Crypto Market Update: Coinbase Posts US$667 Million Q4 Loss

Coinbase reported a US$667 million net loss in Q4 after a US$718 million unrealized decline in its investment portfolio, plus weaker trading activity, pushed revenue downward.

Here's a quick recap of the crypto landscape for Friday (February 13) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrency market news.

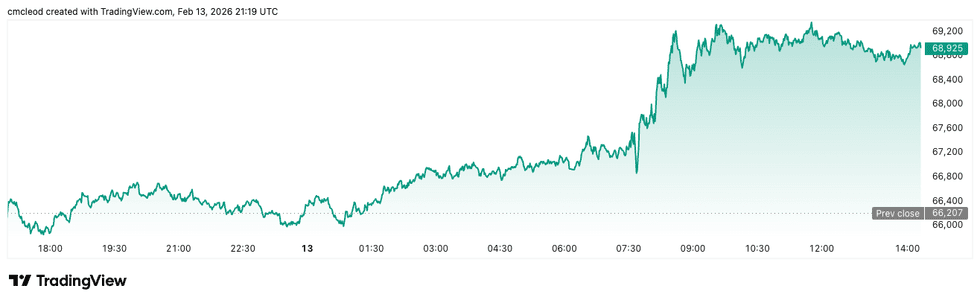

Bitcoin (BTC) was priced at US$68,987.01, up 5.2 percent over the last 24 hours.

Bitcoin price performance, February 13, 2026.

Chart via TradingView.

Despite the perceived recovery, Linh Tran, senior market analyst at XS.com, told the Investing News Network (INN) that Bitcoin lacks a strong consensus from capital flows for a long-term uptrend.

A constructive scenario over the next three to six months depends on gradual improvement in global liquidity, moderation in yields and steady exchange-traded fund (ETF) inflows.

New research shared with INN by the Investors Center reveals a sharp increase in retail investors contemplating an exit from Bitcoin following its recent price drop, alongside "extreme fear" sentiment reflected in the Crypto Fear & Greed Index; these factors suggest Bitcoin's price may remain rangebound.

According to Tran, if financial conditions tighten or additional liquidity stress occurs, the market may need another washout to rebalance leverage. Ultimately, the return of confidence, reflected through durable and sustainable capital inflows, is what matters most for the transitional phase.

Ether (ETH) was priced at US$2,054.76, up by 7 percent over the last 24 hours.

Altcoin price update

- XRP (XRP) was priced at US$1.41, up by 4.7 percent over 24 hours.

- Solana (SOL) was trading at US$85.01, up by 10.2 percent over 24 hours.

Today's crypto news to know

Coinbase posts US$667 million Q4 loss

Coinbase Global (NASDAQ:COIN) reported a fourth quarter net loss of US$667 million as falling crypto prices weighed on its revenue and the value of its investment portfolio. The company's revenue came in at US$1.78 billion, below analysts' expectations, making a 22 percent decline from a year earlier.

The firm attributed much of the loss to a US$718 million drop in portfolio value, largely unrealized, alongside weaker transaction activity. Shares slid ahead of the release and have fallen more than 55 percent over the past six months as cryptocurrencies retreated. Despite the surprise slide, CEO Brian Armstrong sought to reassure investors, saying the firm remains “deliberately well capitalized” with US$11.3 billion in cash and equivalents.

He added that retail customers are largely holding rather than selling, even as volatility persists.

Bitcoin ETFs lose US$410 million

Spot Bitcoin ETFs saw US$410 million in outflows on Thursday (February 12), extending a rocky stretch that has drained nearly US$1.5 billion over two weeks.

The iShares Bitcoin Trust ETF (NASDAQ:IBIT) led the pullback, followed by Fidelity and Grayscale products, as institutional investors recalibrated positions amid macro uncertainty.

Treasury chief pushes CLARITY Act as crypto selloff deepens

US Secretary of the Treasury Scott Bessent urged Congress to pass the Digital Asset Market CLARITY Act this spring, arguing that it will provide stability to markets rattled by volatility.

Speaking on CNBC and later before the Senate Banking Committee, Bessent said the bill will give “great comfort to the market,” and warned that parts of the crypto industry are resisting what he called “very good regulation.”

“There seems to be a nihilist group in the industry who prefers no regulation over this very good regulation,” he told lawmakers, drawing support from Senator Mark Warner.

The legislation has stalled amid disputes over stablecoin yield, DeFi oversight and token classifications, with critics — including Coinbase CEO Brian Armstrong — raising objections. Bessent cautioned that a bipartisan coalition backing the bill could fracture if Democrats retake the House in November. Warner, meanwhile, stressed unresolved concerns around illicit finance and national security risks tied to DeFi.

HIVE's BUZZ HPC platform secures US$30 million in AI cloud contracts

BUZZ High Performance Computing (HPC), a Hive Digital Technologies (TSXV:HIVE,NASDAQ:HIVE) platform, announced that it has signed customer agreements valued at approximately US$30 million over two year fixed terms for artificial intelligence (AI) cloud contracts. The new contracts will support the initial phase of BUZZ's AI-optimized GPU deployment at its Canada West location in Manitoba, with compute capacity expected to be online during the quarter ending on March 31, 2026. This phase consists of 504 liquid-cooled Dell Technologies (NYSE:DELL) server-based GPUs.

This initial phase is expected to generate about US$15 million in annual recurring revenue (ARR) to BUZZ’s cloud business once fully operational, increasing HIVE's total annualized HPC segment revenue to roughly US$35 million.

HIVE said it aims to scale its HPC GPU AI cloud business toward approximately US$140 million in ARR over the next year. The company is using vendor financing and strategic partnerships to scale efficiently and pursue a “dual-engine strategy” of hashrate services and GPU-accelerated AI computing across its facilities in Canada, Sweden and Paraguay.

Taurus and Blockdaemon partner to expand institutional staking

Taurus, a Swiss fintech firm that provides digital asset infrastructure for banks and financial institutions, announced an agreement with blockchain infrastructure company Blockdaemon that will allow banks to offer staking yields to their clients without having to move those assets out of tightly controlled, regulated custody.

Taurus will integrate Blockdaemon’s staking infrastructure into its custody product, Taurus‑PROTECT, which is designed to keep digital assets safe inside banks’ own systems under financial regulator rules.

Taurus also has an agreement to provide digital asset custody, tokenization and node management technology that State Street uses to power its full‑service digital asset platform for institutional investors. Additionally, BNY Mellon (NYSE:BK) is broadening its digita asset platforms by partnering with infrastructure providers, including Blockdaemon.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.