expecting Q4 price will find a bit support from lead-acid battery consumption,” Yao said.

Here’s a look at the lead price chart year-to-date: