Cormark Securities Ups Long-Term Copper Price Forecast

In its latest Base Metals update, Cormark Securities upped its forecast for long term copper prices from $2.75 to $3 per pound, citing concerns over supply. While the firm admitted that it might seem counterintuitive to put in bullish predictions now, when copper prices are low and oversupply is apparent, but it argued that higher prices will be needed to sustain the industry within the next few years.

In its latest Base Metals update, Cormark Securities upped its forecast for long term copper prices from $2.75 to $3 per pound, citing concerns over supply.

The firm admitted that it might seem counterintuitive to put in bullish predictions now, when copper prices are low and oversupply is apparent, but it argued that higher prices will be needed to sustain the industry within the next few years.

“While it may seem counterintuitive to undertake an upward revision to our long-term price deck now in a period of oversupply and low prices, we believe the retrenchment in capital spending and lag from discovery to production is setting up for the next cycle,” the firm stated, adding that it saw stronger copper prices within the next few years.

Cormark isn’t alone in arriving at that thesis. Thomson Reuters is predicting a $7,073 incentive price for new copper production, while a number of the world’s largest mining companies have made comments about placing their bets on copper.

And although some are more bearish on copper, there are plenty of arguments in support of a copper supply crunch.

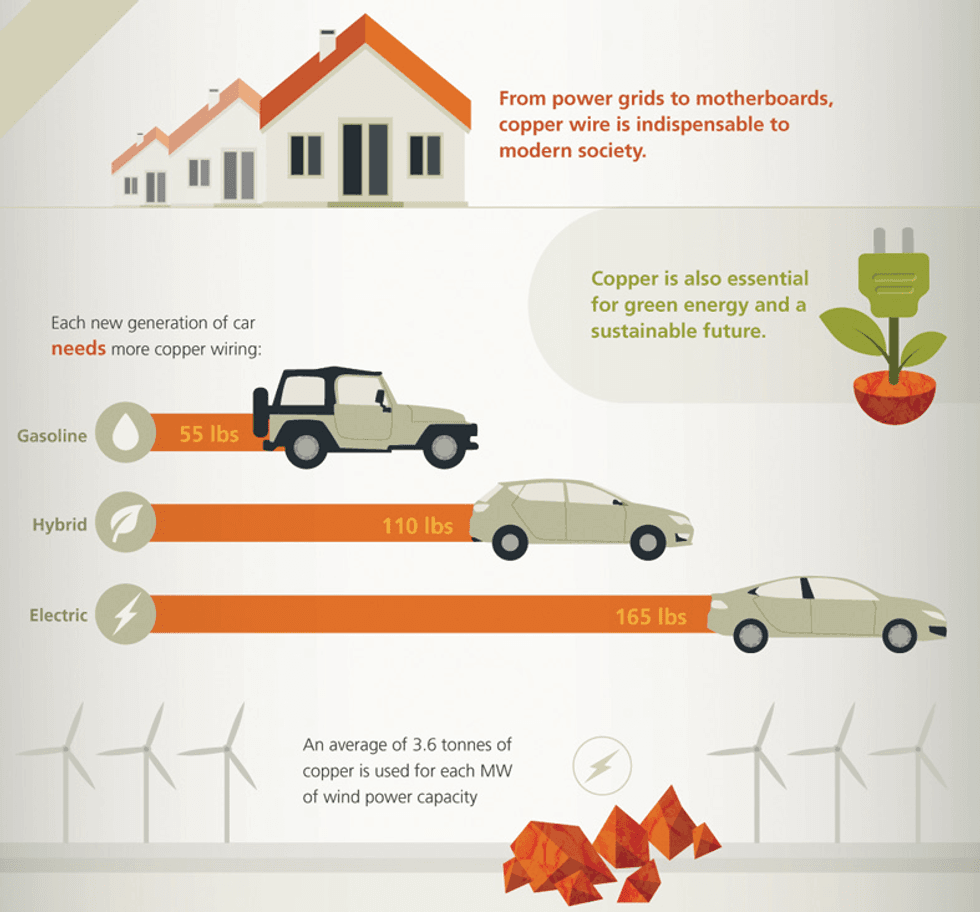

Visual Capitalist recently published an infographic on the subject, noting the importance of copper in power grids, cars and renewable energy:

