Crypto Market Update: ARK Picks Canadian Staking Partner, PayPal Unveils New Service

Elsewhere in the crypto space, TRON filed to raise US$1 billion, and Metaplanet purchased an addition 780 Bitcoin.

Here's a quick recap of the crypto landscape for Monday (July 28) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ethereum and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ethereum price update

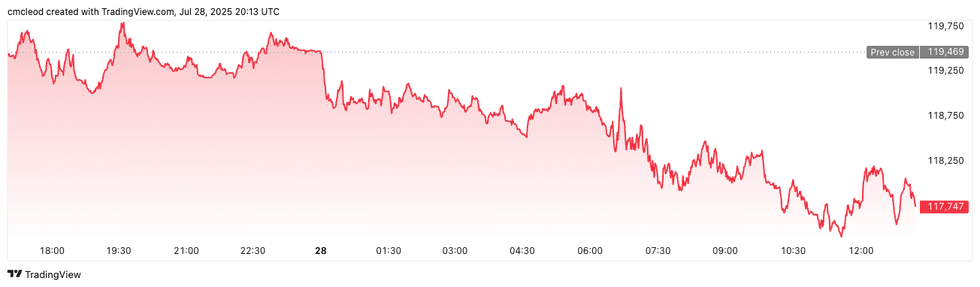

Bitcoin (BTC) was priced at US$117,888, down by 0.9 percent over the last 24 hours. Its highest valuation on Monday was US$118,719, while its lowest valuation was US$117,498.

Bitcoin price performance, July 28, 2025.

Chart via TradingView.

Bitcoin is now approaching a “strong resistance” level between US$119,000 and US$120,000, according to crypto analytics platform Coinank.

In a note to clients, 10x Research founder Markus Thielen described this Bitcoin bull market as defined by sudden, catalyst-driven bursts of momentum and subsequent pauses, making it crucial for traders to focus on macro triggers and react quickly to breakouts rather than relying on a calendar-driven approach.

He cited that a pullback to under US$112,000, the former resistance-turned-support level of the May high, would be the best entry point for BTC bulls. “We would prefer to see bitcoin retest its $111,673 breakout level to provide a more favorable risk/reward entry point," Thielen said.

Ethereum (ETH) was priced at US$3,786.54, down by 1.1 percent over the past 24 hours. Its lowest valuation on Monday was US$3,763.07, and its highest was US$3,855.16.

Altcoin price update

- Solana (SOL) was priced at US$185, down by 1.2 percent over 24 hours. Its lowest valuation on Monday was US$184.91, and its highest was US$191.10.

- XRP was trading for US$3.15, down by 1.9 percent in the past 24 hours. Its lowest valuation of the day was US$3.13, and its highest valuation was US$3.19.

- Sui (SUI) is trading at US$3.99, down 8.1 percent over the past 24 hours. Its lowest valuation of the day was US$3.97, and its highest was US$4.21.

- Cardano (ADA) was trading at US$0.7963, down by 3.7 percent over 24 hours. Its lowest valuation on Monday was US$0.7937, and its highest was US$0.8223.

Today's crypto news to know

ARK Invest chooses SOL Strategies as staking partner

ARK Invest has chosen SOL Strategies (CSE:HODL,OTCQB:CYFRF), a Canadian company focused on the Solana blockchain ecosystem, as its exclusive Solana staking partner for the Digital Assets Revolutions Fund. This agreement means ARK Invest's validator operations will transition to SOL Strategies' staking infrastructure.

SOL Strategies CEO Leah Wald highlighted their focus on providing compliant, reliable access to Solana for institutional and enterprise clients through delegated staking and custom validator infrastructure.

“Cathie Wood and her team at ARK are widely respected for their crypto and tech investing. Their confidence in our validator capabilities reinforces our commitment to providing best-in-class staking solutions for institutional clients,” Wald said in a press release shared on Monday.

The initiative will also involve BitGo, an institutional custody platform that partnered with SOL Strategies in April.

SOL Strategies emphasized that this partnership with ARK Invest, a firm with a history of investing in various staking solutions, validates their institutional infrastructure and market position.

SOL Strategies emphasized that this partnership with ARK Invest, a firm with a history of investing in various staking solutions, validates their institutional infrastructure and market position.

TRON seeks to raise funds for treasury expansion

TRON (NASDAQ:TRON) is looking to raise US$1 billion, according to a Form S-3 filing with the US Securities and Exchange Commission (SEC). The filing states that TRON plans to raise funds through a combination of common stock, preferred stock, debt securities, warrants and rights.

This follows the company’s reverse merger with Justin Sun's blockchain project.

The funds will primarily be used to expand the company's TRX treasury, which already holds over 365 million TRX tokens following last month's reverse merger.

TRON's SEC filing details a treasury strategy including cash, short-term equivalents and TRX tokens, stating, “We view our TRX token holdings as long-term holdings and expect to continue to accumulate TRX tokens.”

PayPal to launch new crypto payment system for merchants

PayPal (NASDAQ:PYPL) is rolling out a new service, Pay with Crypto, designed to simplify international payments for merchants and reduce associated fees. The new offering will allow US merchants to accept payments in more than 100 cryptocurrencies, including USDC. Payments will be instantly converted to either stablecoin or fiat currency, providing merchants with immediate access to funds.

The service will support a wide range of popular digital wallets, such as Coinbase Global (NASDAQ:COIN), MetaMask, OKX, Binance, Kraken, Phantom and Exodus, with more integrations expected.

Pay with Crypto aims to reduce global business losses from complex banking and high cross-border transaction fees by up to 90 percent. It offers a 0.99 percent transaction rate until July 31, 2026, and merchants can hold funds in PYUSD to potentially earn a 4 percent reward.

PayPal CEO Alex Chriss emphasized that this initiative will empower businesses of all sizes to expand globally by removing barriers like high international payment costs and complex integrations.

He cited an example of a merchant in Oklahoma City being able to easily accept crypto from a shopper in Guatemala, improving profit margins and accelerating fund access.

This launch follows last week's introduction of PayPal World, a new global platform that connects five of the world's largest digital wallets, fundamentally reshaping international money movement.

Pay with Crypto is set to become available to US merchants in the coming weeks.

Metaplanet adds 780 more BTC

Metaplanet (TSE:3350,OTCQX:MTPLF) has purchased an additional 780 Bitcoin, raising its total holdings to 17,132 Bitcoin — worth roughly US$2 billion at current prices.

With an average acquisition cost of around US$99,732 per Bitcoin, Metaplanet remains deeply in profit on paper. Its aggressive treasury strategy is modeled after Strategy (NASDAQ:MSTR).

The firm also tracks a proprietary metric called BTC yield, which it says hit 22.5 percent in July alone and soared to 129.4 percent in Q2. Metaplanet's share price rose 5 percent on Monday to 1,240 yen.

Most Americans still see crypto as risky and niche, new poll finds

Despite surging prices and friendlier regulations, most Americans remain skeptical of cryptocurrency.

According to new Gallup polling data, only 14 percent of adults say they own any form of crypto, and a large majority — around 60 percent — indicate they have no intention of buying in. The biggest barrier remains perceived risk, with most respondents rating crypto as either "very risky" or "somewhat risky."

Ownership skews heavily toward younger men aged 18 to 49, 25 percent of whom report holding crypto, while adoption among seniors and women remains minimal. Notably, public understanding still lags: while nearly everyone has heard of crypto, only about a third say they know much about it.

The data suggests a gap between increasing institutional acceptance — spurred by new legislation like the Genius and Clarity Acts—and persistent public doubt about digital assets’ stability and utility.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.