Here’s an overview of the main factors that impacted the copper market in Q2 2020, and what’s ahead for the rest of the year.

Click here for the latest copper price update.

Uncertainty continues to reign for commodities, including copper, but after taking a hit in Q1 the second quarter of the year told a different story for the red metal.

Fundamentals seem to be improving, but whether current prices can be sustained is yet to be seen.

With Q3 already in motion, the Investing News Network (INN) caught up with analysts, economists and experts alike to find out what’s ahead for copper supply, demand and prices.

Copper price update: Q2 overview

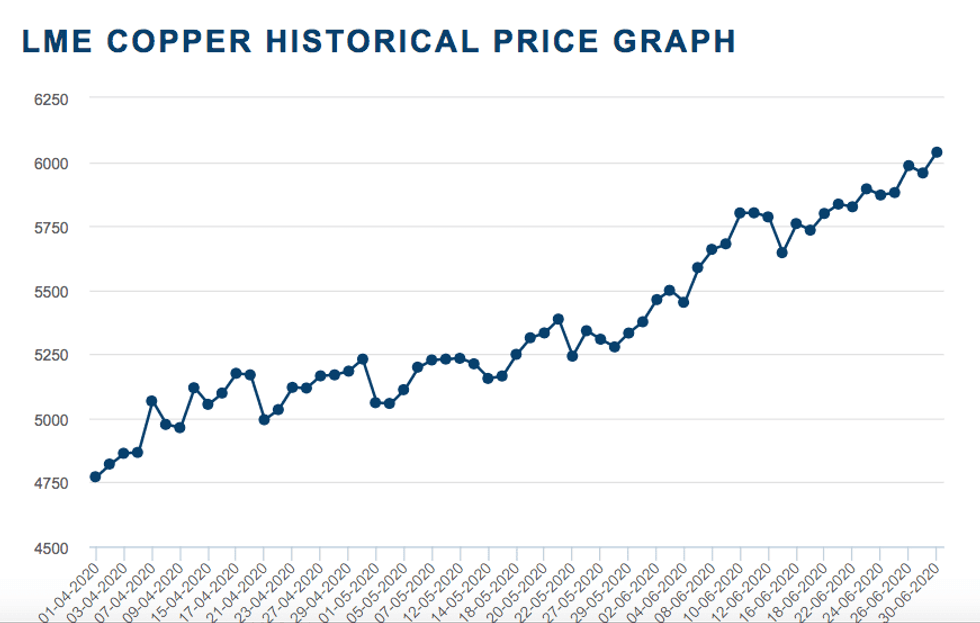

Copper prices kicked off Q2 trading at US$4,772 per tonne. They started to rebound from there to finish the quarter at US$6,038, their highest level for the period.

Chart via the London Metal Exchange.

An improvement in copper demand in China, paired with stimulus packages and supply disruptions in top-producing countries, has pushed prices higher.

Copper prices have rallied strongly in the past three months, and technical signals show that upward momentum is strong for now, Dan Smith of Commodity Analytics told INN.

“However, we will soon get close to some important long-term resistance levels around US$7,050,” he said. “This suggests that we are likely to see the price run into heavy selling above this, and a period of consolidation and high volatility is expected in Q3.”

Copper price update: Demand

For Kieran Clancy of Capital Economics, copper demand recovered quicker than many expected in Q2.

“This is almost entirely due to a remarkable bounce-back in Chinese demand, as policymakers there moved to stimulate activity — particularly in the copper-intensive infrastructure sector,” Clancy told INN. “And with that support set to be stepped up in the months ahead, a further pick-up in Chinese demand will probably remain the key driver in the second half of the year.”

He added that a pick-up in demand outside China will probably be an additional positive at the margin.

Commenting on copper demand in Q2, Karen Norton of Refinitiv also said the increase in Chinese demand has been to the upside of general expectations, helped by restocking and scrap shortages.

“This is significant given that China is likely to be relied upon as the main impetus for demand in the coming months,” she told INN. “However, Chinese copper consumption was facing a slow growth scenario before COVID-19, and any recovery, whatever its shape, will not prevent a decline in demand there this year.”

Additionally, top copper consumer China has already demonstrated its ability to contain new outbreaks of the virus quite quickly.

“Demand is seen falling more than 1 percent in 2020, but the second half will see improvements, helped by the recovery in air conditioner output and 5G network construction,” Norton explained.

However, it is important to remember that as the top exporter of copper-containing products, China’s consumption is also reliant on the effectiveness of major destination countries.

“With some of the latter dealing with the situation better than others, there is potential for a negative impact,” she said.