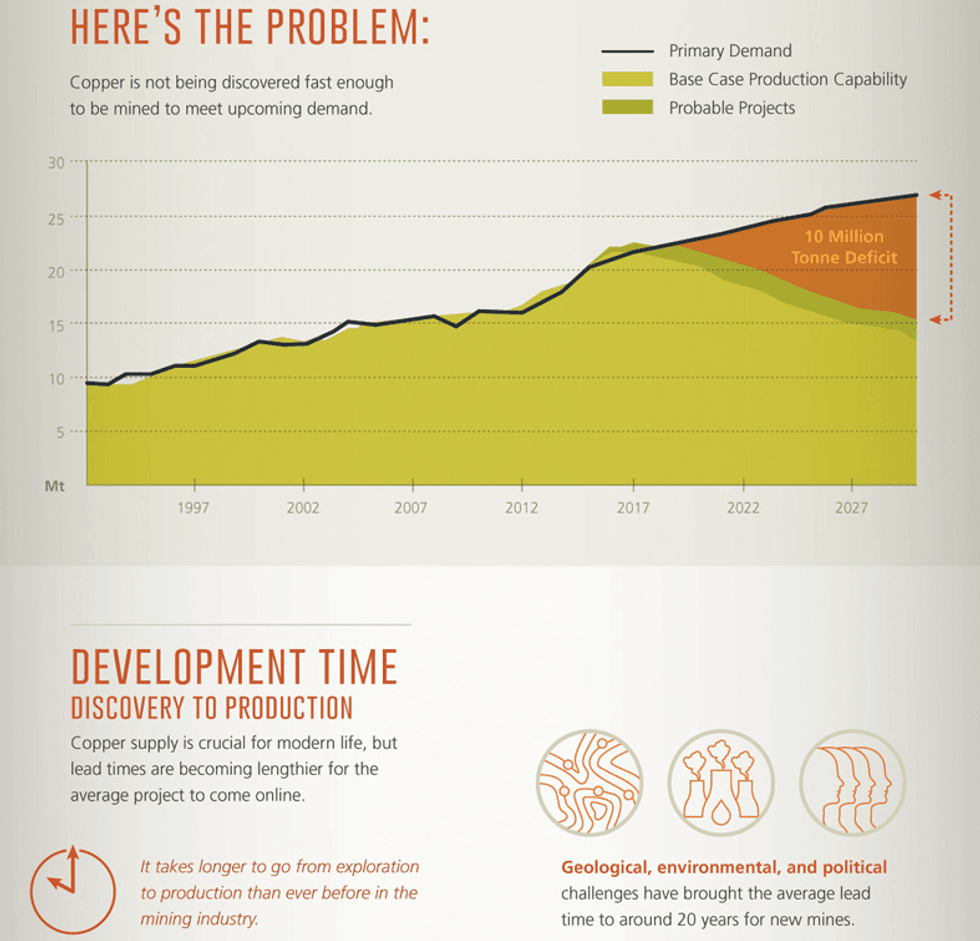

However, it also pointed to longer lead times to develop projects:

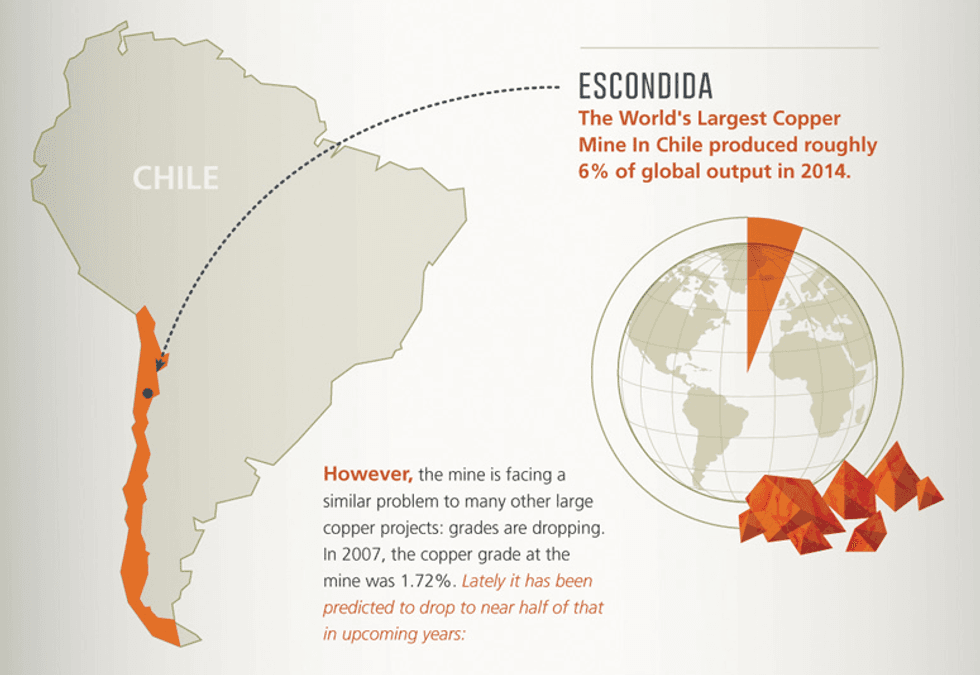

While grades continue to fall at producing mines:

Overall, Cormark stated that the need to restart the development pipeline for copper is “now becoming acute” and that the current situation has “set us up for the next bull cycle in metal prices.”

The firm has shared its bullish predictions on copper before, citing factors such as decreased supply expectations and fewer short positions as points in the red metal’s favour. Here’s a look at some of the points from its most recent note:

Weak development pipeline – Cormark noted that there have been big cuts to exploration spending and capital budgets in general in recent years and that junior mining company spending had all but come to a complete halt. By 2016, Cormark expects capital spending by the majors to have fallen more than 50 percent compared to 2012, improving the outlook for the market in the medium term.

Lower grades – With demand growing at 3 percent per year, Cormark stated that the market needs at least 650,000 tonnes per year of new supply before accounting for losses from falling ore grades and supply disruptions.

Lagging timelines – “Given the time lag to bring on new supply, coupled with declining production from existing older operations, it is only a matter of time before even modest growth rates overtake the slowing supply growth,” Cormark said.

Structural deficit – With the lack of new supply being developed, Cormark sees the market returning to a period of structural deficits. “These deficits are set to emerge even with the current lower level of demand as the mining industry has once again overreacted on the supply-side,” the firm stated.

While there’s plenty of supply available in the near term, Cormark stressed the importance of addressing future supply needs today. Higher prices are needed to move projects forward.

The firm hasn’t changed its near-term price deck, but said that it “would expect more risk to the upside as demand slowly recovers.”