Cannabis Weekly Round-Up: US Cannabis Deals Clear HSR Requirements

The Investing News Network rounds up some of the biggest company and market news in the cannabis market for the past trading week.

During the past trading week (October 28 to November 1), two multimillion dollar cannabis deals got clearance from the US Department of Justice (DOJ).

An executive at a Canadian licensed producer held his stance on a divisive rights offering announced last week, while another Canadian cannabis firm dealt with a dramatic drop in value.

Here’s a closer look at some of the biggest cannabis news over the last week.

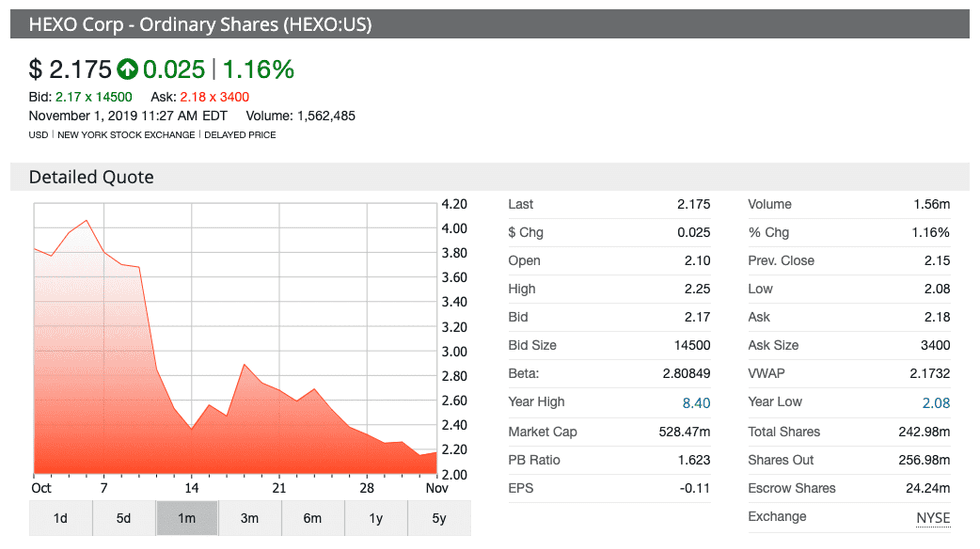

HEXO hits year-to-date low, holds off on future guidance

An increasing net loss gap revealed in HEXO’s (NYSE:HEXO,TSX:HEXO) latest quarterly results caused the share price of the Quebec-based cannabis firm to slump to its lowest point this year.

In its report for the period, released on Tuesday (October 29), HEXO noted a total net loss of C$56.7 million, a jump from the C$10.5 million loss reported in the same quarter last year.

During an earnings call, HEXO CEO Sebastien St-Louis attributed the loss to a slow store rollout and the reserve provision HEXO set up in case of product returns from provincial retailers.

He also told investors they shouldn’t expect to see projections from the company anytime soon.

“Until the market matures and the retail channels are built out, we’ll refrain from providing guidance,” St-Louis said. The executive added that he still remains optimistic on the continued growth of the company.

HEXO dropped 43.9 percent in the month of October in New York as the firm dealt with value hits after withdrawing its outlook for the 2020 fiscal year and announcing 200 job cuts.

Zenabis CEO holds strong on rights offering

After Zenabis Global (TSX:ZENA) announced a rights offering to raise C$20.8 million last week, its share price slipped down to its lowest point in a year.

It was a decision that CEO Andrew Grieve defended during an earnings call on Tuesday, noting that recent market conditions — including a drop in equity for licensed producers in Canada — have put the company in a difficult position.

“(The rights offering) was done to offer shareholders the most compelling opportunity possible to maintain their ownership in the business,” Grieve told investors.

Grieve admitted the year has been hard for the firm, and said that as a result the company is trading at a “significant discount” compared to its peers.

The executive said on Wednesday (October 30) that Zenabis’ shares on the Toronto Stock Exchange will stop trading with an entitlement to a right as the rights will be traded separately on the bourse.

US cannabis deals inch closer to completion

On Wednesday, two multi-state operators announced that the waiting period under the Hart-Scott-Rodino Antitrust Improvements (HSR) Act has expired on their respective million dollar deals.

Both Curaleaf Holdings (CSE:CURA,OTCQX:CURLF) and Cresco Labs (CSE:CL,OTCQX:CRLBF) are now closer to improving their market share across the US with approval from the DOJ.

The clearance on the part of the DOJ could represent a growing interest and acceptance of the cannabis industry at a state level.

Curaleaf’s deal to acquire Cura Partners, owner of the Select cannabis brand, was first announced in May and was valued at US$948.8 million.

With the confirmation of the HSR expiration, however, Curaleaf has told investors that the deal is moving forward with amended terms; now, the number of subordinate voting shares payable has been slashed to 55 million, down from over 95 million.

The difference will be payable to Select’s equity holders on the condition that Curaleaf hits a revenue target of between US$130 million and US$250 million in the 2020 calendar year. The deal is set to close on January 1, 2020.

Cresco Labs’ US$282.5 million deal to acquire Tryke will give Cresco an enhanced presence in Nevada and Arizona and is set to be signed off on in the first half of 2020.

“Upon the closing of the transaction, Cresco will have cultivation, processing, and retail assets in strategic and culturally significant legal states representing 71 percent of the US addressable cannabis market,” said Cresco Labs CEO Charlie Bachtell in a statement.

Market updates

A ManifestSeven report on the cannabis investment community shows investors remain excited about the sector in the face of a recent downturn that continues to batter the industry.

Sturges Karban, CEO of ManifestSeven, said investors seem unfazed by the latest “market correction.”

“Seventy-one percent of retail investors in the US and 73 percent in Canada say they expect investment in the cannabis industry to significantly grow over the next 12 months,” said Karban.

Saskatchewan scrapped its lottery system for awarding retail licenses in favor of a phased-in approach that gets rid of the cap on the number of stores that can be opened in the province and could help shrink the black market.

Gene Makowsky, minister responsible for the Saskatchewan Liquor and Gaming Authority, said in a press release, “We believe opening the market to more retailers will help meet customer demand while also helping discourage competition from unlicensed stores.”

In other provincial cannabis news, the Quebec government passed a law to raise the legal consumption age of cannabis from 18 to 21, which is the highest age gate in the country. The new age limit has its opponents who say the law, which is to go into effect on January 1, 2020, will only serve to further the black market for the drug.

The cannabis sector, including both the legal and illegal markets, added nearly C$8 billion to Canada’s GDP in August, according to data from Statistics Canada.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Danielle Edwards, hold no direct investment interest in any company mentioned in this article.