For Smith, the early phase of the recovery has clearly been V-shaped. “But as we move into H2 growth will start to level off, and many sectors will remain depressed compared to where we were in 2019.”

Copper price update: Supply dynamics

Copper supply has been relatively resilient so far this year, which has been somewhat unexpected, according to Clancy.

“Compared to other base metals, mined copper supply has held up reasonably well, thanks to a surge in Chinese output of copper ore,” Clancy said. “However, with virus numbers in Latin America now climbing rapidly, we think there is significant risk to supply in Q3.”

For his part, Smith said it now looks like Q2 will show a global contraction in supply and weakness will persist into Q3.

“The main mine problems have been in Chile and Peru, but China has also suffered and the ramp-up of supply in Panama has been set back,” he said. “The scrap market in China has also been very tight due to logistical bottlenecks.”

For Refinitiv’s base case view on the supply side, the worst is behind for copper mine production.

“Declines in H2 will be smaller, albeit still sizeable. Mine output will be down a substantial amount year-on-year (around 4 percent), but growth is on the cards again from next year and as it becomes clearer this may have a slight dampening effect, even though that growth will be from a low base,” said Norton.

Commenting on output results in Q2, she said there have been no major surprises so far, other than that one or two mines have managed to exceed her expectations.

One example is the Collahuasi mine in Chile, the world’s second biggest, according to Refinitiv’s Mine Production Database. Even on a cautious view, it now looks set to produce around 600,000 tonnes this year, up from 565,000 tonnes last year.

According to Refinitiv’s data, Q2 is likely to be the worst quarter in terms of mine production losses this year at around 140,000 tonnes. But the firm is also looking for year-on-year declines in Q3 at around 120,000 tonnes, and in Q4 at around 90,000 tonnes.

“This will continue to restrict refined production growth in Q3 and the remainder of 2020,” Norton commented. As a result, Refinitiv is expecting a relatively sizeable global market surplus in 2020.

Copper price update: What’s ahead?

The second half of the year could see the red metal maintain its current price level. Capital Economics is expecting copper to push a little higher in Q3, albeit not as rapidly as it did in Q2.

“The fact that the copper price is now back above where it was pre-pandemic suggests that the coronavirus pandemic has led to an overall improvement in the metal’s fundamental outlook,” Clancy of Capital Economics told INN.

“But while a little counterintuitive, this idea isn’t as farfetched as it first appears. After all, absent the pandemic, policymakers in China wouldn’t be embarking on an infrastructure spending splurge,” he said.

Clancy suspects that a significant amount of supply disruption is already priced into the copper market.

“So if those supply disruptions fail to materialize (or are lower than expected), that poses a downside risk to the copper price,” he said.

Capital Economics has increased its forecasts for the year from US$5,500 to US$6,800.

With the stars aligning in terms of a rebound in Chinese copper demand and a newsflow that largely supports the view that mine supply is tight and tightening, there is further upside potential for prices in Q3, Norton said.

“We remain cautious of this uptrend being sustained, however, and conditions are likely to become more volatile, with prices susceptible to market perception of the latest piece of news related to COVID-19 and/or China/US trade relations,” she added.

Refinitiv’s last forecast for copper was US$5,500, and for now the firm is leaving this unchanged.

Despite concerns about a potential spike in cases dominating news headlines worldwide, Capital Economics is not yet assuming a second wave in its forecasts — but Clancy said this is a key catalyst that investors should keep an eye out for.

“However, even if a second wave were to materialize, we are unlikely to see a return to the nationwide lockdowns we saw earlier this year,” Clancy said. “Instead, policymakers are likely to opt for localized lockdowns, which would be less damaging to copper demand and supply.”

Meanwhile, Refinitiv is already assuming in its forecasts that there will be a second wave of COVID-19.

“In supply, while complacency would be unwise, we also assume that containment measures in the main will be more successful, localized and not last as long when implemented,” Norton said.

“Implementation of strong safety measures at mines in Chile, following union calls, will hopefully lead to improvements that will help in this regard.”

For Smith, it seems reasonable to assume that COVID-19 developments are going to drive prices for the rest of this year.

“Our base case assumes that infection levels remain very high in North and South America, which holds back the demand recovery,” he added. He believes that prices have now overshot fair value, and his firm has not adjusted its forecast upwards in the past month.

When looking at the months ahead, the other factor to look out for, according to Smith, is that correlations between equities and copper remain very high.

“(That shows) that global liquidity is driving commodity markets rather than fundamentals, and that speculative activity is elevated,” he said. “This shows that copper is becoming more vulnerable to a setback in the months ahead, if fundamentals disappoint for any reason.”

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.